The U.S. non-farm employment data released on Friday triggered market concerns about an economic recession. May's figures were revised from 144,000 to 19,000, and June's from 147,000 to 14,000, with an unusual downward revision that put pressure on both stocks and currencies.

BTC briefly fell below $112,000 this morning, reaching a low of $111,903 around 8:30, and temporarily rebounded to $113,430 at the time of writing, with a 24-hour decline of 0.45%.

Ethereum, the second-largest cryptocurrency, experienced an even more significant decline, falling to a low of $3,355 this morning, its lowest in two weeks. At the time of writing, it was trading at $3,440, with a 24-hour decline of 2.3%.

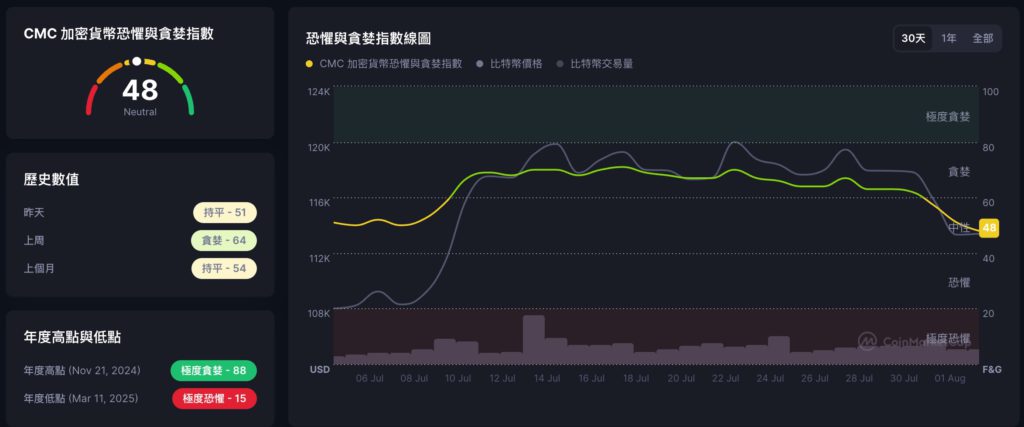

CMC data indicates that the cryptocurrency fear and greed index has fallen below 50 for the first time in a month, suggesting a decrease in market enthusiasm.

BTC Spot ETF Net Outflow Hits Six-Month High, Ethereum Breaks Continuous Inflow Record

The market's withdrawal can be sensed from the flow of U.S. BTC and Ethereum spot ETFs. According to Sosovalue data, the 12 U.S. BTC ETFs experienced a net outflow of $810 million on August 1, the highest in nearly six months.

Ethereum was similar, with its nearly month-long continuous net inflow record broken, recording a $150 million outflow on the 1st.

Network-Wide Liquidation of $390 Million

According to Coinglass data, over the past 24 hours, impacted by the market downturn, a total of 118,000 people were liquidated, with a total liquidation amount reaching $390 million.