15% - This seems to have become the new "baseline" tariff for all future U.S. trade agreements. According to the latest announcements from the U.S. with Japan and the EU last weekend, the EU has now agreed to accept a 15% general tariff rate, similar to Japan, although there are still some unresolved details regarding energy procurement and VAT arrangements. Overall, this agreement is expected to bring an additional $90-100 billion in tariff revenue to the U.S. and attract around $600 billion in new investments from the European continent. If everything falls into place, it would be quite an impressive achievement for the current administration.

Meanwhile, the U.S. has again announced a 90-day tariff grace period for China. However, the market remains cautious about whether substantial progress can be made between the U.S. and China, especially given the harsh tariff conditions faced by Asia (excluding Japan). The issue is still ongoing.

On the other hand, the stock market continues to surge, reaching new highs. This is mainly due to corporate earnings performance being "just on target" (with Alphabet leading the charge) and the significant easing of relations between President Trump and Federal Reserve Chairman Powell. After a high-profile visit to the Fed headquarters, Trump stated:

"There's no need to fire Powell, the Federal Reserve will take the right action"

"Powell told me the economic situation is good"

"Powell is a very good person"

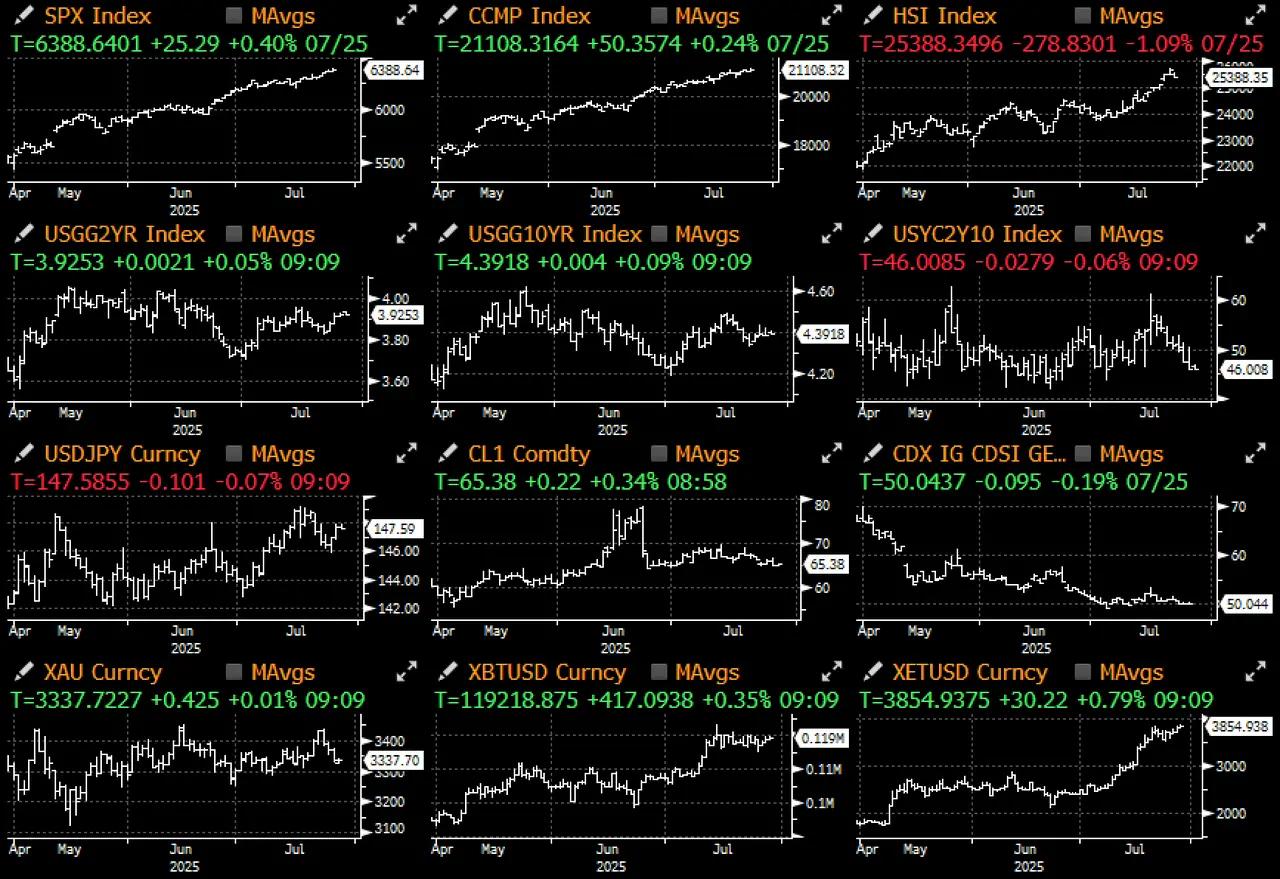

With one of the most influential political uncertainties being mitigated, the U.S. dollar rebounded, the yield curve flattened last week, and stock indices in Europe and Japan rose due to "acceptable" trade agreements with the U.S., while stock market volatility continued to decline, showing one of the most sustained downward trends in history.

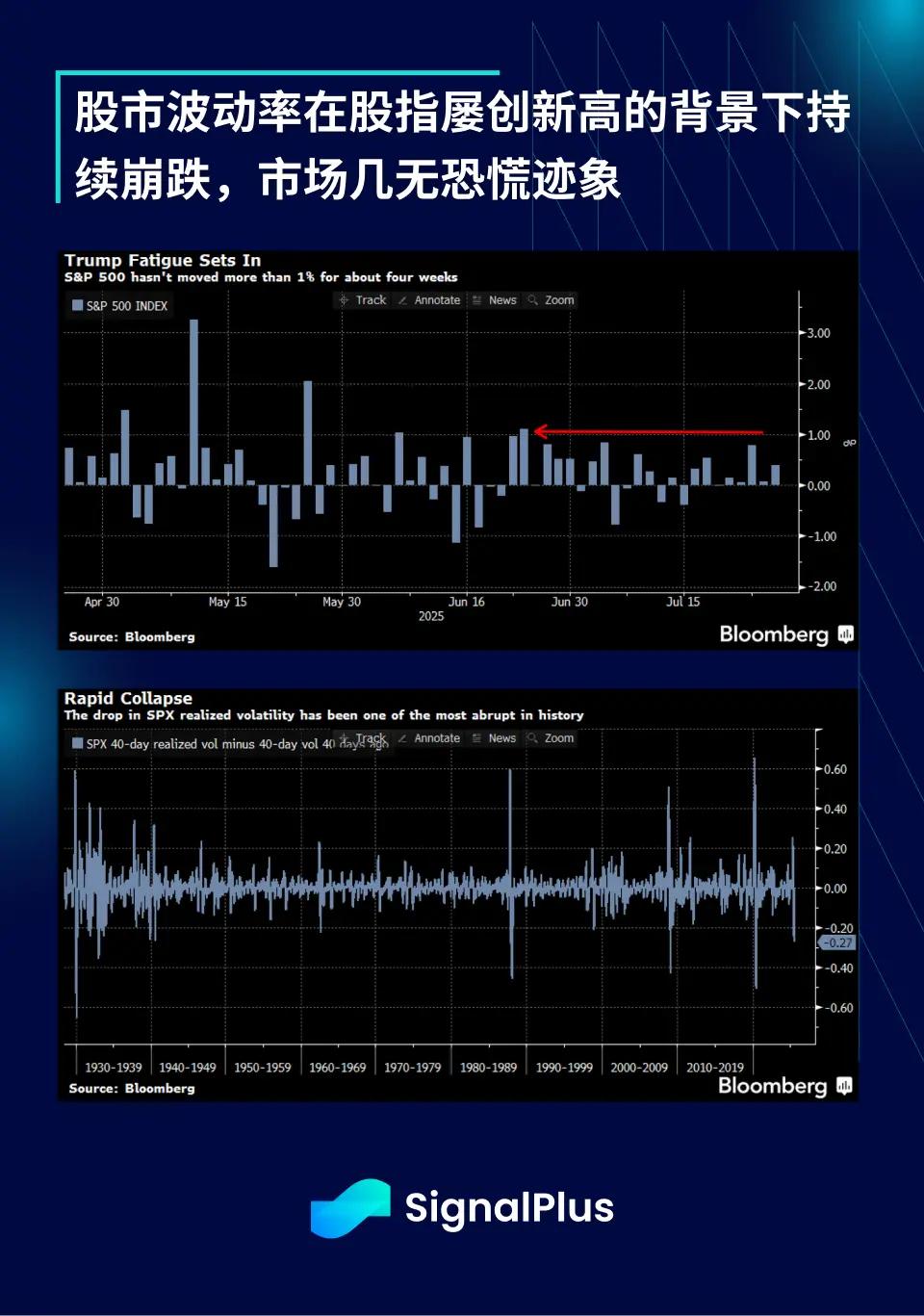

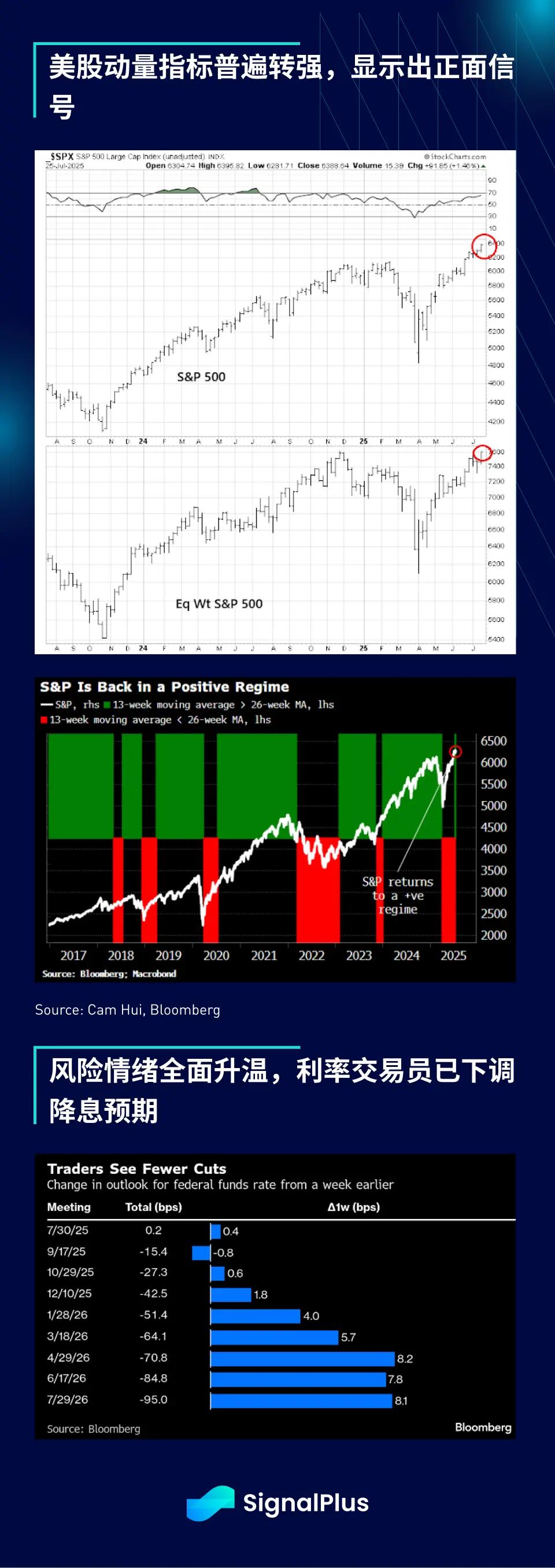

Even more unfavorable for bears, momentum indicators are comprehensively breaking through upward, with the market showing good breadth. Benchmark and equal-weight SPX indices both hit new highs last week. The 13-week and 26-week moving averages have formed a golden cross, and bond traders have significantly lowered rate cut expectations amid high risk sentiment.

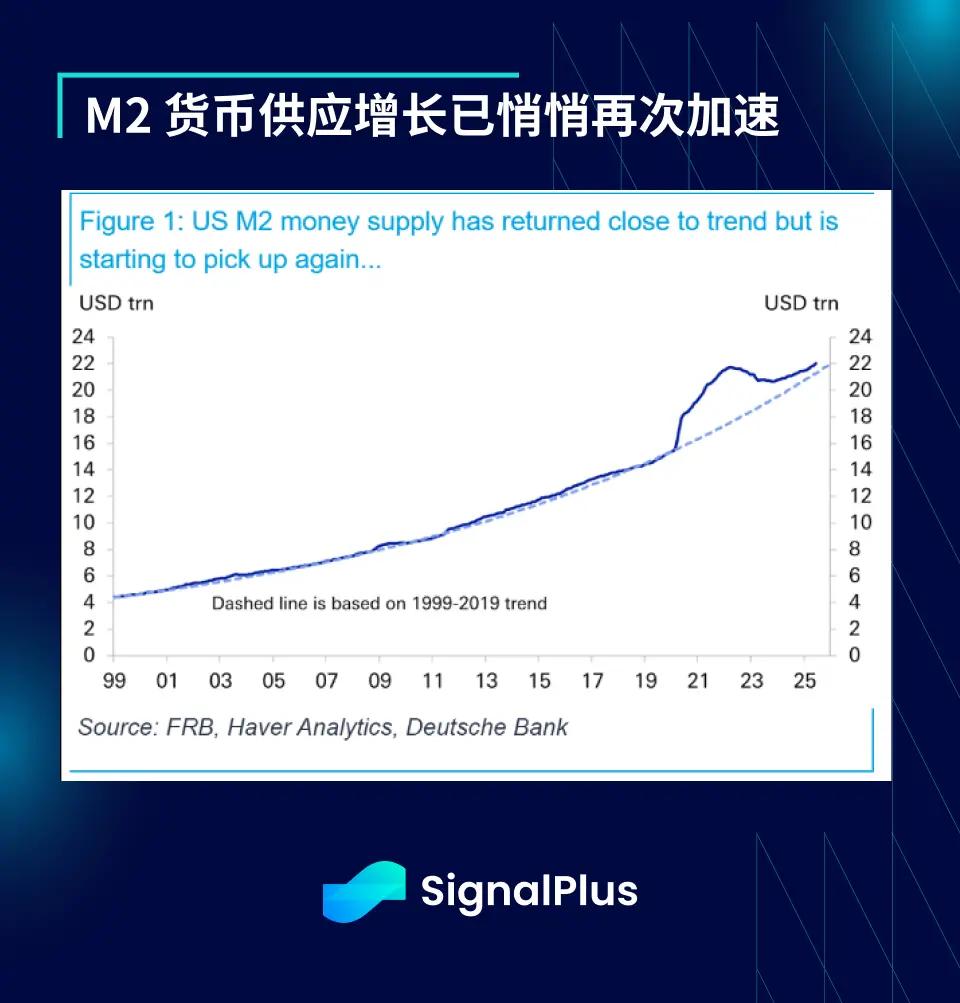

Macro and financial conditions remain favorable. With the recent dovish turn by global central banks and a weakening U.S. dollar, M2 money supply growth has quietly rebounded, providing positive support for financial assets and fixed assets (including commodities and cryptocurrency assets).

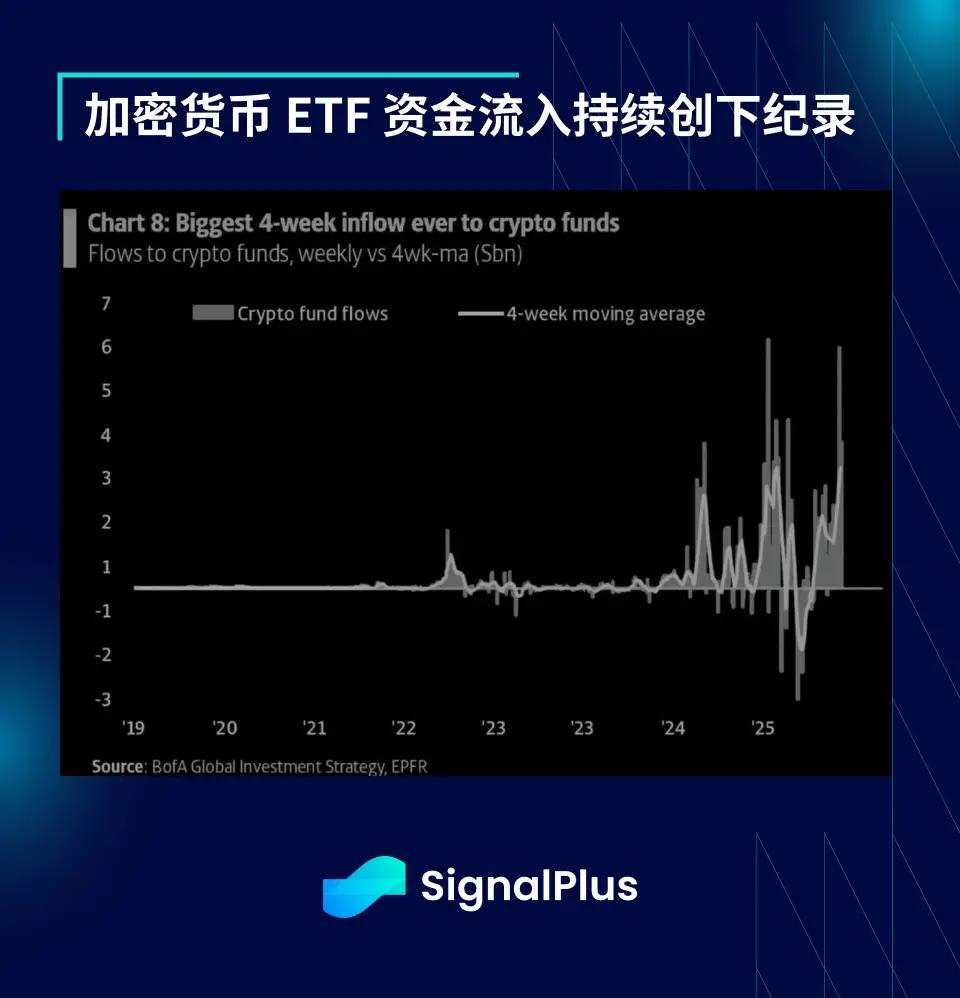

Returning to cryptocurrencies, although Galaxy Digital reported that a "Satoshi Nakamoto era" investor liquidated positions worth $9 billion, the market was barely affected. BTC remained stable around $120,000, and ETH returned to the $4,000 mark. This selling pressure from OGs was offset by record-high spot ETF inflows, with cryptocurrency assets experiencing net inflows for 14 consecutive weeks, accumulating $27 billion in net inflows year-to-date, with weekly net inflows reaching nearly $4.4 billion.

Spot ETF trading volume continues to set new records, with weekly transaction amounts approaching $40 billion. ETH performed most impressively, with inflows of $2.1 billion, almost double the previous record, and cumulative inflows of $6.2 billion year-to-date. Over the past three and a half months, the total asset size of ETH ETFs has increased by nearly 25%.

ETF capital inflows are still predominantly led by the U.S., accounting for over 97% of weekly inflows. The mainstream institutional narrative remains hot. Goldman Sachs and Bank of New York Mellon announced a collaboration to use Goldman's "GS DAP" platform to process some tokenized BNY funds. While this is a positive development for the industry, what's more noteworthy is a statement in the official announcement:

BNY will continue to "maintain the fund's official books, records, and settlements according to currently approved guidelines." -- Bloomberg

This means that the final legal and operational decision-making power still remains with the existing "paper system," which is not entirely consistent with the future imagined by DeFi/native on-chain users, but this is probably the price of mainstream adoption.

Looking ahead, the market indeed seems heated (but which asset class isn't?). Bloomberg points out that an increasingly large part of BTC's current rally comes from expectations of "monetary policy," namely dovish liquidity prospects. We don't have a particularly strong opinion on this interpretation, but it's worth noting that gold prices have recently appeared vulnerable after multiple failed attempts to break through, and a short-term pullback to the $3,000-$3,200 range could potentially drag down BTC.

That said, going with the flow is still the way to go (please do your own research - DYOR). We still recommend avoiding counter-trend operations. Until a new signal is received, continue to maintain your conviction and enjoy the summer. Good luck and happy trading!