On-chain data shows that SharpLink Gaming (stock code: SBET), known as the "Ethereum version of MicroStrategy," has once again made a large-scale investment in ETH! According to the latest data from Lookonchain, SharpLink purchased 77,210 ETH for $295 million on the 28th, raising its total holdings to 438,000 ETH, valued at over $1.69 billion. This holding size makes SharpLink the second-largest Ethereum strategic reserve company, just after Bitmine.

Ethereum Supply and Demand

Notably, according to Ultra Sound Money's data, the 77,210 ETH purchased by SharpLink has exceeded the net issuance of the Ethereum network over the past 30 days (72,795 ETH). At the same time, the company is using most of its newly purchased ETH for staking rewards. SharpLink humorously posted on X on Sunday:

"Banks are closed on weekends, but Ethereum runs 24/7!"

SharpLink Raises Funding to $6 Billion

Additionally, SharpLink previously submitted a revised prospectus to regulators, planning to dramatically increase its stock sales from $1 billion to $6 billion, and use the funds to purchase more Ethereum, attempting to further expand its holdings.

At the same time, SharpLink has been active in talent acquisition. Last Friday, the company announced the appointment of Joseph Chalom as the new co-executive chairman. It is understood that Chalom worked at BlackRock, the world's largest asset management company, for 20 years, with extensive experience in digital assets and global strategy. At SharpLink, he will be responsible for developing and executing the company's global strategy, further promoting its Ethereum investment layout.

ETH Becomes Enterprise-Level Asset

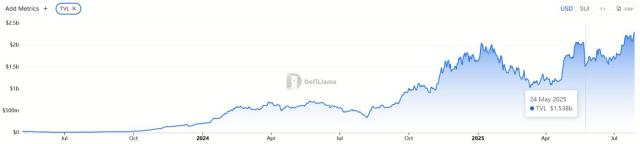

Recently, with the continuous increase in institutional demand, market bullish sentiment on Ethereum has also continued to rise. Many investors and analysts believe that Ethereum's long-term value potential comes from its leading position as a decentralized application (DApp) and smart contract platform.

Meanwhile, ETH offers annual staking rewards of about 3% to 5%, which is a "digital asset reserve that can generate cash flow" rarely seen in traditional assets. Galaxy Digital Research emphasizes that ETH can serve as both a value preservation tool and a productive asset. More and more listed companies will incorporate "ETH value per share" into their valuation models, and even directly use ETH to participate in DeFi strategies such as lending and liquidity pools.

SBET Rises 5% Pre-Market

Possibly encouraged by this news, SBET rose 5.6% before the US stock market opening, with a pre-market trading price of $23.23.