Last week in the cryptocurrency market was truly dynamic with many unexpected fluctuations, from large transactions to scams and important upgrades.

These diverse developments came not only from exchanges and regulatory bodies but also from famous personalities, keeping the market always full of challenges and opportunities.

- Trump Media invests 2 billion USD in Bitcoin, with a long-term financial strategy and utility Token development.

- Scam Tokens proliferated following Ozzy Osbourne's passing on Solana, causing serious damage to investors.

- Galaxy Digital sold over 80,000 Classic Bitcoin worth 9 billion USD without disrupting the market.

How did Trump Media make this large Bitcoin investment?

Mr. Devin Nunes, CEO of Trump Media, confirmed the 2 billion USD investment in Bitcoin and related assets, aimed at protecting financial independence and preparing for the platform's utility Token.

This is a strategic move to consolidate long-term financial position and expand the cryptocurrency ecosystem in the company. Additionally, Trump Media has allocated an extra 300 million USD for Bitcoin options and is studying cryptocurrency ETF funds.

"This investment is the foundation to ensure the company's financial freedom and support the future utility Token issuance plan."

Devin Nunes, CEO Trump Media, 2025

Why did many fraudulent Tokens appear on Solana after Ozzy Osbourne's news?

Within hours of Ozzy Osbourne's passing, at least 15 Tokens using his name appeared on Solana, most of which were confirmed Rug Pull scams.

According to on-chain data, these 10 projects quickly withdrew liquidity, causing investors to lose around 1,625 SOL (over 325,000 USD) in minutes. This trend reflects the increase in fraud schemes linked to prominent events in the cryptocurrency world.

"Nearly 98% of Tokens on Pump.fun are suspected of pump-and-dump models, despite the platform's denial."

Solidus Labs Report, 2025

How much capital did Michael Saylor's company raise to expand Bitcoin investment?

MicroStrategy's strategy recently raised 2.8 billion USD through "Stretch" preferred shares, exceeding the initial 500 million USD plan, to buy more Bitcoin with a target of 84 billion USD by 2027.

With a flexible 9% monthly dividend, the company can easily adjust its strategy in a volatile market. With over 607,000 BTC in its portfolio, MicroStrategy maintains a high-risk strategy to expand holdings.

What did FTX announce about creditor payment plans?

FTX will conduct the next debt repayment on September 30th through BitGo, Kraken, and Payoneer, continuing the court-approved plan.

To date, the exchange has returned 6.2 billion USD and reduced dispute provisions from 6.5 billion USD to 4.3 billion USD. Mr. Sam Bankman-Fried is serving a 25-year prison sentence for fraud charges, and the creditor recovery process remains slow.

What did Ripple's CEO warn about YouTube scams targeting XRP users?

Brad Garlinghouse, Ripple's CEO, posted a warning on social media about fake YouTube channels scamming XRP users with high-profit promise Airdrops.

The scam coincided with a 10% XRP price drop, making investors vulnerable. Ripple's CTO also discovered deepfake videos advertising a 100 million XRP giveaway, emphasizing the need to be cautious with links and verify official accounts.

What progress has Justin Sun's Tron Inc. made on Nasdaq?

Justin Sun officially listed Tron Inc. on Nasdaq by merging with toy production company SRM Entertainment, bypassing the traditional IPO.

Tron Inc. holds TRX worth over 115 million USD, and after the trading registration news, trading volume increased by 36%, creating a boost for the entire cryptocurrency industry.

What is the good news about the investigation into Jesse Powell, Kraken's co-founder?

The FBI officially concluded the investigation into Jesse Powell, with no criminal charges filed, and all devices and cryptocurrencies were returned.

The matter involved a non-profit dispute and did not affect Kraken or cryptocurrency operations. This allows Powell to continue developing Kraken.

What major Ethereum upgrade is expected to launch in November?

Ethereum is expected to launch the Fusaka hard fork in November, including 11 proposals to enhance security and expand network scale.

The testing process has begun with Devnet, followed by two public testnets. Major improvements like EIP-7825 aim to prevent network attacks, with some proposals removed to ensure progress.

What's new after the 44 million USD CoinDCX hack?

CoinDCX, India's largest cryptocurrency exchange, lost 44 million USD due to an internal account breach, but customer assets remain safe as the hacker's source of funds is unrelated to user wallets.

CEO Sumit Gupta said the loss would be covered by company reserves, with stolen Tokens on the Solana-Ethereum bridge currently "frozen". Authorities are investigating, with a 25% recovery value reward announced.

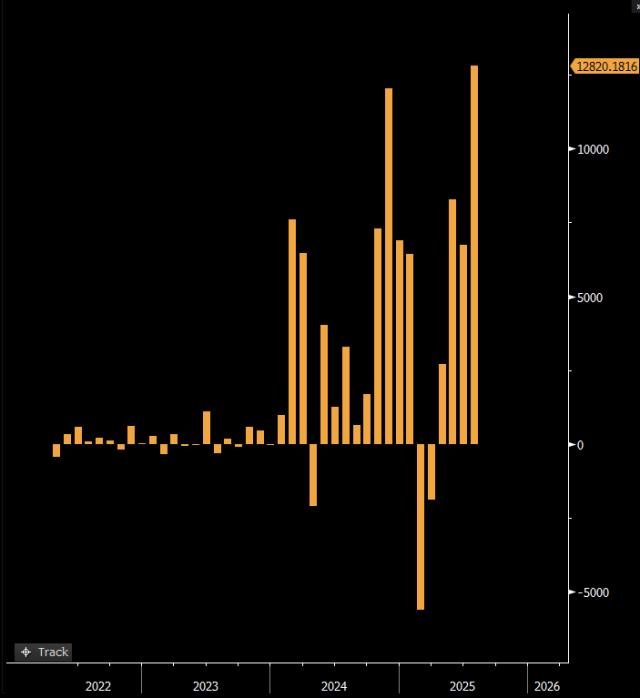

What is the impact of Galaxy Digital selling over 80,000 Classic Bitcoin?

Galaxy Digital confirmed selling over 80,000 Bitcoins produced in 2011, worth over 9 billion USD, to investors in an asset transfer plan.

Notably, the market was almost unaffected in price, reflecting the current maturity and stability of the Bitcoin market, in contrast to previous large sales.

What are the short events you should know this week?

USDT – the first stablecoin managed by the GENIUS Act law launched with the participation of Ethena and Anchorage, supported by cash and government bonds.

Citadel warns SEC about potential loopholes in Tokenization regulations that could affect the stock market, pushing for stricter regulations.

SEC postpones Bitwise ETF approval right after its favorable status, showing caution towards cryptocurrency financial products.

Pudgy Penguins and Igloo Inc. are betting on Non-Fungible Token 2.0 and gaming sector as the next cryptocurrency trend.

Goldman Sachs and BNY Mellon are promoting Tokenization funds on Wall Street, with support from BlackRock and Fidelity.

What prominent trends are shaping the future of the cryptocurrency market?

Bitcoin's role in corporate treasury is significantly increasing as many large companies invest heavily in BTC.

Stablecoins are being promoted by clear regulations, with progress like USDT stablecoin complying with the GENIUS Act law.

Ethereum upgrades focusing on security and performance will be rapidly deployed this year.

Risks from fraudulent Tokens related to famous events are increasing, with pressure on exchanges to prevent them in time.

The Bitcoin market is gradually accepting large transactions without significant volatility, creating a sustainable foundation for the future.

Ending the week with many new highlights, the cryptocurrency market promises to continue with many fluctuations and attractive opportunities.

Frequently Asked Questions

How much has Trump Media invested in Bitcoin?

Trump Media invested 2 billion USD in Bitcoin and related assets, aiming to increase financial autonomy and support utility Token development.

What caused the wave of fake Ozzy Osbourne Tokens on Solana?

Immediately after Ozzy Osbourne's death, many Tokens using his name emerged to exploit his reputation, mostly scams that quickly pulled liquidation.

How many Bitcoins did Galaxy Digital sell and what was the impact?

They sold over 80,000 Bitcoins worth more than 9 billion USD without causing market volatility, showing the market's maturity.

How does FTX plan to pay its creditors?

FTX will repay debts through partners from September 30th, has already returned 6.2 billion USD and continues to reduce dispute reserves.

What will Ethereum upgrade in November?

Ethereum is expected to launch the Fusaka upgrade with improvements in security and scale expansion, aimed at enhancing performance and preventing attacks.