The intersection of Silicon Valley code and Wall Street liquidity once again erupted in conflict. Solana, which has always positioned itself as a high-performance public chain, saw its founder Anatoly Yakovenko blast on the X platform yesterday, calling meme coins and Non-Fungible Tokens (NFTs) merely "digital garbage" with "absolutely no intrinsic value", sparking a shock wave.

The Origin and Context of the 'Digital Garbage' Argument

Yakovenko mentioned that this is not a sudden change in stance. In a previous public debate with Jesse Pollak, founder of Coinbase's Base, he argued that meme coins and NFTs are like "loot boxes" in mobile games, merely speculative mechanisms.

"Meme coins and NFTs are digital garbage, with value only derived from market-driven price discovery."

This short statement immediately sparked a label war in the crypto circle. Supporters believe he directly pointed out the essence of the bubble, while opponents argue that the Solana network cannot escape the transaction fees brought by such assets.

Contradiction: Income Still Relies on Meme Coins

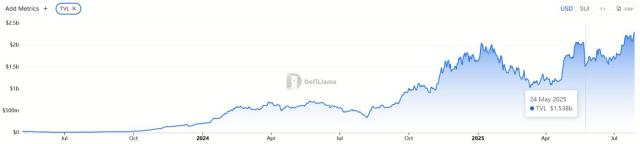

According to the latest report from blockchain infrastructure company Syndica, meme coin transactions accounted for 62% of Solana's decentralized application revenue in the first half of 2025, amounting to approximately $1.6 billion. The second quarter's network revenue reached a new high of $271 million. In other words, the "garbage" Yakovenko speaks of is the primary driver of Solana's cash flow. Commentator Karbon thus sarcastically remarked, "Shouting about technical mission while propping up financial statements with so-called garbage, this two-faced attitude is even more embarrassing than Vitalik's communication style."

For investors, these figures are far more sharp than the debate itself: if a public chain's vision cannot escape high-turnover, low-barrier speculative assets, its technical narrative is destined to sway with the wind. Short-term traders are happy to see transaction fees soar, but grassroots developers are beginning to question whether resources are being squeezed out by traffic games.

Value Debate and Industry Path

In the same discussion, Pollak defended NFTs and meme coins, emphasizing that blockchain is not just a financial infrastructure, but also a cultural carrier, arguing that "beyond price, there is art and community identity". This confrontation highlights the internal division of the industry's concept of "value": engineers pursue efficiency and security, while market promoters chase emotions and stories; these two forces coexist yet conflict.

In reality, if Solana abandons meme coin and NFT traffic, its short-term income will immediately shrink; if it continues to embrace them, the term "digital garbage" becomes self-defeating. This dilemma is not unique to Solana, but a microcosm of the entire public chain business model. Blockchain claims to be decentralized, but fee design inevitably writes speculative demand into protocol economics. When hype determines validator earnings, network security and user costs are tied to the same wavering rope.

For regulators, Yakovenko's remarks provide an unexpected testimony: if even the founder denies the intrinsic value of meme coins and NFTs, future policy discussions may lean more towards restricting speculative tokens. By then, public chains with highly single-structured income will face not just image risks, but potential capital outflow and node exits.

Short-term vs Long-term? Vision Collision

History repeatedly demonstrates that technology platforms often rely on entertainment or speculative content for early expansion, seeking functional upgrades after high user penetration. Whether blockchain can walk this old path depends on how leaders handle the gap between "storytelling" and "earning transaction fees". The Solana incident sounds an alarm for the entire industry: when income proves that "garbage" can be monetized, technical vision must provide a more rigorous public interest narrative, otherwise the expected mainstream adoption will remain stuck in the whitepaper.

When the "digital garbage" topic's heat dissipates, the truly sharp question remains: What will public chains rely on to maintain a sustainable economy? Solana's next financial report may provide the first answer.