Five Bitcoin (BTC) wallets that have been inactive since 2010 moved 250 BTC, valued at approximately $29.6 million, on Thursday, after more than 15 years of inactivity.

However, it seems unlikely that Satoshi's BTC is active and moving.

Early Bitcoin Miners' Wallets Reactivate After 15 Years

Thursday's transactions sparked speculation about the first Miners and Satoshi Nakamoto, the anonymous creator of Bitcoin. These coins were mined on 04/26/2010, just a few months before the Patoshi mining pattern ceased operations.

The Patoshi pattern refers to a special and traceable mining pattern in Bitcoin's first blocks, believed to be linked to Satoshi Nakamoto. It was discovered by researcher Sergio Demián Lerner in 2013 through detailed blockchain analysis.

However, blockchain analysts believe these funds are unlikely to be directly related to Satoshi himself.

It was reported that these coins moved while Satoshi was active on the Bitcoin network.

"According to our research, two previously inactive 50 BTC address transactions mined today were from the end of the period when Satoshi was active (up to around block 54,316). However, it is very unlikely these blocks were mined by Satoshi," wrote Whale Alert, an on-chain tracking service.

Satoshi's BTC tokens are associated with the Patoshi pattern, a notable trend in Bitcoin's early days. The idea is that Satoshi mined Bitcoin early with a unique setup.

Meanwhile, the Patoshi Miners were a special and well-documented mining entity, believed to be operated by Satoshi.

In a previous report, Whale Alert estimated the number of blocks mined and the Bitcoin Satoshi owned.

The study cited 1,125,150 BTC mined up to block 54,316. As of 07/20/2020, these assets were estimated to be worth at least $10.9 billion in total.

Why These Wallets Are "Very Unlikely" to Belong to Satoshi

Blocks associated with the Patoshi pattern have a unique signature. They include a notably narrow nonce range different from other Miners of that time.

"Lerner found additional evidence for his claims in the nonces... the last byte of the nonce was always within the range of 0 to 9 or 19 to 58, while all other Miners used the full range from 0 to 255," Whale Alert explained.

Moreover, researchers believe Satoshi intentionally gradually reduced mining activity around May 2010.

"It can be said that the Patoshi Miners were shut down in May 2010. The shutdown time, mining behavior, systematic mining speed reduction, and lack of aggressive spending indicate that Satoshi was only concerned with developing and protecting the young network," Whale Alert added.

Despite some public speculation, the latest activity does not align with this pattern. According to Whale Alert, Bitcoin mined by Patoshi may be a byproduct of these efforts. Moreover, it is unlikely that the remainder will be spent.

However, these transactions provide a rare glimpse into the earliest Bitcoin adopters.

Whale Alert notes that their findings do not exclude the possibility that Satoshi was also operating a Miner using publicly released software.

"...perhaps just for testing, and we believe it is at least possible that one of the non-Patoshi patterns also belonged to Satoshi," the researcher noted.

Whale Alert said they will soon publish a complete list of blocks potentially mined by Satoshi, which could clarify which old wallets might awaken in the future.

Meanwhile, Bitcoin addresses from the Satoshi era, previously inactive, have reappeared in recent weeks, raising concerns about potential sell-offs.

Galaxy Digital was criticized for helping sell 80,000 BTC from wallets linked to a long-term holder.

Adding to market concerns, some long-inactive Bitcoin wallets suddenly became active in July, sparking speculation of potential further sales.

Community members on X (Twitter) speculate that Bitcoin holders from the Satoshi era might be preparing to exit during the next price surge.

"There have been many old bitcoin transfers recently," one user posted. "Could they be preparing to sell during the next price surge?" wrote a user.

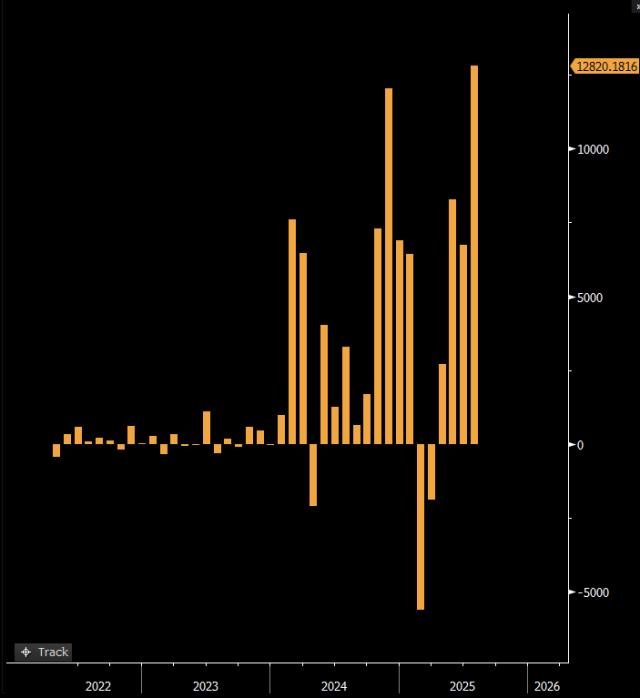

Although Bitcoin's fundamentals remain strong, the coin movement trend of whales in July has created new uncertainty for short-term prospects.

Currently, traders are monitoring the volatility, while investors hope new capital flows might bring BTC back to new highs.