This morning, the Federal Reserve stood pat as expected, once again "maintaining interest rates unchanged". Many people's first reaction was: "Oh no, is it going to drop sharply?" Actually, it's not that simple.

"No rate cut" = Bearish? Wrong, this is actually a prelude to a market turning point

Since September last year, the Federal Reserve has been on the path of rate cuts - although stubborn and slow, the direction was set early. Like seasonal changes, when spring comes, it won't suddenly jump back to winter. The rate cut rhythm will come as it should. Moreover, the six-month silence actually indicates that a rate cut is closer. If not in July, the probability in September naturally increases. When the "bearish news truly lands", it's often the key point for market trend reversal.

Looking at the technical side: Although the market is like a roller coaster, the bottom support is still there

BTC and ETH's recent trends are interesting: selling off at night, pulling back during the day, repeated needle-like movements, typical oscillating wash-out. Last night, BTC briefly dropped to around 11580 and quickly rebounded, and ETH also pulled back to daily highs from 3675, indicating that the bottom support is still intact, and the market has not completely turned bearish.

Short-term support levels to watch:

- #BTC: 115-116 area support, 118-119 as short-term resistance

- #ETH: 3600-3660 area support, 3880-3900 area might falsely break to trap shorts

At this stage, it's not a good time to make a move, waiting is the operation.

In terms of Altcoins: When mainstream coins slightly pull back, Altcoins fall first. But during rebounds, Altcoins don't follow much, typical of "Altcoins not rotating, washing out first".

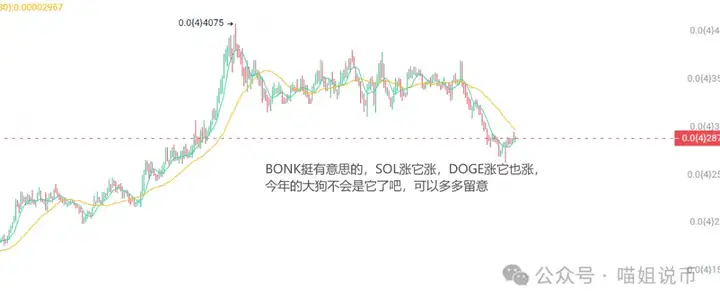

Yesterday, I spent a day persuading fans not to easily run away - many of your coins have already doubled, a 20% pullback is normal, don't get washed out! For example, ETH stood back at 3800 this morning, and #BONK followed SOL's momentum today, most coins will move later.

The key is: Don't run around, the crucial point is choosing the right coin and holding steady

So where are the opportunities? I'm watching these types of coins

Currently, speculation is focused on spot ETF concepts, this round of noteworthy Altcoins are concentrated in "ETF application submitted" mainstream coins and MEME sector:

✅ Mainstream coins: SOL, XRP, LTC, #ADA, #AVAX, APT, #SUI, MOVE, TRX

✅ MEME coins: #DOGE, TRUMP, BONK, #PENGU

SOL's ETF was twice delayed by SEC, but market expectations are stronger. XRP has even entered the "public comment period", with ETF approval potentially ahead of schedule. September-October this year is likely the window for batch ETF approvals. If truly approved, these coins will be directly included in fund pools, becoming passive allocation targets, with more stable leading positions.

Okay, let's continue, today I'll give a unified logic for the coins I'm currently focusing on:

📌 #XRP: Double Bottom structure clearly defined, key point is breaking through 3.25 neckline

4-hour chart structure is very clear, support stable in 3.05-3.10 range, volume cooperation is good. As long as it doesn't break, next target looks towards 3.50+.

📌 #ENA: This wave caught a stablecoin's good news, performing very well. Previously focused, currently can continue holding empty positions, short-term can wait for pullback to重点介入, wait for next TP1

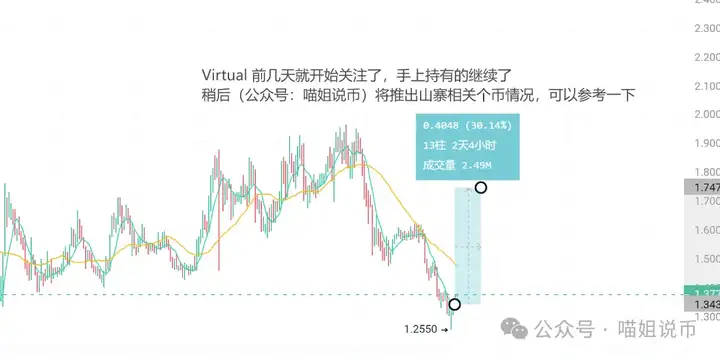

📌 #Virtual: Previously mentioned, currently 1.265 support repeatedly tested, MACD bottom divergence appears. This is possibly the third small-scale uplift after three needle supports, referencing previous two rises of 104% and 55%, this time targeting around 30%.

📌 #DOGE: Bottom structure formed, pullback ending or facing next rebound

Sentiment indicator warming up, observe if next pullback shows volume reduction and stops falling, suitable for gradual long positions.

📌#BSTR: Low market cap potential stock, continuous push-back style uplift

Project background close to $WLFI MicroStrategy play, long-term buy wlfi and usd1. Clear structure, main funds neatly on board, continue to observe.

Summary: The current situation seems calm, but undercurrents are surging. The Federal Reserve's policy has entered the "rate cut countdown", liquidity direction remains unchanged, the crypto market is just accumulating strength. Don't fear short-term oscillation, main line is clear: Focus on ETF concepts + technically structured strong coins, hold steady, not getting washed out is the biggest victory.

The article ends here! If you're lost in the crypto world, consider joining me in layout and harvesting from market makers! FollowPublic Account: Meow Sister Talks Coins

You can join the community WeChat+QQ group to get market analysis, Altcoin operations... WeChat: c13298103401 or QQ: 3806326575