Popular altcoin Solana has struggled to maintain upward momentum since rallying to a cycle high of $206 on July 22. Over the past week alone, the asset has declined by 14%, reflecting the dip in short-term investor confidence.

However, on-chain data suggests that the coin might witness a near-term recovery, with early signs pointing to a shift in sentiment that could fuel a rebound in the sessions ahead.

Long-Term Holders Are Doubling Down on Solana

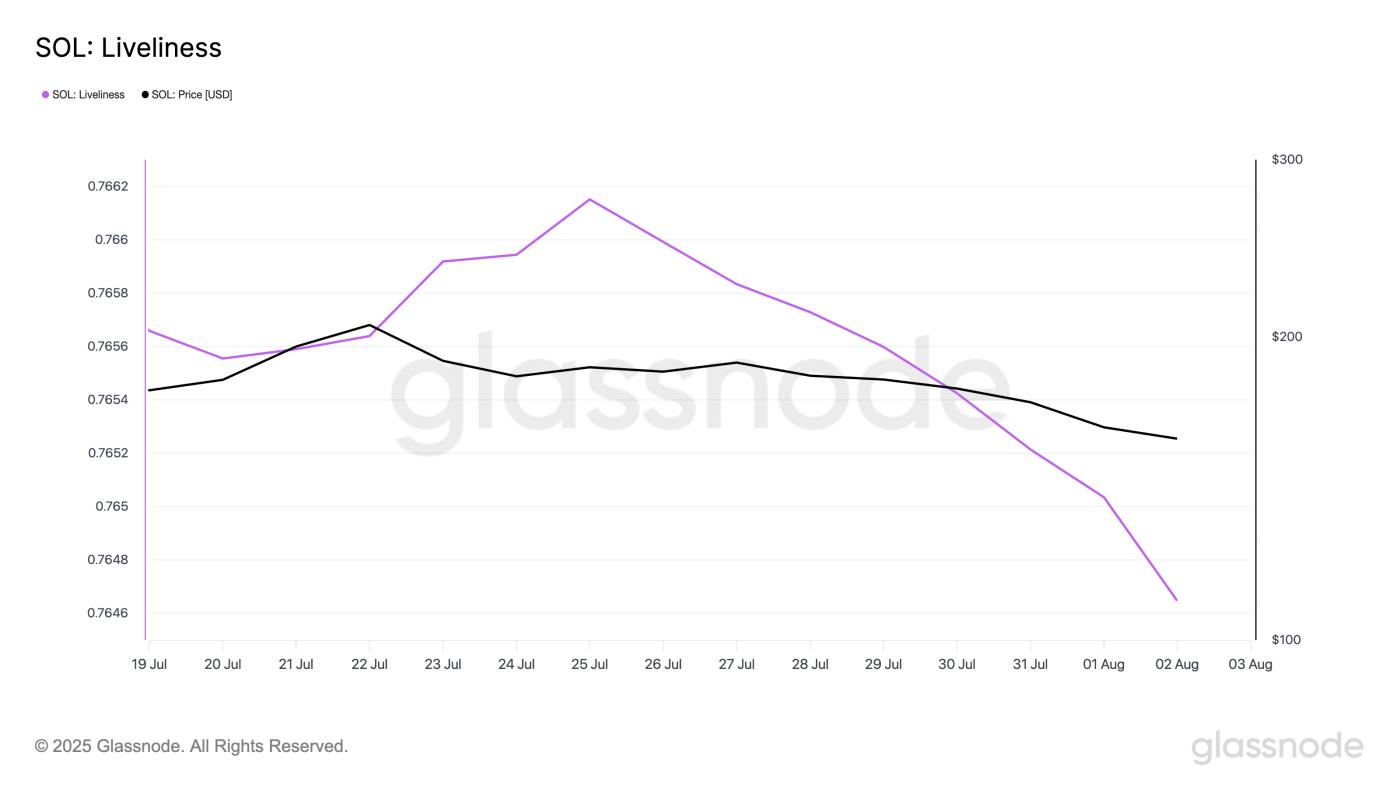

While short-term traders have been offloading their holdings, long-term holders (LTHs) are re-entering accumulation mode. This behavioral change is evident in Solana’s Liveliness, which has steadily declined since July 25.

Per Glassnode, this metric, which tracks the movement of previously dormant tokens, plunged to a weekly low of 0.76 yesterday, confirming the decline in sell-offs among SOL’s LTHs.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

SOL Liveliness. Source: Glassnode

SOL Liveliness. Source: GlassnodeLiveliness tracks the movement of long-held tokens by calculating the ratio of coin days destroyed to the total coin days accumulated. When it rises, it suggests that more dormant tokens are being moved or sold, often signaling profit-taking by LTHs.

Converesly, as with SOL, when this metric falls, it indicates that these investors are moving their assets off exchanges and opting to hold.

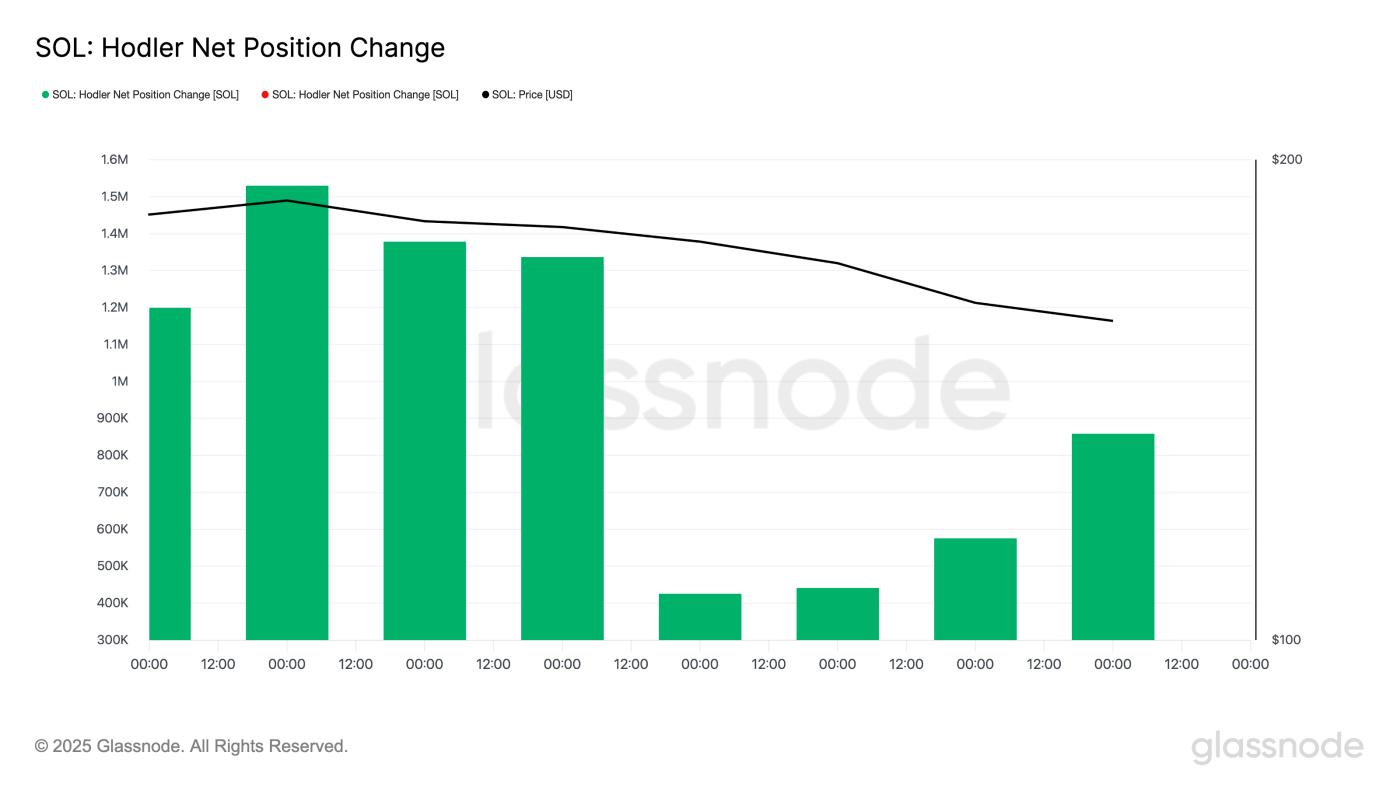

Moreover, since July 30, SOL’s Hodler Net Position Change has recorded a steady uptick. This confirms that more coins are being moved into long-term storage, despite the asset’s lackluster price action.

SOL Holder Net Position Change. Source: Glassnode

SOL Holder Net Position Change. Source: GlassnodeGlassnode data shows that this metric, which measures the 30-day change in the supply held by LTHs, has climbed by 102% over the past four days. When this metric rises like this, it indicates that LTHs are accumulating more coins rather than selling them.

Solana Traders Are Selling at a Loss — Is a Bottom Finally Forming?

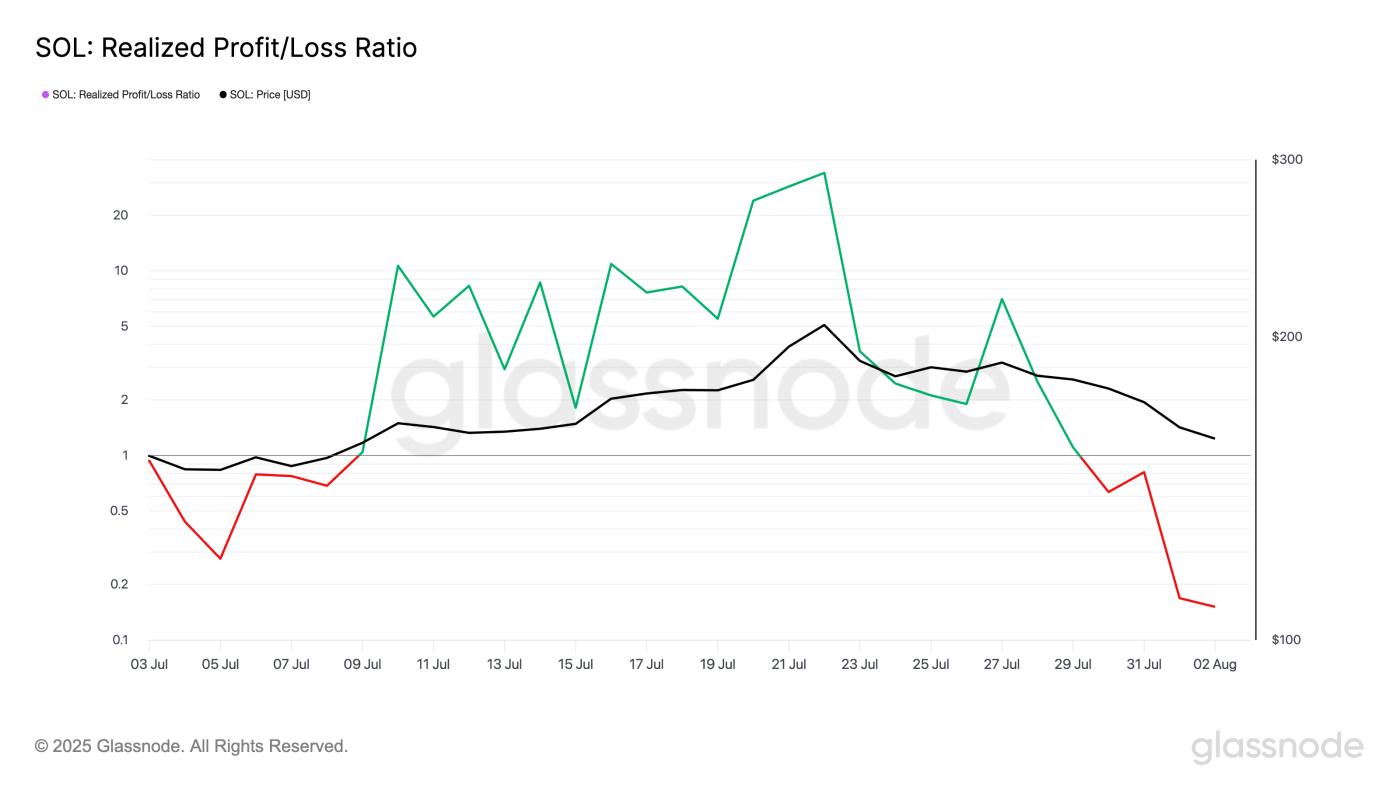

The sustained decline in SOL’s Realized Profit/Loss Ratio supports the bullish outlook above. On-chain data shows that this metric closed at a 30-day low of 0.15 on August 2, indicating that many traders exiting positions continue to do so at a loss.

SOL Realized Profit/Loss Ratio. Source: Glassnode

SOL Realized Profit/Loss Ratio. Source: GlassnodeHistorically, the market tends to stabilize when most participants sell below their cost basis.

With fewer holders willing to offload their tokens at a loss, selling pressure could reduce, paving the way for SOL to find a local bottom ahead of any bullish catalyst that could trigger a rebound.

Solana Hangs in the Balance—Support at $158 Faces Serious Test

SOL trades at $160.55 at press time, holding above a key support floor at $158.80. If buy-side pressure grows, SOL could initiate a bullish reversal and trend toward $176.33.

SOL Price Analysis. Source: TradingView

SOL Price Analysis. Source: TradingViewHowever, if selloffs persist and the support floor weakens, SOL’s price could fall to $145.90.