The US Government May Soon Add Bitcoin to National Reserves, Marking a Historic Turning Point for Cryptocurrency.

With inflation weakening the USD, many businesses are viewing Bitcoin as a long-term value storage medium. Experts predict the US government will follow suit, creating a new wave in the cryptocurrency market.

- Bitcoin is the top choice due to its potential for price appreciation and protection against USD inflation.

- The US may establish a Strategic Bitcoin Reserve Fund, promoting widespread acceptance.

- US officials continue to maintain a large amount of Bitcoin, not selling amid false rumors.

Cash or Bitcoin: Which is Better for Businesses?

Investment expert Anthony Pompliano emphasizes that holding too much cash means losing value due to the continuously weakening USD. He believes Bitcoin is a more viable long-term storage option to combat inflation.

Public companies are self-destructing shareholder value by holding assets that are certainly depreciating – cash. Holding Bitcoin now seems counterintuitive but will become a general trend.

Anthony Pompliano, Entrepreneur & Investor, 7/2025

The USD has depreciated by about 30% in the past 5 years, prompting business leaders to carefully consider the choice between holding cash or switching to Bitcoin. The latter option provides better opportunities for price appreciation and asset protection compared to traditional cash.

Why Bitcoin Remains an Optimal Investment Option?

Pompliano believes Bitcoin continues to lead the cryptocurrency market due to its security and good liquidation. He affirms that incorporating Bitcoin into accounting balance sheets will gradually become a corporate standard.

His company ProCap BTC currently holds nearly 5,000 Bitcoin, equivalent to over $500 million, demonstrating strong confidence in Bitcoin's leading position.

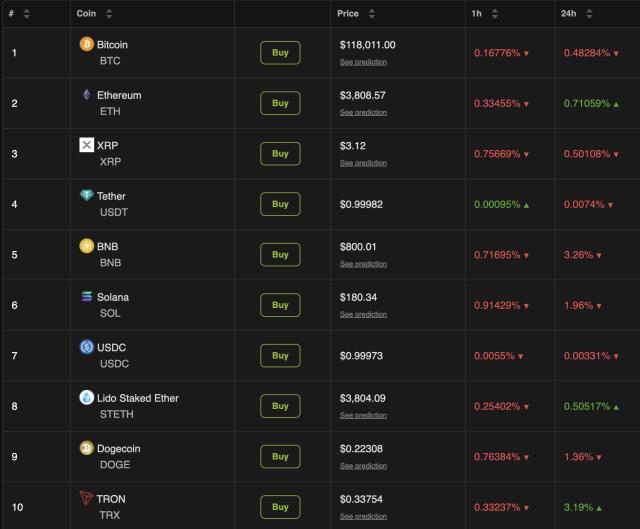

While other currencies like Ethereum or Solana continue to attract attention, Bitcoin remains the center of Wall Street. Additionally, stablecoins are predicted to grow in usage but do not create significant profits as they are pegged to the USD.

Could the US Government Start Buying Bitcoin?

Pompliano predicts the US government will soon create a Strategic Bitcoin Reserve Fund, bringing the cryptocurrency market into a new phase. This will be an important catalyst for pushing Bitcoin prices to new heights.

The US government has begun building a platform for long-term Bitcoin storage plans and will publish an official report in the near future.

Patrick Witt, Senior White House Official in charge of digital assets, 7/2025

Strategic Bitcoin management helps reduce risks related to USD volatility and enhances cryptocurrency's position in national finance. Accordingly, large financial companies will also join this trend in the near future.

The Current Status of Bitcoin Held by the US Government After Selling Rumors

There were incorrect reports that the US had sold 85% of its Bitcoin holdings, causing market confusion. However, data from Arkham Intelligence confirms the government holds nearly 198,000 BTC, valued at $23.5 billion, spread across agencies like the FBI, Department of Justice, and DEA.

Importantly, there have been no transaction movements of these Bitcoin in the past 4 months, confirming stability and no signs of selling by the US Government.

An official announcement about Bitcoin investment could open a new era for the global cryptocurrency industry.

Frequently Asked Questions

Is Bitcoin a Better Choice Than USD for Business Reserves?

Based on market experience and expert assessments like Anthony Pompliano's, Bitcoin protects assets from inflation better than USD.

How Many Bitcoins Does the US Government Currently Own?

The US government currently holds approximately 198,000 Bitcoin ($23.5 billion), with no signs of selling in the past 4 months, according to an Arkham Intelligence report.

What is a Strategic Bitcoin Reserve Fund?

It is the US government's plan to store Bitcoin long-term to increase asset value and reduce risks associated with the USD.

Can Bitcoin Replace the USD's Value Reserve Role?

Bitcoin has significant long-term potential due to its security and limited supply, but cannot immediately replace the USD due to financial and legal scale.

Are Other Cryptocurrencies Comparable to Bitcoin?

According to Pompliano's analysis, Bitcoin holds a special market position, and while altcoins may grow, they cannot yet match its reputation and acceptance.