Author: arndxt, Crypto KOL

Translated by: Felix, PANews

Original Title: Liquidity Illusion: When Monetary Bubbles Mask the Structural Collapse of Civilization

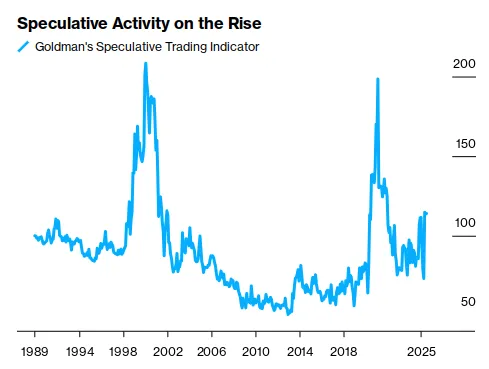

We are currently at the end of an extremely financialized cycle.

An Altcoin can surge tenfold in a month, but potentially drop 20% in a day, while CT would be surprisingly shocked. We are in a bubble market, but the bubble is merely a surface phenomenon. The deeper issue lies in liquidity, distortion, and a civilization gradually collapsing under the weight of its own contradictions.

The S&P 500 index hits a new high, and people are jubilant. But taking a step back, this so-called historical high is merely a liquidity illusion, measured by a currency driven by inflation with no underlying support. Adjusted for inflation, the S&P index has made no progress since the 2000s. This is not "growth", but a chart of money supply.

Moreover, the Federal Reserve will not cut rates next week. In an optimistic scenario, perhaps September, or possibly once in December if the economic situation deteriorates. But interest rate adjustments can no longer solve any problems. What we face now is a structural issue, and only three things truly matter:

1. The Slow Disintegration of the Debt System

[Rest of the translation continues in the same manner, preserving the original structure and meaning while translating to English]