Author: Jeff Dorman, Chief Investment Officer of Arca; Translation: Jinse Finance xiaozou

The Growth of Cryptocurrency Remains Misunderstood by Most

Last week, digital assets generally declined without a compelling reason. On the positive side, the White House released a report from the Presidential Working Group on Digital Assets, and SEC Chairman Atkins announced the launch of the Project Crypto initiative, which will facilitate on-chain liquidity for all assets and ultimately allow brokers to trade all assets on a single platform. On the negative side, the Federal Reserve maintained interest rates the day before an extremely weak employment report, causing market expectations of a September rate cut to rise to 80%, copper prices plummeted due to a reversal in tariff policies, and mixed tech company earnings triggered a downturn in US stocks.

The price trend of cryptocurrencies over the past 9 months has indeed attracted attention, but is this attention warranted? I frequently receive calls from financial journalists requesting comments on certain topics. Although this year can be considered the most breakthrough year in digital asset history, with Wall Street and ordinary investors' interest in blockchain and cryptocurrencies reaching unprecedented heights, the topics media ask me to comment on have barely changed in the past 7 years. They typically focus on the following basic themes:

"Why is Bitcoin rising (or falling)?" and "What is your target price?"

"Is this an Altcoin rebound?"

"Which L1 protocol (ETH, SOL, or other new darling) will win?"

"Meme coins..." (I'm even too lazy to hear the question because I've heard it too many times)

And the newly added questions like "What do Trump's policies mean? What impact does this have on TRUMP coin?"

I have never received a question about BNB—despite being arguably the best token in history from a token economics and investment return perspective, and Binance being one of the most profitable and innovative companies ever. However, I have been asked multiple questions about CZ (Binance CEO and founder).

I have never received a question about Hyperliquid (HYPE)—despite potentially being one of the most per-capita profitable companies in history and one of the fastest-growing enterprises, with a unique token issuance method (airdropped to users, without accepting any VC investment).

I have also never been asked about Pump.fun (PUMP)—another rapidly growing company that recently completed one of the largest and highest-valued ICOs in history.

I have never been asked about Aave (AAVE)—a lending protocol with over $50 billion in net deposits, ranking among the top 50 US banks by deposit volume. Aave occupies nearly 18% of total DeFi locked value (TVL), holds nearly 80% market share in on-chain lending, and possesses over half of DeFi's net deposits.

Imagine if financial journalists only reported on gold, meme stocks, and S&P 500 without covering Amazon, Google, recent IPOs, or JPMorgan—such reporting would clearly fail to attract most people's interest. Unfortunately, this is the current state of digital asset reporting. It's difficult to determine whether this stems from journalists' lack of professional skills in reporting more interesting crypto topics or from financial audiences' lack of interest in such content.

Why Do L1 Protocols Have Value?

Regular readers of my articles know I despise the term "Altcoin"—which simplifies all crypto tokens beyond Bitcoin into a single category. Although this term is completely outdated, it has etymological origins: "Altcoin" emerged in crypto's early development when only two token types existed besides Bitcoin: Bitcoin clones (XRP, BCH, LTC, etc.) and L1 smart contract protocols (like ETH, ADA, EOS, XLM, etc.). These tokens were indeed Bitcoin alternatives at the time. Almost all problems in current crypto industry terminology and reporting stem from: the industry's early existence of only these two token types (Bitcoin and L1 protocols), while industry terms failed to progressively cover today's increasingly diverse sub-sectors, token types, and issuer types. Digital assets' scope is now far broader and mostly unrelated to Bitcoin, so categorically labeling all tokens as "Altcoins" is ignorant.

[The translation continues in the same professional manner for the rest of the text, maintaining the specified translations for specific terms.]Social Value

Finally, let's look at social value. Was being part of these networks cool? Perhaps it was 5 years ago, but now that every crypto project has its own L1 protocol or is building one, this halo effect has basically disappeared. Social value still exists, but it is gradually weakening. However, most of the value of L1 smart contract protocols comes precisely from social value, as financial value and utility value are relatively low compared to their market capitalization.

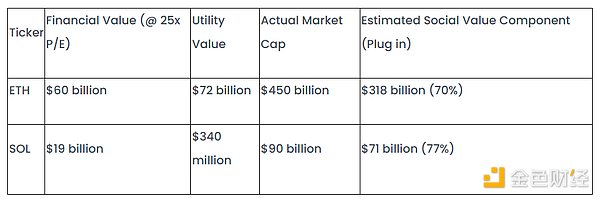

Let's analyze the two largest smart contract protocols using the above sum-of-the-parts valuation method:

If a similar analysis is performed on all L1 protocols, the results would be similar. Financial value + utility value is far lower than market value, which means that most of the value comes from social value (70-80% of the token's value).

Perhaps the above sum-of-the-parts valuation method is too rough, and there are other sources of value for protocol native tokens. After all, native tokens become reserve currencies on the chain. For example, meme coin traders on SOL use SOL to buy and sell tokens, not USDC or other stablecoins; NFT traders use ETH. But do these blockchains really deserve values of $9 billion and $45 billion? Just because they support trendy trades that almost no one thinks are the future of blockchain? Perhaps the focus is not on current trends, but on potential future trends and use cases—no one could have predicted the emergence of DeFi summer, ICOs, NFTs, meme coins, or other blockchain growth engines. However, those holding L1 protocol tokens as reserve currencies did benefit from the rapid rise of these trends.

Nevertheless, the core goal of blockchain is asset transfer, and 99% of global assets are stocks, bonds, and real estate. Crypto assets like NFTs, meme coins, and even equity-like tokens of real crypto businesses (such as DePin and DeFi) are almost meaningless in the grand scheme of driving real assets on-chain.

So the question is: which blockchains will carry the most real assets in the future? Even if the sum-of-the-parts analysis shows their valuation is too high, this chain might still be undervalued because it will achieve the fastest growth. But the trading pairs on this chain will be stablecoins, not native tokens.

Blockchain obviously has value, but any objective value analysis might conclude that token prices are currently overvalued by 50-80%. Perhaps the fundamental reason these L1 protocols can trade at 100-1000x fee multiples is that the market only compares them to BTC, not based on fundamental analysis. When you use an asset without a valuation model (BTC) as a reference, the comparative conclusions are inevitably absurd.

I have been working on a crypto token fundamental valuation model for nearly a decade, and no one has ever logically explained why L1 protocols are worth their current valuation. My former colleague Nick Hotz's attempt came closest—he viewed L1 blockchains as nations, thus equating native tokens to fiat currencies. But this method is still not a true valuation analysis, as it falls into circular reasoning (valuing ETH in terms of ETH).

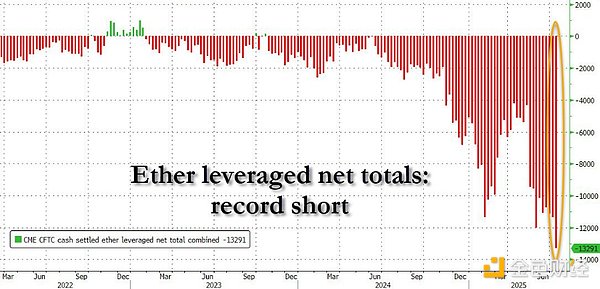

Although there are slight differences in data about ETH short positions reaching historical highs (mainly from basis trading), this phenomenon may have its deep rational basis. If market participants start to agree with my view, L1 protocols will eventually evolve into infrastructure-like commodities similar to telecom operators.

In my personal opinion, if blockchain truly becomes the final trading technology for all assets, the total value of all L1 protocols is likely higher than the current market total valuation. How valuable is the internet? If this analogy holds, then the sum of all blockchains indeed has enormous value—but most individual protocols probably do not. In the end, only 1-2 winners may remain, so I would prefer protocols valued at $1-2 billion rather than those over $50 billion, as they are essentially high-risk bets, and I prefer lower-priced chips.

But this judgment is based on my core view: 99% of global assets are not yet on-chain, which means ETH or SOL's current advantages are insignificant in the long term—because these chain assets are only in the testing phase using valueless assets.

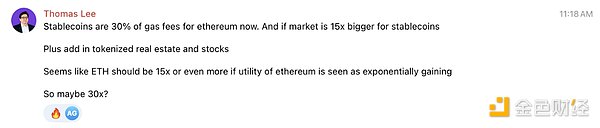

A more optimistic answer is closely related to security. For example, Treasury Secretary Scott Bessent predicts stablecoin scale will reach $3.7 trillion. How much market value would ETH need to support a $4 trillion stablecoin market? Permanent ETH bull Tom Lee (through private communication) says: "That's why I think Goldman Sachs and JPMorgan will eventually stake ETH—to ensure network security." Given his prediction of 15x stablecoin growth, he believes ETH will grow 30x.

I very much agree with this analytical framework. This logic does hold—if you are a traditional financial institution trying to dominate the stablecoin space, you would naturally invest in the L1 protocol tokens that provide underlying security for this business.

Ironically, this is completely contrary to the "fat protocol theory". The real value actually exists in the applications built on the chain, not in the underlying protocols themselves. But to support the development of these applications, the value of the underlying protocols will also grow.