Trading Volume "Bounces Back Downward"

The bear market from 2023 to 2024 pushed Non-Fungible Tokens into an ice age, with many believing Non-Fungible Tokens were beyond salvation. However, by July 2025, the daily total Non-Fungible Token transaction amount suddenly surged from around $2 million in June to between $20 million and $26 million, with the highest day reaching $26 million, instantly making the market feel the sprint of BTC and ETH, carrying Non-Fungible Tokens along.

In the past two days, the daily transaction count has dropped from over 100,000 to less than 8,000, a volume reduction of over 90%.

CoinGecko data shows that the Non-Fungible Token market's 24-hour transaction volume has declined by over 36%, remaining at around $16 million, with momentum significantly weakened.

Blue-Chip Non-Fungible Tokens Become an Eternal Prelude

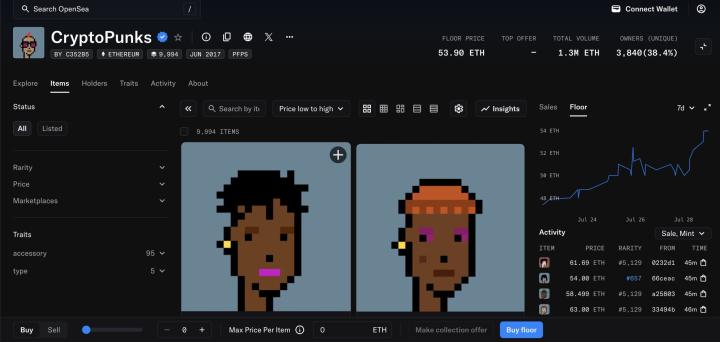

The truly price-driving transactions were a few time-tested blue-chip Non-Fungible Tokens:

- CryptoPunks saw a sales surge of nearly 590% in mid-July, contributing $37 million in a single week, with the floor price subsequently rising above $200,000, with GameSquare even purchasing number 5577.

- Moonbirds' floor price increased by 152.4% within 30 days, reaching around 1.7 ETH.

- Pudgy Penguins' heat slightly decreased but remained in the top tier.

- Bored Ape Yacht Club (BAYC) had weekly sales exceeding $5.8 million, a 62.33% week-on-week increase.

Ethereum's daily Non-Fungible Token transaction volume of around $19.4 million far surpasses Solana. Many analysts believe that Ethereum's recent price resilience will make the Non-Fungible Tokens on its chain highly correlated in valuation, making blue-chip Non-Fungible Tokens the preferred high-price trading option.