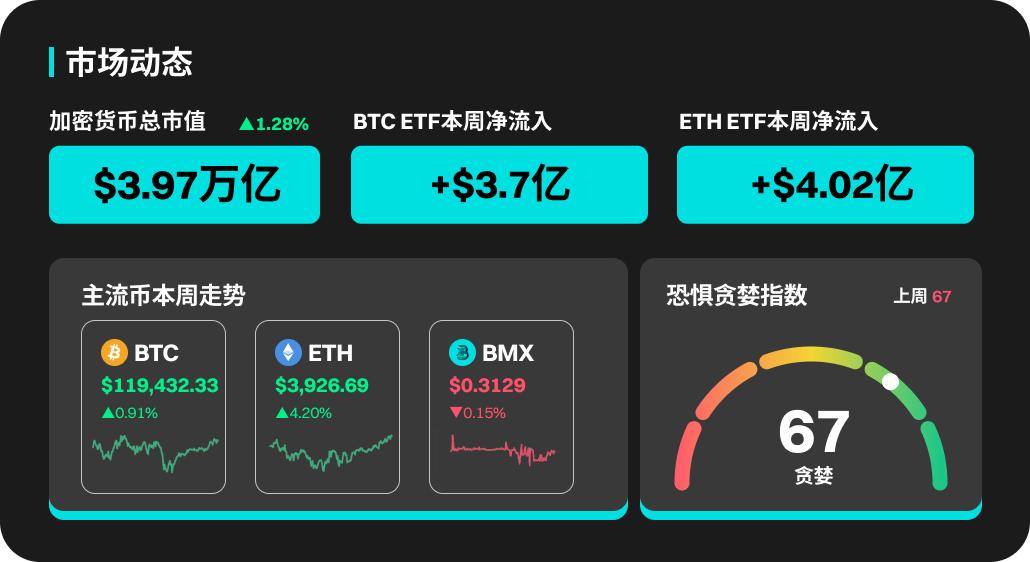

This Week's Crypto Market Dynamics

BTC ETF experienced net outflows for 3 consecutive days, but achieved a net inflow of $370 million in the past week due to consecutive net inflows on Thursday and Friday. BTC ETF has realized large-scale net inflows for 7 consecutive weeks, with a total inflow of over $10 billion in the past 7 weeks. Over the past week, BTC remained in a high-level narrow range, while its market dominance slightly decreased to 60.2%, indicating that Altcoins performed better recently.

Last week, ETH ETF saw a net inflow of $402 million, significantly exceeding BTC ETF's fund inflow. ETH ETF has achieved net fund inflows for 8 consecutive weeks, with over $7 billion flowing in during the past 8 weeks. ETH once again surged above $3,850, with a 58% increase in the past 30 days. The ETH/BTC exchange rate broke through 0.032, doubling from its yearly low point; additionally, ETH's market share significantly increased, rising to 11.8%.

This Week's Popular Cryptocurrencies

In terms of popular cryptocurrencies, SPA, KERNEL, MDT, HYPER, and ERA all performed impressively. KERNEL's price increased by 37.12% this week, reaching a high of 0.2582 USDT. MDT's price rose by 79.68%. SPA's price increased by 3.13% this week, with a 24-hour trading volume of 40.73B USDT.

US Market Overview and Highlights

On July 25th (Friday) Eastern Time, US stock indices collectively rose, with the S&P 500 index increasing 0.40% to 6,388.64 points; the Dow Jones index rising 0.47% to 44,901.92 points; and the Nasdaq index climbing 0.24% to 21,108.32 points.

Last week, the Dow Jones index rose 1.26%, the Nasdaq index increased 1.02%, and the S&P 500 index gained 1.46%. The benchmark 10-year US Treasury yield is 4.40%, while the 2-year US Treasury yield, most sensitive to Federal Reserve policy rates, is 3.91%.

The Federal Open Market Committee (FOMC) will hold a two-day monetary policy meeting on Tuesday (July 29th)

The US will release Q2 GDP data series on July 30th

The Federal Reserve will announce its interest rate decision on July 30th, with Powell holding a press conference

The White House's first crypto policy report will be publicly released on July 30th

Ethereum will celebrate the 10th anniversary of its Genesis Block on July 30th

Hong Kong will begin implementing the Stablecoin Regulation on August 1st, making it illegal to publicly promote any unlicensed stablecoins

Hot Sectors and Token Unlocks

Non-Fungible Token

The Non-Fungible Token market is showing strong recovery signs. Since the beginning of this month, its market value has increased by 94% to $6.6 billion, reaching its highest level since early 2025.

Weekly trading volume jumped 51% to $136 million, potentially making July one of the best-performing months since February. Sales volume increased by 7% quarter-on-quarter, but this month's total sales won't exceed June's. Last month's sales exceeded 5 million, while July has just crossed the 300,000 mark. The reason? ETH is rising, and Non-Fungible Tokens are rising too. In just 7 days, the average Non-Fungible Token price soared 40% to $146. Decreased trading volume and rising prices indicate market changes. Blue-chip stock fever is returning.

Jupiter (JUP) will unlock approximately 53.47 million tokens at 10 PM Beijing time on July 28th, representing 1.78% of current circulating supply, valued at around $31.7 million

Sign (SIGN) will unlock about 150 million tokens at 6 PM Beijing time on July 28th, representing 12.5% of current circulating supply, valued at around $11.7 million

Kamino (KMNO) will unlock approximately 229 million tokens at 8 PM Beijing time on July 30th, representing 9.53% of current circulating supply, valued at around $13.8 million

Optimism (OP) will unlock about 31.34 million tokens at 8 AM Beijing time on July 31st, representing 1.79% of current circulating supply, valued at around $22.8 million

Sui (SUI) will unlock approximately 44 million tokens at 8 AM Beijing time on August 1st, representing 1.27% of current circulating supply, valued at around $188 million

GoPlus Security (GPS) will unlock about 542 million tokens at 8 AM Beijing time on August 1st, representing 20.42% of current circulating supply, valued at around $11.6 million

ZetaChain (ZETA) will unlock approximately 44.26 million tokens at 8 AM Beijing time on August 1st, representing 4.78% of current circulating supply, valued at around $9.9 million

Risk Warning:

The risk of using BitMart services is entirely borne by you. All cryptocurrency investments (including returns) are inherently highly speculative and involve significant risk of loss. Past, hypothetical, or simulated performance does not necessarily represent future results.

The value of digital currencies may rise or fall, and buying, selling, holding, or trading digital currencies may involve substantial risks. You should carefully consider whether trading or holding digital currencies is suitable for you based on your personal investment objectives, financial situation, and risk tolerance. BitMart does not provide any investment, legal, or tax advice.