As July approaches its end, the market is clearly entering a critical point of "choosing direction" at the monthly line's conclusion.

As I previously said: The bull market may be approaching its end in September, with August being the last time window for market makers to create a prosperity illusion. From now on, the market will create an illusion of a "comprehensive bull market", especially with mainstream and some altcoins driving the rhythm, but we both know that this is when it's easiest to be washed out and miss the last boarding point.

BTC and ETH: Opportunities and Strategies Under Volatility

#BTC: Yesterday, it rebounded to around 119.3, which is basically as expected, with the hourly line showing a second selling signal. In the short term, if it can't stand above 119.3, it may drop back to 115. The 116-118 range is the most active short-term interval, and historical data also shows it's quite active.

In the long term, BTC whales are experiencing a new round of "profit-taking" and handover, but this time the market has shown extremely strong resilience - without the usual sharp drop.

The key signal is: glassnode data shows that long-term BTC holders have made profits of up to $2.5 billion, far exceeding historical levels for the same period. Yet the price remains stable, which indicates: the market is undergoing a structural transformation, with reduced short-term volatility but a still robust mid-term logic.

#ETH: ETH's performance is also close to expectations. Today, ETH needs to see if it can break through 3820-3880; if not, there's a risk of dropping back to 3600-3660.

I've always emphasized: ETH is the truly high-quality asset that can transcend cycles. Many people hold "old altcoins" like #Doge, #ADA, #UNI, yet always fantasize that they might one day outperform ETH - this thinking is fatal in the second half of a bull market. If you missed BTC in the past year, holding ETH now is like being at BTC's starting line a year ago.

A Major Market Move Brewing at Month-End?

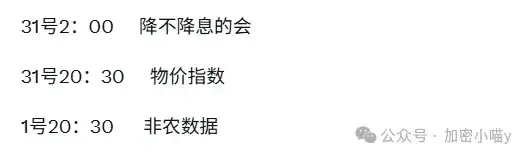

Tonight we'll receive ADP employment data and Q2 GDP core data, with the key focus being the FOMC meeting tomorrow morning.

The market currently believes there's a 63% probability of a 25 basis point rate cut in September, but that's not important. What truly influences the market is every word Powell says in the press conference. His wording will directly impact the subsequent market trend - sentiment is the biggest driver.

This BTC Trend is Not Simple

BTC's volatility is entering historic lows, with the current three-month actual volatility only 70%, far below the 143% during the 2021 bull market. What does this mean?

Low volatility = Preparing for a major market move.

From long-term holding data, the short-term cost line is concentrated in the 115,700-118,000 range. As long as there's no panic-selling, this serves as a "safety cushion". Long-term sells are also quickly taken over by giant institutions like Westly, making the market structure healthier.

Summary: July closes, August pulls up; fake prosperity is coming, don't get washed out. If you're still hesitating, either get on board or regret it after the train has left.

That's it for the article! If you're feeling lost in the crypto world, consider planning and harvesting with me! Follow the public account: Crypto Meow y

Join the community without barriers, get market analysis and altcoin operations... WeChat: c13298103401 or QQ: 3806326575