#SOL

- SOL trades above key MA with bullish MACD crossover

- Mixed news flow balances SPAC cancellation with ecosystem growth

- Upper Bollinger Band at $201.80 presents near-term target

SOL Price Prediction

SOL Technical Analysis: Bullish Signals Emerge

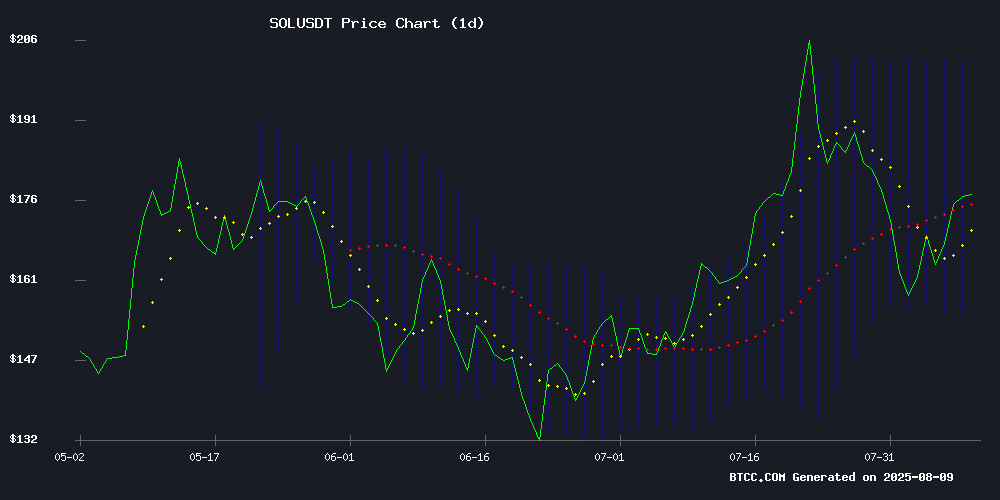

SOL is currently trading at $178.33, slightly above its 20-day moving average of $178.1960, indicating a neutral to bullish bias. The MACD shows a bullish crossover with the histogram at 6.1783, suggesting upward momentum. Bollinger Bands reveal price hovering NEAR the middle band, with potential to test the upper band at $201.8037 if buying pressure continues.

Mixed Sentiment as Solana Faces Headwinds and Opportunities

While solana has gained 15% in 3 months, recent news highlights both challenges and growth potential. The canceled $1.5B SPAC deal and competition from projects like Unilabs Finance create uncertainty. However, Coinbase's DEX expansion and CARV's Web3 innovations could drive adoption. 'The ecosystem developments offset some bearish news,' notes BTCC's John.

Factors Influencing SOL's Price

Solana Gains 15% in 3 Months: Is It a Buy Ahead of Next Rally?

Solana (SOL) has surged 15% since late April, climbing from $146 to $167 amid growing institutional interest. The blockchain's speed and low-cost transactions—averaging 2.2 million daily active addresses and 98 million daily transactions—are outpacing rivals like Ethereum. Transaction fees remain under a cent, with settlements under two seconds.

Traditional finance is taking notice. Solana's efficiency reduces collateral demands and accelerates settlements, making it a magnet for developers building consumer-scale dApps. The question isn't just about short-term gains but whether SOL can sustain this momentum for years.

Coinbase Expands DEX Trading to U.S. Users, Excluding New York

Coinbase is integrating decentralized exchange (DEX) trading into its app for U.S. users, with New York excluded due to regulatory constraints. The platform will support Base-native tokens from emerging projects like Virtuals AI Agents and Reserve Protocol DTFs, offering simplified on-chain access. "Every day, more tokens are launched on Base than anywhere else," the company stated, emphasizing its commitment to empowering builders and traders alike.

Retail users gain earlier access to new tokens, while developers benefit from seamless distribution through Coinbase's ecosystem. CEO Brian Armstrong confirmed solana token support is in development, aligning with the exchange's goal of making decentralized trading as accessible as centralized platforms. Base, Coinbase's Layer 2 chain, continues to drive innovation with scalable solutions for token issuance and trading.

$1.5B SPAC Deal for Solana DAT Reportedly Canceled Amid Fund Backlash

A $1.5 billion SPAC merger involving Joe McCann’s Solana Digital Asset Treasury (DAT) has been scrapped following scrutiny over the underperformance of his Asymmetric Financial hedge fund. Sources describe the situation as "fluid," with the firm exploring alternative paths to public markets.

The deal, which would have taken the entity—branded as Accelerate—public via Gores Holdings X, collapsed without disclosed reasons. McCann, poised to lead Accelerate as CEO, faces mounting criticism as his crypto fund hemorrhages liquidity, down 80% from its peak.

Investor materials reveal Accelerate aimed to pivot toward treasury management for digital assets, though some view the venture as a lifeline for McCann’s struggling hedge fund. Neither McCann nor CoinList board member Komal Sethi, slated to become Accelerate’s CSO, has publicly addressed the fallout.

Unilabs Finance Gains Traction as Solana Struggles to Maintain Momentum

Market uncertainty lingers following Trump's tariff decision, casting a shadow over crypto valuations. Solana's price rebound to $172 shows tentative strength, but the token remains 5% below recent highs after failing to sustain its $200 peak. Institutional interest persists, with BIT Mining acquiring 27,000 SOL tokens ahead of the Solana Seeker mobile launch.

Capital is rotating toward Unilabs Finance, a rising platform that has raised $12 million in presale funding. Analysts project the token could challenge Solana's dominance, with price targets reaching $2 before 2026—potentially outpacing SOL's annual gains. The mobile-optimized platform positions itself as a gateway for Web3 adoption, mirroring Solana's strategic focus.

Solana and Remittix: Divergent Paths in Crypto's Bull Market

Solana's SOL token shows resilience NEAR $170 despite a weekly dip, with technical patterns suggesting potential volatility. Three catalysts loom: spot ETF approvals (with August as a key window), Firedancer/Alpenglow upgrades targeting 600K TPS throughput, and an 83% surge in developer activity this year. Bulls project an $850 price target for 2025, though skeptics cite validator economics and Base chain competition as headwinds.

Meanwhile, Remittix emerges as a dark horse with $18.3M raised in its token sale at $0.0895 per token. Positioned as a cross-border payments solution, the project eyes a $5 valuation—a 5,500% potential upside that dwarfs Solana's projected returns. Early-stage investors appear to be hedging bets between Solana's institutional appeal and Remittix's microcap growth narrative.

CARV Concludes Tech Fairness Hackathon, Showcasing AI and Web3 Innovations

CARV, a pioneer in AI infrastructure for sovereign AI Beings, has successfully wrapped up its Tech Fairness Hackathon in collaboration with FAIR3 and HackQuest. The event attracted over 600 applicants and 200 projects, with 21 teams emerging as winners from 30 finalists.

The hackathon highlighted global interest in agent-based, privacy-first applications, aligning with CARV's vision to evolve from data infrastructure to a fully autonomous AI Being Stack. Participants tackled challenges across four Core layers: AI Agent Infrastructure on SVM, Decentralized Data Orchestration, Modular Identity & Reputation, and Open Innovation.

Notable projects demonstrated the potential of decentralized agents in real-world applications, from AI-powered health solutions to generative storytelling platforms. The event underscores the growing synergy between AI and Web3 technologies.

How High Will SOL Price Go?

Based on current technicals and market sentiment, SOL could test $201.80 (upper Bollinger Band) in the near term. Key levels to watch:

| Indicator | Value | Implication |

|---|---|---|

| 20-day MA | $178.19 | Support level |

| Upper Bollinger | $201.80 | Next resistance |

| MACD Histogram | +6.1783 | Bullish momentum |

BTCC's John suggests: 'A close above $180 could confirm the uptrend, with $200+ achievable if ecosystem growth continues.'