TL;DR

In July 2025, the U.S. economy continues to show a pattern of rising inflation and weakening growth momentum, with CPI and core inflation remaining above the Federal Reserve's 2% target, making immediate easing unlikely in the short term. While the labor market remains overall stable, signs of marginal weakness are emerging, with moderate consumer rebound and an unstable foundation. High interest rates and credit costs continue to suppress household spending. Divergence within the Federal Reserve regarding rate cuts has intensified, with market expectations of potential rate cuts in September, still dependent on subsequent inflation and employment data. Meanwhile, geopolitical risks and domestic policy negotiations are increasing market uncertainty, with the Fed maintaining a high-interest-rate and wait-and-see stance, putting pressure on market risk appetite.

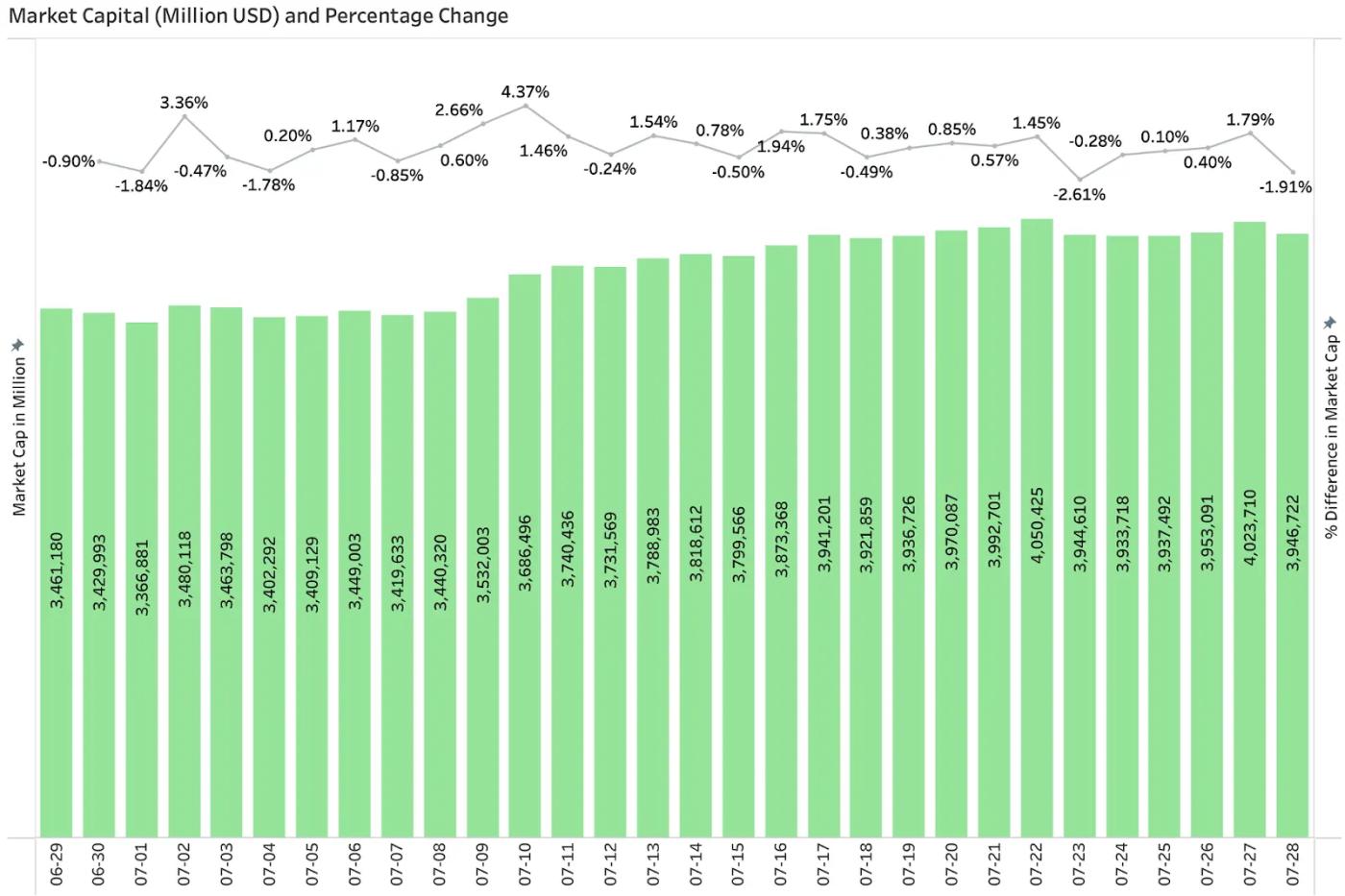

Crypto market trading volume significantly increased in July, with a daily average of $161.2 billion, a 56% increase from the previous month, with multiple single-day volumes exceeding $200 billion. Total market capitalization rose to $3.94 trillion (+16.2%), with BTC market dominance at 60.6% and ETH at 11.8%. Funds are accelerating from BTC to ETH and its ecosystem, with market sentiment rapidly warming. New popular tokens primarily focus on infrastructure projects, with Layer1 and Layer2 (such as Chainbase, ZKWASM, Caldera, ERA) receiving the most attention, while DeFi applications remain an important growth driver.

In July, BTC spot ETF net inflows were $20.15 billion, ETH net inflows were $10.71 billion, driving prices up by 11.46% and 55.83% respectively, with Ethereum showing stronger attraction. During the same period, stablecoin circulation surged by $9.617 billion, with USDE rising 36.2% in a single month, leading the market.

BTC repeatedly failed to break $120,000, reaching a high of $120,113 on July 23rd before retracing to a low of $114,759, currently around $119,600, still constrained by the 20-day moving average (around $116,300). ETH shows the strongest trend, rising from $3,740 to $3,881 in the past two days, with ETF net inflows of $24 billion in six days. If it breaks $3,745, it could potentially reach $4,094–$4,868. SOL remains relatively weak, dropping below $200 to a low of $184, currently consolidating between $187–$190. If it breaks $176, it may drop to $157.

U.S. stock companies like SharpLink and Bitmine are massively accumulating and staking ETH, creating an "Ethereum version of MicroStrategy", promoting ETH's transformation from a technical asset to an institutional-level reserve asset. The 'GENIUS Act', the first federal stablecoin law in the U.S., has officially taken effect, clarifying stablecoin banking regulatory pathways and stimulating stablecoin inflows and institutional deployment of on-chain payment and settlement applications. The first Solana ETF (SSK) supporting on-chain staking has been listed in the U.S., introducing a "staking + cash dividend" structure, marking a new era of revenue-generating crypto ETFs.

The CLARITY Act has passed the House and entered Senate review, expected to promote compliance and capital inflow in the U.S. crypto market. Solana spot ETF approval is accelerating, with multiple institutions submitting applications, and SEC expected to review by October at the latest. Ethereum staking ETFs led by BlackRock are also under review, potentially approved in Q4 2025.

According to CoinGecko data, as of July 28, the total cryptocurrency market capitalization steadily rose to $3.94 trillion, growing 16.2% from the previous month. BTC's market share was 60.6%, while ETH's market share increased to 11.8%, with the ETH/BTC exchange rate rising to 0.32. In this round, ETH performed better than BTC, with funds gradually flowing from BTC to ETH and its ecosystem. The total market value broke through $4 trillion on July 22, reaching a new high. Since July 11, the market value growth rate has significantly accelerated, reflecting continuous fund inflows and market confidence restoration driven by mainstream asset increases. Driven by BTC's repeated new highs, ETH's strong leadership, and hot sector rotation, the crypto market's market value expansion shows structural characteristics, indicating that the overall market is entering a new upward cycle.

Popular Tokens Launched in July

Among the popular tokens launched in July, hot tracks were mainly concentrated in infrastructure projects, with Layer1 and Layer2 projects like Chainbase, ZKWASM, Caldera, and ERA being the most market-favored. The DeFi project Aspecta also received some attention, showing the market's dual focus on underlying technologies and decentralized financial ecosystems. Overall, investors demonstrated strong interest in infrastructure projects that enhance blockchain performance and scalability, while DeFi applications remain an important growth driver.

[The rest of the translation follows the same professional and accurate approach, maintaining the specific terminology translations as instructed.]SOL showed a weak trend this week. After failing to break through the key $200 resistance, the price quickly retreated and fell below the $185 integer support level, touching a low of around $184. Currently, the price is hovering in the $190–$187 range, forming a typical inverse head and shoulders or cup and handle pattern on the chart. If it breaks through the $180–188 resistance zone, it may potentially reverse upward, with a target of around $220; however, if it breaks below the short-term support of $176 (or near the 20-day moving average), it may accelerate the pullback towards the $157 area.

Over the past two days, SOL has only shown a slight rebound, with its trend significantly lagging behind ETH and BTC. Market enthusiasm is low, with reduced interest from new investors and signs of long-term holders selling.

5. Hot Events This Month

Ethereum Version of MicroStrategy Drives Price Increase

Recently, US-listed companies such as SharpLink, Bitmine, Bit Digital, and BTCS have continued to increase their ETH holdings and establish an "Ethereum version of MicroStrategy" through on-chain staking. As of July 21, 2025, SharpLink holds approximately 358,000 ETH (market value of about $1.278 billion), Bitmine holds 300,700, and Bit Digital and BTCS hold 120,300 and 31,900 ETH respectively. SharpLink has surpassed the Ethereum Foundation to become the largest institutional holder globally, and Bitmine, driven by Wall Street capital like ARK Invest, plans to increase its ETH allocation to 5%, further strengthening ETH's market positioning as an "enterprise-level asset".

With the recovery of ETH price and continuous net inflows of ETF, ETH is transitioning from a retail-driven technical asset to an institutional-led reserve asset. The current institutional holding pattern presents a "dual-center": SharpLink represents the native crypto camp, while Bitmine represents the traditional capital path, driving ETH into a new narrative cycle of "staking + reserve + governance". The overall trend indicates that ETH is entering a phase of institutional re-evaluation driven by ETFs, listed companies, and on-chain nodes.

US Stablecoin Law Passed

On July 17, 2025, the US House of Representatives passed the GENIUS Act with 308 votes to 122, and it was signed into law by the president the next day, marking the birth of the first federal regulation on US dollar stablecoins. The law establishes the "Permitted Payment Stablecoin Issuers" qualification and requires issuers to have a bank or trust identity approved by federal or state authorities, reserve with cash or short-term US Treasury bonds, daily public disclosure, prohibition of collateral re-use, no interest returns, and subject to oversight by the Treasury Department, OCC, and Bank Secrecy Act. The law also excludes stablecoins from securities and commodity laws, clearly removing them from SEC/CFTC jurisdiction and placing them under bank regulatory authorities.

Shortly after the signing, the crypto asset market significantly warmed up: Bitcoin and Ethereum and other major crypto assets rose sharply, with Ethereum rising by around 50% in July, Bitcoin price increasing by 10.27%, and stablecoins seeing inflows of $9.617 billion. In the financial institution sector, payment giants like JPMorgan, Mastercard, and Visa are accelerating stablecoin issuance or exploring on-chain payment solutions. Traditional banks and online platforms (such as Circle, Coinbase, PayPal, Amazon, Walmart) are also quickly integrating stablecoins into payment, cross-border settlement, and corporate cash management businesses, thereby promoting stablecoin applications into mainstream financial services.

First Solana Staking ETF Listed in the US

In July, the US welcomed its first historically approved ETF for staking cryptocurrencies - the REX-Osprey Sol + Staking ETF (SSK). The fund has been approved by regulators and officially listed on the Cboe BZX exchange early this month. The ETF's most distinctive feature is its embedded "staking" mechanism: a portion of the SOL assets held by the fund will participate in Solana network validation through on-chain staking, earning approximately 7% annual staking rewards, which will be distributed to investors in cash, similar to the traditional financial "fixed deposit + dividend" model. About 60% of the SOL assets held by the fund participate in on-chain staking with an annual yield of around 7%, to be distributed in cash, while the remaining 40% is invested in overseas Solana ETP products to avoid the 19b-4 process and be listed through S-1 registration. This "staking + dividend" structure distinguishes SSK from ETFs that only track SOL futures, and the market views it as a landmark achievement of the Trump administration's relaxation of crypto regulation.

Affected by the news, SOL rose by 6% in early July. Currently, institutions like Grayscale, VanEck, and Bitwise have also submitted S-1 application documents for Solana Spot ETF, expected to submit revised versions by late July. The SEC is likely to complete the review by mid-to-late August (with the latest review deadline being October 10). Spot staking ETFs for Ethereum and other cryptocurrencies are also expected to follow suit.

6. Next Month's Outlook

CLARITY Act

The Digital Asset Market Clarity Act (CLARITY Act), which has been closely watched by the market, has successfully passed the US House of Representatives and entered the Senate review stage in late July, marking a key step in US crypto asset regulatory legislation. The act aims to clarify the classification standards and regulatory boundaries of crypto assets, defining the responsibilities of the SEC and CFTC for the first time, and providing a clear compliance path for decentralized projects, stablecoins, and DeFi protocols. If the act is successfully passed, it will bring three major positive impacts:

Enhance regulatory certainty, encouraging compliant operation of projects and exchanges, and boosting institutional confidence;

Grant CFTC greater regulatory authority, weakening SEC's regulatory power, and potentially ending years of regulatory disputes;

Confirm the legal status of DeFi and self-custody, reducing compliance burden for developers and clearing obstacles for decentralized innovation.

Under the expectation of policy benefits, multiple DeFi blue-chip projects and exchange-type assets have rebounded since mid-July. If the Senate review goes smoothly in August and maintains the House version's support for DeFi exemption and "mature chain" clauses, the CLARITY Act is expected to become an important turning point in driving a new round of compliance and capital entry into the US crypto market.

SOL Spot ETF and Ethereum Staking ETF Review

The progress of the Solana Spot ETF is accelerating, with seven institutions including Grayscale, VanEck, Fidelity, and Franklin submitting S-1 registration statements to the SEC in mid-June, generally covering staking mechanisms and redemption process designs. The SEC requires applicants to submit revised versions by July 31 to clarify specific operational details. According to regulatory provisions, the SEC's latest approval deadline for such ETFs is October 10, 2025, but if applicants submit supplementary documents on time, the market generally expects the SEC may make a decision in mid-to-late August. If approved, Solana will become the third mainstream crypto asset to receive spot ETF support after Bitcoin and Ethereum.

Regarding the Ethereum staking ETF, BlackRock submitted a revised 19b-4 file on July 16, proposing to partially or fully stake ETH holdings through a staking service provider to obtain additional returns. Grayscale submitted an application to add staking functionality to its ETH trust product earlier this year but was still under review as of June. The SEC released its first crypto ETF regulatory guidelines on July 7, clarifying standardized regulatory processes for staking, custody, and revenue distribution, and considering introducing a unified reporting template to shorten the approval cycle to 75 days. Currently, if the overall process proceeds smoothly, the first batch of ETH staking ETFs is expected to be approved as early as the fourth quarter of 2025.