#ETH

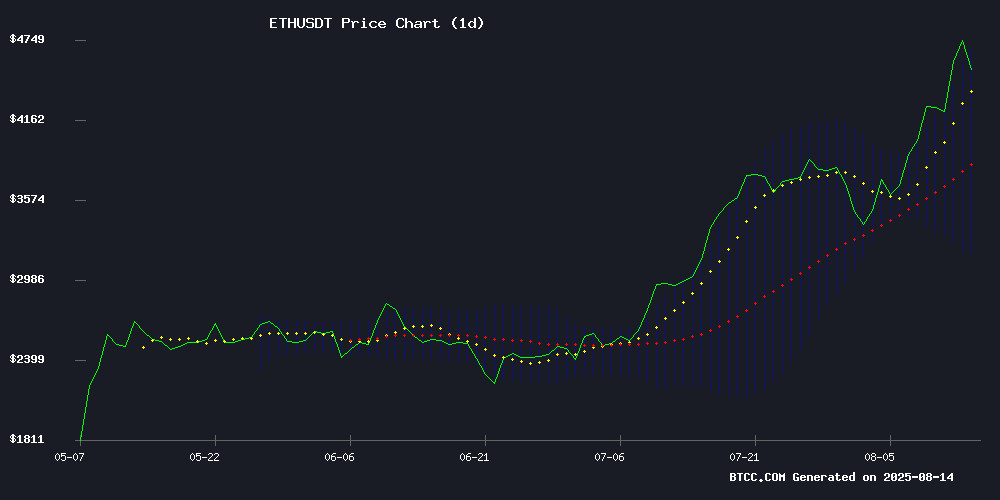

- Technical Breakout: ETH price sustains above 20MA with MACD showing bullish convergence

- Institutional Adoption: Record ETF inflows and major partnerships (Stripe/Blackstone) creating demand

- Ecosystem Growth: MetaMask stablecoin launch and DeFi advocacy strengthening network effects

ETH Price Prediction

ETH Technical Analysis: Bullish Signals Emerge Above Key Moving Averages

ETH/USDT is currently trading at $4,694.70, significantly above its 20-day moving average of $3,939.92, indicating strong bullish momentum. The MACD histogram shows convergence at -79.55, suggesting weakening downward pressure. Bollinger Bands reveal price hugging the upper band at $4,716.29, typically signaling overbought conditions but also reflecting sustained buying pressure.

"The technical setup shows ETH is in a powerful uptrend," said BTCC analyst John. "A sustained hold above the $4,700 level could trigger FOMO buying, with the next resistance at the psychological $5,000 mark."

Institutional Tailwinds Propel Ethereum to New Heights

Ethereum's rally to $4,700 coincides with MetaMask's stablecoin partnership with Stripe/Blackstone and record ETF inflows of $729M daily. Fundstrat's $15K prediction and Standard Chartered's upgraded $7,500 target underscore growing institutional confidence.

"The institutional adoption pipeline is accelerating faster than most predicted," noted BTCC's John. "While whale activity and leverage risks remain, the Stripe collaboration could onboard millions to Ethereum's ecosystem through MetaMask's new stablecoin."

Factors Influencing ETH's Price

MetaMask to Launch Stablecoin mmUSD/mUSD in Partnership with Stripe and Blackstone

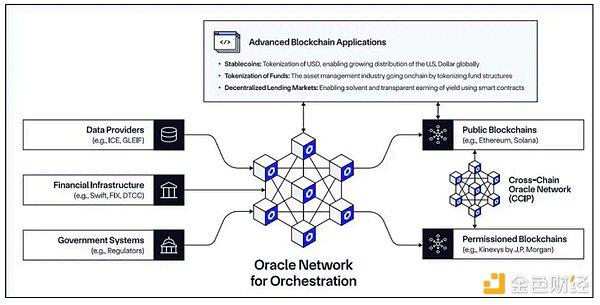

MetaMask, the Ethereum wallet provider with over 30 million monthly active users, is preparing to launch its own U.S. dollar-pegged stablecoin as early as this week. The token, referred to as mmUSD or mUSD, marks MetaMask's entry into the $280 billion stablecoin market, which is projected to reach $750 billion by 2026.

The stablecoin will be backed by treasury management services from Blackstone and custody solutions, enabling MetaMask to capture yield from underlying assets like U.S. Treasuries. The project emerged through a now-deleted governance proposal on Aave's platform, with sources indicating a live launch by late August 2025.

Key to the initiative is MetaMask's partnership with Stripe-owned Bridge, a stablecoin payments facilitator. Bridge's platform, acquired by Stripe for $1.1 billion last year, competes with traditional payment networks and will support the new stablecoin's integration across MetaMask's wallet services.

Ethereum Foundation Denies $12.8M ETH Sale Amid Wallet Speculation

Rumors of a $12.8 million Ethereum sell-off by the Ethereum Foundation were swiftly refuted by the organization. On-chain data initially suggested a wallet linked to the Foundation sold 2,975 ETH, but co-Executive Director Hsiao-Wei Wang clarified the address hasn't been under their control for years.

The wallet in question received 20,756 ETH from a Foundation address in 2017 during Ethereum's early days. Wang emphasized the Foundation's ETH holdings have dwindled from 9% of supply at ICO to under 0.3% today, with many legacy addresses now operated by third parties.

This incident highlights the challenges of tracking cryptocurrency movements across decentralized networks, where historical associations don't necessarily reflect current control. The Ethereum Foundation maintains transparency about its dwindling ETH reserves as the network approaches its tenth anniversary.

ETH Price Skyrockets To $4.7K Amid Bullish Market Sentiment

Ethereum's native token ETH surged past $4,700, marking an 8% gain within 24 hours and approaching its all-time high of $4,867 from November 2021. The rally reflects growing institutional interest and robust network activity, positioning ETH as a bellwether for altcoin markets.

Glassnode data reveals accelerating bid momentum, with on-chain metrics suggesting sustained investor optimism. Market observers attribute the price action to converging factors: anticipation of spot ETF approvals, increasing treasury allocations from corporations, and rising gas fees indicating network congestion.

The $4,600 breakthrough establishes new support levels, with technical analysts eyeing $5,000 as the next psychological barrier. This movement mirrors Bitcoin's dominance earlier in the cycle, now shifting toward Ethereum's ecosystem growth and layer-2 adoption.

Fundstrat Predicts Ethereum Could Reach $15K by 2025 Amid Institutional Adoption

Ethereum is gaining traction as a cornerstone of institutional crypto strategies, with Fundstrat analysts projecting its native token ETH could surge to $15,000 by 2025. The bullish forecast reflects Ethereum's dominant position in hosting stablecoins and enterprise blockchain projects.

Thomas Lee of Fundstrat describes Ethereum as "the biggest macro trade for the next 10-15 years," citing AI-driven token economies and Wall Street's blockchain financialization as key drivers. The GENIUS Act and SEC's Project Crypto are accelerating institutional participation, with ETH already up 60% monthly to $4,770.

Ethereum Faces Volatility Amid Whale Activity and Leverage Risks

Ethereum's price trajectory hangs in the balance as market makers and whales trigger turbulence. Analyst Ash Crypto flags cascading liquidation risks, with leveraged long positions now vulnerable after a short squeeze. ETH's 2.7% surge to $4,750 masks growing instability—every 1% move could unleash disproportionate liquidations given current open interest.

Coinbase data reveals exchanges' price formation strategies may exacerbate swings. The market microstructure appears fragile: liquidity-dependent events now function as volatility amplifiers rather than stabilizers. Traders ignoring margin management protocols risk being caught in the downdraft when positions unravel.

Standard Chartered Raises Ethereum Price Target to $7,500 Amid Institutional Surge

Ethereum's rally continues unabated, with Standard Chartered revising its year-end price target to $7,500—nearly doubling its previous forecast. The bank's 2028 projection now stands at $25,000, reflecting growing institutional confidence in ETH's long-term value proposition.

The cryptocurrency currently trades at $4,625, a mere 4% below its all-time high, after posting 30% weekly gains. This surge coincides with record inflows into spot ETH ETFs, which attracted $1.54 billion within two days of trading. BlackRock's ETHA leads the pack with $10.5 billion in assets under management.

Institutional accumulation has reached unprecedented levels, with buyers scooping up 3.8% of ETH's circulating supply since June—twice the pace of Bitcoin's fastest institutional adoption period. Analysts now eye $5,241 as the next resistance level, with some charts suggesting $8,500 could materialize if Bitcoin reaches $150,000.

Ethereum ETFs Attract $729 Million in Daily Inflows as Institutional Demand Surges

Spot Ethereum ETFs in the U.S. recorded their second-largest single-day inflow since launch, with $729.1 million moving into the funds on Wednesday. BlackRock's ETHA led with $500.9 million, followed by Fidelity's FETH at $154.7 million. The inflows come amid a 3.44% price rally for ETH, which traded at $4,772 during the period.

Analysts at Standard Chartered revised their year-end ETH price target upward from $4,000 to $7,500, citing institutional accumulation, ETF flows, and favorable stablecoin regulatory developments. Six of nine available Ethereum ETFs saw net inflows this week, building on Monday's record $1.02 billion influx.

Radiant Capital Hacker Nearly Doubles Stolen Funds Through Ethereum Trading

A hacker who stole $53 million from Radiant Capital nearly ten months ago has almost doubled the illicit gains through strategic Ethereum trades. The initial haul, converted into 21,957 ETH, has ballooned to $102.54 million after partial liquidation.

Recent on-chain activity shows the attacker sold 9,631 ETH for $43.94 million at an average price of $4,562, while retaining 12,326 ETH worth $58.6 million. This represents a 93.5% profit increase from the original theft, showcasing both the volatility and opportunity inherent in cryptocurrency markets.

The case underscores persistent security vulnerabilities in decentralized finance, particularly around cross-chain protocols like Radiant Capital that facilitate lending across multiple blockchains. Ethereum's price appreciation since the January 2023 exploit has effectively rewarded the attacker's holding strategy.

Eric Trump Turns to Ethereum After Banks Close Trump Family Accounts

Major U.S. banks, including Capital One, JPMorgan Chase, Bank of America, and First Republic, abruptly closed hundreds of Trump-linked accounts in 2025. Eric Trump claims the move was politically motivated, prompting the family to adopt cryptocurrencies like Ethereum for financial operations.

The shift has intensified debates over banking sector biases and the role of digital assets as an alternative. Eric Trump now actively advocates for crypto, framing it as a solution to traditional financial exclusion.

MetaMask Prepares to Launch Its Own Dollar-Pegged Stablecoin, mUSD

MetaMask, the dominant Ethereum wallet with over 30 million monthly active users, is finalizing plans to introduce its proprietary stablecoin. The dollar-pegged mUSD will mark the company's strategic expansion into the $150 billion stablecoin market—a sector growing exponentially alongside decentralized finance.

Partnerships with Stripe-acquired payment processor Bridge and investment giant Blackstone signal institutional-grade infrastructure backing the project. An accidentally leaked governance proposal recently fueled speculation about an imminent launch, though MetaMask officials remain tight-lipped.

The move capitalizes on MetaMask's established position as Web3's gateway. By integrating native stablecoin functionality, the platform could streamline transactions for its massive user base while competing with Circle's USDC and Tether's USDT.

DeFi Education Foundation Establishes Nonprofit Arm to Strengthen Advocacy

The DeFi Education Foundation (DEF) has launched a 501(c)(3) nonprofit organization, marking a strategic shift to bolster its lobbying efforts in Washington. The new structure enables tax-deductible donations, including crypto contributions, while expanding DEF's mission to educate policymakers on decentralized finance.

This move comes as U.S. regulators intensify scrutiny of DeFi protocols. The nonprofit status provides DEF with enhanced legal and financial flexibility to advocate for open-source developers and noncustodial platforms. "We're protecting the builders who power this ecosystem," the organization stated in its announcement.

The foundation maintains its core operations while gaining capacity to accept in-kind crypto donations—a feature that may appeal to capital gains-conscious contributors. DEF's policy push focuses on creating regulatory clarity for decentralized technologies amid growing legislative attention.

How High Will ETH Price Go?

Based on current technicals and institutional catalysts, ETH appears poised for further upside:

| Scenario | Price Target | Timeframe |

|---|---|---|

| Conservative | $5,800 | EoY 2025 |

| Moderate | $7,500 | Mid-2026 |

| Bullish (Fundstrat) | $15,000 | Late 2025 |

Key drivers include:

- MetaMask's mUSD adoption potentially locking ETH value

- ETF inflows sustaining $500M+/week

- L2 scaling reducing gas fee volatility

"The $4,700 level is now critical support," emphasized John. "A weekly close above $5,000 would confirm the next leg up."