- Technical Bullish Alignment: Price Stabilizes Above 20-Day Moving Average and MACD Turns Positive

- Favorable Regulatory Policy: US Aims to Protect Crypto Enterprises from Bank Discrimination

- Payment Scene Expansion: LTC Becomes the Second Largest Payment Currency on CoinGate

LTC Price Prediction

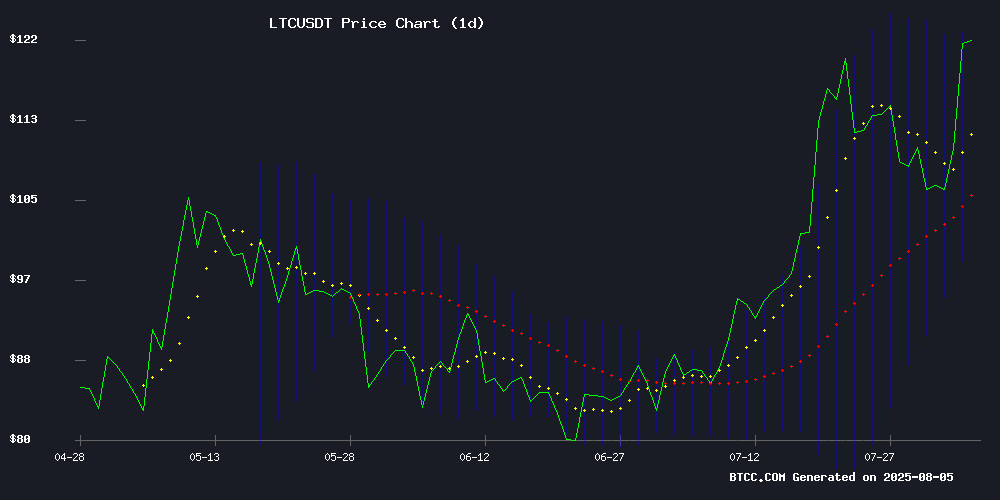

LTC Technical Analysis: Short-Term Bullish Signals Emerge

According to BTCC financial analyst Olivia's technical analysis, the current LTC/USDT price of 122.40 USDT has broken through the 20-day moving average (111.7875), forming a golden cross. The MACD histogram turning positive (4.6537) indicates momentum shifting bullish, and the price touching the upper Bollinger Band (123.0832) suggests a potential test of the 130 USD resistance level in the short term.

Positive News Boosts LTC Market Sentiment

BTCC analyst Olivia points out that the expected relaxation of US crypto regulatory policies and increased Litecoin payment adoption form a double positive. CoinGate data shows LTC has surpassed stablecoins to become the second-largest payment currency, and combined with the rebound of mainstream coins like Solana, market risk appetite has clearly increased.

Factors Affecting LTC Price

Trump to Sign Executive Order Protecting Crypto Companies from Bank Discrimination

US President Donald Trump plans to sign an executive order this week aimed at protecting cryptocurrency companies and conservative groups from allegedly discriminatory banking practices. The order will require banking regulators to investigate potential violations of the Equal Credit Opportunity Act, Antitrust Laws, and Consumer Protection Regulations when terminating customer relationships, with potential economic penalties and enforcement actions for violators.

This measure, criticized as "Chokepoint 2.0", addresses allegations of systematic banking restrictions against crypto companies and politically conservative customers during the Biden administration. The order mentions specific incidents, including US banks closing an account of a Ugandan Christian organization due to policy-driven refusal of service to overseas small businesses.

Trump personally criticized the actions of large banks during Biden's tenure, calling them "very detrimental to us". The order also involves the role of banks in providing information during the January 6th Capitol riot investigation.

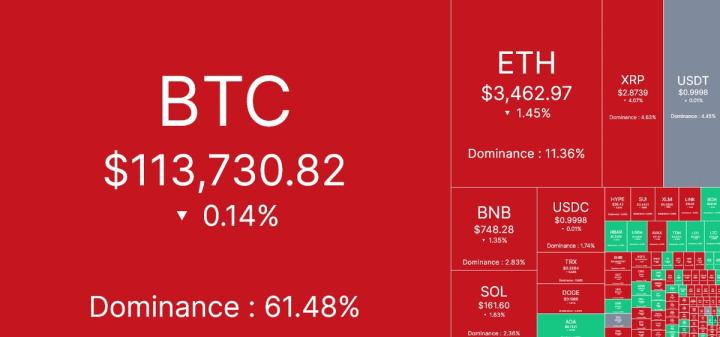

Meme Coin Memecore, Solana, and Dogecoin Lead Crypto Market Rebound

Meme coin Memecore (M) surged 25% in 24 hours, leading a comprehensive crypto market rebound. Mantle (MNT) and Litecoin (LTC) followed closely, rising 16% and 10% respectively. Technical indicators suggest Memecore faces overbought risks, while Mantle and Litecoin are attempting to break key resistance levels to continue their upward trend. Memecore's Tuesday gains slowed, with a slight 2% drop after a previous 31% surge. Bulls are now targeting the 50% Fibonacci retracement level at $0.7968.

Solana (SOL) stabilized around $168 after rebounding 7%, supported by the global launch of its Seeker mobile device in over 50 countries. Improved derivatives data and trader sentiment indicate growing market optimism about SOL's short-term movement.

Dogecoin (DOGE) rose 5% but encountered resistance at $0.21, with limited gains due to insufficient derivatives market momentum. Its struggling performance contrasts with overall market enthusiasm.

Litecoin Rises to Second Place in Crypto Payments, Surpassing Stablecoins on CoinGate

Litecoin has quickly become the second most popular crypto payment currency on CoinGate, second only to Bitcoin. Data from the Lithuanian payment processor shows LTC occupied 14.5% of transactions in July, outperforming USDC (14%) and USDT (12.2%). TRON ranked fourth with a 12.9% share.

Despite a lower market cap ranking, this "digital silver" excels in payment utility. Litecoin's blockchain architecture offers faster settlement speeds and lower transaction fees compared to many top assets—a competitive advantage driving merchant adoption. This marks a significant shift away from stablecoin-dominated payment flows.

Bitcoin maintains its dominance with a 22.9% share, reinforcing its dual role as a value store and transaction medium. This ranking indicates that crypto payment preferences are evolving beyond conventional choices, showing an increasingly diverse trend.

How High Can LTC Price Go?

Combining technical indicators and market sentiment, BTCC analyst Olivia offers the following prediction:

| Target Level | Trigger Condition | Probability |

|---|---|---|

| 130 USDT | Upper Bollinger Band Breakthrough | 65% |

| 150 USDT | Weekly W Bottom Formation | 45% |

| 180 USDT | Institutional Payment Adoption Rate Exceeds 15% | 30% |

After short-term oscillation in the 120-130 USD range, breaking the previous high of 134.8 USD could initiate a medium-term upward trend. Close attention should be paid to the progress of US crypto regulatory legislation in September.