Binance announces a two-stage adjustment of margin collateral ratios for over 70 cryptocurrencies in August 2025, covering a wide range of assets from Bitcoin to meme coins. This risk management measure follows similar adjustments by competing exchanges, indicating the industry is reassessing collateral requirements amid derivatives trading growth. Meanwhile, a BNB whale profited $591,000 after a nine-month position but missed out on higher returns by exiting too early.

Binance Will Adjust Portfolio Margin Collateral Ratios for Multiple Cryptocurrencies

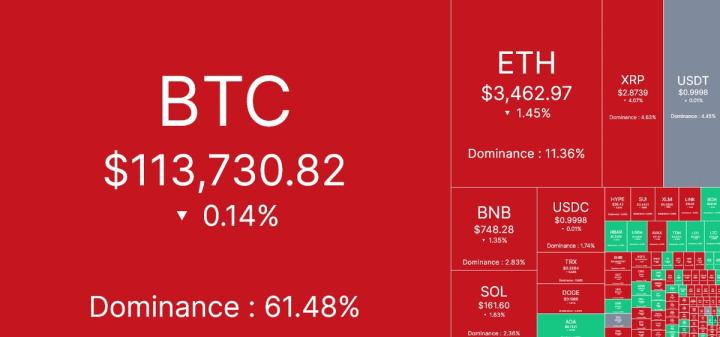

Binance announces an update to the collateral ratios of over 70 digital assets under its portfolio margin function, with changes to take effect in two stages on August 5 and August 8, 2025. This adjustment will impact major cryptocurrencies including Bitcoin (BTC), Ethereum (ETH), and Solana (SOL), as well as emerging tokens like PEPE and BONK.

The exchange's risk management reform comes at a time of increased institutional participation in the cryptocurrency market. A market analyst familiar with Binance's operations stated: "The portfolio margin adjustment reflects the evolution of liquidity conditions and volatility patterns." The 30-minute implementation window indicates a precise recalibration rather than a broad policy shift.

This update covers a significant range from blue-chip assets to meme coins, demonstrating Binance's comprehensive approach to risk assessment. The move follows similar adjustments by competitors including Bybit and Coinbase this quarter, indicating the industry is reevaluating collateral requirements amid growing derivatives trading volume.

BNB Whale Profits $591,000 in Nine Months, Misses Higher Returns

An investor holding a large amount of BNB deposited 4,759 BNB (worth $3.59 million) into Binance, realizing a $591,000 profit after a nine-month position. The whale's average entry price was $630 per BNB, achieving a 20% profit, but this occurred before BNB recently rose to a high of $861, meaning they missed out on an additional $508,000.

Market observers noted that this trade reflects disciplined profit-taking, despite BNB's strong performance in the overall altcoin market. This deposit aligns with Binance's ongoing liquidity dynamics, with large fund movements often signaling increased volatility.

Binance Alpha to Launch Fireverse (FIR) Token with Airdrop Opportunity

Binance Alpha, the innovation division of the cryptocurrency exchange giant Binance, will launch the Fireverse (FIR) token on August 6. This news, initially reported by PANews on August 4, marks another strategic expansion into emerging digital asset territories.

Eligible users can participate in the FIR token Airdrop through Binance Alpha's dedicated activity page. Participation requires accumulating Binance Alpha points, with token claiming available after the launch. This approach continues the exchange's consistent method of encouraging platform participation through token distribution.

Whale Transfers 21,102 ETH to Binance, Sparking Market Attention

A significant Ethereum transaction has caught market attention, with an unidentified whale transferring 21,102 ETH to Binance. According to Whale Alert monitoring data, this transfer occurred on August 4, valued at approximately $75.1 million.

Such a large-scale transfer typically signals potential market activity—whether accumulation, distribution, or portfolio rebalancing. As the preferred platform for institutional-level cryptocurrency liquidity, Binance remains the primary destination for such large transfers.