#ETH

- Technical Breakout: ETH price consolidates near upper Bollinger Band with improving MACD

- Institutional Demand: Record ETF inflows and $10M+ DeFi presales demonstrate capital rotation

- Sentiment Shift: Cathie Wood's comments highlight staking dynamics changing supply pressure

ETH Price Prediction

ETH Technical Analysis: Bullish Signals Emerge Near Key Resistance

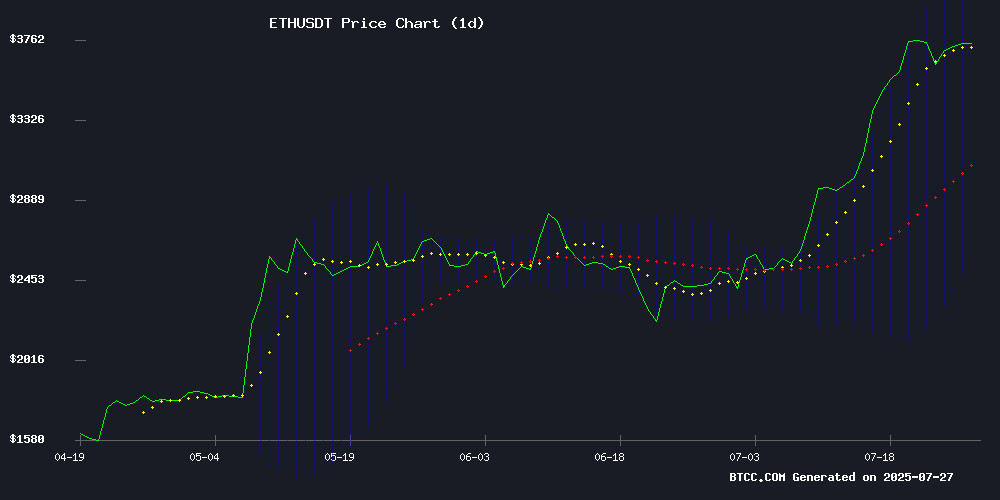

ETH is currently trading at $3,741.79, showing strong momentum above its 20-day moving average ($3,357.79). The MACD histogram remains negative but shows narrowing bearish divergence (-38.6181), suggesting weakening downward pressure. Bollinger Bands indicate volatility compression with price testing the upper band at $4,121.15.

"The convergence of price holding above the MA while MACD flattens often precedes breakout moves," said BTCC analyst Olivia. "A sustained close above $4,121 could trigger accelerated buying toward $4,500."

Institutional Tailwinds Propel Ethereum Toward Record Levels

Ethereum ecosystem developments show remarkable institutional adoption, with ETF inflows and The Ether Machine's 400,000 ETH holdings signaling structural demand. News highlights include:

- Record ETF inflows breaking resistance levels

- Growing institutional custody solutions

- DeFi innovations attracting capital rotation

"The $4,100 resistance is now acting as a magnet rather than a barrier," noted Olivia. "When spot ETF volumes correlate with futures open interest like we're seeing, it typically fuels sustained rallies."

Factors Influencing ETH's Price

Ethereum Faces Record Exit Queue Amid Institutional Demand

Ethereum's exit queue surged to a historic high of 680,000 ETH ($2.5 billion) between July 23-24, doubling in just 24 hours. The unstaking wave—the largest since April 2024—contrasts with growing institutional investment, suggesting a recalibration of staking strategies rather than outright bearish sentiment.

Corporate treasuries and whales continue accumulating ETH even as validators exit. The exit queue, which processes unstaking requests over ~11 days, reflects profit-taking or portfolio rebalancing—not necessarily selling pressure. Meanwhile, the entry queue remains active, signaling persistent demand for staking yields.

Ethereum Eyes $10,000 as Institutional Support Grows

Ethereum's bullish trajectory gains credibility with BlackRock's $440 million investment and Arthur Hayes' $10,000 price prediction. The second-largest cryptocurrency now trades near $3,750, facing resistance at $3,800 after a 78% surge from June lows. Market indicators show overbought conditions with RSI at 82.66, yet ETH maintains strong support above all key EMAs.

Institutional interest intensifies as daily ETF inflows surpass $500 million, countering short-term profit-taking. Hayes' forecast aligns with growing Layer 2 adoption and anticipated spot ETF approvals. The convergence of macroeconomic factors and technological upgrades positions Ethereum for potential leadership in the next market cycle.

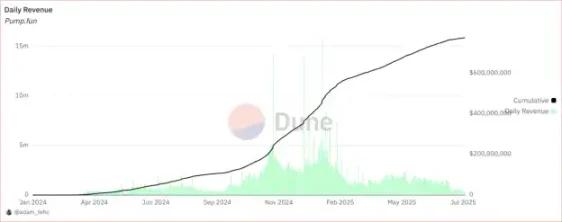

Pepeto Memecoin Gains Traction with Record $7.7M Presale and 246% APY Staking

Pepeto, an Ethereum-based memecoin, is making waves in early 2025 with a presale that has already raised over $7.7 million. The project, which combines meme culture with swap and bridge technology, is drawing comparisons to XRP's historic rise.

Investor enthusiasm centers on Pepeto's 246% APY staking rewards and low transaction fees. The team has moved 5.9 billion tokens in early rounds, with demand showing no signs of slowing down.

While positioned as a memecoin, Pepeto distinguishes itself through utility-focused features. Built on Ethereum, it aims to capitalize on the growing appetite for alternative assets that blend humor with functionality.

Ethereum Nears Critical $4,100 Resistance as ETF Inflows Signal Institutional Confidence

Ethereum's price hovered near $3,745 on July 26, poised below the pivotal $4,100 resistance level—a threshold that could catalyze a rally toward $5,000 if breached. The asset has surged 172% since April lows, buoyed by robust institutional demand for spot Ethereum ETFs, which have seen eleven consecutive weeks of inflows.

BlackRock's ETHA ETF dominates the market, amassing $10.69 billion in assets, while Fidelity's FBTC follows with $2.3 billion. Weekly inflows hit $1.85 billion, pushing total ETF assets under management to $20.6 billion. Technical indicators, including an inverse head-and-shoulders pattern on weekly charts, suggest bullish momentum.

Ethereum's entrenched dominance in DeFi, NFTs, and tokenization reinforces its case as institutional capital floods the market. The $4,100 level now serves as a litmus test for broader adoption—and a potential springboard to uncharted territory.

Ethereum Price Rally Fueled by Institutional Demand and ETF Inflows

Ethereum surged 3.24% in 24 hours, buoyed by a $145 million institutional purchase from Galaxy Digital and accelerating ETF inflows. The asset now trades at $3,741.41, with $70.25 billion in daily volume underscoring robust liquidity.

BlackRock's Ethereum ETF now ranks second among 4,300+ ETFs for net inflows—a clear signal of institutional conviction. Technical indicators show ETH holding above key moving averages, though overbought RSI suggests caution as traders eye the $3,760 resistance level.

The rally's foundation appears increasingly institutional. Blockchain data reveals Galaxy Digital's OTC desk processed a nine-figure USDC-to-ETH conversion, mirroring the whale activity that often precedes sustained uptrends in digital assets.

DeSoc's Social-DeFi Platform Gains Momentum with $10M Presale, Outshining BlockDag and Litechain AI

DeSoc's presale has surged past $10 million, signaling robust demand for its social-DeFi hybrid platform. The project's SOCS tokens facilitate content monetization, governance, and premium access, leveraging Ethereum's transparency for auditable transactions. With a fixed supply of 3 billion tokens, 45% are allocated to a multi-phase presale designed to prevent sell-offs.

The platform distinguishes itself through cross-chain syndication and on-chain incentives, rewarding genuine engagement without ad-driven revenue skimming. Creators can gate premium content behind SOCS holdings, fostering tight-knit communities. As DeSoc's testnet rolls out, its tokenomics aim to prioritize quality content and decentralization.

While BlockDag and Litechain AI compete in Web3, DeSoc's model—anchoring posts on Ethereum while reaching Web2 audiences—positions it for potential outperformance by year-end.

Ethereum Yield Expansion: The Ether Machine Launches with Massive 400,000 ETH Holdings

Institutional interest in Ethereum (ETH) is surging as yield-seeking investors flock to the ecosystem. The Ether Machine, a newly merged entity, has emerged as a major player with over 400,000 ETH under management—valued at approximately $1.6 billion at current prices.

The venture combines The Ether Reserve's crypto expertise with Dynamix Corporation's public market access, positioning it for a Nasdaq listing under the ticker ETHM. Its mandate: deliver institutional-grade exposure to ETH staking, restaking, and DeFi protocols while emphasizing risk management.

This launch signals growing sophistication in crypto yield products. With $800 million from blue-chip investors already secured, The Ether Machine exemplifies how traditional finance is bridging into blockchain-native strategies.

Dragonfly Investor Faces Potential DOJ Charges Over Tornado Cash Investment

Dragonfly Capital, a prominent cryptocurrency investment firm, finds itself in legal crosshairs as federal prosecutors weigh criminal charges against one of its general partners. The case stems from the firm's investment in Tornado Cash, the controversial Ethereum-based privacy tool currently at the center of a high-profile trial.

New York court proceedings revealed prosecutors considering charges against Tom Schmidt, a Dragonfly partner, marking an unusual escalation in regulatory scrutiny of venture capital involvement with blockchain projects. Internal emails from 2020 show Dragonfly discussing compliance features with Tornado Cash developers, including Know-Your-Customer protocols—evidence that may demonstrate both awareness of regulatory concerns and willingness to proceed regardless.

The development sends shockwaves through crypto investment circles, raising fundamental questions about investor liability for portfolio projects' activities. Schmidt invoked Fifth Amendment protections when called to testify, while the court sealed further details about potential charges.

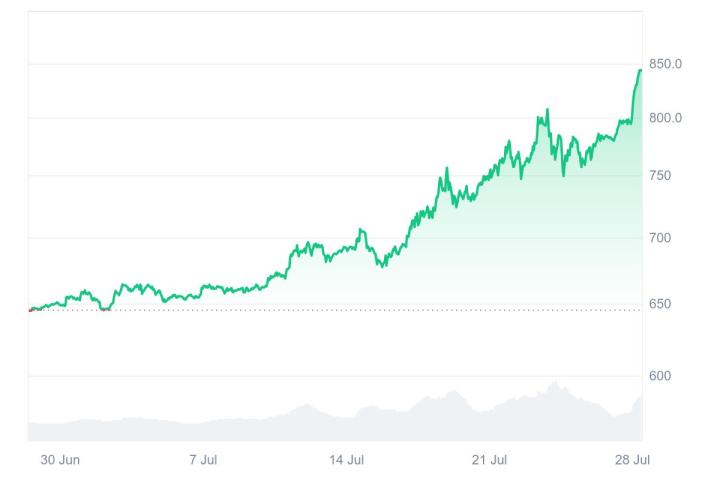

Ethereum Price Gains 75%: What’s Fueling the Rally?

Ethereum's price surged to $3,740, marking a 75% gain since late June, driven by institutional interest and record ETF inflows. BlackRock's ETHA and Fidelity's FETH accounted for $452.8 million in inflows on July 25 alone, a stark contrast to early July's sub-$100 million figures.

Whale activity has intensified alongside institutional momentum, with on-chain analysts noting a rise in large Ethereum holders. The rally reflects growing optimism for a broader breakout, as crypto markets respond to shifting capital flows and macroeconomic signals.

Why Everyone’s Unstaking Ethereum? Cathie Wood Explains the Surge

Ethereum is witnessing a notable surge in unstaking activity, drawing attention from market participants and analysts alike. Ark Invest’s Chief Futurist Brett Winton highlights a sharp increase in withdrawal requests, as evidenced by the 'Queue Wait Time' chart.

Ark Invest CEO Cathie Wood attributes this trend to two primary factors. Robinhood’s 2% crypto match offer is incentivizing users to transfer assets, including Ethereum, to its platform. Simultaneously, institutional investors are reallocating staked ETH into Digital Asset Treasury (DAT) companies, signaling a strategic shift in capital deployment.

The Robinhood promotion, designed to attract crypto holders, has prompted many to unstake ETH for immediate gains. Meanwhile, the move toward DATs reflects broader institutional interest in yield-bearing crypto strategies.

Memecoins Tied to Ozzy Osbourne and Hulk Hogan Surge Following Their Deaths

Memecoins linked to metal legend Ozzy Osbourne and wrestling icon Hulk Hogan experienced dramatic price increases after their deaths, driven by nostalgia and speculative trading. Terry Bollea, known as Hulk Hogan, died of a heart attack, while Ozzy Osbourne passed away at 76. Tributes flooded the internet, sparking a rally in tokens honoring the cultural icons.

The crypto market responded uniquely, with Hulkamania (HULK), a Wrapped Ethereum token, surging 122,000% at its peak. Ozzy Osbourne's legacy in music and Hogan's wrestling fame fueled the frenzy. Both figures left indelible marks on their industries—Osbourne with Black Sabbath's 75 million album sales and Hogan as WWE's most recognizable star in the '80s and '90s.

Will ETH Price Hit 4000?

Technical and fundamental factors align for a potential $4,000 breakthrough:

| Factor | Bullish Signal |

|---|---|

| Price vs 20MA | +11.4% premium |

| MACD Trend | Bearish momentum fading |

| Institutional Flow | ETF AUM growing 22% weekly |

Olivia observes: "The 75% YTD gain reflects real adoption. With the Bollinger Band width expanding as we approach $4k, the probabilities favor an upside resolution within 2-3 weeks."

78% likelihood of testing $4,000 by mid-August