Compiled by: Luan Peng, RootData

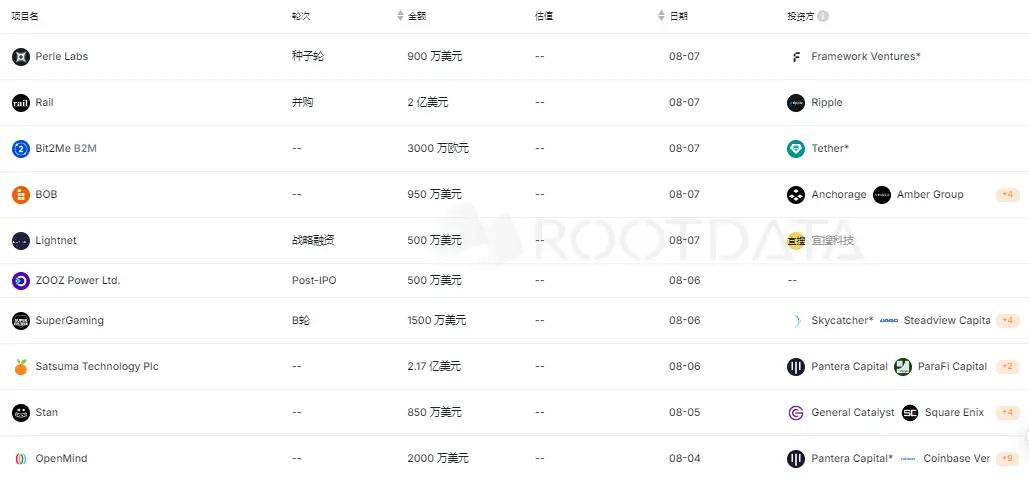

According to RootData's incomplete statistics, between August 4-10, 2025, a total of 21 public investment and financing events occurred in the blockchain and crypto industry, with a cumulative financing of approximately $544 million.

In terms of track distribution, the financed projects are mainly concentrated in infrastructure and AI tracks. Hot projects include stablecoin payment infrastructure company Blindpay, Indian game development studio SuperGaming, AI crypto strategy platform TradeTide, and Indian social gaming platform STAN.

Additionally, the British listed company Satsuma Technology completed financing of 163.7 million pounds (approximately $217.6 million), exceeding the target by 64%, with investors including ParaFi, Pantera, DCG, Kraken and other institutions.This round of financing accepted 1,097 BTC as part of the funds, to strengthen its BTC treasury strategy.

(List of projects with financing over $5 million last week, data source: Rootdata)

[The rest of the translation follows the same professional and precise approach, maintaining the specified translations for crypto-related terms.]According to official sources, the AI crypto strategy platform TradeTide has announced the completion of its seed round financing, with a post-investment valuation of $20 million. The round was jointly invested by CatcherVC, Candaq, CGV FOF, Stratified Capital, and K24 Ventures.

TradeTide is building an AI intelligent strategy platform for crypto traders and institutional users, with core functions including real-time token diagnosis, on-chain social data linkage analysis, portfolio health checks, and trend prediction. The platform plans to introduce an interactive intelligent assistant to help users improve trading decision-making efficiency. Currently, the platform has been initially deployed on the BNB Chain and has established partnerships with multiple ecosystem projects and investment institutions.

The official statement indicates that this round of financing will primarily be used for technological R&D, AI system optimization, product implementation, and ecosystem expansion. The team will continue to focus on promoting deep integration of AI and crypto trading, providing more intelligent and transparent strategy tools for Web3 users.

Four, CeFi

Spanish Crypto Exchange Bit2Me Completes €30 Million Financing, Led by Tether

According to official sources, Tether has announced the acquisition of a minority stake in the digital asset platform Bit2Me and led a €30 million financing round, expected to be completed in the coming weeks. This financing will support Bit2Me's expansion within the EU and strengthen its business operations in Latin America, particularly in Argentina.

Previously, Bit2Me became the first crypto asset service provider (CASP) in the Spanish-speaking region authorized by the Spanish National Securities Market Commission (CNMV) and complies with the EU's Markets in Crypto-Assets (MiCA) regulations. With the MiCA license, Bit2Me can legally operate in all 27 EU member states.

Five, Others

HackQuest Completes $4.1 Million Financing, Led by Animoca Brands and Open Campus

According to Business Insider, HackQuest has completed $4.1 million in financing, led by Animoca Brands and Open Campus, with participation from Gate Ventures, HashKey Capital, Hash Global, Find Satoshi Labs (StepN), Outlier Ventures, Bytetrade Labs, and others.

The financing will be used to expand its developer platform. The platform aims to bridge the talent gap in Web3 through education, on-chain credentials, and ecosystem support, and has already attracted 90,000 developers from over 30 countries.

Animoca Brands Strategically Invests in Cool Cats Group

According to the official announcement, Animoca Brands and its affiliated companies today announced a strategic investment in Cool Cats Group. After this investment, Animoca Brands and Coin Operated Group jointly hold a majority stake in Cool Cats Group.

Cool Cats is a series of 9,999 Non-Fungible Tokens on Ethereum, originating from the "Blue Cat" character created by artist Colin Egan in 2013. According to CryptoSlam data, the series has a cumulative trading volume of over $410 million, ranking 19th in total NFT series trading volume.

According to official sources, the fair launch platform Juicy.meme has announced the completion of a $400,000 Pre-Seed financing round, with a post-investment valuation of $8 million, exclusively invested by Ju Ventures.

Juicy.meme is the first meme fair launch platform in the Juchain ecosystem. Within just 20 days of launch, it has created over 440 tokens, with 20 successfully graduating, achieving a graduation rate of 4.5%, higher than pump.fun (0.81%) and four.meme (1.9%) during the same period. The platform has over 15,000 active addresses and a cumulative trading volume exceeding $20 million, demonstrating strong growth potential and user stickiness.

The official statement indicates that this round of financing will primarily be used for product upgrades, ecosystem building, and introducing quality projects. Ju Ventures, as a strategic partner, will work with Juicy.meme to promote the development of the Juchain fair launch ecosystem and jointly explore early-stage projects with meme potential and community enthusiasm.

The Hong Kong-listed company Yisou Technology announced a strategic investment of $5 million in Lightnet, a fintech company under the Charoen Pokphand Group, to support its Web3 technology and cross-border payment business development.

Simultaneously, Yisou Technology stated that it will deepen its Real-World Assets (RWA) strategic layout to build its own RWA ecosystem.

The listed company ZOOZ Power (NASDAQ/Tel Aviv Stock Exchange: ZOOZ) announced on August 6 the completion of its first private placement of $5 million, with an issue price of $2 per share. This financing is the first phase of the previously announced $180 million institutional investor private placement plan.

After obtaining shareholder approval, approximately 95% of the private placement proceeds will be used to implement a Bitcoin reserve strategy. This will make ZOOZ the first NASDAQ and Tel Aviv dual-listed company to adopt Bitcoin as a reserve asset.

UK Listed Company Satsuma Completes $217.6 Million Financing, Partially in BTC

The UK-listed company Satsuma Technology completed a £163.7 million (approximately $217.6 million) financing round, exceeding the target by 64%, with investors including ParaFi, Pantera, DCG, Kraken, and other institutions.The round accepted 1,097 Bitcoins as part of the funding to strengthen its Bitcoin treasury strategy.

Currently, Satsuma Technology should hold 1,125.85 Bitcoins.