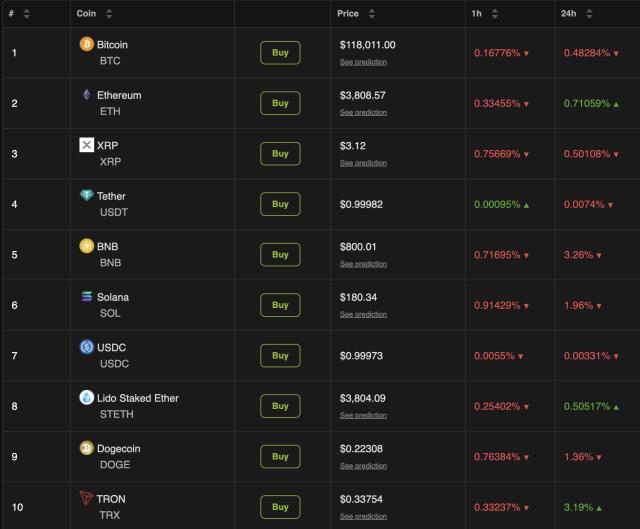

The total amount of Bitcoin held by listed companies globally continues to increase strongly, reaching nearly 687,500 BTC with a market value of over $81.7 billion.

Last week, many famous companies worldwide expanded Bitcoin investment despite some temporarily stopping purchases. This is a positive signal for the cryptocurrency market, as listed companies view Bitcoin as a long-term strategic asset.

- In the last week of July 2025, the net capital flow into Bitcoin by listed global companies reached $577 million.

- Expanding Strategy's STRC fund to $2.52 billion to enhance Bitcoin purchases and operational activities.

- Bitcoin held by listed companies accounts for about 3.45% of Bitcoin's total market value.

How much did listed companies spend on Bitcoin last week?

The latest data from SoSoValue shows that in the week ending July 28, 2025, listed global companies purchased a net Bitcoin worth $577 million. This is a significant increase as many corporations focus on building Bitcoin portfolios to diversify assets.

Specifically, Metaplanet in Japan invested $92.5 million to add 780 BTC, raising its total holdings to 17,132 BTC. Electric vehicle company Volcon (NASDAQ: VLCN) entered the market with its first purchase of $374.7 million, equivalent to 3,183 BTC.

Additionally, many other businesses are actively expanding their Bitcoin holdings, demonstrating the trend of adopting Bitcoin as a strategic asset in public companies.

Why did Strategy (formerly MicroStrategy) pause Bitcoin purchases and expand the STRC fund?

Strategy decided to temporarily halt Bitcoin purchases last week to focus on preparing capital for a new financial plan. The company announced expanding its STRC investment fund from $500 million to $2.52 billion to raise additional financial resources.

Scaling up the STRC fund demonstrates Strategy's commitment to long-term Bitcoin accumulation and strengthening corporate operations.

Michael Saylor, co-founder of Strategy, July 2025

The expected raised amount of $2.474 billion will be used to buy Bitcoin and enhance the company's operational activities. This strategic move helps Strategy maintain its leading position in corporate Bitcoin investment.

What percentage of the market do listed companies' Bitcoins occupy?

As of July 28, 2025, the total amount of Bitcoin owned by listed companies worldwide reached 687,440 BTC, equivalent to approximately $81.7 billion. This figure accounts for about 3.45% of Bitcoin's total circulating value.

This demonstrates the increasing importance of corporate organizations in building and holding large amounts of Bitcoin. This contributes to stabilizing and providing support for the cryptocurrency market in the long term.

The participation of reputable institutional individuals not only enhances liquidation but also increases market credibility for Bitcoin.

Raphael Caffi, Blockchain financial expert, 2025 report

Which companies stood out in Bitcoin purchases this week?

Not only Metaplanet and Volcon, but many other companies are also actively adding Bitcoin with diverse investments:

| Company | Country | Industry | Investment Value (USD) | BTC Purchased | Average Purchase Price (USD/BTC) | Total BTC Holdings |

|---|---|---|---|---|---|---|

| Sequans Communication | France | Wafer Manufacturing | 88.56 million | 755 | 117,296 | 3,072 |

| ANAP | Japan | Fashion | 55.56 million | 584.91 | 94,981.4 | 814.14 |

| The Smarter Web | UK | Digital Advertising | 26.6 million | 225 | 118,076 | 1,825 |

| Semler Scientific | USA | Healthcare Services | 20.8 million | 175 | 119,230 | 5,021 |

| Blockchain Group | France | Web3 Services | 6.83 million | 58 | 117,783 | 2,013 |

Frequently Asked Questions

How are listed companies investing in Bitcoin?

They buy Bitcoin directly on exchanges or through investment funds, focusing on building long-term portfolios to diversify assets and increase shareholder value.

Why are many companies expanding their STRC financial fund?

The goal is to increase Bitcoin investment capital and support business development, helping to consolidate their position in the cryptocurrency market.

What percentage of total supply do companies' Bitcoins represent?

Currently, listed companies own about 3.45% of the total Bitcoin in global circulation, equivalent to approximately $81.7 billion.

How many Bitcoins did Volcon purchase and at what price?

Volcon invested $374.7 million, buying 3,183.37 BTC at an average price of $117,697/BTC last week.

How do companies' Bitcoin purchases affect the market?

This approach helps increase liquidation, stabilize prices, and enhance transparency, contributing to attracting more institutional investors.