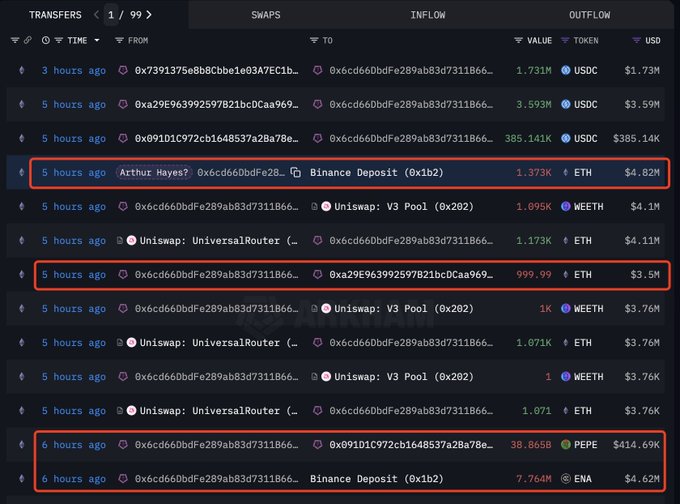

According to on-chain data monitoring platform Lookonchain, BitMEX co-founder Arthur Hayes sold a large amount of cryptocurrencies today, including $8.32 million worth of Ethereum (2,373 ETH), $4.62 million of ENA (7.76 million tokens), and $414,700 worth of PEPE (38.86 billion tokens), totaling approximately $13.35 million in funds.

Arthur Hayes Reveals Bearish Stance

As the community speculated why Arthur Hayes, who has long been bullish on cryptocurrencies, would sell a large portion of his holdings during today's market downturn, Hayes explained around 1 PM that the cryptocurrency pullback might not be over, with Bitcoin potentially dropping to $100,000 and Ethereum possibly falling to $3,000:

Why? The US tariff bill will expire in the third quarter... at least the market believes so after the non-farm employment data. No major economic entity is creating enough credit to quickly drive nominal GDP growth. Therefore, $BTC will test $100,000, and $ETH will test $3,000.

Arthur Hayes: Bitcoin to Reach $250,000, Ethereum to Hit $10,000 by Year-End

It's worth noting that just last July, Hayes wrote in a long article that the upcoming Ethereum bull market will completely ignite the market, advising people to "not be afraid of tariffs, not be afraid of war, and not be afraid of random social issues", and predicted that Bitcoin will surge to $250,000 and Ethereum will rise to $10,000 by year-end:

The upcoming Ethereum bull market will completely ignite the market.

Since Solana rose from $7 to $280 from the ruins of FTX, Ethereum has been the least favored among major cryptocurrencies. But now that's different; Western institutional investors, led by Tom Lee, are very fond of Ethereum.

Buy first, ask questions later. Or don't buy, and sit in the club corner drinking a beer that tastes like urine, watching a group of people you think are less intelligent than you buying champagne at the next table.

My year-end targets:

. Bitcoin = $250,000

. Ethereum = $10,000