In this article, BlockBeats will summarize the key industry news content of the week (July 28th-August 3rd) and recommend in-depth articles to help readers better understand the market and learn about industry trends.

Important News Review

The market continued to pull back this week, with Bitcoin falling below $112,000. Previously strong Altcoin also saw a general decline.

On August 3rd, Bitcoin briefly fell below $112,000, a 24-hour drop of 0.55%. Ethereum briefly fell below $3,360, a 24-hour drop of 2.42%. As the market adjusted, previously strong Altcoin fell across the board: VINE saw a 29.8% drop in a single day; ZORA saw a 15.6% drop; and ENA saw a 9.7% drop. According to Coinglass data, on August 1st, long positions across the network were liquidated, totaling $922.2 million, the largest single day of liquidation since February 25th of this year. It is worth noting that after February 25th, the market experienced a downward consolidation that lasted for over two months. Related reading: "Bitcoin Falls Below $115,000: Is This a Delayed Feedback from the Selloff of 80,000 BTC?" and "Bull Market Presses Pause: Institutional Buying Cannot Stop the Market Adjustment, Short-Term Volatility May Continue."

The White House officially released a digital asset report, but there was no substantial update on the Bitcoin reserve plan.

On July 31, the White House released its long-awaited digital asset report, which laid out a national strategy to make the United States a global leader in blockchain, cryptocurrency markets, and tokenized finance. Although the report covers a wide range of digital asset policy areas, it does not provide a substantive update on the government's planned Bitcoin reserves. It simply reiterated the statement in President Trump's January executive order without listing next steps or implementation timetables. The 166-page document was led by David Sacks, head of the White House's cryptocurrency and artificial intelligence affairs, and Executive Director Bo Hines. It integrates the opinions of the Treasury Department, the Commerce Department, the U.S. Securities and Exchange Commission (SEC), and the U.S. Commodity Futures Trading Commission (CFTC), and lists several proposals for simplifying supervision, supporting innovation, and modernizing supervision. Related reading: "Interpreting the White House Digital Asset Report: Clarifying Regulation, Embracing DeFi and Innovative Financial Products"

The Federal Reserve kept interest rates unchanged this week, but two governors dissented from the rate decision, the first time in nearly 30 years.

On July 31, the Federal Reserve kept interest rates unchanged on Wednesday. There was a rare disagreement in the decision-making process, and the statement did not specify when the interest rate cut might be made. The decision was opposed by two Trump-appointed governors, Waller and Bowman, both of whom believed that the current monetary policy was too tight. This is the first time in more than 30 years that two governors have voted against the resolution. The FOMC voted 9 to 2 to maintain the benchmark overnight interest rate in the range of 4.25%-4.50%, remaining unchanged for the fifth consecutive meeting. Related reading: "For the first time in nearly 32 years, the Federal Reserve has had two dissenting votes. What signals does it send?"

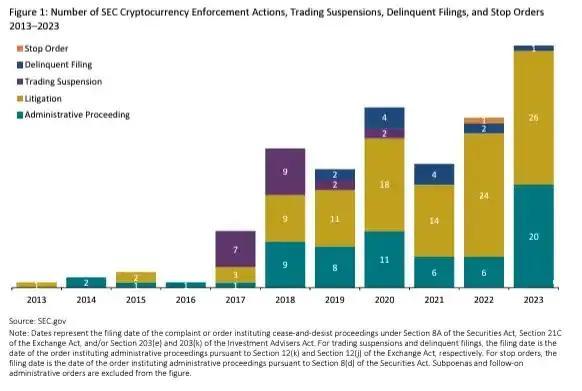

The US SEC launches Project Crypto to promote the on-chain financial market

On August 1st, Reuters reported that the U.S. Securities and Exchange Commission (SEC) launched Project Crypto, an initiative aimed at modernizing securities regulations and enabling the on-chainization of U.S. financial markets. Related reading: "Full Text of SEC Chairman's 'Project Crypto' Speech: Migrating the U.S. Financial Market to the Chain," "Project Crypto Arrives: Who Will Be the Biggest Winner in the New American On-Chain Order?"

The SEC has updated its cryptocurrency ETP listing standards, potentially signaling the imminent approval of a large number of crypto ETFs.

On July 31st, the U.S. Securities and Exchange Commission (SEC) released its "Listing Standards" for cryptocurrency ETPs through new trading platform filings. The document indicates that any token/ETF listed on the Coinbase derivatives trading platform with continuous futures trading for at least six months is expected to be approved. Market analyst @qinbafrank stated that this significant change has three implications: it means a large number of crypto-asset spot ETFs are about to be approved; Coinbase will be the biggest beneficiary, as its crypto futures listing will be highly sought after by various project developers; and the SEC's approval authority for crypto-asset spot ETFs will be transferred to the Commodity Futures Trading Commission (CFTC), as the CFTC is the primary regulatory body responsible for deciding which assets can have futures contracts.

Insider: It is recommended that the construction of national public chains be led by central state-owned enterprises

On August 2nd, Caixin reported that an insider, in an interview regarding stablecoins, stated that my country currently lacks a globally influential public blockchain. Another insider suggested that the construction of national-level backbone public chains should be led by central state-owned enterprises, while the development of industry-level public chains should be open to market competition. One insider stated, "Public chains are the infrastructure for the issuance of stablecoins and are of vital importance and indispensable for building an autonomous, controllable, secure, and efficient financial infrastructure system for the digital financial era."

Rumors debunked: Multiple foreign media reports that "China will ban cryptocurrency trading and mining again" may be false

On August 3rd, multiple overseas media outlets and influencers, including Kalshi, First Squawk, Cointelegraph, and The ETF Store President Nate Geraci, reported that China had just officially announced a ban on cryptocurrency trading and mining. BlockBeats has learned from multiple sources that no such ban has been announced recently. In fact, China had already completely banned crypto mining activities as early as May 19, 2021.

Ethereum celebrates its 10th anniversary this week, with over 780,000 Torch Commemorative NFTs minted.

On July 30, Ethereum celebrated its tenth anniversary. Over the past ten years, ETH has risen from $0.3 to over $4,000, becoming the 28th largest asset in the world and the second largest cryptocurrency in terms of market capitalization after Bitcoin. Ethereum is widely used in DeFi, NFT and other fields. It is known as the "world computer" and has reshaped our world unknowingly. On July 31, the minting of the Ethereum tenth anniversary torch commemorative NFT was completed, with a total of over 780,000 pieces and over 660,000 holders. "The Torch" NFT is used to pay tribute to those who shaped the development of Ethereum in its first decade and the values that will help build Ethereum in the future. Related reading: "Ten-year-old Ethereum, the first year of Wall Street taking over" , "From miners to stakers: Ethereum's ten years of computing power and narrative changes"

Linea Announces Token Economics: Total Supply Approximately 72 Billion, 9% Airdropped to Early Users

On July 30th, Linea officially announced the LINEA token economics: the total supply is 72,009,990,000 (approximately 72 billion), equivalent to 1,000 times the initial circulating supply of ETH. The distribution mirrors Ethereum's genesis distribution: 85% of the supply is dedicated to the ecosystem, and the remaining 15% is allocated to the Consensys treasury. Early adopters will receive tokens from a 9% allocation, which will be airdropped and fully unlocked during the Time General Evolution (TGE). 75% of the LINEA token supply will be allocated to the Ecosystem Fund, managed by the Linea Alliance, which includes ENS Labs, Eigen Labs, SharpLink, Status, and Consensys. ETH will serve as the network gas token. After deducting L1 costs, 20% of gas fees will be burned, reducing ETH supply and strengthening its monetary premium. The remaining 80% of gas fees will be used to burn LINEA. Related reading: "Linea airdrop is approaching: This time, L2 starts to feed back L1?" , "Linea is about to hold TGE, what is the LXP points threshold and reasonable valuation?"

US SEC approves physical redemption mechanism for Bitcoin and Ethereum ETFs

On July 30, according to market news, the U.S. Securities and Exchange Commission (SEC) officially approved the physical redemption mechanism for Bitcoin and Ethereum ETFs.

The US SEC confirmed receipt of an application to allow BlackRock’s Ethereum spot ETF to be collateralized.

On July 30th, the U.S. Securities and Exchange Commission (SEC) confirmed receipt of an application to allow staking of BlackRock's Ethereum spot ETF. Nate Geraci, president of The ETF Store, stated earlier this year that staking of an ETH ETF was inevitable, and that it would happen even faster under the Trump administration.

CCTV's World Weekly features a special report on Trump's crypto-friendly policies and stablecoins

On July 27th, CCTV's "World Weekly" program ran a special evening report on Trump's crypto policies and stablecoins. The report stated that despite Trump's introduction of a series of crypto-friendly bills, including the Genius Act, Bitcoin and other cryptocurrencies still face significant price volatility and security risks. The report, which lasted approximately 20 minutes, noted that Trump's active promotion of stablecoins is highly correlated with Federal Reserve policy and the excessively high US national debt. It also described stablecoins as a new generation of "dollar hegemony." As countries around the world accelerate the issuance of their own stablecoins, "establishing a more stable international order presents a new challenge."

Hong Kong's Stablecoin Ordinance will officially take effect this Friday, and the first batch of stablecoin licenses may only be limited to 3-4 companies.

On August 1, the Hong Kong Stablecoin Ordinance officially came into effect, and the Hong Kong Monetary Authority has opened applications for stablecoin issuance licenses, marking that the development of stablecoins in Hong Kong has entered a new stage of implementation. Over the past year, the Hong Kong Monetary Authority has promoted sandbox testing of stablecoin application scenarios, and gradually clarified the regulatory scope and application path. Now participating institutions will move from testing to the issuance and circulation of coins under the formal regulatory system. According to incomplete statistics, dozens of institutions have stated that they will apply for stablecoin licenses. On the 2nd, according to Caixin, from June to July this year, discussions on stablecoins on both sides of the Pacific reached a boiling point, and then cooled down. Hong Kong may narrow the scope of the first batch of stablecoin licenses to three or four. Related reading: "Directly hit the implementation of Hong Kong's stablecoin policy, you only need to know this" , "Dialogue with Xiao Feng: Cold thinking behind the stablecoin craze, Hong Kong may once again become the world center of digital assets"

Hong Kong's Stablecoin Ordinance: Issuers must control and prevent users from using VPNs for identity authentication

On July 31, the Hong Kong Monetary Authority stated in its regulatory guidance document for licensed stablecoin issuers, the "Stablecoin Ordinance", that it requires licensed stablecoin issuers to "ensure that they will not issue or offer specified stablecoins in jurisdictions where trading of specified stablecoins is prohibited" and that "licensees should implement control measures to mitigate the risks of location masking (such as the use of virtual private networks, or VPNs) in remote customer identity authentication procedures and during daily operations."

Tether surpasses South Korea to become the 18th largest holder of US Treasury bonds

On August 1st, according to Messari data, Tether surpassed South Korea to become the 18th largest holder of U.S. Treasury bonds. According to Tether’s latest Q2 financial report, its U.S. Treasury holdings have exceeded $127 billion.

Ming Pao: JD.com has registered "JCOIN" and "JOYCOIN," which are expected to be the names of its stablecoins.

On July 29th, Ming Pao reported that local media outlets, citing registration documents, reported that JD.com's JD Coin Chain had registered the names "JCOIN" and "JOYCOIN," which some speculated were the names of its stablecoins. According to the registration documents cited in the report, the services provided by "JCOIN" and "JOYCOIN" include electronic funds transfers and cryptocurrency financial transactions using blockchain technology. JD Coin Chain is a participant in the Hong Kong Monetary Authority's Stablecoin Issuer Sandbox. Last July, it collaborated with Airstar Bank, a local virtual bank backed by Xiaomi and Futu, to explore new stablecoin-based cross-border payment solutions for businesses within the sandbox.

Figma's US stock surged 250% on its first day of listing; the address of the suspected Figma founder holds over $1.7 million worth of AGLD tokens

On August 1, according to rockflow data, the US stock Figma soared 250% on its first day of listing, closing at $115.50. It rose another 24.2% after the market closed, quoted at $143.45. Figma once stated in the prospectus it submitted that the company has been authorized to issue "Blockchain Common Stock." In addition, in early July, Figma disclosed that it held nearly $70 million in Bitcoin ETFs and had been approved to purchase another $30 million in Bitcoin. According to Arkham data, the address suspected to be Figma founder Dylan Field holds more than 2.3 million AGLD tokens, worth $1.76 million, which is the largest holding of the address. In addition, the address also holds ETH, PEOPLE and LOOT NFTs. Related reading: "The first unicorn to open the on-chain IPO channel, Figma's aesthetic is unique in Silicon Valley"

The CEO of "Fat Penguin" revealed that the team has participated in US cryptocurrency legislation; the SEC officially confirmed that it has received the Canary Pengu ETF application

On July 31, Luca Netz, CEO of Pudgy Penguins, said in an interview, "Pudgy Penguins and the Abstract team have officially participated in U.S. cryptocurrency legislation as government advisers and issued recommendations. Team members have traveled to Washington, D.C. many times in the past three months and have submitted an application for the PENGU ETF. The ETF will include not only PENGU tokens but also NFTs." On August 1, the U.S. Securities and Exchange Commission (SEC) officially confirmed receipt of the Canary PENGU ETF application. This ETF is the first hybrid spot ETF of Meme tokens and NFTs. As Wall Street's attention to it increases, market participants expect that the decisive moment of the intersection of digital assets and traditional finance is about to come.

CEA Industries and 10X Capital, backed by YZiLabs, announced a $500 million private placement to establish a BNB strategic reserve.

On July 28th, CEA Industries (NASDAQ: VAPE) and 10X Capital, backed by YZi Labs, announced a $500 million private placement to establish the world's largest publicly traded BNB treasury. The financing consists of two tranches: a common stock PIPE raising $500 million (including $400 million in cash and $100 million in cryptocurrency); and warrants, which, if fully exercised, are expected to raise an additional $750 million in cash. Officials stated that the PIPE was oversubscribed by over 140 institutions worldwide, including major participants such as YZi Labs, Pantera Capital, and Arche Capital. On the same day, CEA Industries (VAPE) shares in the US surged 548.85% on the news of the $500 million private placement to establish the BNB treasury. Notably, the company's stock closed at just $8.88 on Friday, with a market capitalization of just $7.4669 million. Related reading: "BNB Treasury managed by the richest Chinese person, can it continue to rise after a 600% surge?" , "US$500 million in financing attracted over 140 institutions to subscribe, giving BNB a new entrance on Wall Street"

Bridgewater Associates founder Ray Dalio sells remaining shares and resigns from board of directors

On August 1, Reuters reported that according to a letter sent to investors, Ray Dalio, founder of Bridgewater Associates, sold his remaining fund shares. Bridgewater Associates was founded by him 50 years ago. The transaction marks the end of many years of transition for the world's largest hedge fund with US$92.1 billion in assets under management. Ray Dalio, 76, resigned as CEO in 2017 and handed over control of Bridgewater Associates to a new generation of investors in 2022. A source said that Ray Dalio will also resign as a member of the board of directors. Related reading: "Bridgewater's Dalio "officially retires": sells out the last holdings and resigns from the board of directors"

Justin Sun will complete his space flight on a Blue Origin spacecraft on August 3

On July 31st, TRON founder Justin Sun announced on the X platform that he would fly to space aboard Blue Origin's New Shepard on August 3, 2025, becoming the youngest Chinese astronaut in history. In 2021, Sun successfully bid $28 million for a seat on New Shepard's first crewed flight and donated the entire bid to Blue Origin's "Future Club" to support STEM education for young people worldwide.

PayPal's new feature allows US merchants to accept over 100 cryptocurrencies

On July 28, Fortune reported that financial technology giant PayPal announced a new payment option on Monday, allowing small and medium-sized merchants in the United States to accept over 100 digital assets, including major cryptocurrencies like Bitcoin and Ethereum, as well as Trump commemorative coins like the TRUMP and even FARTCOIN. A company spokesperson stated that this feature is available to all US merchants using PayPal's online payment processing platform. PayPal plans to expand its cryptocurrency payment service to large corporate clients in the United States and globally, but declined to provide a specific timeline.

Industrial Bank proposed to study stablecoins in its semi-annual work meeting

On July 28, according to the 21st Century Business Herald, Industrial Bank recently held its 2025 semi-annual work meeting, proposing to embrace technological change, research stablecoins, carry out "artificial intelligence +", promote "data element X", do a good job in basic work, take greater steps on the road of intelligent transformation and digital transformation, and accelerate the transition from "digital industrial bank" to "smart industrial bank".

A Sichuan court in China heard a case involving the use of virtual currency to resell foreign exchange, involving over 200 million yuan.

On July 30, it was reported that from 2020 to 2021, the defendants, Wan Mouyuan, Chen Mouwen, and Huang Mouyuan, illegally traded foreign exchange outside of state-regulated trading venues using virtual currencies such as USDT, totaling 234 million RMB. The three individuals had a clear division of labor, using virtual currencies to transfer funds between RMB and USD, completing US dollar transactions through Hong Kong company accounts. Because the case involved a new type of crime involving virtual currencies as foreign exchange intermediaries, the Muchuan County Court of Leshan City requested an escalation to the Intermediate People's Court. On August 28, 2024, the Leshan Intermediate People's Court found the three individuals guilty of illegal business operations and sentenced them to 13 years and 6 months in prison (for multiple offenses), 5 years and 6 months in prison, and 2 years and 6 months in prison, respectively, and imposed fines totaling 2.1 million RMB. The verdicts have now taken effect.

Details of a corruption case involving 140 million yuan in rewards for a short video platform in Beijing have been revealed, with the use of virtual currency for money laundering and other methods to transfer the stolen funds.

On July 28, Feng, a former employee of a short video platform company in Beijing's Haidian District, exploited his position to collude with external suppliers, exploiting loopholes in the company's incentive policies and leaking internal data to illegally embezzle 140 million yuan in company bonuses. The suspects also transferred the illicit funds by registering shell companies and laundering funds using virtual currencies. Feng instructed Tang and Yang to use eight different overseas virtual currency trading platforms to convert the fraudulently obtained funds into Bitcoin and other virtual currencies. Faced with the evidence, Feng's group surrendered over 90 Bitcoins, allowing the company to recover some of its losses. Ultimately, Feng and seven others were sentenced by the Haidian District People's Court to prison terms ranging from 14 years and six months to three years for embezzlement, and were fined accordingly. The verdicts have now taken effect.

This week's top investors: Courtyard, Zodia Markets, Delve, Manifold, Yuanbi Technology, Finloop, Stable, Billions, OpenAI, Subzero Labs

On July 28, it was reported that New York startup Courtyard completed a $30 million Series A financing round, led by Forerunner Ventures and followed by existing investors such as NEA and Y Combinator.

On the 28th, according to official news, Zodia Markets, a cryptocurrency trading company controlled by Standard Chartered Bank (STAN), announced the completion of US$18.25 million in Series A financing. This round of financing was led by Pharsalus Capital, with participation from other strategic investors such as Circle Ventures, The Operating Group, and XVC Tech.

On the 30th, Delve, an AI-powered security and compliance platform founded by two 21-year-old MIT dropouts, Karun Kaushik and Selin Kocalar, announced that it had secured $32 million in funding at a valuation of $300 million. This round of financing was led by Insight Partners.

On the 30th, Manifold, a decentralized AI infrastructure company, announced the completion of a $10.5 million Series A funding round to accelerate the development of its decentralized AI cloud platform, Targon. This round was led by OSS Capital, with participation from prominent investors such as Digital Currency Group and Tobias Lütke.

On the 30th, RD Technologies announced the completion of a nearly US$40 million Series A2 financing round, led by ZhongAn International, Zhongwan International, Cuican Investment and Hivemind Capital, with participation from Sequoia China, Hengjiu Digital Capital, Junshi Investment and Guotai Junan International Private Equity Fund.

On the 31st, according to the official account of Finloop, a subsidiary of Fosun, the company recently completed a nearly 10 million US dollar Series A financing round, with investors including Web3 industry institutions such as the Solana Foundation.

On the 31st, it was reported that Stable, a new blockchain project built around Tether's USDT, announced the completion of a $28 million seed round of financing, led by Bitfinex and Hack VC.

On August 1st, digital identity verification platform Billions announced the completion of a $30 million funding round, with participation from Polychain, Coinbase Ventures, and Polygon. The funds will be used to build the first universal human-machine and artificial intelligence network.

On the 1st, according to the New York Times, OpenAI completed $8.3 billion in financing, with a valuation of $300 billion, as part of its plan to raise $40 billion this year.

On the 2nd, it was reported that the encryption startup Subzero Labs completed a $20 million seed round of financing, led by the encryption investment institution Pantera Capital, and participated by the encryption venture capital Variant, Coinbase Ventures, and the encryption department of high-frequency trading company Susquehanna.

This week's hot articles

VC in the crypto tells the $2 trillion story to Wall Street

A new financial trend centered around crypto assets is rapidly spreading across the US stock market. Numerous shell companies have been transformed into "cryptocurrency reserve companies," triggering skyrocketing stock prices and attracting top VCs and institutional investors such as Pantera and Primitive. This model, known as DAT (Digital Asset Treasury), essentially uses financial engineering and storytelling to inject crypto assets into listed companies, achieving premium arbitrage in the capital market. As market sentiment heats up and the number of projects surges, global capital is rushing to inject digital assets like Bitcoin into US stocks and regional markets. However, this has also triggered warnings of risks such as bubbles, regulatory arbitrage, and insider trading, creating a new escape route for crypto investors.

Figma, the first unicorn to open an on-chain IPO channel, has a unique aesthetic in Silicon Valley.

Figma has not only gained market recognition for its robust revenue growth and robust collaborative products, but also became the world's first tech company approved to issue blockchain common stock. Founder Dylan Field, known for his low-key and pragmatic approach, has long focused on crypto technology and developed an on-chain capital structure. Figma's decentralized approach contrasts with Robinhood's platform tokenization approach, representing two paradigms for on-chain IPOs: embedded governance and asset packaging. In its collaborative systems, governance framework, and financial structure, Figma is pioneering the future of the "on-chain company" model, demonstrating the power of infrastructure reshaping in the transition from Web2 to Web3.

Can the BNB treasury managed by the richest Chinese person continue to rise after a 600% surge?

The BNB treasury narrative has officially taken shape. A small US-listed shell company called VAPE, led by Binance-backed capital, secured $1.25 billion in a PIPE financing round, transforming itself into the world's first publicly listed company with a BNB reserve, emulating the MicroStrategy model. Control of VAPE has been transferred to 10X Capital and YZi Labs, with the narrative, structure, and capital synergizing to create a precise valuation loop. While the project has garnered significant institutional support and driven its stock price, the underlying risks of warrant dilution, liquidity pressure, and industry resource concentration have also sparked controversy. This case exemplifies the wave of structural arbitrage in the crypto capital market, highlighting the entry of the crypto into an era of financial engineering focused on "telling a good story and grabbing liquidity."

Hong Kong's stable currency policy is implemented, and this is enough for you to know

Starting August 1, 2025, Hong Kong officially launched the application process for stablecoin issuance licenses, marking a new phase in regulatory implementation. The first batch of licenses will have high entry requirements, emphasizing compliance requirements such as real-name know-your-customer (KYC), full reserves, and redemption mechanisms. Only a handful of licenses are expected to be issued by the end of the year. The policy clarifies that stablecoins should serve financial efficiency, cross-border settlement, and Web3 applications, and must not be used as speculative tools. With the opening of pegged currencies, RMB stablecoins are legally feasible, but require careful consideration. Market enthusiasm is high, with dozens of Chinese-backed institutions preparing applications. JD.com, Standard Chartered, and Ant Group are already in the sandbox or have confirmed plans to issue their own tokens. Hong Kong is becoming a key testing ground for global stablecoin regulation and application.

Kraken is about to IPO. What targets can be hyped?

Kraken is raising $500 million at a $15 billion valuation and has frequently hinted at IPO plans. This, coupled with the lifting of SEC and FBI oversight, has garnered significant market attention. Kraken's share price on the private placement platform Forge has tripled in a year, allowing retail investors to preemptively enter the market through methods such as special purpose vehicles (SPVs). Its Layer 2 network, Ink, has also launched, spearheaded by Kraken. Its native token, $INK, will be used for ecosystem incentives, deeply integrated with CeFi, and become a potential new Layer 2 hotspot. Kraken is also actively expanding its payment, derivatives, and global clearing services to build a comprehensive financial ecosystem, preparatory to its IPO. If the IPO goes through, it could trigger another surge in crypto market sentiment.

Why did Solana react so strongly to Base's "content token fundamentals"?

The heated debate within the Base and Solana communities over "content coins" and meme coins reflects a fundamental disagreement within the crypto world regarding "fundamental value." Platforms like Zora have attempted to tokenize content, incorporating concepts like the creator economy and attention marketplace. However, most content coins currently lack sustainable revenue, a user base, and clear governance. Their value is highly dependent on buzz and sentiment, making it difficult to build a stable ecosystem. While on-chain ledger mechanisms and decentralized narratives hold potential, content coins are currently mostly speculative and have yet to escape the fate of "hype is everything." The industry remains in a phase of trial and error.

The 70x God Plate Collapsed, Can the Meme DeFi IMF Come Back?

After experiencing a nearly 70-fold surge, the Ethereum mainnet MemeFi project recently experienced a plunge of up to 85%, causing market turmoil. The decline stemmed from a series of liquidations triggered by whale-level selling, exposing flaws in the platform's collateralized lending design, particularly its ability to collateralize its own token, MemeFi, which amplified risks. On-chain data suggests the IMF team may have been involved in cashing out, sparking concerns among influencers and the community. Despite official statements that the platform has not suffered systemic losses and the token has rebounded strongly, controversy surrounding the security of funds and the motivations behind the manipulation continues to simmer, highlighting the fragility and governance risks of the MemeFi model.

When Christie's can buy houses with cryptocurrency, a new milestone in the RWA track

With the improving regulatory environment in the United States and the structural bottleneck of high prices and low liquidity in the real estate market, crypto technology is becoming deeply embedded in the real estate industry, giving rise to a new sector called "Crypto Real Estate." With the establishment of a crypto real estate division at Christie's International Real Estate, high-net-worth buyers have begun purchasing luxury homes with pure cryptocurrencies like Bitcoin and Ethereum, ushering in a new paradigm in real estate transactions. Simultaneously, platforms like RealT are leveraging blockchain to enable real estate tokenization, rental dividends, and on-chain lending, allowing users to access real estate assets much like DeFi. Policy coordination is also accelerating. The United States has already allowed compliant crypto assets to be included in mortgage assessments and is exploring crypto mortgages. Despite the maturing infrastructure, on-chain real estate still faces challenges such as high educational barriers, high volatility, and complex governance. It requires continued evolution in terms of compliance and user awareness before it can enter the mainstream.

Besides BNKR, what other potential projects does Clanker have?

Since 2025, Clanker has become the most innovative launch platform on the Base chain. From AI and social networking to the on-chain economy, it has incubated a series of projects that integrate finance and social networking, building a highly narrative ecosystem. Representative projects include $DRB, inspired by AI and peaking at over $38 million in market capitalization; $BRACKY, which uses AI agents for sports prediction; $A0X, a Jesse Pollak-like avatar; Noice, a social tool that allows tipping as payment; $QR, which uses an auction mechanism to reshape attention; and Native, which is building an on-chain AI city. Clanker not only facilitated the integration of MemeFi and Mini Apps, but also established Base as an on-chain content economy that allows for experimentation, financialization, and sustainable storytelling.

After ZORA, what other related targets are worth paying attention to?

ZORA's price surged tenfold after its coin launch, surging from $30 million to $300 million. This surge has become the centerpiece of a new wave of sentiment on Base, sparking heated debate over the legitimacy of "content tokens." Content token dashboards like ZORA, TBA, and ART are also gaining traction. Noice, a reward-based social mini-app, has been invited to participate in official conferences, steadily gaining prominence. Bankr, backed by Coinbase Ventures, is also seeing a resurgence in AI-powered content storytelling. Meanwhile, new content economy initiatives centered around posting and post manipulation are emerging on Base, signaling a growing wave of on-chain experiments focused on content, social networking, and platform-run ecosystems.

The Bitcoin ecosystem is hot again. Which four fronts need attention?

The Bitcoin ecosystem has recently seen a resurgence, with BRC 2.0 taking center stage. Leveraging off-chain executors, BRC20 introduces smart contract functionality and will officially activate on August 14th, triggering a strong rally in projects like Adderrels. Established Bitcoin NFT projects like NodeMonkes and Bitcoin Puppets have also benefited, with gains. Despite a pullback, the rune sector has shown promising 30-day performance, with Kraken listings and increased institutional investment boosting its interest. Furthermore, CENTS, a leading art asset, also saw strong performance. Overall, while the Bitcoin ecosystem remains sluggish, BRC 2.0 and content innovation, driven by the Chinese-speaking community, are generating new momentum.

Sui Finance launches $450 million in financing. What is the background of this company?

Mill City Ventures, a US-listed company, announced it will invest 98% of its $450 million in private equity funding into the SUI token, marking its official transformation into a crypto-focused financial institution and the launch of its SUI Treasury strategy. The funding round was led by hedge fund Karatage, with participation from the Sui Foundation and support from institutions such as Galaxy, highlighting the strong consensus and confidence in Sui. Karatage was deeply involved in the early development of the Sui ecosystem, while the Sui Foundation continues to drive network prosperity through capital repatriation and ecosystem incentives. With record-breaking TVL and rising price, Sui is becoming a new Layer 1 hotspot, joining ETH, SOL, and BNB, to attract mainstream investment.

Gold, Bitcoin, and Pokémon Cards: Which is the "Perfect Collateral" of this Era?

The traditional 60/40 portfolio is outdated, the stock market is becoming casino-like, bonds are no longer an effective hedge, and young investors are increasingly disillusioned with the old financial system. Jeff Park advocates investing in "resistance assets" that are scarce, non-fungible, and independent of traditional systems, such as Bitcoin and physical gold. These assets can truly diversify risk and protect against the erosion of asset values during financial repression. He believes that investing in Bitcoin is not simply about chasing price increases, but more about hedging against the decline in the value of fiat currencies. He also believes that options trading can provide investors with more efficient risk management tools, helping them profit in an uncertain environment.

Uncovering Tom Lee: From Wall Street Influencer to Founder of Ethereum Microstrategy

Tom Lee is a veteran Wall Street strategist known for his data-driven and contrarian views. He served as Chief Equity Strategist at JPMorgan Chase before founding Fundstrat and pioneering a Bitcoin valuation framework. He maintains a commitment to viewing crypto assets as part of mainstream investment portfolios, believing the rise of stablecoins signals that Ethereum will become the core infrastructure connecting traditional finance and the crypto world. In 2025, he assumed the role of Chairman of BitMine, promoting an enterprise Ethereum treasury model with the goal of acquiring and staking 5% of the total ETH supply. This initiative attracted large institutions such as ARK and Founders Fund, making BitMine the world's largest publicly traded company in terms of ETH holdings. Lee emphasized that compared to ETFs, on-chain treasury companies offer greater structural leverage and strategic leadership, making them the preferred path for institutional investors to invest in crypto assets in the next phase.

Forbes: Robinhood hopes to become the "only financial portal" for the younger generation

At a legendary estate in Cannes, France, Robinhood hosted a dramatic crypto-themed event, marking the full launch of its globalization and blockchain strategy. CEO Vlad Tenev made a star-studded appearance, announcing support for stock token trading for European users, the launch of crypto staking, the acquisition of Bitstamp, and the development of its own blockchain. With tokenization at its core, Robinhood is attempting to reshape the global financial system and enable 24/7 on-chain asset circulation. Its crypto revenue surged to $626 million in 2024. Tenev is also targeting traditional financial services such as IRAs, mortgages, and robo-advisory, striving to create the "only financial tool" for the younger generation. He is also leveraging his AI startup, Harmonic, to combine AI and crypto to create a future where people can manage their own wealth.

The Winklevoss Twins' Two Bets: Facebook and Bitcoin

The Winklevoss twins have risen from Harvard elites and Olympic rowers to protagonists in Facebook's creative disputes and early evangelists in the crypto space, enduring betrayal, lawsuits, gambles, and vision. They forgo cash in their settlement with Facebook in favor of stocks, ultimately reaping hundreds of millions of dollars in returns. They also bet big on Bitcoin at a time when it was considered a cult, becoming the first Bitcoin billionaires. They not only invested but also built infrastructure, founded the regulated exchange Gemini, promoted the Bitcoin ETF, and, through unwavering conviction and political engagement, continued to push crypto mainstream. Though often seen as "missing the boat," they were actually ahead of their time.

The latest dispute between Gemini and JPMorgan Chase reveals the hardline stance of traditional financial institutions toward crypto platforms. Tyler Winklevoss has accused JPMorgan of engaging in "financial persecution" by denying data access and suspending cooperation, sparking industry recollections of "Operation ChokePoint 2.0." The core dispute revolves around bank control of data and the safeguards for data sharing required by the US Consumer Financial Protection Act. Banks are now circumventing regulations through fee collection and colluding to pressure regulators to restrict crypto companies from obtaining licenses, exacerbating the direct conflict between the banking industry and crypto platforms. With shifting regulatory landscapes and reshuffling political power, the "financial cold war" is heating up.

A 30-year review of technology stocks' returns: Where will the next $100 billion company be?

Over the past 30 years, value growth in the technology industry has been concentrated in a very small number of unique companies, often born from new technological waves, disrupting old paradigms and creating new markets. Investors who blindly apply old logic or market size assessments often miss out on truly promising stocks. Consumer products, hard technology, and enterprise software each have their own characteristics, but power laws dominate the long-term return landscape. The trillion-dollar companies of the future will be even more unpredictable and less conforming to past models, and artificial intelligence is opening the window for this new generation of giants. Understanding uncertainty, benchmark interest rates, and differentiation is key to seizing the next wave.

Wired In-Depth: The Trump Factor Behind American Bitcoin

Trump's second son, Eric, co-founded American Bitcoin, a Bitcoin mining company. In partnership with Hut 8, he built the largest mining platform in the United States, leveraging the family's influence to expand capital and partnerships. Within three months of its founding, the company raised $220 million and mined 215 Bitcoins. Its goal is to accumulate Bitcoin reserves through low-cost mining and strategic acquisitions. With the Trump administration promoting crypto-friendly policies, the project is seen as a key step in the family's efforts to deepen its crypto presence and leverage political capital and energy policy to expand its influence in the industry.

Click here to learn about BlockBeats' BlockBeats job openings

Welcome to join the BlockBeats official community:

Telegram group: https://t.me/theblockbeats

Telegram group: https://t.me/BlockBeats_App

Official Twitter account: https://twitter.com/BlockBeatsAsia