Original author: Hazel & lvy

Original link: https://mp.weixin.qq.com/s/ChR7nGhDqJQ5jqdtKQwYrw

Disclaimer: This article is a reprint. Readers can get more information through the original link. If the author has any objection to the reprint format, please contact us and we will modify it according to the author's request. The reprint is only for information sharing and does not constitute any investment advice, and does not represent Wu Blockchain views and positions.

1. Introduction

In the past few years, the wave of Chinese digital entertainment going global has swept the world. From the short drama APP that is popular in the Middle East to the domestic 3A games that have landed on the European and American charts, there is a key proposition behind them: how to solve the problem of the "last mile" of cross-border payment?

We had a conversation with Essay, an enthusiastic listener of the program. Her company, PayerMax, is an explorer in this field. In the Middle East, North Africa, Southeast Asia and even Latin America, which are full of complex markets, PayerMax is helping Chinese companies to land accurately with its understanding of the local payment ecosystem.

Interestingly, as the popularity of stablecoins increases, we see many emerging stablecoin payment companies begin to explore the layout of cross-border merchants. However, there are still many challenges on this road: obtaining compliance licenses, adapting to local payment habits, cultural shocks, polishing risk control models, the art of cooperating with local teams, and various unexpected situations... These are precisely the "true scriptures" that traditional payment companies have accumulated in 7 years of actual combat.

In addition to discussing the details of cross-border payments in digital entertainment, this episode also explains the modules and principles of cross-border payments from the perspective of traditional finance, discusses the possible advantages of stablecoins, and the problems facing the large-scale adoption of stablecoins.

We hope you can gain something from the experience of local experts.

Guest Essay Zhu

PayerMax COO, former head of China's new economy industry at JPMorgan, Morgan Stanley, Bank of America, MSCI, 20 years of experience in finance, payment expert

Anchor Hazel Hu

Host of the podcast "Zhi Wu Bu Yan", 6+ years of experience as a financial media reporter, core contributor of the Chinese Public Goods Fund GCC, focusing on the actual application of encryption. X: 0xHY2049; Immediately: A careless Yueyue

Anchor Ivy Zeng

The host of the podcast "Zhi Wu Bu Yan", used to work as a post-investment investor in VC, participated in pop-up cities and became involved in payment, and is currently responsible for growth in a new type of bank. X: IvyLeanIn; Immediately: The rice spoon is placed in the cup; Xlog: ivyheretochill

2. Introduction to PayerMax

Today we are honored to invite Essay, an expert who has been deeply involved in the field of overseas payments for Chinese companies for many years. She has 20 years of experience in the financial industry and is currently the COO of PayerMax. Coincidentally, Essay is also an alumnus of the two hosts of Zhiwubuyan. We welcome Essay.

Hazel: Essay, why don’t you first tell us about your career experience and how you joined PayerMax?

Essay: Essay is my more commonly used English name. My Chinese name is Zhu Dongbo. I have been working in the banking industry for almost 20 years. I have worked in three American houses, JP Morgan, Morgan Stanley and Bank of America Merrill Lynch. At the beginning, what we did was to support European and American companies to come to Asia and China to develop their business. Gradually, our Chinese companies began to go global, so my role also changed, from landing multinational corporate business in Asia to supporting our Chinese companies to go global.

My last job was as the head of JP Morgan China's new economy industry. It was also because of this opportunity that I was able to support the internationalization of Chinese companies in depth and was honored to work with many entrepreneurs. Unfortunately, because we were on the front line, we were also the first to face the Sino-US conflict. I was very tired, so I finally decided to leave the US bank. I learned a lot, but it was a pity to leave the US bank. In between, I started a business in the education industry for a short period of time, but it failed in this environment, so I returned to my comfort zone and joined PayerMax, a client at the time.

Hazel: I see that you worked at JP Morgan from 2018 to 2021, which was around the time when the Sino-US issue started to flare up, so it is completely understandable. Why don’t you tell us what kind of company PayerMax is?

Essay: PayerMax started its business about seven years ago. In the early days of the business, we set an all-overseas strategy, and we went to the more difficult Belt and Road countries. In terms of business model, we did not start with cards or bank accounts. We integrated the national wallets of Southeast Asian countries. After finding our own unique value on this basis, we went to the Middle East and North Africa markets. When we arrived in the Middle East market, we found that cards cannot be ignored and banks are in a dominant position, so we will continue to increase data access to cards and bank accounts. During the whole process, we obtained eight payment licenses in seven countries, including but not limited to Hong Kong, Singapore, the United Arab Emirates and Saudi Arabia.

Hazel: Who are your main customers?

Essay: Our clients are mainly in the online economy, including large industries such as games, social media, and e-commerce ecosystems.

Hazel: PayerMax may have become a hidden champion in the Middle East or other Southeast Asian countries, and it has been in business for a long time. But for those who are not in the overseas market, they may not be very familiar with it. Compared with some international payment giants, such as Stripe and Adyen, Chinese people are more familiar with them. So I would like to ask, in the payment field, we have some local solutions, such as those that focus on serving the overseas businesses in the Middle East, and there may also be some so-called global ones, such as Stripe. Compared with these global payment giants, does PayerMax have some specific comparative advantages in serving Chinese overseas companies?

Essay: I think this question can be viewed from three dimensions:

· First, we focus on different markets. Just now you mentioned that Stripe is doing global market. There is a big premise here. The European and American markets account for a very large proportion of the entire economy. So for Stripe, developed countries, such as the first-tier countries in Europe and the United States, are their main battlefield. PayerMax accompanies Chinese companies going global. The first step is to go to Southeast Asia, the Middle East, and Latin America. We will have certain advantages in the development of developing countries. PayerMax cooperates with Chinese companies to go global, especially Chinese digital entertainment companies, so we will deepen our roots in the Belt and Road countries.

Second, if we divide the industry from the perspective of the entire online economy, commodity trade still accounts for the majority. PayerMax has a deep understanding of the digital entertainment industry. Why can we do a good job in the sub-industry more accurately? The combination of our entire payment solution and the method of risk control model data analysis are different from those of many traditional payment companies.

· Third, I think this is a cultural and language issue, because to serve Chinese companies going overseas, you have to be as competitive as them. At the same time, you have to dig deep into the countries and tracks you choose, because China's cost reduction and efficiency increase are too severe, so we have to dig deep into every link.

The last one is personal service. We may get up in the middle of the night to revise our risk control model for merchants, so that transactions can go through. In my opinion, this is a personal service level.

Hazel: It is indeed difficult for other countries to catch up. It may be difficult for any country outside of East Asia to reach this level.

3. In-depth insights into the Middle East and North Africa markets

Ivy: Next, I would like to talk about the in-depth insights into the Middle East market. Understanding the geopolitical environment is also the basis for understanding cross-border payments. In order to give everyone a clearer concept of payments in the Middle East, can Essay describe the battle map of cross-border payments in the Middle East and North Africa?

Essay: OK, I will talk about it from top to bottom. Sometimes we use the names of the Middle East, Gulf countries, etc., so we now uniformly talk about the concept of MENA (Middle East and North Africa). When we do payment, we first look at the country's macroeconomics and its payment infrastructure and regulatory status. We will distinguish between the six GCC countries in the Middle East, the six Gulf countries, and other Middle East and North African countries. Because the payment infrastructure of the six GCC countries is very similar to that of developed countries in Europe and the United States.

First, because its Internet infrastructure is very complete, online payment, especially mobile payment, has a high demand rate. Secondly, these countries have mature financial systems, and their central banks are very strong, and their banks are also complete and strong, which is relatively close to Europe and the United States. Third, in the six GCC countries, bank cards are the mainstream payment method, and wallets account for a relatively low proportion. The last point is that the six GCC countries are mainly countries with petrodollar monetary policy, so their exchange rates are pegged to the US dollar, and there are basically no foreign exchange controls, so the exchange rate is stable and free.

What are the characteristics of other countries such as North Africa, Turkey, and other countries in Eurasia? They are in the process of development and have a relatively large population base, so we think these countries are closer to Southeast Asia. From several characteristics, the population is still growing, the Internet and smartphones are more popular, but the financial infrastructure of these countries is not so mature, there are relatively many non-banking populations, and their banking infrastructure itself is not stable.

E-wallets have a relatively high market share, and the more common QR code payment, operator payment, etc. are more popular because these payment methods are relatively low threshold, less bank account requirements, and purely local payment is cheap, so they are closer to the situation in Southeast Asia. The last point is that the exchange rate is unstable, and there are basically foreign exchange controls, so you often hear about the collapse of remittance currencies.

So we have made a classification from a general direction. Our operational strategy is still based on financial infrastructure and customer needs. For example, in GCC countries, we will be closer to the traditional financial system, such as providing more virtual bank account solutions or card solutions, etc.

For other countries in the Middle East and Central Asia, we will adopt a more mixed model and see what the mainstream payment methods are. For example, in Egypt, wallets are the mainstream operation, and the wallets are operator wallets, not bank wallets, so OK, we will take them in. For example, in African countries, their operators are very powerful, so we will bring them in, and the corresponding card and bank account ratio will decrease because there are too many non-banking populations. Another point is that for HSBC countries, one of the important things we do is to see if there is any solution that can have the opportunity to solve the problem of payment collection? This is the overall logic of our construction, following the local situation and customer needs.

Ivy: Maybe the audience will want to start taking notes after hearing this. We will put this battle map in our show notes later, and you can check it out for yourself. I went to Dubai for a meeting in April and stayed in the Middle East for half a month. From my experience, this is still a very religiously sensitive region, and some local policies may be more changeable. How will the religious and policy-changing characteristics affect payment strategies?

Essay: Ivy, I’m curious which country in the Middle East you visited?

Ivy: I'm in Dubai and Abu Dhabi, which are relatively international places.

Essay: Fortunately, in my opinion, Abu Dhabi is very international.

Essay: First of all, the payment strategy is a manifestation. It is crucial to comply with local laws and regulations and to achieve a win-win situation with local channels. Let me talk about the dimensions in which payment in Muslim areas is different from other areas.

Muslim countries as a whole will follow the Islamic legal system. So if you look at the MSCI index, sometimes there will be a small variant called Islamic, which will be filtered according to their doctrines. More relevant to our payment:

First of all, whether the interest is obtained reasonably, whether there is gambling behavior, and the prohibited list will have corresponding restrictions under the Islamic law system.

Secondly, privacy protection. You will see women in the Middle East wearing very tight clothes. The burqa they wear is called Abaya, the veil they wear is called Hajab, and even the Niqab veil that only exposes two eyes. Just imagine how difficult it is to do facial recognition and KYC account opening for them, so personal privacy protection will bring difficulties to our business. At the same time, Middle Eastern countries, especially countries like Saudi Arabia, have extremely strict data localization for anti-money laundering. The strictness of data exchange and local protection in the Middle East is Tier 1 among all the countries we have operated.

The third point is cultural shock. According to our experience, we can predict some risks. For example, many of our merchants are global operators. They start the same game or live broadcast in Southeast Asia and may come directly to the Middle East. However, such a copy-paste strategy often does not work in the Middle East. For example, their religion will lead to the exposure of clothes. The soft and cute culture that we like in East Asia is close to child pornography in their eyes. Therefore, cultural shock makes many entrepreneurs faint directly, especially the boundary between this soft and cute culture and child pornography. This is why we will do corresponding screening to reduce cultural shock when merchants carry out local business. I fully understand that entrepreneurs are launching the same product globally. But for the Middle East and Muslim countries, it will be a big cultural shock.

So whether from the perspective of laws, data privacy protection, or culture, these three factors will lead to different business practices for our merchants. Their business models are designed differently, so what we can do is to implement payment services based on their business models. We can even tell them in advance which business models they need to change when they arrive at the local market, and even their fee model and profit margins will change. These are some of the things we do, and we always maintain two-way communication.

Hazel: I understand. I think many geographical concepts are blind spots for entrepreneurs going overseas at the beginning. For example, we often talk about going overseas in Southeast Asia, the Middle East, and Latin America. It seems that as long as these places are placed in the same geographical area, they can use the same set of strategies. But when you go deeper, you will find that each country has its own characteristics. I have been to Turkey and Egypt. I think the differences between North Africa and such countries are already huge. Dubai and Saudi Arabia may be completely different environments.

Just now I mentioned the policy changes. I know Saudi Arabia is one of the countries that has undergone a relatively large policy change in recent years. It is a very different world before and after the opening up. I would like to ask again, in addition to religious and political factors, the Middle East itself may also have some specific pain points in the payment process. For example, because I used to do research on Saudi express delivery, I know that a big problem in Saudi Arabia is that it cannot be delivered, because the address may be written very vaguely, and it may be delivered to a desert or a mountain, or a house, but there is no specific address, and it cannot be found after searching around. What are the pain points in our daily payment process, especially some pain points that Chinese entrepreneurs cannot think of?

Essay: I think this is the pain point. Hazel and I both thought of COD (cash on delivery), which shows how painful it is. We also serve some local logistics companies, so I will talk to you about the pain points of cross-border e-commerce payment in the Middle East based on actual experience.

First of all, let me share some data. The online payment success rate of the top e-commerce companies is probably less than half. You can imagine how low the online payment success rate is in the initial incubation period. Therefore, when talking about e-commerce in the entire Middle East region, COD is an issue that cannot be avoided. So why do we have this problem?

First, the delivery is not accurate. It is uncertain whether the goods can be received. The buyer may not be able to deliver the goods, and the consignee may not be able to receive the goods. Why? It is related to urban infrastructure. Leyard only started to have a 5-digit postal code in 2013, and many houses were built by themselves, and the postal code was not particularly clear. It was not until 2022 that the extension code was added to the postal code, and combined with the GPS positioning system, a more accurate positioning was achieved. This was two or three years ago, and this layer of infrastructure had just been built at the national level.

Second, objectively speaking, the development of e-commerce in the Middle East is not slow. For example, Shein entered Saudi Arabia in 2015, which was relatively early. Before Shein, Amazon, a European and American e-commerce company, had already acquired SQL, the largest local e-commerce company. So the Middle East entered e-commerce relatively early, but the consumption habits of e-commerce were not cultivated so quickly, and there are many reasons for this.

First, there is a big family culture here, and for nomads, the sense of happiness of seeing and touching things is very important, and shopping in shopping malls is an important part of their lives, so the habit of e-commerce is slowly penetrating. And our Chinese entrepreneurs are also very good, combining online and offline interactions. Since 2003, Shein has opened some pop-up stores in Leyard, and opened a pop-up store again in June this year, so he will integrate online and offline in this way. So the love of seeing goods is really in the blood of the people.

At the same time, because there are more impulse purchases, many consumers choose cash on delivery, which is a double insurance for themselves. They can refuse to pay, they can refuse the delivery, or even refuse to open the store. However, this is quite damaging to e-commerce.

The last point is related to the entire infrastructure. Many of our express delivery workers are women, but they do not necessarily have their own independent bank cards. Currently, the card holding rate of women in MENA, especially in Muslim countries, is from 35% to 70%. In countries with stricter religious rules, such as Saudi Arabia, this figure may be below 50%. So they only have cash and no cards, and they cannot consume online. They can order online, but they have to pay offline. These reasons have led to COD being a structural problem in the short term.

Let me tell you how we will solve this problem. There are two solutions. One is to change the payment method. We will do pay by link, which means we will change the behavior of collecting money and swiping POS to payment by link. The other is that we will work with logistics companies to come up with some innovative solutions. If we can't beat it, we will join this state. Payment will happen together with delivery, but hopefully it will not be cash.

Hazel: This. I want to add that the essay just mentioned that the development of e-commerce in the Middle East is not late. The example that comes to my mind is that when I was in Egypt last time, my landlord recommended me to use the food delivery software, Talabat. I wondered if it was another Chinese Internet company, so I searched it. I didn’t expect that this company founded in Kuwait started doing food delivery in 2004! Comparing the timeline, Ele.me was not available in Shanghai until 2008, and Meituan Waimai was not established until 2010.

The company also entered Egypt through acquisitions. A local Egyptian company called Otlob was renamed Talabat. Otlob was even established earlier, in 1999.

Another point is the habit issue I just mentioned. Of course, I am not in the Middle East, but I have this feeling in Europe. Sometimes it is not that the e-commerce platform is not good enough, but I really want to communicate with people face to face offline. For example, if they ask me to scan the code to pay in a French restaurant, I will feel very uncomfortable, because the overall culture here is that you should serve me in person. However, it may be a completely different feeling in China. I think the Middle East may also have this habit of preferring offline consumption, and this habit is difficult to change. This is my personal life experience in the Middle East and Europe.

Essay: I totally agree. So I think our engine felt from the beginning that this must be changed, but now we say that this cannot be changed, so we add optimization.

Ivy: Essay: During your time working in the Middle East, were there any local payment cases that overturned your perceptions? Did they completely change your view of this market?

Essay: I want to share a very interesting series. Taking Saudi Arabia as an example, I want to tell the story of the aggrieved big spenders. Big spenders are krypton gold players. You may have always believed that the consumption power of the Middle East is strong, which is true.

First, let's focus on Saudi Arabia. According to the data, Saudis like to spend money and are willing to spend, both men and women. According to the data from Neso, a game and e-sports data analysis agency that we often use, there are many free games on Saudi apps, but even with so many free games, 60% of Saudi gamers still like to spend money, and about 34% of them are ordinary consumers who will continue to buy. About 8% are large consumers, VIPs, who like to continue to buy in large quantities, which shows that they really like to spend money.

Sometimes I also attend offline VIP meetings of some game clients, where I can see female players, and these are brave female players who are willing to come out, so there are more female players behind the scenes. According to interviews, female consumption willingness is also very strong.

Secondly, let's look at the data provided by the Saudi Arabian Central Bank. We can see that the entire online economy is growing very fast. At the same time, the transaction price of e-commerce is much higher than that of offline. In March this year, the total consumer spending of Saudi Arabia increased by 17%, setting a new record. At the same time, the unit price of online consumption is 2.5 times that of offline POS consumption. So it can be seen that those who love to spend love to spend online.

Isn't this very exciting? So what are the pain points? For example, if there is a krypton gold consumer, he sits at home, buys things and recharges on several mobile phones, then what do we see as the background? IP address, multiple devices, multiple cards, in the middle of the night, continuous challenge of large amount payment, doesn't this look like fraud? So it is easy for our payment company to intercept the risk, or close the file, or the card group to prevent fraud and automatically intercept the risk control.

So, I regard them as the aggrieved big R. I just want to recharge, they are all my cards, the phone is mine, and I am at home, but they may fail the transaction at best, or even directly block the card at worst.

What can we do? First, we will work with merchants to get some basic information about these big spenders. We will label the big spenders, and we will communicate these labels with our collection files and even with the card group. We hope to add these labels to the whitelist. In this way, we can identify the big spenders who love to recharge, which is 8% of the population I mentioned earlier, and release them more smoothly accordingly. And this is cumulative, and it will go more smoothly. There may be some ad hook ROI in the middle, but we maintain a state of mutual communication, and this aggrieved big spender is unlikely to be put into the fraud risk control.

This incident has completely overturned my previous understanding of working in banking or traditional payment.

4. Changes in the Middle East’s financial infrastructure

Hazel: I also encountered this in Europe. Europe has very strict risk control and anti-money laundering. If you transfer a small amount and it exceeds the value by a little, the bank will call you. They are afraid that you may have problems and will intercept you. I would like to ask, have there been any changes in the Middle East recently, and are there any differences in the perception of the global payment market?

Essay: I think the Middle East and North Africa region is quite similar to Southeast Asia. They are all doing some corresponding structural decoupling - having their own independent decks and independent financial calculations as much as possible. What is the reason behind this? I think the Russian-Ukrainian war has taught many sovereign countries a lesson. When seeing the lessons of the past, we must have our own financial independence and prepare for a rainy day.

After the outbreak of the Russian-Ukrainian war, in March 2022, Visa and Mastercard began to withdraw from Russia and were also

SWIFT was kicked out, and Russia became an isolated island. So people who use Visa and Mastercard overseas will find their cards completely unusable overnight. From a national perspective, this is an infrastructure-level risk.

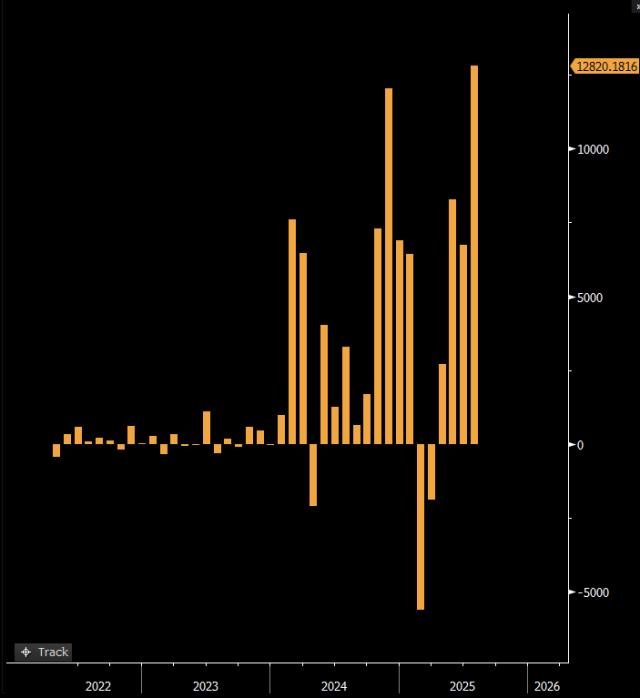

So what did Russia do? Its local deck is called Mir. At first, Mir was a deck that the country wanted to promote but didn't necessarily want to use. But it is obvious that it has increased by 10% from Q1 of 2022. At the end of the year, at the end of 2023, its market share has reached 50-56%. It can be higher, but infrastructure may not keep up.

In this example, the central banks of all countries will certainly take corresponding risk prevention measures, so what we can see is the rise of local card groups. Let me give you an example. Among the six GCC countries, five countries did not have local card groups before the Russo-Ukrainian war. For example, MADA, which everyone often hears about, is managed by the Saudi Central Bank. Because the UAE is highly internationalized, it does not have a local card group, it only has VISA Mastercard. But in 2024, the UAE also began to promote the local card group, and it will be fully launched in 2025. Like we do business in the UAE, we have to add its local cards in addition to VISA Mastercard. The example of the UAE is clear. You can see that it has been determined to go international for so many years. In 2024, it directly promoted the local card group, and it was pushed very quickly. It was pushed from top to bottom. You must do it, it's that simple.

Another point is that real-time payment is taking the market share of cards. What does that mean? A big reason why we use cards is because they are timely. When you buy something, it arrives immediately. Consumption is instant. Now GCC countries are working hard to launch a real-time payment system. The payment speed is close to real-time and it is available 24/7. This has completely changed the payment habits. It is very similar to China, which used to have some banking hours. Now we basically have 24/7. China's payment experience is very extreme. Objectively speaking, GCC countries are on this path.

In the first step, UAE and Saudi Arabia, which have better infrastructure, have launched their own micropayment, called Sarie, which is led by the Saudi Arabian Central Bank (SAMA). Its single payment limit is about 3,000 US dollars. This will replace the small payment scenarios previously carried by bank cards, and we can see that from the perspective of quantity, instant payment is rising straight up. Then we will have a bolder guess later, will the GCC 6 countries one day open up small payments in the region? If this is done, the entire region will be empowered. The same thing is happening in Southeast Asia. It feels like different countries have created different WeChat groups, where everyone chats.

Hazel: You just mentioned that Visa and MasterCard are no longer accepted in Russia, including the Mir issue. I just experienced it this year. I went to Russia in April. Before that, I didn’t know that Visa and MasterCard were not accepted in Russia. After I went there, I found that as a Chinese, I actually had some advantages over Europeans and Americans, because I had UnionPay cards, and UnionPay cards could be used to withdraw cash at three local banks, but Visa and MasterCard were completely unacceptable. I also investigated at the time, because I looked at the Mir system, including that Mir is not only accepted in Russia now, but also in some Central Asian countries that are within Russia’s sphere of influence. China may have more experience in this area, because China has its own UnionPay and the CIPS calculation system. Although the scale is not comparable to this global card group, it is true that because our domestic market is large enough, we have built our own system from the beginning.

Essay: Many central banks envy and admire our global card network like UnionPay, because many countries here only issue debit cards, and they can't issue credit cards. They also have credit. The ability to issue credit cards, like our UnionPay and GCB, means that your currency has global credibility, and there is a lot of infrastructure to be done behind it. Many central banks have also directly expressed to me that they are very envious of our national currency and the global credit card network of our national currency. They also hope that one day their cards can become global credit cards. One day they hope that their Mada can be swiped overseas, not just in their own country.

Ivy: I would also like to add that I have researched India’s payment system before. Earlier, India was completely covered by Visa and MasterCard and had not yet developed its own card system. Later, it gradually wanted to break away from the state of complete dominance by Visa and MasterCard and developed its own card system. Before 2013, the top five retail payment systems in Russia were all American institutions, which was an absolute advantage. It was not until after being sanctioned that they developed their own retail payment and fast payment systems.

5. Compliance and localization

Hazel: The next question is about licenses. I noticed that PayerMax holds payment licenses from many countries. This is also a pain point for many new entrants to the industry. To apply for a license, no matter how qualified you are, it may take a long time and cost a lot. Can Essay introduce some companies that may be paying attention to this field? What qualifications do the licenses we have now require companies to have? What efforts has PayerMax made in the past to apply for these licenses? What significance does it bring to the markets we have deeply cultivated, especially the Middle East?

Essay: Licenses may be a black box. Because this market has no shortage of rich people, nor people who are committed to this market, but licenses are always difficult to obtain. Why? Because I think licenses are an art of balance. You can bring development to a country, and at the same time you can make the country's regulators, usually the central bank, believe that you will not manipulate the privileges you have obtained.

Some friends often say: I want to invest in a certain country, tell me how much money to invest? I want to get a card. I said, boss, the thing that the Middle East has the most is money. In the Middle East, which local family is poorer than you?

First of all, why do we need a license? You don’t need a license for cross-border payments. But if you want to do local payments, the purpose of getting a license is to better meet the needs of merchants - more, faster, better, and cheaper.

Fast: Local payments are always faster than cross-border payments and have a higher success rate.

· Savings: The cost structures of cross-border payments and local payments are completely different.

Therefore, payment companies like us, or any company that wants to provide glocal services, will want to access local payments. And the local payment license is your entry threshold - it is impossible for local companies to do payment and foreign companies to not need a license. This kind of regulatory arbitrage is impossible. The license is your ticket to globalization.

For example: Why can PayerMax provide Saudi Arabia's local payment Mada? Because we are licensed in Saudi Arabia. In the eyes of the Saudi Central Bank, we are not a "foreign guest", but a local payment company with a local office, and you can find us at any time. It's that simple.

To apply for a license, money is a necessary but not sufficient condition. You must have:

1. Local Company: A local entity must be established.

2. Local team: Even local nationals are needed, because this represents a kind of commitment and identity. Put yourself in their shoes, what would China's "central bank" think when it sees a team composed entirely of foreigners? The same is true for other countries.

3. Local development plan: Why should the central bank support foreign-funded enterprises? You have to prove what you can bring to the country:

· Promote the local economy, such as promoting the development of online payments

Cultivate local talents, especially in the Middle East, where they prefer to “train through competition” and let foreign companies help train their teams

Output core capabilities, such as risk control models and other know-how

Of course, the most basic commitment is compliance, such as data localization. From Day 1, these must be clearly reflected in the application materials. The most important thing is to convince the regulator that issuing a license to you is meaningful to the country.

This is the core of a successful license application - win-win thinking.

Hazel: I see. Because in the last episode we talked about a European bank, and of course we talked a lot about how to localize, including how to give a better answer to the regulator. I think these two answers can be compared with the last episode.

But here I want to say something very important: in addition to the rules, there are many things that need to be done to ensure that what the company does meets the expectations of local regulators. This may not be clearly written in the rules, but you have to make the regulators feel that their expectations can be met.

You just mentioned "fast, good, and economical", right? I think the question of "economical" is also very important. Maybe we are not so sensitive when we swipe our cards, but for merchants, optimizing 0.5% of payment costs, multiplied by their turnover, this number is very large. So how do we do it here? Help merchants optimize costs by matching the combination of acquiring bank channels and settlement paths in real time?

Essay: This question may have many dimensions. I will only talk about one dimension now - how to do smart routing from a structural perspective. Let's take the simplest card payment scenario as an example.

The decks will be divided into:

International card group, Visa / Master / Amex, etc. Visa / Master account for the absolute majority

Local decks, such as Saudi Mada decks

International decks have a two-tier pricing structure:

1. Global acquiring network and price entry standards

2. Regional acquiring, such as the CMI we use in the Middle East

Local card groups are local acquirers, such as Mada cards

This is the three-tier structure, and each tier has its own advantages and disadvantages, mainly in terms of price and efficiency:

Global acquiring: Easiest to access (one-stop access to global services), but the most expensive

Regional acquiring: You can get regional prices, which is cheaper than global acquiring

Local acquiring: The best price, just like China’s UnionPay and Amex always have two different prices

For example, if the global acquiring fee of Mada is about 5% (this is not the actual quote of PayerMax), the regional acquiring fee may be 3%, while the local acquiring fee may be only 2%. This price difference is determined by the payment structure itself.

The next question is whether it is possible. This depends on the nature of the enterprise: if an Asian enterprise wants to use the Middle East acquiring, it may have to go for global acquiring; if a Middle Eastern enterprise uses the Middle East acquiring, it may go for regional acquiring; if a Saudi local enterprise uses Saudi acquiring, it is a very natural local transaction. In addition, industry factors must be considered, which is what we often call MCC industry codes. The risk and cost structure of different industries are different, and they need to be adapted according to the country. This is actually a two-way running-in process between merchants and payment companies.

Although some companies can save 5% of the cost, they may prefer not to do it after considering factors such as local operating costs. We see two main types of companies in the market: one is the extreme pursuit of cost optimization, and the other is the overall ROI. As a payment company, we will give suggestions based on the customer's existing conditions. For example, if the customer's KPI is to reduce costs, we can provide corresponding solutions. This is the value we can provide.

Ivy: The topic of Chinese teams entering emerging markets has always been of great concern to me. I have also done some research before. Local payment methods account for more than 80% in the Middle East. How does PayerMax quickly integrate various local payment methods? And it is definitely necessary to recruit local teams. What have the local teams done for the company?

Essay: I think this is a very good question. We in China are now learning how to be truly internationalized, especially in the Middle East and Latin America where cultural differences are greater. This is the real challenge of internationalization. Because in Southeast Asia, we may be able to solve the problem by sending one or two Chinese backbones, but this trick will not work in the Middle East (laughs).

As for how to do it specifically, I think it depends on the position and scope of responsibility. For example, our local team mainly does several things: the first is dealing with local stakeholders. For example, the team I lead is working with institutions. These people are basically locals. They speak the same language, which makes it easier to build trust and help us get started quickly. The second is working with regulators. We prefer reputable locals, which is a good process of increasing trust.

Positions such as customer service must also be locals, because they require local language, cultural empathy and time zone matching. For these external contact positions, it is necessary to use locals, and not using local talents is an exception. But for work such as refined operations, our Chinese team is already very experienced, so it is very appropriate to use the Chinese team or the Asian team at this time.

Local team management is actually very costly and requires a lot of manpower management. Because there are not many Chinese people who work so hard (laughs), we often encounter management problems caused by inconsistent team rhythms. We need to learn to appreciate their shining points. Sometimes they look chill, but they get the job done. This may be a subject that Chinese managers need to practice.

The key is to keep an open mind and not always think about copying the successful experience in China. I often wonder: How did international companies like Amazon succeed here? They are also outsiders, how did they localize? This is a question I often think about when exploring emerging markets.

Ivy: I learned a lot. I also reflected on my previous experience in localization in Latin America. I found that locals must be hired for external BD, operations, and customer service. At that time, I also tried to contact the channels and locals there directly, but was mistaken for a Nigeria scam. Because Latin America has received too many Nigerian scam messages, people are particularly wary. Later, we changed to local ambassadors recruited by us to contact them, and it went much more smoothly. After all, there must be a foundation of trust between people.

Essay: Let me put it this way, you don’t laugh when he tells a joke because you don’t know what’s funny about it.

Ivy: Regarding the vertical fields that PayerMax is in, in the fields of games and social networking, we have seen that PayerMax has covered more than 2/3 of the companies in the top 30 of the App Store list, which is a very large proportion. I would like to know about PayerMax's market strategy and the logic of customer selection?

Essay: It's very simple. Our first concern is going overseas, and our second concern is risk matching. Because in the online economy, the entire gaming industry and social media have different business models, and the risk assessments behind them are different. So we will pay attention to our own license scope, and PayerMax as our own risk option, and we will make corresponding matches. It's quite simple to make a choice.

I think market strategy is simpler, because the demand is there, the key is whether you can meet the demand. When we break through in several markets, we may have what others do not have - we may be the only one or one of the only three in the market that can provide services; or we may be better than others - maybe we can bring better value to merchants through some... (laughs) or we can bring better value to merchants through our global network, such as capital optimization, etc. And the key is that we are compliant and can be implemented. Many payment companies often hear "service is disconnected". I believe that as a third-party payment APP, you have heard this sentence more - "account closed" and "service is disconnected", right? So I think compliance and implementation are just these three things, and it is good if we can do it.

Ivy: For merchants, being able to receive money in compliance with regulations is more important than anything else.

6. Traditional financial cross-border payments vs. stablecoins

Hazel: Web3 payments are also a focus of our attention recently, especially stablecoins. Stablecoins have dominated our headlines this month. From the perspective of traditional payments, or from our current perspective of the payment industry, can stablecoins really solve the timeliness and cost pain points of cross-border settlement? What are their core advantages? What are their limitations?

Essay: I think I can only talk about this briefly, because I am still learning every day. But as someone with a traditional financial background - I used to work in a US bank and now I am working in cross-border payments - I can share some of my views and hope to keep communicating with you on this topic.

First of all, I think the term "real solution" is a bit heavy. Why? Because stablecoins are still new, both Web3 technology and stablecoins are relatively new. They are still growing and may encounter some problems in the process. So I think we need to keep watching, but I am optimistic. Because from the top-level architecture design to the technical implementation methods, stablecoin payments do have the possibility of structurally optimizing timeliness and cost.

Compared with traditional finance, cross-border payments have three key parameters: the first is SWIFT, the second is US dollar clearing, and the third is liquidity reserves.

SWIFT was founded in Belgium in 1973 to solve the problem of global capital flow. It only transmits information, not funds - the flow of funds depends on clearing and liquidity reserves. In 2017, SWIFT launched GPI (Global Payment Innovation) to try to improve transparency and let you know where the money is now. However, due to the limitations of the message system, these innovations have limited effects.

The technical architecture of stablecoins is nearly 150 years behind SWIFT, which is a generational difference. Secondly, the existing US dollar clearing system is extremely centralized - all US dollars are ultimately settled in New York, with several large banks (such as JPMorgan Chase) as primary clearing banks. This system is mature but very heavy. Third, in order to ensure the efficiency of fund clearing, we must prepare reserve funds in various places and institutions, and these fund costs will eventually be passed on.

For example: US dollars in the United States, offshore US dollars in China, and US dollars in Lebanon have completely different liquidity. Even in the United States, the rating of 1 billion US dollars in JPMorgan Chase and in a community bank is different. But when we discuss USDT/USDC, we no longer care about:

Geographic location: Stablecoins are the same whether in Saudi Arabia or New York

Institutional rating: We only look at the numbers - I have 10 or 100 stablecoins, I can just transfer them. This radically simplifies payments.

So from the perspective of timeliness and cost, stablecoins may indeed optimize cross-border payments by simplifying complex parameters into numbers. But is this too good to be true?

We also need to observe how new technologies can assume the social responsibilities of traditional financial institutions: anti-money laundering, fund tracing, etc. These responsibilities are now borne by banks and constitute our costs. When the scale of stablecoin payments expands and these responsibilities need to be assumed, can it still maintain its current lightness? Many Fintech companies were very fast when they first started, but their development slowed down after being included in the traditional regulatory framework. So I am cautiously optimistic - optimistic but not overly optimistic.

Hazel: I agree with this. Previously, people may think that USDT is not very compliant, and USDC is relatively compliant. But yesterday, a well-known on-chain detective ZachXBT broke the news that tens of millions of dollars of USDC are used by North Korean hackers to pay salaries every year, and Circle may have turned a blind eye to this matter. Of course, this is a one-sided revelation, but it does show that there are big loopholes in this risk control that need to be addressed.

You just mentioned that the Gulf countries/Middle Eastern countries are starting to develop their own systems out of concern that Visa/MasterCard may be out of service. I am curious about what the financial regulators you have contacted think about stablecoins - do they allow countries to develop their own systems more independently, or are they more constrained by the US/dollar system?

Essay: If stablecoins are directly linked to the central bank, they will lose some of their charm. What we may need to think about is how the entire country views the issue of sovereign currency. So I think for the situation of each country, I can only observe what has happened and then speculate on what will happen.

At present, the UAE, which is the most open in terms of regulation, has already launched the AED stablecoin (local currency stablecoin), which I think basically represents a direction of development. As for other larger economies, such as Saudi Arabia, we have not seen any obvious moves. But in general, competition drives progress.

If one country issues it first, I believe other countries will at least take it into consideration. But is it appropriate for the central bank to do this? This involves national will... It's hard to say. Because there is a paradox here: if it is linked to a highly centralized institution, it loses the meaning of decentralization. Just like the Blockchain Trilemma mentioned by Vitalik Buterin before, stablecoins will also face similar problems - there needs to be a trade-off between the degree of decentralization, efficiency and market recognition.

So the key is to see what form we will see the evolution in. At present, the UAE is ahead.

Hazel: I asked this question because many users may not know that USDC and USDT are also centralized. For example, if they want to freeze your account, it will only take a few minutes. Of course, the freezing speed of USDT may be slower now, after all, it is a company, and you may need to issue a judicial notice before it takes action. USDC sometimes responds faster. But in essence, they are all under the centralized control of the source - they can freeze your account at any time. However, the genius bill may legally block the possibility of issuing truly decentralized stablecoins. So there are indeed many variables in the future.

7. Quick Questions and Answers

Ivy: Next is our quick question and answer session, which is a self-examination session for our listeners who are doing overseas business. Please ask Essay to provide some diagnostic suggestions on the payment health of these apps at different stages of overseas expansion.

First, if I have an APP with a monthly turnover of 100,000 US dollars, what indicator should I optimize first?

Essay: Payment success rate, payment connection rate, survive, and get the money back.

Ivy: What if I have a monthly turnover of one million US dollars?

Essay: First consider how to live well, or which is your advantageous market, and seize it as soon as possible.

Ivy: We have grown bigger and stronger, and our monthly turnover has reached tens of millions of US dollars. Which direction should we focus on for upgrading next?

Essay: Business stability. Continue to come. In addition, your counterparty risk - because you will definitely have a lot of money in different counter parties - your counterparty risk, and how can you continue to grow? Especially for our Internet companies, basically every product has a cycle. You have to think about the sustainable and stable development in the past, what did you do right at that time? How to continue to do it right? I think this is very critical.

Ivy: Next, let’s look at some risk warning signals. What payment data anomalies are red alerts that these overseas merchants must intervene immediately?

Essay: Each merchant may be different. I would like to give advice from the perspective of payment. First, there are two success rates: absolute success rate and relative success rate.

Let me give you a very specific example: For example, when we look at card payments, I may set my absolute success rate expectation at 80%, which is my goal. But for example, for operator wallets in North African countries, the success rate may only be 30%, so we need to look at the absolute success rate - what is your goal? Have you actually achieved it? This will show whether you did it right at the start.

The second is the relative success rate. We must continue to observe the data. For example, if our data suddenly goes high or low, a sudden high may be due to an attack. So when there is a fluctuation, we must quickly attribute it: what exactly happened?

Hazel: The last question we will ask each guest is, Essay, do you have any questions that you are interested in and would like to know? We will interview many projects and guests in the future, so we can throw them to other guests to answer.

Essay: Okay, I want to ask: If we are guests who make apps or do business, when will you start using stablecoins as a payment method? To be honest, we have heard a lot about stablecoins as a payment company, but when asked seriously, we don’t see so many examples of merchants.

So I would like to ask: When will you use it? Is there a time expectation? Is there a trigger point? For example, at what stage, from the perspective of company strategy, will this thing become a "must do" thing?

Hazel: This is also what we want to do in the future, because we have adopted many project payment institutions, but what is the real voice of the merchants? We also want to find out. Thank you Essay, we have a very fruitful chat today.

【End of article】

Original link: https://mp.weixin.qq.com/s/ChR7nGhDqJQ5jqdtKQwYrw

Disclaimer: This article is a reprint. Readers can get more information through the original link. If the author has any objection to the reprint format, please contact us and we will modify it according to the author's request. The reprint is only for information sharing and does not constitute any investment advice, and does not represent Wu Blockchain views and positions.

1. Introduction

In the past few years, the wave of Chinese digital entertainment going global has swept the world. From the short drama APP that is popular in the Middle East to the domestic 3A games that have landed on the European and American charts, there is a key proposition behind them: how to solve the problem of the "last mile" of cross-border payment?

We had a conversation with Essay, an enthusiastic listener of the program. Her company, PayerMax, is an explorer in this field. In the Middle East, North Africa, Southeast Asia and even Latin America, which are full of complex markets, PayerMax is helping Chinese companies to land accurately with its understanding of the local payment ecosystem.

Interestingly, as the popularity of stablecoins increases, we see many emerging stablecoin payment companies begin to explore the layout of cross-border merchants. However, there are still many challenges on this road: obtaining compliance licenses, adapting to local payment habits, cultural shocks, polishing risk control models, the art of cooperating with local teams, and various unexpected situations... These are precisely the "true scriptures" that traditional payment companies have accumulated in 7 years of actual combat.

In addition to discussing the details of cross-border payments in digital entertainment, this episode also explains the modules and principles of cross-border payments from the perspective of traditional finance, discusses the possible advantages of stablecoins, and the problems facing the large-scale adoption of stablecoins.

We hope you can gain something from the experience of local experts.

Guest Essay Zhu

PayerMax COO, former head of China's new economy industry at JPMorgan, Morgan Stanley, Bank of America, MSCI, 20 years of experience in finance, payment expert

Anchor Hazel Hu

Host of the podcast "Zhi Wu Bu Yan", 6+ years of experience as a financial media reporter, core contributor of the Chinese Public Goods Fund GCC, focusing on the actual application of encryption. X: 0xHY2049; Immediately: A careless Yueyue

Anchor Ivy Zeng

The host of the podcast "Zhi Wu Bu Yan", used to work as a post-investment investor in VC, participated in pop-up cities and became involved in payment, and is currently responsible for growth in a new type of bank. X: IvyLeanIn; Immediately: The rice spoon is placed in the cup; Xlog: ivyheretochill

2. Introduction to PayerMax

Today we are honored to invite Essay, an expert who has been deeply involved in the field of overseas payments for Chinese companies for many years. She has 20 years of experience in the financial industry and is currently the COO of PayerMax. Coincidentally, Essay is also an alumnus of the two hosts of Zhiwubuyan. We welcome Essay.

Hazel: Essay, why don’t you first tell us about your career experience and how you joined PayerMax?

Essay: Essay is my more commonly used English name. My Chinese name is Zhu Dongbo. I have been working in the banking industry for almost 20 years. I have worked in three American houses, JP Morgan, Morgan Stanley and Bank of America Merrill Lynch. At the beginning, what we did was to support European and American companies to come to Asia and China to develop their business. Gradually, our Chinese companies began to go global, so my role also changed, from landing multinational corporate business in Asia to supporting our Chinese companies to go global.

My last job was as the head of JP Morgan China's new economy industry. It was also because of this opportunity that I was able to support the internationalization of Chinese companies in depth and was honored to work with many entrepreneurs. Unfortunately, because we were on the front line, we were also the first to face the Sino-US conflict. I was very tired, so I finally decided to leave the US bank. I learned a lot, but it was a pity to leave the US bank. In between, I started a business in the education industry for a short period of time, but it failed in this environment, so I returned to my comfort zone and joined PayerMax, a client at the time.

Hazel: I see that you worked at JP Morgan from 2018 to 2021, which was around the time when the Sino-US issue started to flare up, so it is completely understandable. Why don’t you tell us what kind of company PayerMax is?

Essay: PayerMax started its business about seven years ago. In the early days of the business, we set an all-overseas strategy, and we went to the more difficult Belt and Road countries. In terms of business model, we did not start with cards or bank accounts. We integrated the national wallets of Southeast Asian countries. After finding our own unique value on this basis, we went to the Middle East and North Africa markets. When we arrived in the Middle East market, we found that cards cannot be ignored and banks are in a dominant position, so we will continue to increase data access to cards and bank accounts. During the whole process, we obtained eight payment licenses in seven countries, including but not limited to Hong Kong, Singapore, the United Arab Emirates and Saudi Arabia.

Hazel: Who are your main customers?

Essay: Our clients are mainly in the online economy, including large industries such as games, social media, and e-commerce ecosystems.

Hazel: PayerMax may have become a hidden champion in the Middle East or other Southeast Asian countries, and it has been in business for a long time. But for those who are not in the overseas market, they may not be very familiar with it. Compared with some international payment giants, such as Stripe and Adyen, Chinese people are more familiar with them. So I would like to ask, in the payment field, we have some local solutions, such as those that focus on serving the overseas businesses in the Middle East, and there may also be some so-called global ones, such as Stripe. Compared with these global payment giants, does PayerMax have some specific comparative advantages in serving Chinese overseas companies?

Essay: I think this question can be viewed from three dimensions:

· First, we focus on different markets. Just now you mentioned that Stripe is doing global market. There is a big premise here. The European and American markets account for a very large proportion of the entire economy. So for Stripe, developed countries, such as the first-tier countries in Europe and the United States, are their main battlefield. PayerMax accompanies Chinese companies going global. The first step is to go to Southeast Asia, the Middle East, and Latin America. We will have certain advantages in the development of developing countries. PayerMax cooperates with Chinese companies to go global, especially Chinese digital entertainment companies, so we will deepen our roots in the Belt and Road countries.

Second, if we divide the industry from the perspective of the entire online economy, commodity trade still accounts for the majority. PayerMax has a deep understanding of the digital entertainment industry. Why can we do a good job in the sub-industry more accurately? The combination of our entire payment solution and the method of risk control model data analysis are different from those of many traditional payment companies.

· Third, I think this is a cultural and language issue, because to serve Chinese companies going overseas, you have to be as competitive as them. At the same time, you have to dig deep into the countries and tracks you choose, because China's cost reduction and efficiency increase are too severe, so we have to dig deep into every link.

The last one is personal service. We may get up in the middle of the night to revise our risk control model for merchants, so that transactions can go through. In my opinion, this is a personal service level.

Hazel: It is indeed difficult for other countries to catch up. It may be difficult for any country outside of East Asia to reach this level.

3. In-depth insights into the Middle East and North Africa markets

Ivy: Next, I would like to talk about the in-depth insights into the Middle East market. Understanding the geopolitical environment is also the basis for understanding cross-border payments. In order to give everyone a clearer concept of payments in the Middle East, can Essay describe the battle map of cross-border payments in the Middle East and North Africa?

Essay: OK, I will talk about it from top to bottom. Sometimes we use the names of the Middle East, Gulf countries, etc., so we now uniformly talk about the concept of MENA (Middle East and North Africa). When we do payment, we first look at the country's macroeconomics and its payment infrastructure and regulatory status. We will distinguish between the six GCC countries in the Middle East, the six Gulf countries, and other Middle East and North African countries. Because the payment infrastructure of the six GCC countries is very similar to that of developed countries in Europe and the United States.

First, because its Internet infrastructure is very complete, online payment, especially mobile payment, has a high demand rate. Secondly, these countries have mature financial systems, and their central banks are very strong, and their banks are also complete and strong, which is relatively close to Europe and the United States. Third, in the six GCC countries, bank cards are the mainstream payment method, and wallets account for a relatively low proportion. The last point is that the six GCC countries are mainly countries with petrodollar monetary policy, so their exchange rates are pegged to the US dollar, and there are basically no foreign exchange controls, so the exchange rate is stable and free.

What are the characteristics of other countries such as North Africa, Turkey, and other countries in Eurasia? They are in the process of development and have a relatively large population base, so we think these countries are closer to Southeast Asia. From several characteristics, the population is still growing, the Internet and smartphones are more popular, but the financial infrastructure of these countries is not so mature, there are relatively many non-banking populations, and their banking infrastructure itself is not stable.

E-wallets have a relatively high market share, and the more common QR code payment, operator payment, etc. are more popular because these payment methods are relatively low threshold, less bank account requirements, and purely local payment is cheap, so they are closer to the situation in Southeast Asia. The last point is that the exchange rate is unstable, and there are basically foreign exchange controls, so you often hear about the collapse of remittance currencies.

So we have made a classification from a general direction. Our operational strategy is still based on financial infrastructure and customer needs. For example, in GCC countries, we will be closer to the traditional financial system, such as providing more virtual bank account solutions or card solutions, etc.

For other countries in the Middle East and Central Asia, we will adopt a more mixed model and see what the mainstream payment methods are. For example, in Egypt, wallets are the mainstream operation, and the wallets are operator wallets, not bank wallets, so OK, we will take them in. For example, in African countries, their operators are very powerful, so we will bring them in, and the corresponding card and bank account ratio will decrease because there are too many non-banking populations. Another point is that for HSBC countries, one of the important things we do is to see if there is any solution that can have the opportunity to solve the problem of payment collection? This is the overall logic of our construction, following the local situation and customer needs.

Ivy: Maybe the audience will want to start taking notes after hearing this. We will put this battle map in our show notes later, and you can check it out for yourself. I went to Dubai for a meeting in April and stayed in the Middle East for half a month. From my experience, this is still a very religiously sensitive region, and some local policies may be more changeable. How will the religious and policy-changing characteristics affect payment strategies?

Essay: Ivy, I’m curious which country in the Middle East you visited?

Ivy: I'm in Dubai and Abu Dhabi, which are relatively international places.

Essay: Fortunately, in my opinion, Abu Dhabi is very international.

Essay: First of all, the payment strategy is a manifestation. It is crucial to comply with local laws and regulations and to achieve a win-win situation with local channels. Let me talk about the dimensions in which payment in Muslim areas is different from other areas.

Muslim countries as a whole will follow the Islamic legal system. So if you look at the MSCI index, sometimes there will be a small variant called Islamic, which will be filtered according to their doctrines. More relevant to our payment:

First of all, whether the interest is obtained reasonably, whether there is gambling behavior, and the prohibited list will have corresponding restrictions under the Islamic law system.

Secondly, privacy protection. You will see women in the Middle East wearing very tight clothes. The burqa they wear is called Abaya, the veil they wear is called Hajab, and even the Niqab veil that only exposes two eyes. Just imagine how difficult it is to do facial recognition and KYC account opening for them, so personal privacy protection will bring difficulties to our business. At the same time, Middle Eastern countries, especially countries like Saudi Arabia, have extremely strict data localization for anti-money laundering. The strictness of data exchange and local protection in the Middle East is Tier 1 among all the countries we have operated.

The third point is cultural shock. According to our experience, we can predict some risks. For example, many of our merchants are global operators. They start the same game or live broadcast in Southeast Asia and may come directly to the Middle East. However, such a copy-paste strategy often does not work in the Middle East. For example, their religion will lead to the exposure of clothes. The soft and cute culture that we like in East Asia is close to child pornography in their eyes. Therefore, cultural shock makes many entrepreneurs faint directly, especially the boundary between this soft and cute culture and child pornography. This is why we will do corresponding screening to reduce cultural shock when merchants carry out local business. I fully understand that entrepreneurs are launching the same product globally. But for the Middle East and Muslim countries, it will be a big cultural shock.

So whether from the perspective of laws, data privacy protection, or culture, these three factors will lead to different business practices for our merchants. Their business models are designed differently, so what we can do is to implement payment services based on their business models. We can even tell them in advance which business models they need to change when they arrive at the local market, and even their fee model and profit margins will change. These are some of the things we do, and we always maintain two-way communication.

Hazel: I understand. I think many geographical concepts are blind spots for entrepreneurs going overseas at the beginning. For example, we often talk about going overseas in Southeast Asia, the Middle East, and Latin America. It seems that as long as these places are placed in the same geographical area, they can use the same set of strategies. But when you go deeper, you will find that each country has its own characteristics. I have been to Turkey and Egypt. I think the differences between North Africa and such countries are already huge. Dubai and Saudi Arabia may be completely different environments.

Just now I mentioned the policy changes. I know Saudi Arabia is one of the countries that has undergone a relatively large policy change in recent years. It is a very different world before and after the opening up. I would like to ask again, in addition to religious and political factors, the Middle East itself may also have some specific pain points in the payment process. For example, because I used to do research on Saudi express delivery, I know that a big problem in Saudi Arabia is that it cannot be delivered, because the address may be written very vaguely, and it may be delivered to a desert or a mountain, or a house, but there is no specific address, and it cannot be found after searching around. What are the pain points in our daily payment process, especially some pain points that Chinese entrepreneurs cannot think of?

Essay: I think this is the pain point. Hazel and I both thought of COD (cash on delivery), which shows how painful it is. We also serve some local logistics companies, so I will talk to you about the pain points of cross-border e-commerce payment in the Middle East based on actual experience.

First of all, let me share some data. The online payment success rate of the top e-commerce companies is probably less than half. You can imagine how low the online payment success rate is in the initial incubation period. Therefore, when talking about e-commerce in the entire Middle East region, COD is an issue that cannot be avoided. So why do we have this problem?

First, the delivery is not accurate. It is uncertain whether the goods can be received. The buyer may not be able to deliver the goods, and the consignee may not be able to receive the goods. Why? It is related to urban infrastructure. Leyard only started to have a 5-digit postal code in 2013, and many houses were built by themselves, and the postal code was not particularly clear. It was not until 2022 that the extension code was added to the postal code, and combined with the GPS positioning system, a more accurate positioning was achieved. This was two or three years ago, and this layer of infrastructure had just been built at the national level.

Second, objectively speaking, the development of e-commerce in the Middle East is not slow. For example, Shein entered Saudi Arabia in 2015, which was relatively early. Before Shein, Amazon, a European and American e-commerce company, had already acquired SQL, the largest local e-commerce company. So the Middle East entered e-commerce relatively early, but the consumption habits of e-commerce were not cultivated so quickly, and there are many reasons for this.

First, there is a big family culture here, and for nomads, the sense of happiness of seeing and touching things is very important, and shopping in shopping malls is an important part of their lives, so the habit of e-commerce is slowly penetrating. And our Chinese entrepreneurs are also very good, combining online and offline interactions. Since 2003, Shein has opened some pop-up stores in Leyard, and opened a pop-up store again in June this year, so he will integrate online and offline in this way. So the love of seeing goods is really in the blood of the people.

At the same time, because there are more impulse purchases, many consumers choose cash on delivery, which is a double insurance for themselves. They can refuse to pay, they can refuse the delivery, or even refuse to open the store. However, this is quite damaging to e-commerce.

The last point is related to the entire infrastructure. Many of our express delivery workers are women, but they do not necessarily have their own independent bank cards. Currently, the card holding rate of women in MENA, especially in Muslim countries, is from 35% to 70%. In countries with stricter religious rules, such as Saudi Arabia, this figure may be below 50%. So they only have cash and no cards, and they cannot consume online. They can order online, but they have to pay offline. These reasons have led to COD being a structural problem in the short term.

Let me tell you how we will solve this problem. There are two solutions. One is to change the payment method. We will do pay by link, which means we will change the behavior of collecting money and swiping POS to payment by link. The other is that we will work with logistics companies to come up with some innovative solutions. If we can't beat it, we will join this state. Payment will happen together with delivery, but hopefully it will not be cash.

Hazel: This. I want to add that the essay just mentioned that the development of e-commerce in the Middle East is not late. The example that comes to my mind is that when I was in Egypt last time, my landlord recommended me to use the food delivery software, Talabat. I wondered if it was another Chinese Internet company, so I searched it. I didn’t expect that this company founded in Kuwait started doing food delivery in 2004! Comparing the timeline, Ele.me was not available in Shanghai until 2008, and Meituan Waimai was not established until 2010.

The company also entered Egypt through acquisitions. A local Egyptian company called Otlob was renamed Talabat. Otlob was even established earlier, in 1999.

Another point is the habit issue I just mentioned. Of course, I am not in the Middle East, but I have this feeling in Europe. Sometimes it is not that the e-commerce platform is not good enough, but I really want to communicate with people face to face offline. For example, if they ask me to scan the code to pay in a French restaurant, I will feel very uncomfortable, because the overall culture here is that you should serve me in person. However, it may be a completely different feeling in China. I think the Middle East may also have this habit of preferring offline consumption, and this habit is difficult to change. This is my personal life experience in the Middle East and Europe.

Essay: I totally agree. So I think our engine felt from the beginning that this must be changed, but now we say that this cannot be changed, so we add optimization.

Ivy: Essay: During your time working in the Middle East, were there any local payment cases that overturned your perceptions? Did they completely change your view of this market?

Essay: I want to share a very interesting series. Taking Saudi Arabia as an example, I want to tell the story of the aggrieved big spenders. Big spenders are krypton gold players. You may have always believed that the consumption power of the Middle East is strong, which is true.

First, let's focus on Saudi Arabia. According to the data, Saudis like to spend money and are willing to spend, both men and women. According to the data from Neso, a game and e-sports data analysis agency that we often use, there are many free games on Saudi apps, but even with so many free games, 60% of Saudi gamers still like to spend money, and about 34% of them are ordinary consumers who will continue to buy. About 8% are large consumers, VIPs, who like to continue to buy in large quantities, which shows that they really like to spend money.

Sometimes I also attend offline VIP meetings of some game clients, where I can see female players, and these are brave female players who are willing to come out, so there are more female players behind the scenes. According to interviews, female consumption willingness is also very strong.

Secondly, let's look at the data provided by the Saudi Arabian Central Bank. We can see that the entire online economy is growing very fast. At the same time, the transaction price of e-commerce is much higher than that of offline. In March this year, the total consumer spending of Saudi Arabia increased by 17%, setting a new record. At the same time, the unit price of online consumption is 2.5 times that of offline POS consumption. So it can be seen that those who love to spend love to spend online.

Isn't this very exciting? So what are the pain points? For example, if there is a krypton gold consumer, he sits at home, buys things and recharges on several mobile phones, then what do we see as the background? IP address, multiple devices, multiple cards, in the middle of the night, continuous challenge of large amount payment, doesn't this look like fraud? So it is easy for our payment company to intercept the risk, or close the file, or the card group to prevent fraud and automatically intercept the risk control.

So, I regard them as the aggrieved big R. I just want to recharge, they are all my cards, the phone is mine, and I am at home, but they may fail the transaction at best, or even directly block the card at worst.