Last night's wave was really mind-blowing. The price didn't drop much, but most people's positions were gone.

In the middle of the night, gold took a big hit, BTC broke through the consolidation low point with a volume surge and then pulled back, with the Americans playing a brutal information wash, really ruthless. The 117 level currently can't be broken, and it will likely kill another wave of shorts, waiting to maximize panic before launching.

In a bull market background, this volatility is to clear out people. True bulls just need to learn to "catch the needle", and the key is not to be led by emotions. Here are a few key time points worth noting:

- Tomorrow's monthly line closing may bring a trend reversal

- Friday night at 20:30, non-farm data will typically trigger volatility

- Next Monday's weekly line closing will determine whether this wave will soar

Now Altcoins are starting to dump again. BTC and ETH haven't truly crashed, and many are probably already shouting "Altcoin season, bull market is coming". But don't forget, Powell wasn't joking yesterday. He first poured cold water on September rate cut expectations, then directly criticized Trump's "beautiful tax law", meaning fiscal stimulus can't save current inflation. In summary: things will get tough, and the Federal Reserve won't go easy!

So, don't be too aggressive now. The structure remains, opportunities are still there, just the rhythm is getting harder. Do you often wonder why some people can always position themselves in advance? Earning millions in a bull market, while you buy where it drops, and can even lose money in a bull market? Actually, it's not because your luck is bad. Ultimately, Bitcoin's rise and fall has a pattern, and this pattern... when explained, is actually quite simple.

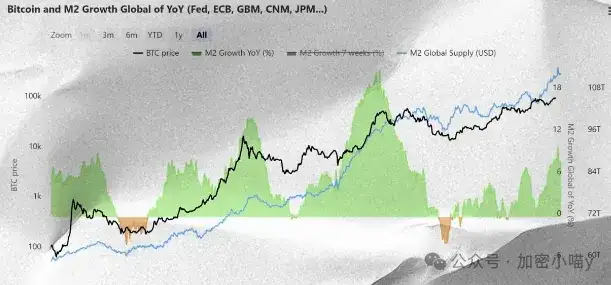

What truly drives the market is not the K-line chart, but M2 liquidity.

Over the past 12 years, I've been studying Bitcoin's underlying logic. The core discovery is: Bitcoin's trend is almost positively correlated with global M2 (money supply). When liquidity is loose, BTC rises; when liquidity tightens, it falls. What you see as crypto rising and falling is actually driven by global water release.

Let's be direct - those who follow M2 will prosper, those who go against M2 will perish.

Looking back at key market moments, almost every time the Federal Reserve cuts rates or releases liquidity, Bitcoin immediately takes off. For example, in 2020 during the pandemic's massive liquidity release, BTC rushed to $60,000; when major rate hikes came in 2022, it immediately entered a bear market. Without understanding M2, you can only guess.

The current situation is clear: late-stage high interest rates + controlled inflation + upcoming rate cuts, with room for further rate reductions, the true peak of this bull market hasn't arrived yet.

So why is crypto price recently weak? Because short-term M2 is contracting. The Federal Reserve hasn't released new liquidity, and market funds have been absorbed by US stocks and crypto. August and September trends are relatively volatile. But this "pullback" is actually preparing for the fourth quarter. After the pullback, opportunities will come! If you look at Bitcoin's seasonal patterns, you'll find that July's average increase is nearly 10%, but August and September are often pullback periods, red every year.

Don't underestimate this pullback - it's actually your golden window to buy the dips for October and November's main upward wave. Especially in October and November, BTC's historical average increase is around 20%, the easiest period to make money in a year.

I will personally focus on emotion-driven leaders like #SOL, #PENGU, #DOGE, #BONK. They often become the strongest targets in October.

There's also the RSI indicator, which was detailed in yesterday's article, so I won't elaborate here. Recommended reading: [link]

As a side note, the US dollar index is also a key variable: When the dollar depreciates, BTC rises; when the dollar rises, BTC is likely to fall. In the short term, the dollar may rebound, and BTC might test lower levels, but the medium-term direction remains unchanged - M2 will rise, the dollar will fall, and the market will continue to rise.

For example, since April this year, the dollar index has fallen nearly 10% from its high, which actually corresponds to this round of BTC's rebound. But recently, the dollar index has started to rise, with a pullback needed, which is a short-term negative for BTC. So a short-term pullback is highly probable, but the medium-term trend remains unchanged: M2 will rise, the dollar will depreciate, and BTC will continue to rise.

Summary: Whether you're new to the crypto or have already earned through several rounds, don't let your understanding stop at "guessing rises and falls". We should learn to understand the underlying capital logic.

The article ends here! If you're feeling lost in crypto, consider joining me in layout and harvesting from market makers! Follow the public account: Crypto Meow y

You can join the community via WeChat/QQ group for market analysis, Altcoin operations... WeChat: c13298103401 or QQ: 3806326575