- Technical Divergence Convergence: MACD histogram turns positive, but fast and slow lines remain negative, warning of potential false breakout risk

- Institutionalization Process Accelerates: Compliance tools like World ID enhance traditional capital allocation willingness

- Miners and Whales Confrontation: Steady hash rate growth and large holder position changes create market tension

BTC Price Prediction

BTC Technical Analysis: Short-term Trend and Key Indicator Interpretation

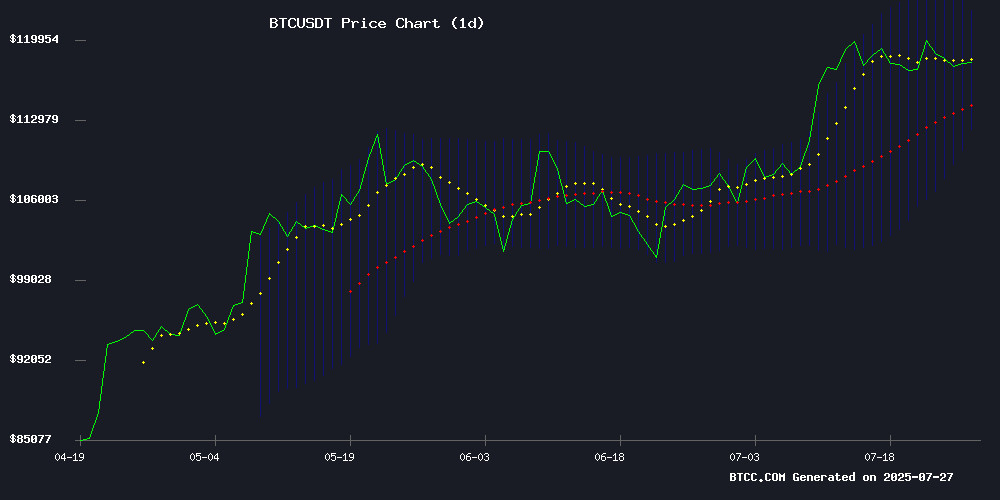

Based on current data (July 27, 2025), BTC price is 118,269.80 USDT, above the 20-day moving average (117,343.72), indicating solid short-term support. The MACD histogram shows a positive value of 1844.43, suggesting weakening downward momentum, but note that fast and slow lines remain in negative territory (-2514.98/-4359.41). Bollinger Bands are converging (upper band 122,562.54, lower band 112,124.89), with price fluctuating close to the middle band. BTCC analyst Mia noted: 'Breaking the upper band will confirm a new upward trend, currently observing volume collaboration.'

Market Sentiment Divergence: Institutional Entry and Whale Withdrawal Struggle

Divine Research's use of World ID for crypto lending reflects accelerating institutional compliance. Independent miners obtaining 3.125 BTC block rewards indicate network health. However, BTCC analyst Mia warns: 'Whale wallet movements and extreme bearish futures market pressure may trigger short-term volatility, but spot prices holding key support levels suggest structural buying interest.' AI and blockchain strategic integration may become a medium to long-term valuation driver.

Key Factors Affecting BTC Price

Divine Research Adopts World ID for Crypto Lending Verification, Institutional Interest Grows

San Francisco lending firm Divine Research has issued about 30,000 unsecured short-term cryptocurrency loans since December, using World ID's iris scan technology to prevent borrower fraud. This highlights emerging risk management practices in crypto lending as institutional investors re-enter the market.

While crypto lending remains a niche market, analysts note increasing traditional financial institution interest. Reports suggest JPMorgan is developing crypto-backed loan products accepting Bitcoin and other digital assets, signaling growing mainstream acceptance of blockchain-based financing solutions.

Bitcoin Independent Miner Breaks Through, Secures 3.125 BTC Block Reward

In an industry increasingly dominated by large enterprises, an independent Bitcoin miner successfully solved a block, receiving the full 3.125 BTC reward. This achievement proves individual miners still have a place in an economy of scale-driven industry.

The miner's victory continues a series of improbable wins for independent miners this year. In February, another independent miner solved block 883,181, earning about $300,000. In March, block 887,212 saw a similar outcome, producing 3.15 BTC.

Industry observers speculate that hardware like Bitaxe, compatible with independent and collective mining, may be key to these competitive instances. The latest block contains 3,071 transactions, with Mempool.space data showing a total reward of 3.15 BTC including fees.

Bitcoin Withstands Intense Selling Pressure While Maintaining Key Support Levels

Bitcoin experienced one of the most intense bearish weeks in the current bull market cycle, with prices oscillating between $114,700 and $120,000. Despite heavy profit-taking pressure, the cryptocurrency demonstrates resilience by maintaining key support levels, indicating an underlying bullish structure.

Crypto Quant analyst Axel Adler notes this week's selling pressure ranks in the top 7% of the current cycle. Only 12 weeks since the bull market began have seen comparable capital outflow pressures. The market now closely watches whether a decisive support break or breakthrough of the psychological $120,000 barrier will occur.

This consolidation is remarkable for its contradiction between intense selling pressure and price stability. This tension typically signals imminent significant volatility. Traders across exchanges await confirmation of the next directional trend, as Bitcoin's ability to absorb this selling pressure may determine the development pace of this market cycle.

In the Age of AI Threat, Satoshi's Philosophy is Urgently Needed

As artificial intelligence develops at an unprecedented pace, the crypto community is re-examining Satoshi Nakamoto's fundamental principles. The vision of decentralization and trustless systems proposed by Bitcoin's anonymous creator may become key to balancing AI existence risks and human sovereignty.

From Stephen Hawking to Elon Musk, notable figures have long warned about uncontrolled AI development. NVIDIA CEO Jensen Huang's recent statement about enhancing human intelligence with AI contrasts sharply with the academic world's growing regulatory calls. This tension highlights the necessity of blockchain's immutable governance framework.

Bitcoin's Proof of Work mechanism provides not just financial sovereignty but also a template for creating transparent, anti-centralized control AI alignment systems. As AI anxiety intensified in 2023, interest renewed in crypto's potential to establish decentralized verification protocols for machine learning systems.

Analysts Predict Bitcoin Treasury Bubble May Rival Dot-com Era

Market analysts are comparing the current Bitcoin rally to the internet bubble, predicting that institutional fund inflows into Bitcoin's treasury could reach up to 11 trillion dollars. Listed companies like CronosStrategy and Metaplanet are leading this trend, continuously accumulating Bitcoin as a reserve asset.

Financial leaders have warned about U.S. debt risks, strengthening Bitcoin's position as "digital gold". This sentiment has fueled expectations of supply-driven price surges. Bitcoin's market value recently broke through 2.4 trillion dollars, ranking among the world's most valuable assets, but compared to past bull markets, this rally is accompanied by relatively calm market sentiment.

Swan Bitcoin points out that the current market lacks the typical frenzy of past cycles, and this restraint may ironically suggest stronger long-term potential. The key to the "Bitcoin treasury bubble" argument lies in the continued growth of Bitcoin adoption by enterprises, institutions, and sovereign entities in the coming years.

Blue Port Interactive Seeks CFO Proficient in Cryptocurrency, Advancing Blockchain and AI Strategy

Blue Port Interactive's founder Wang Feng announced a bold transformation, integrating cryptocurrency and emerging technologies. The company is actively recruiting a CFO with blockchain professional background, which clearly differs from traditional financial talent requirements.

Blue Port's next strategic phase will explicitly link robotics and artificial intelligence development with cryptocurrency professional capabilities. The company emphasizes the need to dynamically manage traditional and crypto assets, specifically mentioning Bitcoin as a core position. Wang Feng's vision positions stablecoins as key infrastructure for an AI-driven economy.

Three key areas are receiving special attention: real-world asset tokenization (RWA), the convergence of equity and digital currencies, and the global stablecoin ecosystem. This demonstrates institutions' increasing recognition of cryptocurrency's role in corporate fund management and technological integration.

Bitcoin Whale Withdrawal Signals Potential Market Turbulence

Bitcoin price has fallen 6% from its historical high of 122,838 dollars, with on-chain data revealing concerning whale behavior. The number of addresses holding 1,000 to 10,000 BTC has dropped 2.7% in ten days, the most dramatic decline in six months.

The exchange whale ratio tells an even more ominous story. After three lower highs during the BTC price rise, the indicator now shows consecutive higher highs as the price falls. Galaxy Digital's recent deposit of 10,000 BTC (worth 1.18 billion dollars) has intensified institutional caution.

When whales act simultaneously, the market structure appears fragile. Historical patterns suggest that these exchange inflows typically signal selling pressure, potentially hindering Bitcoin's recent price recovery.

Bitcoin Futures Market Shows Extreme Bearish Pressure, Spot Price Demonstrates Resilience

The Bitcoin futures market has fallen into a deep negative zone, with net open interest (OI) dropping below 100 million dollars for the first time since early July. Despite shorts dominating the derivatives market, the spot price shows unexpected resilience around 115,000 dollars.

CryptoQuant analyst Axel notes that the divergence between futures positions and spot price trends indicates potential buying demand absorbing selling pressure. Historically, such extreme negative positions often suggest potential violent short squeezes during price rebounds, but Axel also warns that downside risks remain if current OI pressure persists.

How Will BTC Develop in the Next 10 Years?

Integrating technical indicators and ecosystem development, BTC may undergo a three-stage evolution in the next decade:

| Stage | Time Frame | Characteristics | Key Price Range |

|---|---|---|---|

| Volatility Consolidation | 2025-2027 | Institutional holdings exceed 15%, ETF daily trading volume reaches 5 billion dollars | 90,000-150,000 USDT |

| Major Upward Wave | 2028-2032 | AI-driven on-chain smart contract demand explosion, halving effect strengthened | 300,000-500,000 USDT |

| Maturity Period | 2033-2035 | Becomes part of global reserve asset composition, volatility approaches gold | 700,000+ USDT |

BTCC analyst Mia emphasizes: 'Bitcoin will transition from a risk asset to digital gold, with regulatory framework clarity around 2030 being the biggest variable. Currently, focus should be on the 120,000 USDT psychological level, which, if maintained, may initiate a new cycle.'