Suddenly, the most eye-catching thing in the US stock market no longer seems to be AI, but a bunch of junk companies on the verge of delisting. Over the past few months, the US capital market has been experiencing an unprecedented pace of large-scale reverse mergers with increasingly large amounts of money.

Publicly listed companies have completely abandoned their core businesses, turning cryptocurrencies into their fundamentals, leading to stock prices soaring several-fold, even dozens-fold, in a short period of time. The US stock market has now become a playground for the crypto to engage in extensive financial experimentation. This time, crypto VCs have truly brought their stories to the ears of Wall Street.

In the US stock market, the "firecrackers" are setting off DAT fireworks

When Primitive Ventures invested in Sharplink three months ago, they had no idea that this new sector within the US crypto market would become so crowded in such a short period of time. "Back then, not many people were discussing these investment cases, and the market enthusiasm couldn't even begin to compare to it now, but it was only a month or two ago," said Yetta, a Primitive partner.

In June of this year, Sharplink Gaming announced the completion of a $425 million funding round, becoming the first company on the US stock market to reserve Ethereum. Following the announcement, the company's stock price soared, at one point increasing more than tenfold. Primitive, as the only fund in the Chinese-speaking community to participate in this investment, garnered significant attention within the community.

"We've discovered that while the crypto market's liquidity isn't great, institutional buying power is incredibly strong. Bitcoin ETFs have consistently strong volume, and the OI for Bitcoin options on CME even surpasses that of Binance." Last April, Primitive held an internal meeting for a comprehensive review, and since then, they've settled on a new investment direction: the integration of CeFi (centralized finance) and DeFi (decentralized finance). Now, they've become one of the busiest VCs in the crypto.

Primitive now receives daily emails from investment banks inviting funds to invest in crypto reserve companies. In this new wave of investment, investment banks act as intermediaries, helping project teams find and coordinate all investors and assisting teams in roadshows.

Over the past month, Primitive has discussed at least 20 cryptocurrency reserve projects. However, the only publicly listed investments they have made are Sharplink and MEI Pharma, another company involved in Litecoin reserves. This cautious investment approach stems from concerns about an overheated market. Since May of this year, the team has been closely monitoring various top signals.

"We do feel the market is significantly more frothy now than it was a few months ago," Yetta told Beating. The team now produces daily market reports and assesses appropriate exit strategies based on the current situation. "Crypto Reserve is a financial innovation, and while you can be bullish on its underlying assets in the long term, there are also risks of drastic deleveraging and bubble bursting during market downturns."

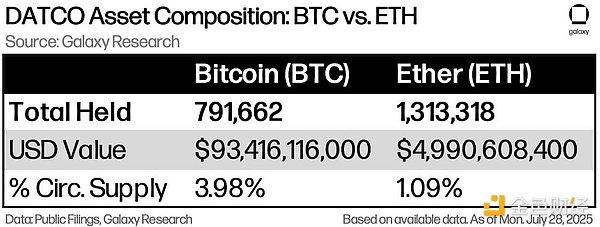

Unlike Primitive, Pantera is rolling up its sleeves and preparing to go all in. This 12-year-old crypto VC has even coined a new term for the field: DAT (Digital Asset Treasury). In early July, Pantera established a new fund and named it the DAT Fund.

In the fundraising memo, Pantera partner Cosmo Jiang wrote: “As an investor, it is very rare to find yourself at the starting point of a new investment category. Recognizing this and reacting quickly to take advantage of early investment opportunities is critical.”

The story Pantera tells investors is very simple: if the number of Bitcoins per share a company holds increases every year, then holding shares in that company will allow you to own more and more Bitcoins.

The underlying strategy of Bitcoin reserves, led by MicroStrategy and other cryptocurrency reserve companies, is to raise funds from the market and purchase more crypto assets through financial instruments such as private placements, convertible bonds, and preferred stock when their market capitalization is at a premium to the value of the crypto assets on their books. Because the stock is trading at a premium, the company is able to accumulate more assets at a lower cost.

Investors typically use the mNav (Market Cap to Net Asset Value) metric to measure premium multipliers and assess a company's financing capabilities. "Obviously, the stock market is volatile, and sometimes the market overvalues certain assets. Initiating financing through financial instruments at these times is essentially selling off this volatility. From this perspective, premiums can actually be sustained over the long term," Cosmo told Beating.

In April this year, Pantera invested in Defi Development Corps (DFDV), which reserves Solana's public chain token SOL. It is the first company in the US stock market to use a cryptocurrency other than Bitcoin as a reserve asset. Its stock price has risen more than 20 times in the past 6 months.

However, for Pantera, this was definitely an anti-consensus investment, because no one was willing to invest in it at the beginning of the project, and the company's $24 million in financing almost all came from Pantera.

Most of DFDV's members are Kraken executives, and its CFO has experience operating a Solana validator node. The team's deep understanding of Solana and expertise in traditional finance were key factors in attracting Pantera. "Despite this, we did incorporate some downside protection into the transaction structure, but DFDV's phenomenal success was something we completely unexpected."

"I think the real catalyst was Coinbase's inclusion in the S&P 500. It forced every fund manager in the world to consider crypto." Since Trump's election, the crypto industry has been rapidly advancing in traditional capital markets. Circle's IPO drew global attention to stablecoins, and Robinhood's entry into RWAs further propelled security tokenization to the forefront. Now, DATs are becoming a new concept to follow suit.

Less than a month after investing in DFDV, Cantor Equity Partners also approached. DFDV's success accelerated SoftBank and Tether's Bitcoin Reserve Company plan, ultimately raising approximately $300 million in external funding through a private placement of CEP, with Pantera once again becoming its largest external investor.

The investments in DFDV and CEP came from Pantera’s flagship Venture Fund and Liquid Token Fund, and the team initially thought these would be the fund’s only investments in the sector.

However, market development soon exceeded Pantera's expectations. Due to the limitations of the two funds in terms of portfolio framework and concentration, Pantera quickly decided to establish a new fund.

On July 1st, Pantera launched its DAT Fund, aiming for $100 million. On July 7th, the fund was officially announced as complete. Due to the overwhelming enthusiasm of LPs, Pantera subsequently launched a second DAT Fund. By the time of the mid-month interview with Beating, the first DAT Fund had been fully deployed.

In publicly available investment cases, Pantera often serves as the "anchor," meaning the largest investor. Because DAT companies often have poor initial liquidity, which can easily lead to price discounts, the team must first bring in significant investors from the OTC market to build a base of investors, ensuring liquidity and narrowing price spreads.

On the other hand, the "Anchor Investor" initiative itself is part of Pantera's market entry strategy. "In the past two months, we've received nearly 100 proposals from DAT companies. Pantera is usually the first one they call because we entered the market early enough and have established a leading position in this field. They also see that we are truly capable of making big bets and daring to issue large bills."

Of course, Pantera doesn't invest in every company it sees. The fund also values DAT companies' ability to create a "cognitive lead" in marketing. Its investments in Sharplink and Bitmine were largely driven by this consideration. Bitmine was DAT Fund's first investment, and Pantera served as an "anchor" in the transaction.

On June 2nd, Joseph Lubin, a core figure in the Ethereum community, led the completion of a reverse takeover of Sharplink, establishing the first Ethereum reserve company. On June 12th, Joseph and other core Ethereum developers released an Ethereum fundamentals report through Etherealize, introducing Ethereum's investment value to institutions.

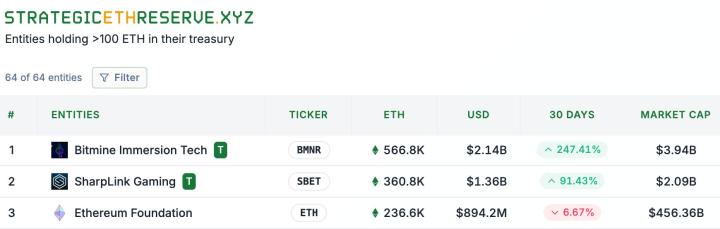

On June 30th, Bitmine, the second Ethereum reserve company, was established. Thomas Lee, known as "Wall Street cryptocurrency expert," endorsed the company and began appearing frequently in mainstream media, explaining investment opportunities in Ethereum. Around the same time, Sharplink's stock price began to climb, and the "Ethereum arms race" quickly became a hot topic in the industry.

"To truly open the channel for financial leverage, the market value of DAT companies must reach at least US$1 billion to US$2 billion," Cosmo told Beating. Only when it reaches this level can the company truly obtain a valuation premium in the market and open another door to institutional capital through tools such as convertible bonds or preferred stocks.

But before that, DAT companies need to first tell their story to ordinary investors—not just crypto-native investors, but also the broader mainstream retail investor base in the stock market. "They need to understand the story and be willing to participate. The market must first believe it will happen before the entire model can work."

Building sustained trust with the market is another key factor in DAT's success. Traditional financial markets require transparency and discipline. The team must be both crypto-native and possess traditional financial acumen. They must manage and disclose information as a listed company and be familiar with SEC rules and procedures to ensure efficient and professional access to the US capital market.

"We spend a lot of time on due diligence. What really matters isn't the static number of mNav. It's whether they have a clear management structure, can they secure stable financing, and are they capable of building a new business model. That's what makes a truly outstanding 'DAT startup team.'"

In addition to Bitcoin, Ethereum, and Solana reserves, Pantera has recently invested in several other large-cap Altcoin reserves. From Bitcoin to mainstream cryptocurrencies and then to Altcoin, the story the crypto tells investors has evolved: Unlike Bitcoin DATs, which rely solely on financial engineering for growth, mainstream tokens can generate income through staking and DeFi activities. Altcoin protocols, on the other hand, have mature application scenarios and revenue fundamentals in the crypto market, allowing stock market investors to gain exposure to their growth through DATs.

Different from the financing path of Bitcoin and mainstream currency DAT, the initial reserves of many Altcoin DATs come directly from the protocol foundation itself or its token investors.

Sonnet BioTherapeutics (SONN), Hyperliquid's strategic reserve company, initially invested over 10 million HYPE tokens directly into the company from top crypto VC Paradigm, which purchased them late last year. Beating also learned that the Ethena Foundation also spearheaded the establishment of StablecoinX, Ethena's strategic reserve company. PIPE investors can directly participate in the financing using their ENA tokens or USDC.

Due to poor liquidity, Altcoin DATs often experience significant price increases immediately after funding announcements, creating opportunities for insider trading. In the case of SONN, the official announcement was released on July 14th, but the stock price began to rise sharply on July 1st, quadrupling by the night before the announcement.

CEA, the BNB reserve company backed by YZi Labs, recently encountered a similar issue. According to Beating, to prevent participants from knowing the company's name in advance, the team purchased several US shell companies in advance and randomly selected them at the last minute. Even so, front-running occurred hours before the official announcement on July 28th.

On the other hand, many investors are concerned about the potential "one-handedly" risk of Altcoin DATs. Due to the illiquidity of the crypto market, large-cap, high-priced tokens are difficult to exit without a discount. However, by injecting crypto assets into DAT companies, the tokens' inherent liquidity becomes real liquidity in the US stock market.

Therefore, investors must carefully discern whether the goal is to "provide growth exposure" or "find exit liquidity." "Many DATs choose to operate within regulatory loopholes, such as listing on low-threshold trading boards. However, these short-term operations make it difficult to establish a stable information disclosure and compliance system. If they fail to generate a genuine capital premium, they are simply playing the game of passing the buck."

Regulation is also a risk for DAT companies. If the SEC classifies on-chain assets like Altcoin as securities, DAT structures would require significant adjustments. Even so, companies like Primitive and Pantera still believe this is a better market. "Because US stocks offer greater liquidity and public company investors have more protections, investing in DATs now offers better odds and a better chance of success than pure crypto investments," said Yetta.

The world outside the US stock market is still competing for the "first micro-strategy"

The US stock market is the most efficient, inclusive, and liquid capital market. This is the consensus among investors. Nasdaq remains the best place to replicate the next MicroStrategy. However, this doesn't mean there aren't opportunities in other capital markets. Beyond the US stock market, everyone's goal is to become the next Metaplanet.

Over the past year, Metaplanet's stock premium has steadily increased, delivering over a 10-fold return to investors. The success of this "Asian miracle" product has opened the eyes of many to the opportunity for regional arbitrage.

Asian markets are pioneers in Bitcoin reserves. In mid-2023, Waterdrop Capital partnered with China Pacific Insurance Investment Management (Hong Kong) Co., Ltd. to establish the Pacific Waterdrop Fund. Subsequently, Waterdrop acquired a stake in Boyaa Interactive, a Hong Kong-listed company that had just launched a Bitcoin purchase program. In 2024, MicroStrategy's stock price surged, further confirming this industry trend. Currently, Waterdrop has invested in five Hong Kong-listed companies and plans to acquire stakes in at least ten by the end of the year.

"It's clear that the current US market for Bitcoin and mainstream cryptocurrency reserve companies is already very crowded, and the next wave of growth is likely to come from capital markets outside the US," said Nachi, a crypto trader who is now participating in the wave of reserve company investments. This year, he participated in an investment in Nakamoto Holdings, a Bitcoin reserve company, and quickly received a 10-fold return.

At the beginning of the year, Nachi invested in Mythos Venture as a personal LP. This fund specializes in "Asian Bitcoin Reserve". Its most recent investment was in the Thai listed company DV8, which recently announced the completion of a financing of 241 million baht, becoming the first Bitcoin reserve company in Southeast Asia.

In addition, he has personally participated in several Bitcoin reserve projects in other regions, with most investments in seven-figure sums. For example, in April of this year, he completed the acquisition of Latin America's first Bitcoin reserve company, Oranje. The project was supported by Itaú BBA, Brazil's largest commercial bank, and raised nearly $400 million in its first round of financing.

"We believe there's room in markets like Japan, South Korea, India, and Australia for [a Bitcoin reserve company]." After joining Mythos, Nachi's role gradually shifted from limited partner to a quasi-general partner, working with other members to identify investment opportunities. His mission is to identify publicly traded companies interested in acquiring them, and shell companies in Asia have become a frequent target of Nachi's recent meetings.

Striving for first place is key to success in capital markets outside of the US. This not only allows the team to accumulate first-mover advantage but also helps the company capture greater market attention. However, this also means that regional arbitrage within the Bitcoin Reserve Company narrative is a race against time.

When it comes to acquisitions, there are huge differences between shell companies. Some companies can be bought for $5 million, while in the case of Thailand's DV8, several parties spent about $20 million.

The entire process, from shell acquisition to listing, typically takes one to three months, with regulatory approval efficiency being the most significant factor. However, from identifying an opportunity to closing it can take at least six months, or even longer.

The DV8 acquisition took nearly a year to complete, with the deal officially closing in July of this year. The investors leading the acquisition were UTXO Management and Sora Venture, the primary architects behind Metaplanet.

Sora also recently orchestrated and completed the acquisition of SGA, a publicly listed South Korean software services company. "Capital markets in Asia, especially Southeast Asia, are relatively closed, but the volume here is actually very large. It's just that many foreign investors don't understand the level of activity in these markets," Luke, a partner at Sora Ventures, told Beating.

"Everyone is racing against time right now, but in the Asian market, I think few can compete with Sora." In Luke's view, local regulations are a major barrier to entry for many overseas investors. Most VCs lack experience in fully participating in acquisitions and communicating with regulators, and they don't actually understand the Asian market.

Sora Ventures' strategy is to bring in numerous local partners to help connect with stock exchanges and regulators, accelerating project implementation. In the South Korean SGA case, the team completed the deal in less than a month, from initial discussions to finalization. This marked the fastest acquisition in the history of the Korean Stock Exchange.

A company's fundraising pace and market strategy present another hurdle. "mNav's valuation model is a very late-stage one, valid only after a significant amount of Bitcoin has been accumulated. Early-stage companies, on the other hand, have completely different strategies and premium logic from MicroStrategy." Thanks to equity structures like super-voting rights, US-listed DATs are able to maintain team control while continuously diluting equity.

However, Asian listed companies generally lack such mechanisms, limiting the team's potential for dilution. This means they must carefully manage their fundraising cadence while simultaneously using cash flows from core operations to repurchase shares for reverse dilution. DV8 in Thailand has reportedly obtained relevant local licenses and will soon launch a cryptocurrency trading platform.

Currently, Sora is accelerating the finalization of an acquisition in Taiwan and advancing the establishment of a second Bitcoin reserve company in Japan. In May of this year, the team acquired a 90% stake in Top Win, a Hong Kong-based luxury goods distributor listed in the US. The company will soon be renamed Asia Strategy. "Our goal is to create nine to ten 'Metaplanets' in Asia and integrate them into a US-listed parent company, allowing US stock market investors to indirectly gain premium exposure to Asian companies through us."

Top Win participated in the acquisition of Metaplanet, Hengyue Holdings, DV8, and SGA, and the company is about to complete its initial round of financing. Sora Ventures still adopts the "multi-player + small capital" model, with a total fundraising amount of less than US$10 million and a 6-month lock-up period.

Luke hopes that Top Win will present a capital structure with 30% holdings in Asian companies and 60% in Bitcoin reserves in the future, thereby presenting a different narrative to investors. Of course, this is just the team's vision and story. Whether the premium in the Asian market is sustainable and whether US stock investors will buy into this Asian narrative remains to be seen by the market and time.

"It must be admitted that the Asian market has a high floor and a low ceiling. If you really want to achieve a certain scale, you can only go to the US stock market, which attracts investors and players from all over the world." Although investors try to chase the Alpha of Bitcoin's reserve narrative in various countries, all investors have a consensus that the Beta that maintains everything still comes from the favorable drive of US regulation.

"If bills such as the Bitcoin National Reserve are truly implemented, the US government's purchases will drive other regional governments and sovereign funds to make simultaneous allocations, and Bitcoin may continue to rise," said Nachi.

People saved by "crypto-stocks"

Compared to the bleak crypto market, the current DAT sector is remarkably vibrant. This new wave has not only captured attention but also appears to offer an escape hatch for investors trapped in the crypto. "Currently, all of the top 100 crypto projects by market capitalization are considering developing DATs," one investor told Beating.

The end of 2024 and the beginning of 2025 coincided with the critical juncture when most crypto VC funds matured and began a new round of fundraising. However, poor DPI data discouraged many LPs from investing. Since the beginning of the year, many crypto funds have been closed.

Since 2022, primary market valuations in the crypto sector have continued to inflate, with many projects raising tens of millions of dollars in seed rounds. However, few have demonstrated real innovation or proven success. With the development of cryptocurrency ETFs and the FinTech+Crypto sector, VCs have become the last resort for LPs investing in crypto assets.

On the other hand, shrinking market liquidity is also making project exits more difficult. Retail investors are no longer willing to pay for "VC coins," while projects are still faced with the high costs of listing on exchanges. "Nowadays, listing on leading trading platforms generally requires giving up at least 5% of the token quota. Based on a $100 million market capitalization, this comes to $5 million. Acquiring a shell company on the US stock market would cost around the same."

However, the opening of the US regulatory environment has given everyone new hope. Cryptocurrency reserves have not only found the best exit channel for tokens, but also provided a new storyline for attracting institutional funds to the crypto sector.

In addition to crypto VCs, midstream investment banks have also benefited from this trend. According to Bloomberg, DAT trading accounts for 80% of the working time of many midstream investment bank brokers, and business in this area is expected to grow by 300% by the end of the year.

Now, the industry is eager to move the $2 trillion cryptocurrency market into the US stock market. In less than two months, dozens of DAT companies have emerged in the market.

Pantera envisions significant consolidation in the DAT sector within three to five years. When the downturn hits, smaller DATs unable to achieve scale will face negative premiums and be acquired by larger competitors at bargain-basement prices. "DATs are 'experimental fields for new treasury models,' not centers of technological innovation. Ultimately, only two or three companies will survive."

But the music seems to have just begun. Cosmo believes the competition is still at least six months away from becoming intense. "It's still a mystery who will ultimately win. All we can do is support the teams we believe have the potential to become one of the 'two or three' companies in the future."

Click here to learn about BlockBeats' BlockBeats job openings.

Welcome to join the BlockBeats official community:

Telegram group: https://t.me/theblockbeats

Telegram group: https://t.me/BlockBeats_App

Official Twitter account: https://twitter.com/BlockBeatsAsia