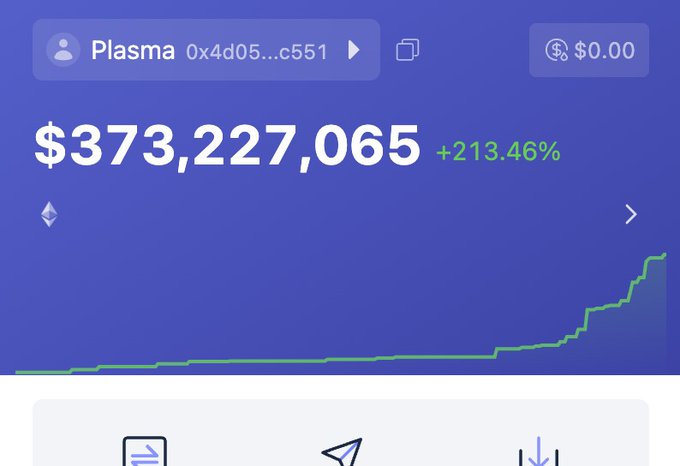

sale concluded. Final numbers are in

$320,000,000 is fighting to get a portion of $209,000

• $50,000,000 available to be purchased

• Just $209,000 was not purchased. Roughly 0.41%

• $373,000,000 total deposited, meaning 323,000,000 oversubscription

• x1545 oversubscribed capital

Assuming overcommitted funds are returned within 2 days, you can calculate the APR for overcommitments. Let's break it down:

- $10,000 overcommitment gets you $6.5 worth of tokens

- $9993.5 is refunded back to you

- considering most deposits were made in the last minute, let's use 3 days as lock to calculate APR

- $6.5 worth of tokens bought 130 XPL

- at 2B valuation, 130 XLP is worth $26

- So you started with $10,000, and now have $10019.8 (9993.8+26)

- This means $19.8 profit in 3 days. That's 24% APR

You can change both duration (2 days instead of 3, etc) and launch FDV (1B instead of 2B, 5B, etc).

Launch is in roughly 40 days. Refunds for overcommitments should be processed shortly. Upon launch, users get both their OG deposit back, and the XLP fully unlocked (except USA, 12-mo lock).

closely monitoring ⚡️

This was refunded today BTW. Double that APR ⚡️

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content