This week, the S&P 500 and Nasdaq reached record highs thanks to positive signals from the US-Japan trade agreement and the US AI development plan.

Factors such as pressure to reduce interest rates from the White House to the Fed, US-China trade negotiations, and important economic data will strongly impact the financial market in the coming week.

- The US market recorded new highs due to policies and trade agreements.

- Next week will focus on major economic events and the Fed's interest rate decision.

- US-China trade negotiations and economic reports will create significant market volatility.

Why did S&P 500 and Nasdaq set record highs this week?

Positive macro factors likely drove the rise of S&P 500 and Nasdaq, according to reports from US financial market experts. Particularly, the trade agreement between the US and Japan and the US AI Plan are seen as key drivers.

The trade cooperation agreement with Japan not only expands export opportunities but also helps consolidate investor confidence in economic prospects. Additionally, the US's strong AI investment plan helps stimulate technological development and attract capital into technology stock groups, increasing Nasdaq's attractiveness.

Experts note that this trend reflects the optimism spreading across the US stock market, despite concerns about interest rates and existing trade tensions.

Will the interest rate reduction policy be implemented in the near future?

Pressure from the White House on Fed Chairman Powell to promote interest rate cuts is considered significant, as this is the first time a US President has directly visited the Fed headquarters in nearly 20 years. This demonstrates the heated expectations for financial market support.

"Reducing interest rates is a necessary factor to maintain economic recovery momentum and consolidate investor confidence in the current phase."

Jerome Powell, Chairman of the US Federal Reserve, 2024

In this context, the US Secretary of the Treasury is expected to approve a new Fed Chairman candidate before the end of the year, which could create a policy change favorable to investors. However, the Fed still needs to carefully consider actual economic data to determine an appropriate interest rate.

What important economic events will occur next week?

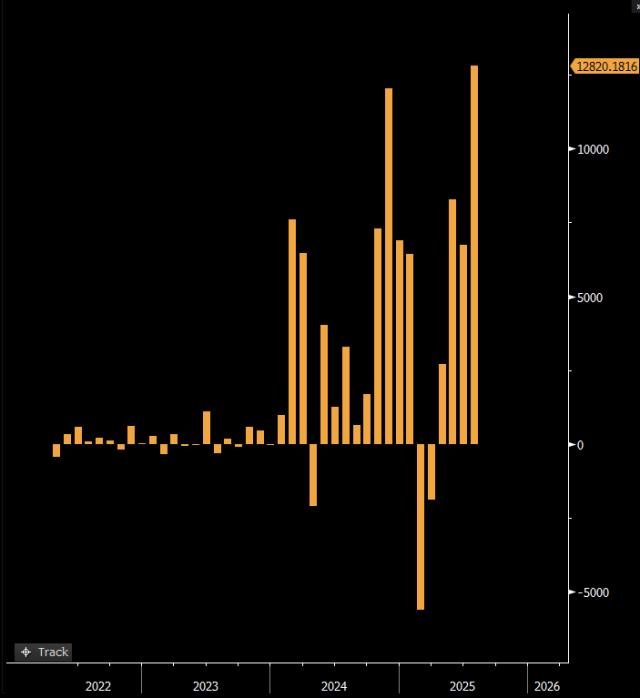

The week from July 28 to August 1 will witness many key economic data, including Q2 GDP and the Fed's interest rate decision on July 30. Economic negotiations between the US and China in Sweden will also significantly impact market sentiment.

Specifically, indicators such as China's manufacturing PMI, US non-farm employment report, and unemployment rate will help investors better assess the global economic health. Additionally, the Bank of Japan's interest rate decision will be closely monitored.

A large amount of data and important events are predicted to create significant market volatility, requiring investors to have strict risk management strategies.

How will US-China trade negotiations affect the market?

The US and China's resumption of 4-day trade negotiations starting July 27 has received significant attention from investors, as this is one of the most important market stabilization factors in recent times.

Through negotiation rounds, both sides aim to reduce tariff tensions and enhance economic cooperation, which will ease risks related to supply chains and international trade.

"We aim to achieve substantial progress to support growth and create favorable conditions for multilateral trade."

US Trade Representative, July 2024

Positive impacts from negotiations can reduce pressure on financial markets and encourage capital flow back to stocks sensitive to global trade.

What are the highlights for each day next week?

[Table translated as in the original text]Frequently Asked Questions

1. Why did US stock indices rise strongly this week?

The combination of the US-Japan trade agreement and the US AI development plan consolidated investor confidence, creating a positive momentum for the S&P 500 and Nasdaq indices.

2. How does the pressure to reduce interest rates from the White House affect things?

This pressure makes the Fed consider an interest rate reduction policy to support economic recovery and stabilize the financial market in the current risky context.

3. What are the expectations for US-China negotiations?

Negotiations aimed at reducing tariffs and enhancing cooperation will help alleviate trade tensions, creating conditions for global economic stability and growth.

4. How does the Fed's interest rate decision affect the market?

The Fed's interest rate decision is a crucial event that influences borrowing costs and investment sentiment, directly impacting stock prices and financial assets.

5. What economic data should be watched in the coming week?

GDP indicators, PMI, employment reports, and PCE price index are key data points that help assess whether the economy is recovering or declining.