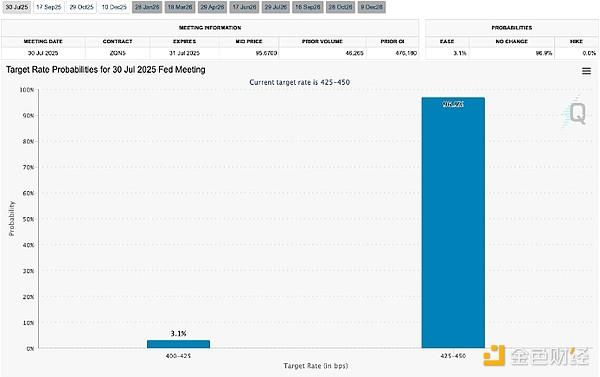

The Federal Reserve (Fed) is set to announce its latest federal benchmark interest rate decision in the early morning of July 31st Taiwan time. The market generally expects that Powell will continue to maintain interest rates unchanged this month. However, the expectation of a rate cut in September remains high, so the subtle signals revealed during this FOMC meeting decision-making process are worth investors' attention.

Rare Internal Disagreement Surfaces

According to Ainvest reporting, although the market generally expects the Fed will not cut rates this month, some analysts predict that two Fed officials, Waller and Bowman, may vote against postponing the rate cut at this meeting. Both have expressed concerns about delaying rate cuts, citing rising employment risks and current high interest rates.

Waller recently stated that given inflation is close to the target level with limited upside risks, policy rates should not be lowered only after labor market deterioration. Bowman also said she would support lowering policy rates as early as the July meeting if US inflation pressure is controllable.

It's worth noting that both have a history of voting against previous decisions. Bowman was the first Fed committee member to cast a dissenting vote since 2019 in the September 2022 meeting. At that time, Bowman opposed reducing rates from the 20-year high of 5.3% by 50 basis points and warned that potential inflation rates were still above the Fed's target, and officials should cautiously avoid unnecessarily stimulating demand. In March this year, Waller voted against the decision to slow down the balance sheet reduction pace.

If both vote against postponing rate cuts this time, it will be the first time since 1993 that multiple board members have cast dissenting votes in the same meeting, indicating internal cracks in the Fed's economic assessment and adding more variables to future policy shifts.

White House Pressure Tests Fed Independence

The political dimension is also disrupting the view. This year, Trump has more than once publicly pressured, specifically naming that the Fed should immediately cut rates:

"The Fed must cut rates. They are our biggest problem! China and other countries are doing the same. They must do it!"

However, Fed Chair Powell has repeatedly responded that he will not cut rates under Trump's pressure, nor will he proactively resign. Powell has repeatedly emphasized that Fed decisions "look at data, not politics", so the stance revealed in his statements after this meeting is also worth paying attention to.

Further Reading: Fed Mouthpiece: Trump Pressures Two Fed Officials to Support Rate Cut, Powell Becomes the Biggest Loser

Trump's Tariffs and September Rate Decision

Lastly, Trump's tariffs are set to take effect on August 1st. Although the US has reached trade agreements with some countries and a continuously tough European stance, it is yet to be seen where the new round of tariffs will lead the global economy. Meanwhile, since Trump implemented reciprocal tariffs in April, multiple US economic indicators seem not to have been severely impacted. Whether the US economy will be affected by these tariffs and influence the Fed's subsequent policies is also worth our continued attention.