The truth about Temasek's China position dropping to 18%: A misunderstood "retreat", an underestimated bold bet, behind the percentage decline lies 4 billion Singapore dollars of real investment.

In the skyscrapers of Singapore's Marina Bay Financial District, Temasek Holdings just submitted a record-breaking performance report: Portfolio net value of 434 billion Singapore dollars (approximately 2.35 trillion yuan) for the 2025 fiscal year, an increase of 45 billion Singapore dollars from the previous year, setting a new historical high.

In this glossy financial report, one number has stirred waves in the Chinese market: Calculated by asset location, Temasek's investment proportion in China has dropped to 18%, further widening the gap with the Americas (24%). Suddenly, the narrative of "Temasek's withdrawal from China" spread like wildfire.

"Whether it's 18% or 19%, Temasek remains bullish on China long-term, heavily invested in China, with absolutely no changes," He Yi, Chairman of Temasek China, told Caixin reporters with a resolute tone.

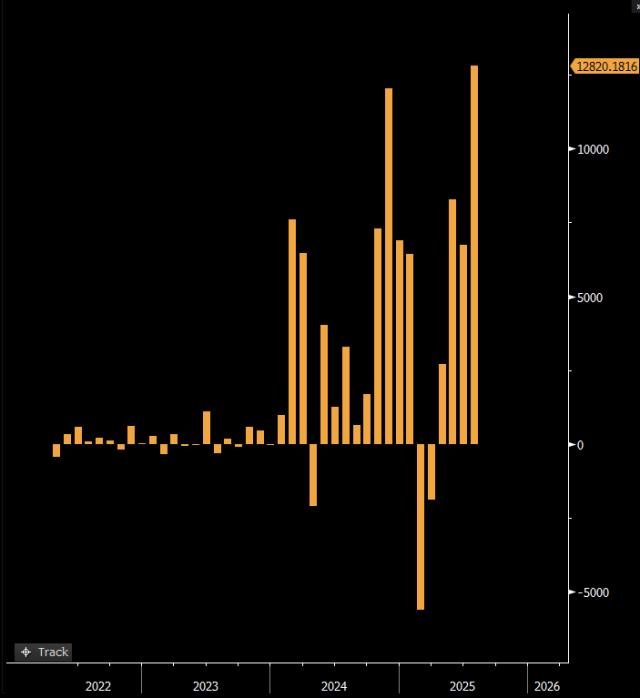

He revealed a counterintuitive fact: In the 2025 fiscal year, Temasek's absolute portfolio net value in China increased by about 4 billion Singapore dollars (approximately 21.6 billion yuan). Behind this proportion decline lies the denominator inflation effect from the US stock bull market and Temasek's global asset reallocation.

When the market is blinded by percentages, smart capital has already seen through the essence.

[The rest of the translation continues in the same manner, maintaining the professional and accurate translation style.]Temasek's bet on Peg and other renewable energy platforms is precisely a hedging strategy to address this "walking on thin ice" situation. Emerging market differentiation is intensifying: Argentina is expected to grow by 5% through "Milei economics," Mexico may experience zero growth due to trade impacts, and India appears bright on the surface but is actually experiencing consumption slowdown. In this context, Temasek's 8% India position and 18% China position form a subtle complement, with the former betting on domestic demand resilience and the latter gambling on industrial upgrading.

"We will not exit just because the fund is expiring." Temasek's India team's statement about the Zomato investment reveals their confidence in crossing cycles. This long-termism is precisely the ballast to withstand geopolitical storms.

In July 2025, Temasek signed an investment agreement in Mumbai, India, planning to invest $10 billion in India within three years; meanwhile, the Temasek private equity team on the Bund in Shanghai is screening early-stage life science projects. These two scenes constitute a brilliant metaphor for global investment. He Yi and others deeply understand the arithmetic of capital: when 18% corresponds to 423 billion yuan in absolute value, and 4 billion new dollars are continuously injected each year, this goes far beyond asset allocation's technical level, directly pointing to a belief vote on national transformation.

"All Temasek-invested enterprises are trying AI applications." Shen Ye's observation reveals the true pulse of the Chinese economy. While international focus is occupied by overcapacity and consumption weakness, Temasek sees logistics robots with 98% automatic sorting rates in Shenzhen warehouses, compressed new car development cycles of 10 months in automotive R&D centers, and market-surviving photovoltaic factory operators who have shed subsidies.

Global capital has not left the stage, it has just changed posture to take root deeply.