Within 48 hours after the Federal Reserve's July meeting, the market experienced a dramatic expectation reconstruction. When Chairman Powell's hawkish statement penetrated the trading hall, the interest rate swap market instantly reacted - the probability of a September rate cut plummeted from 68% before the meeting to 40%, and the October rate cut probability slid from "a done deal" to 80%. Behind this expectation collapse lies the historic divergence of the Federal Reserve's first two board members (Waller and Bowman) voting against maintaining the rate resolution since 1993, and the increasingly tense relationship between the White House and monetary policymakers.

Federal Reserve July Resolution: Hawkish Signal Penetrates the Market

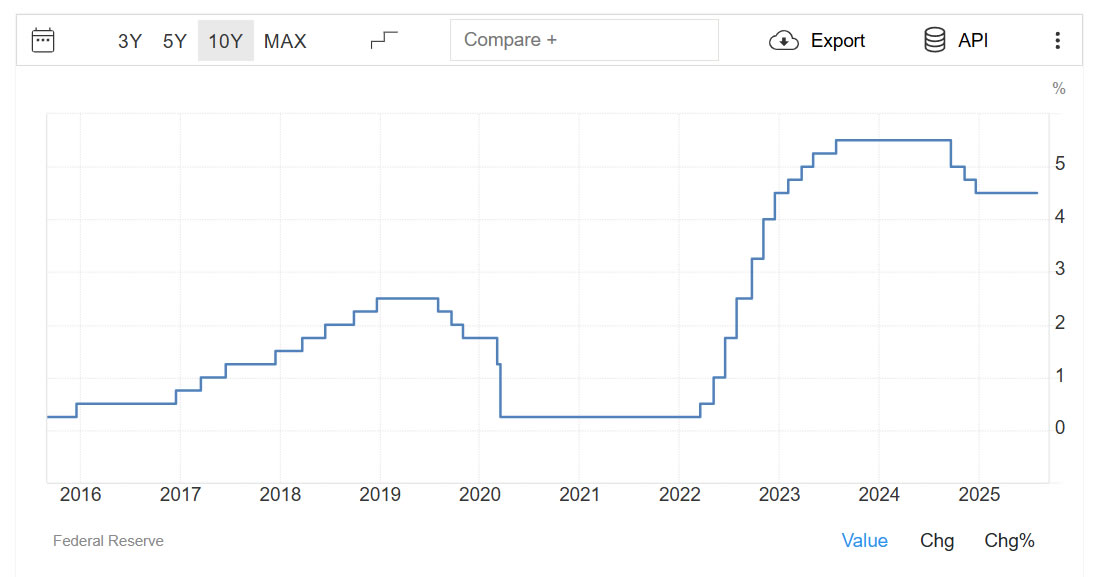

US interest rates remain close to their highest level in over a decade. Source: Trading Economics

The decision from the Federal Reserve headquarters in Washington DC on July 31 seemingly continued the market's general expectation: the federal funds rate remained unchanged in the 4.25%-4.50% range, continuing the tightening stance since 2024.

[The translation continues in this manner, maintaining the specified translations for specific terms and preserving the <> tags.]- Economic Data Sensitivity Increases: August 1st Non-Farm Payrolls and August 13th CPI will become market volatility catalysts, requiring vigilance against short-term leverage risks.

- Strategic Value of Seasonal Patterns: If a panic sell-off occurs in September, historical data shows "buying the dip for the fourth quarter" is statistically the optimal strategy.

- Political Variable Weight Increases: Trump threatens to appoint a "more moderate chairman" when Powell's term expires in 2026, and political pressure may force a policy shift.

As Wall Street traders turn their attention to the September FOMC meeting, the cryptocurrency market is experiencing a silent accumulation of energy. The postponement of rate cut expectations may temporarily suppress the bull market's pace, but it is also gathering more powerful momentum for an ultimate breakthrough.

Similar to the script after the emergency rate cut in March 2020 - initial market doubts were ultimately engulfed by a surging wave of liquidity, and this time, the institutional funding pipeline brought by the Bitcoin ETF may make the transmission of loose policies more rapid than at any point in history.

The Federal Reserve's hawkish statements are like sprinkling fine sand into the bull market engine, but true mechanics understand: when the monetary policy shift of the world's largest central bank is a foregone conclusion, a brief slowdown is merely a momentary pause before the storm.