This is an article analyzing the returns, value growth, lessons learned, and future significance of technology companies over 30 years.

The next company with a market value of $100 billion will be different from the previous one.

This sounds like an obvious statement, but we can't help falling into the trap of pattern matching. Looking for the next Google/Meta/Amazon, or the Uber of X industry, the Airbnb of Y industry, or the AI agent of almost any industry.

Well, to avoid being swept away by the latest trend every week, we must look back. As Churchill said: "The further back you look, the further ahead you can see."

So I want to analyze the largest companies established in modern history. Not bound by narrative, but focusing on what the data tells us, using Mauboussin's perspective of looking from an external viewpoint!

Causal thinking is an innate narrative method. It can both convincingly predict the future and explain the past. Our brains are good at creating simple narratives to explain what happens around us.

The second method is to adopt statistical thinking, often called the external perspective. Unlike methods that weave stories based on causal relationships, statistical methods focus on reference categories of similar past cases and analyze their outcomes. The results of these reference categories are called base probabilities.

Therefore, we will delve into:

1. Technology value growth data from the past 30 years

2. Lessons learned from value growth

3. What these lessons mean for today's technology investments

TL;DR

1. The next billion-dollar company will be completely different from the past

2. Clarify your track: Are you aiming for a home run, a grand slam, or targeting outer space like Space Jam?

3. Software is like chicken, 80% of the taste is the same

4. "Market size" might be the biggest reason excellent investors miss excellent companies

5. Companies are often closely related to the technological wave they rely on

6. Finally, never underestimate the power of the power law!

Additionally, we released the Felicis startup recruitment plan last week. Welcome to check the areas we look forward to investing in.

About the methodology: Most technological value is concentrated in the largest companies, so I selected all companies on Pitchbook with an IT value of over $5 billion established since 1995. (Note: This does not include Amazon, Nvidia, Microsoft, and Apple.) I had Claude help categorize these companies, so I believe the exact data is very accurate in direction, but not in essence.

Let's begin.

30 Years of Tech Company Return Data

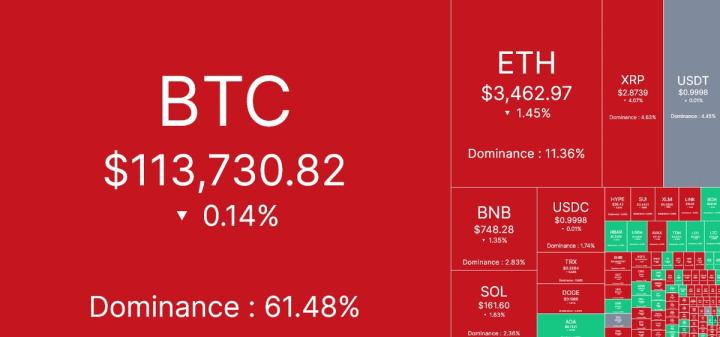

This dataset covers 65 categories, over 300 companies, creating $13 trillion in value. Here are the highlights of the most successful companies:

Now I won't discuss the power law in detail, but the top seven companies occupy nearly 50% of this dataset.

This leads to the first and most important conclusion:

1. The Next Billion-Dollar Company Will Be Completely Different

First, technology's value is primarily driven by unique companies, often founded by unique individuals. Because of their "uniqueness", relying on pattern matching makes it easier to miss great companies rather than discover them.

If a company has never experienced something like this, it's hard to imagine its future development. How could you estimate Google's market size in 1998? Or Meta's market size in 2004? It's simply impossible.

Take OpenAI, the most unique AI company currently, as an example. It started as a non-profit research laboratory without a clear technological vision, lost co-founders, and had a complex governance structure. Yet, it has gradually moved towards becoming one of the most important companies in history. This is uniqueness to the extreme.

The most successful companies have no so-called "publicly comparable objects"; they are unique. The largest companies often create entirely new categories, which is precisely why they are difficult to discover.

Neil Mehta defines this as finding "the global few founders who can create most of the value humans enjoy."

To start understanding some data, please look at the largest companies established since 1995:

Most of these companies either created entirely new industries or reshaped industries with such extensive expansion that it was almost equivalent to creating their own industry (such as Tesla).

Looking at the data by category leads to the following conclusion:

2. Clarify the Game You're Participating In: Home Run, Grand Slam, or Targeting Outer Space Like Space Jam

If we review Mauboussin's base rate concept, I believe we need a different thinking model to invest in these different categories.

Most value is created by consumer companies (dominated by power law). However, the number of enterprise software companies is almost twice that of consumer companies.

To make this more intuitive, I added a "Slugging Ratio" column, which is the ratio of "total company value/number of companies" to understand the degree of power law distribution in different industries.

Over the past 30 years, consumer companies have often been driven by network markets with a true winner-takes-all landscape. If you happened to invest in one of these giants, the only mistake was often underestimating their future scale. Yuri Milner's $10 billion investment in Facebook is an example.

If a company can truly integrate network effects into its business model, its advantages will immediately increase.

Hard tech companies (any company manufacturing hardware) have the second-highest "Slugging Ratio", mainly because hard tech companies are more difficult to survive. Usually, these companies need more capital, take longer to scale, have more challenging product development, are more susceptible to financing difficulties, and find it harder to disrupt existing giants.

However, if they can break through this speed bottleneck, the market opportunity will be enormous.

However, consumer and hard tech companies have limited capacity. Because of this, enterprise software has become an ideal investment vehicle in the venture capital field.

In non-winner-takes-all markets, rapidly expanding enterprises have strong moats and lower operating costs. In an environment with many venture capital funds, there are more winners to chase, more mature markets, and overall lower risk. But if everything goes well, there will be huge upside potential. This is a good way to reduce risk in an inherently high-risk industry.

3. Software is Like Chicken, 80% of the Taste is the Same

Borrowing from Vista Equity Partners founder Robert Smith's words, "Software companies taste like chicken... they sell different products, but 80% of what they do is almost the same."

If we look at most of the largest enterprise software companies, they are either:

1. Applications built on databases with unique workflows

2. Infrastructure for building these applications

3. Securing these applications

This is not to say these companies aren't differentiated, but their differentiation is much more subtle on the surface. Sales, marketing, and establishing brand awareness are equally important, if not more important, than technological differentiation.

In a world where software construction is becoming easier, functionalities can be replicated within days, and AI coding tools are becoming more sophisticated, the technological moat in software may be limited to unique data or integration.

The key is that technological differentiation is often not a decisive factor for enterprise software companies.

In this context, I find the argument of "GPT wrappers" interesting, which suggests that AI application companies are merely repackaging LLMs. Most enterprise software companies use SQL (or NoSQL) databases and build unique workflows for specific customer groups.

If we look at the largest AI enterprise application companies recently, they are all "large language model wrappers". But this is no different from the largest enterprise software companies of the past decade, which ultimately grew into giants with market capitalizations exceeding $100 billion!

As I mentioned before, enterprise software has lower and more predictable risks compared to other categories. However, apart from horizontal enterprise software, market size doesn't seem as important as it appears. "How big can this company be?" and "How large is this market?" are two entirely different questions.

4. "Market Size" Might Be the Biggest Reason Excellent Investors Miss Excellent Companies

If there's one thing humans find most difficult to handle, it's uncertainty. And this is precisely what new markets bring.

Palantir, Shopify, Uber, and many other companies have more or less created markets that didn't exist before.

Even attempting to add certainty to inherently uncertain problems can lead to foolish behavior.

Take the famous debate between Aswath Damodaran and Bill Gurley about valuing Uber. Gurley's conclusion was that Uber's potential market size might be 25 times Damodaran's initial estimate.

I studied companies founded since 2010 that achieved the highest multiple returns in public markets, which can be considered an underestimation indicator.

Some patterns emerged:

1. Investors underestimated market size, especially for market-expanding companies or vertical markets: Shopify, Guidewire, Zillow, AppFolio, etc., were underestimated. Similarly, in private markets, investors underestimated vertical software companies like Toast and ServiceTitan.

2. As new business models surpass old ones, enterprises experience multiple expansions: Tesla (the most extreme example) and all listed software companies have experienced multiple reshaping compared to their previous competitors. Today, Tesla alone has a market value close to $1 trillion, more than twice the total market value of all major car manufacturers when it entered the market.

3. Investors underestimated the power of platforms: ServiceNow, Palo Alto, Crowdstrike, Workday, Atlassian, and Datadog all expanded their market by extending product lines. As software development becomes easier, technical differences between platforms become smaller, and customers are more inclined to choose platforms over point solutions. In the era of integration, platformization is a good thing!

This is not to say market size is unimportant, but to emphasize that market size is easily misestimated.

5. Companies Are Often Closely Tied to the Technological Wave They Ride

If the previous section was about "market size", this section is about "why now?". A well-known question in venture capital is: "Why wasn't this company created before? What new insights now enable its existence?"

In most cases, the answer is that a new technological wave enables the company's existence. Today, this wave is Artificial Intelligence (AI). In the past, it was the internet, then mobile technology, followed by the convergence of internet and mobile, and then cloud computing.

We can see below the birth times of companies over $5 billion by industry:

The internet connected the world, giving rise to aggregative business models.

Mobile technology went further, putting the internet in everyone's hands, opening up a new consumer market landscape.

Fintech is a rare example showing how regulation can drive new technology industries. Especially after 2010, with the implementation of the Durbin Amendment, fintech experienced a boom.

Cloud computing was the most disruptive wave in technological history, enabling companies to build software via credit card without relying on data centers.

Now, with the development of AI, which companies will be inspired? What will they look like?

1. AI programming tools further advance cloud computing, enabling software creation not just for developers, but for anyone. This will bring a software explosion similar to the cloud computing era.

2. AI also unlocks the ability to automate voice and text workflow processing. We're already seeing this trend in programming, customer service, and AI recording, but it will expand to more application scenarios.

This expands the software market in ways we've never seen before. For example: In this dataset, no legitimate software company's valuation exceeded $5 billion. Yet Harvey, founded just three years ago, is already valued at $5 billion.

Rex Woodbury proposed a good thought experiment about the current state of AI:

I like Alfred Lin's analogy of mobile and cloud. In the mobile era, a valuable exercise was to break down iPhone functions and predict which companies each function could empower. He gave an example: GPS allowed delivery workers to drive around with Google Maps for food delivery. This gave birth to DoorDash.

Technological waves open a narrow window for new companies, and we're seeing this window emerge now.

6. What Happens Next?

Last week, while reading Will and Ariel Durant's "History", I saw this line: History mocks all attempts to fit it into theoretical patterns or logical frameworks; it always breaks our generalizations and overturns all rules. History itself is complex and ever-changing, as wonderfully unpredictable as the Baroque style.

Perhaps this article is foolish, even attempting to fit the most anomaly-based industry into a logical framework!

What remains constant is human nature. Using reverse thinking, humans often struggle to imagine exponential growth, handle exceptional situations, and deal with uncertainty.

To handle this uncertainty, our best options are:

1. Understand the "base rate" of company categories (what is likely to happen)

2. Understand where differentiation comes from (in software, sometimes it's primarily sales and marketing)

3. View market size as a first-principles exercise of problem-solving, not a simple pattern-matching activity

4. Recognize that each wave of companies is unique and unpredictable, and that's where its value lies.

Steve Jobs said about computers: "I think one of the real differences between us and high-order primates is that we're tool makers...... To me, computers are the most remarkable tools we've ever created. They're like a bicycle for our minds."

Jobs was right. Computers opened an unprecedented wave of creativity.

Today, we're witnessing the birth of the greatest "mind bicycle" in history. Living in this era is truly exciting!

Click to learn about BlockBeats job openings

Welcome to join the BlockBeats official community:

Telegram Subscription Group: https://t.me/theblockbeats

Telegram Communication Group: https://t.me/BlockBeats_App

Twitter Official Account: https://twitter.com/BlockBeatsAsia