Author: Nathan Ma, DMZ Finance Co-Founder & Chairman

Original link: https://www.techflowpost.com/article/detail_27100.html

Disclaimer: This article is a reprint. Readers can get more information through the original link. If the author has any objection to the reprint format, please contact us and we will modify it according to the author's request. The reprint is only for information sharing and does not constitute any investment advice, and does not represent Wu Blockchain views and positions.

Core ideas:

- Stablecoins explode, 2025 is the Skype moment for blockchain finance

- The construction of Web3.0 failed, and Finance3.0 was built

- RWA asset on-chain: ledgers must be decentralized, assets must be centralized

- Hong Kong 100-Coin Wars: Challenges of Emerging Stablecoins

- RWA's Middle East Opportunities: A World-Class Digital Asset Hub

- RWA linkage between Mainland China/Hong Kong and the Middle East

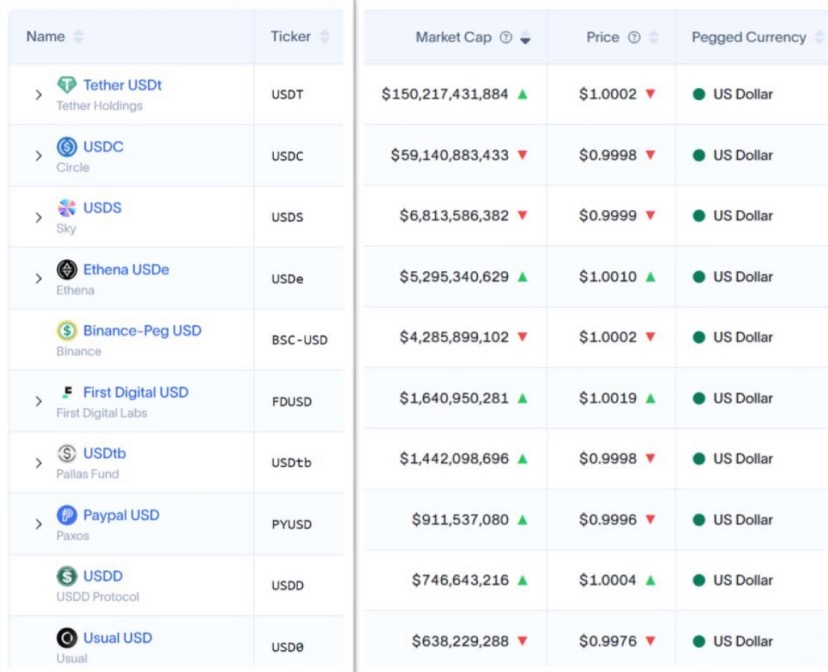

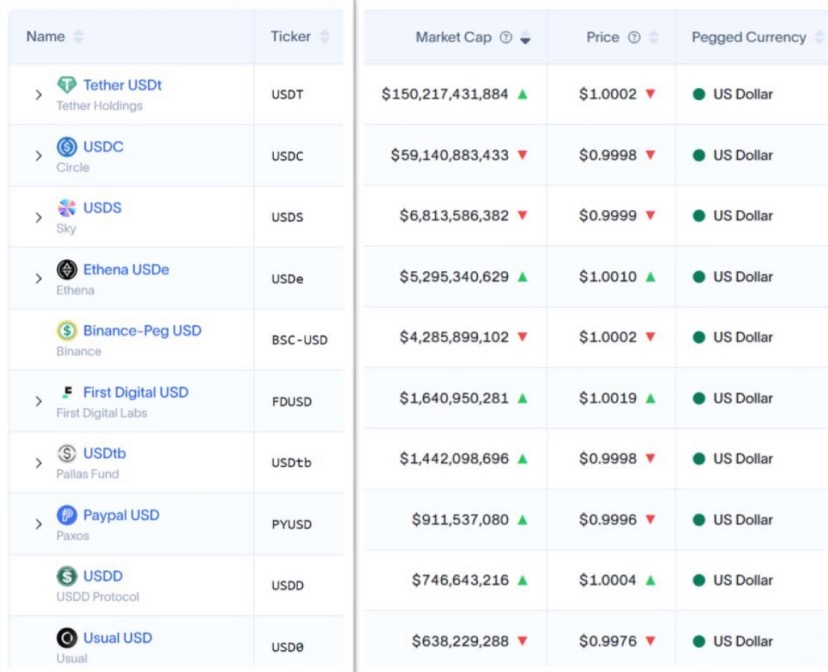

As one of the most core applications of blockchain finance, stablecoins will experience explosive growth in 2025.

According to RWA.xyz data, as of July 2025, the global stablecoin market has exceeded $250 billion. In the past 12 months, the number of active stablecoin addresses exceeded 240 million, the number of payments reached 1.4 billion, and the total transaction volume reached $6.7 trillion. In 2024, the annual transaction volume of stablecoins has surpassed the combined transaction volume of Visa and MasterCard, becoming one of the most important payment carriers in the world.

According to the U.S. Treasury Borrowing Advisory Committee (TBAC), the basic market value of stablecoins is expected to reach US$2 trillion in 2028; if the interest-paying stablecoin market is included in the statistics, the overall scale may reach US$3.5 to US$4 trillion.

2025 is the Skype moment for blockchain finance

Before Skype was born in 2003, making international calls was expensive and inconvenient. The advent of Skype completely subverted the traditional telephone network, enabling instant transmission of voice and text around the world almost free of charge. And this was just the beginning of the change.

WhatsApp was launched in 2009, WeChat was introduced in 2011, and the rise of WeChat Pay and Alipay officially opened the curtain on Internet finance.

Stablecoins, as one of the most representative applications in blockchain finance, were originally invented as a transaction medium on the chain. However, with geopolitical sanctions, global inflation and international turmoil, stablecoins have gradually evolved into a powerful challenger to the traditional international payment system SWIFT.

This challenge stems from the efficiency and cost advantages brought by its native technology: traditional SWIFT cross-border transfers take an average of about 5 working days and cost about 2-3%; while blockchain-based stablecoin payments achieve 24/7 global real-time arrival. Taking the Solana chain as an example, its average transfer fee can be as low as $0.00025 per transaction, which has a significant cost advantage.

Just as Internet communications replaced telephone networks in 2003, blockchain networks are replacing traditional interbank payment networks today. This trend is irreversible, and this change has just begun.

The effort to build Web3.0 failed, and Finance3.0 was built

The real watershed between Web2.0 and Web1.0 is not the upgrade of interaction methods, but the full explosion of the application layer. Search, video, payment, e-commerce, games, social networking, all the Internet experiences we are accustomed to today, have emerged in the Web2.0 era. The driving force behind it is not an empty concept, but the leap forward in "chip performance and network bandwidth", which directly triggered an unprecedented application revolution.

If we use the explosion of applications as the standard for dividing generations, the so-called "Web3.0" in the past did not usher in a real large-scale explosion of applications, which was mainly due to the innovation of the underlying infrastructure - such as distributed ledgers and cryptocurrency technology. And simply using the functional level of "centralization" and "decentralization" to distinguish generations is obviously not convincing enough.

From this perspective, the construction of Web3.0 has not been successful. What has been built is "Finance 3.0": based on a decentralized network, using cryptocurrency as a medium, the exchanges, derivatives, leverage, lending and other functions of the traditional financial world are moved onto the chain.

Finance 1.0 — Traditional Financial System

Finance 2.0——Internet Finance

Finance 3.0——Blockchain Finance

The most important application in Finance 3.0 is the stablecoin built on a decentralized network, which is profoundly reshaping the global payment and clearing network. The degree of disruption of this innovation is comparable to the replacement of horse-drawn carriages by trains, which has brought about a qualitative leap in efficiency and cost.

RWA asset on-chain: ledgers must be decentralized, assets must be centralized

Unlike Finance 2.0, the blockchain network was designed as an underlying platform for tradable assets since its inception. Initially, it mainly supported crypto-native assets such as Bitcoin (BTC) and Ethereum (ETH). Now, the tokenization of real-world assets is accelerating. U.S. stock tokens, U.S. debt tokens, gold tokens, real estate tokens, etc. have been put on the chain. This not only means that assets can be transferred in real time, but also can be used as collateral to participate in diversified financial services such as lending and DeFi, which greatly improves the liquidity and income potential of real assets. The Boston Consulting Group (BCG) predicts that by 2030, the market size of RWA tokenized assets is expected to reach 16 trillion US dollars.

There are two core issues in the process of RWA on-chain: one is the selection of the ledger (blockchain) - public chain or alliance chain, and what is the degree of decentralization? The other is the priority type selection of on-chain assets, which assets are more suitable for on-chain first? These two issues directly affect the success and scale of asset on-chain.

The author’s view is that the ledger must be decentralized, and the assets must be centralized.

1. Ledger selection: RWA should choose decentralized public chains first

In the practice of RWA tokenization, it is recommended to choose decentralized public chains, such as Ethereum, Solana, or exchange ecological public chains BNB Chain, Base, etc. Taking the US Treasury bond token (T-Bill Token) as an example, the three major representative products at present: BUIDL launched by BlackRock and Securitize, BENJI by Franklin Templeton, and QCDT launched by QNB and DMZ Finance, are all issued on the public chain.

The core reason lies in their two core application scenarios:

1) Stablecoin reserve assets

BUIDL has become the main underlying asset of the yield-based stablecoin USDtb (Ethena). At its peak, USDtb holdings accounted for more than 70% of BUIDL issuance.

Circle has reached an agreement with BlackRock to replace 90% of the short-term Treasury positions in the USDC reserves with BUIDL to improve on-chain transparency and returns.

2) Exchange margin mortgage

There is already a precedent in traditional finance: at the Chicago Mercantile Exchange (CME), more than 50% of the margin is U.S. Treasuries.

The blockchain world is also replicating this model: OKX and Standard Chartered Bank launched the "Collateral Mirroring" pilot project in April 2025, supporting institutional clients to use crypto assets and tokenized money market funds (such as Franklin Templeton's BENJI) as trading collateral. It is reported that exchanges such as Binance and Bybit will soon launch similar solutions.

If we issue treasury bond tokens today and put them on the chain, but we choose a consortium chain or a private chain, it will be difficult to participate in the two most critical application scenarios mentioned above, which will seriously weaken the significance and value of the chain itself. However, judging from the current practice of financial institutions, in the initial stage, they still generally tend to choose consortium chains or private chains, more out of considerations of security and market control. As for the long-term effect of this choice in the market, it remains to be further observed.

2. Asset selection: must be centralized.

The higher the degree of centralization, the more mature the asset standardization, rating system and secondary liquidity.

Treasury bonds/gold > Stocks > Large bank deposits > Private placement bonds > Real estate > Charging stations > Malu grapes

The centralization of assets offsets the decentralized nature of the blockchain network. Only by combining the two can liquidity be released globally. Putting charging piles on the chain cannot solve their liquidity problem; putting grapes on the chain is more like a concept hype, and it is difficult to form a deep market.

Hong Kong Hundred Coins War: Opportunities and Challenges Facing Emerging Stablecoins

Recently, as legislation in countries and regions represented by the United States and Hong Kong has become increasingly clear, the popularity of the stablecoin market has reached an unprecedented high.

From a functional perspective, stablecoins can be roughly divided into three categories: transaction stablecoins, payment stablecoins, and yield stablecoins. Although there are overlaps between the three, their focuses are different.

Among them, the success of trading stablecoins is highly dependent on the support of leading exchanges, and the cost of obtaining support is usually to give up a large amount of profits - such as the relationship between Coinbase and USDC; another way is direct support from the exchange, such as Binance's deep integration and dominance of FDUSD.

After USDT/USDC, a certain scale of stablecoins was formed, mainly "yield-based stablecoins", such as Ethena's USDe and USDtb, etc. Their core mechanism is to transfer profits to users through the income structure (such as funding rate or protocol income), thereby increasing the attractiveness of holding coins.

The emerging "compliant stablecoins" are centered on payment scenarios, and their issuers are mostly payment giants (such as PayPal, Visa) or cross-border e-commerce platforms (such as Amazon, JD.com, etc.). This type of stablecoin is usually rooted in its existing global payment business and adopts the promotion path of "first To B and then To C".

During my recent research in Hong Kong, I had in-depth discussions with many institutions and learned that hundreds of institutions and companies are applying for or preparing to apply for Hong Kong stablecoin licenses. The "hundred-coin war" has already begun in Hong Kong. However, this competition faces many challenges:

1. No income and difficult to hold: According to the regulatory frameworks of the United States, Hong Kong and other places, compliant stablecoins are not allowed to pay interest directly to holders, which makes users lack holding incentives other than payment, affecting their ability to accumulate funds.

2. It is difficult to enter the trading scene and the threshold of exchanges is high: Although the issuers of popular compliant stablecoins are actively contacting mainstream exchanges, the "entry tickets" of the leading exchanges are scarce and it is difficult to actually go online.

3. There are many barriers in payment scenarios, and it is difficult to break the circle: the stablecoins issued by major e-commerce companies mostly serve their own ecosystems and are difficult to achieve cross-platform interoperability. It is difficult to imagine that Amazon will support JD.com's stablecoin, and vice versa.

In order to solve the above pain points, new innovative companies have created solutions around the clearing and settlement of stablecoins and the integration of revenue. Among them, infrastructure companies supported by large banks have inherent advantages, including: Partior, which is incubated by the Monetary Authority of Singapore (MAS), focuses on cross-border payments of stablecoins, and is supported by DBS, JP Morgan, and ENBD; Taurus, which focuses on tokenization of the European market and is supported by Credit Suisse and Deutsche Bank; and DMZ Finance, an RWA infrastructure service provider, supported by QNB and Standard Chartered Bank.

These institutions have all been selected for the QFC Digital Asset Lab led by the Qatar Central Bank and are seen as key players in building the next-generation stablecoin infrastructure.

RWA's Middle East Opportunities: A World-Class Digital Asset Hub

The development potential of RWA in a region can be evaluated from three dimensions: regulation, ecology and market.

Regulatory dimension: As early as 2018, the Abu Dhabi Financial Free Zone ADGM (FSRA) launched what is widely regarded as one of the world's first crypto asset regulatory frameworks, including comprehensive regulations on exchanges, custodians and issuance mechanisms. VARA was established in 2022 and became the virtual asset regulator in Dubai in addition to DIFC. It then signed a cooperation agreement with SCA in 2024 to provide a cross-emirate regulatory path for operating entities. Currently, Binance, OKX and Deribit have obtained official licenses from Dubai VARA, and Bybit has also obtained a temporary license.

In July 2025, Dubai regulator DFSA officially approved the first tokenized money market fund - QCDT. The fund is registered in DIFC and launched by QNB and DMZ Finance. The fund and token custody are both placed in Standard Chartered Bank (Dubai). QCDT combines the strengths of Dubai and Qatar, two major financial centers in the Middle East, based in the Middle East and radiating to the global market.

Ecological dimension: Data shows that the scale of crypto assets held by the UAE sovereign wealth fund has exceeded US$40 billion. In March this year, MGX, a subsidiary of the Abu Dhabi sovereign fund, invested US$2 billion in Binance, becoming the first sovereign fund to acquire a stake in a top cryptocurrency exchange. At the same time, the Middle East is spending hundreds of billions of dollars to build the largest AI computing power cluster outside the United States. In Dubai, a large number of top wealth management companies, hedge funds, quantitative trading institutions, private equity funds and family offices are actively deploying in the field of crypto assets.

Dubai is known as the world's third largest financial center. The Dubai International Financial Center (DIFC) brings together more than 2,600 financial institutions and companies. By the end of 2024, they include:

- More than 260 banks and capital market institutions;

- More than 410 wealth management and asset management firms, including 75 hedge funds;

- more than 125 insurance and reinsurance companies;

- more than 800 family businesses;

In terms of Chinese financial institutions, DIFC is home to the only cluster of Chinese financial enterprises in the UAE. China's top five banks account for more than 30% of DIFC's total banking and capital market assets, and about 30% of Chinese companies are Fortune 500 companies.

Market dimension: Data shows that by 2025, about 9,800 millionaires are expected to move to the UAE, making it the country that attracts the most high-net-worth individuals in the world that year, surpassing the United States and the United Kingdom. The penetration rate of crypto assets in the UAE is expected to reach 39% in 2025, far higher than the global average of 6.8%.

Dubai, Abu Dhabi and Doha have the following advantages:

- Zero personal income tax and capital gains tax, and very low corporate tax rates;

- Global market connections: Dubai’s “10-year golden visa” policy has a low threshold, and the time difference with Hong Kong, Singapore and mainland China is only 4 hours, and the time difference with London and Switzerland is 3 hours and 2 hours respectively, forming an ideal global market cross-hub.

Therefore, the RWA opportunities in the Middle East are far from being a traditional “rich market”, but rather a compliant market for global institutions and high net worth investors. The compliance of RWA projects in the Middle East will be highly recognized by the global capital market.

The three major factors of regulation, ecology and market jointly drive the Middle East to become an important center for global crypto assets.

Middle East and Mainland China/Hong Kong RWA linkage

The Middle East is the best market for offshore RMB stablecoins. The annual trade volume between mainland China and Hong Kong and the UAE exceeds US$110 billion, and that between mainland China and Hong Kong and Qatar exceeds US$30 billion. If part of the trade volume can be settled through offshore RMB stablecoins issued in Hong Kong, it will greatly activate the vitality of the RWA and Chinese stablecoin markets.

In addition, domestic high-quality assets can also consider using the Middle East compliance framework to showcase and raise funds on this world-class digital asset center stage, which will also bring significant help and improvement to actual business and brand value.

Conclusion

When the ideals of Web3.0 are hindered in real practice, Finance3.0 has made substantial breakthroughs in core financial scenarios such as payment, clearing, and transaction mortgages by relying on stablecoins and asset on-chain. Its underlying logic is clear: the ledger must be decentralized to gain global trust; assets must be centralized to connect to real value.

As global regulation becomes increasingly clear and traditional financial institutions enter the market at an accelerated pace, the Middle East is rapidly becoming a key hub connecting new financial infrastructure and global capital flows. It has both a forward-looking institutional framework and global liquidity and resource allocation capabilities. In addition, the economic and trade linkages with mainland China and Hong Kong provide a realistic soil for the scalability of stablecoins and RWA.

We are standing at the starting point of reshaping the global financial landscape, and a new era of stablecoins and RWA has begun.