Author: Matt Hougan, Chief Investment Officer of Bitwise

Translated by: Saoirse, Foresight News

Currently, there are indeed many promising developments in the cryptocurrency field: regulatory and legislative progress continues to improve, stablecoins are gaining momentum, corporate Bitcoin purchases are surging, institutions are steadily incorporating cryptocurrencies into their investment portfolios through ETFs, and Ethereum has regained vitality, injecting much-needed Altcoin dynamics into the entire cryptocurrency market.

However, these situations have long been an open secret. I always feel that the market underestimates the scale of each advancement, but this does not mean they are happening without attention. Media coverage of the cryptocurrency bull market has been overwhelming.

Nevertheless, I believe that by the end of this year, the market will still encounter a series of significant upward surprises that are powerful enough to drive prices to rise sharply. The following four important developments, in my view, are not yet reflected in the current market pricing.

More Governments Will Buy Bitcoin This Year

At the beginning of 2025, the market generally believed that the three major sources of Bitcoin demand this year are ETFs, corporations, and governments, which we call the "three horses of Bitcoin demand".

So far, two of these horses have been in action: ETFs have purchased 183,126 Bitcoins, and listed companies have bought 354,744 Bitcoins. Given that the Bitcoin network only produces 100,697 Bitcoins, this has already pushed its price up by 27.1%.

But the third horse has not yet truly exerted its force. Admittedly, the United States has established a "Strategic Bitcoin Reserve", but it only contains Bitcoins obtained through criminal confiscation; Pakistan announced the establishment of a national Bitcoin reserve, Abu Dhabi invested in a Bitcoin ETF, but compared to the large-scale purchases by ETFs and corporations, these are just sporadic efforts.

The market generally believes that the process of countries using Bitcoin as a reserve asset has been shelved, but I have doubts. Although government and central bank actions are slow, based on discussions at Bitwise, they are indeed making progress.

To be clear: I do not believe there will be a grand announcement of collective government action by the end of the year, but I can be sure that more countries will join, and the number will be sufficient to make this trend a significant potential driver in 2026. This alone could significantly boost prices.

USD Depreciation + Interest Rate Decline = Bitcoin Rise

A unique aspect of the current situation is that Bitcoin's price is approaching historical highs while interest rates hover near their peak since Bitcoin's birth in 2009. This should not happen. For assets like Bitcoin (and gold) that generate no income, high interest rates are undoubtedly a major challenge, significantly raising the opportunity cost threshold of holding such assets.

The market has been digesting expectations of multiple rate cuts before the end of the year, which should support Bitcoin. But I believe the market has overlooked a key trend with an even more far-reaching impact.

The Trump administration strongly desires a weaker dollar and hopes for a more lenient policy from the Federal Reserve. From directly criticizing Fed Chairman Jerome Powell to appointing Stephen Millan, who advocates for dollar depreciation, to the Federal Reserve Board, these actions strongly signal that the government wants significant interest rate cuts and dollar depreciation.

Not three rate cuts, but possibly six or even eight.

Millan's appointment is particularly noteworthy. He is known for a research paper arguing that the dollar's status as a global reserve currency imposes a heavy burden on the United States. He calls for a new "Mar-a-Lago Agreement" to lower the dollar's exchange rate relative to other major international currencies and suggests the Fed could achieve this through massive money printing.

If money printing leads to a significant drop in interest rates and a sharp dollar depreciation, Bitcoin prices could rise significantly.

Lower Volatility Means Higher Allocation

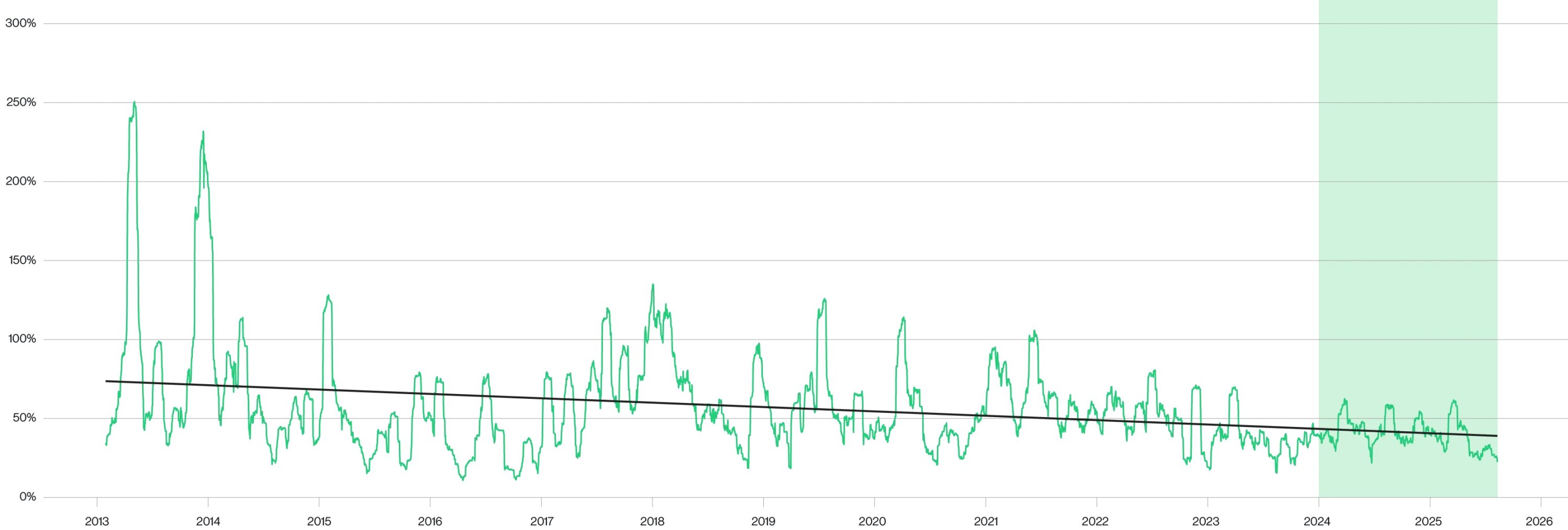

One of the most underestimated trends in the cryptocurrency field is the significant decrease in Bitcoin's volatility. Since the launch of the spot Bitcoin ETF in January 2024, not only has Bitcoin's own volatility significantly decreased, but the rate of change in its volatility has also slowed dramatically.

Bitcoin 30-day Rolling Volatility

(Data source: Bitwise Asset Management, based on Coin Metrics data; time range: December 31, 2012 to August 10, 2025)

Note: Green shaded area is the period after the spot Bitcoin ETF launch

The reason for the volatility decline is not hard to understand: the development of ETFs and corporate Bitcoin purchases have introduced new types of buyers to the cryptocurrency market, and progress in regulation and legislation has significantly reduced market risk. I believe this is now Bitcoin's "new normal", with its volatility currently roughly equivalent to that of high-volatility tech stocks like Nvidia.

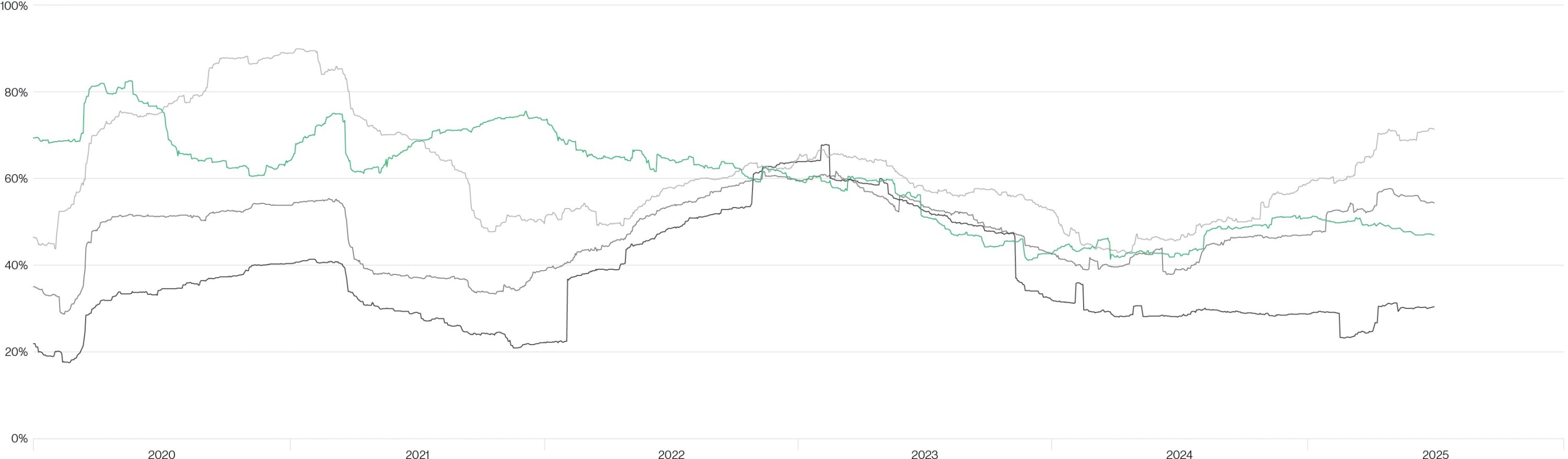

Bitcoin vs Tesla, Nvidia, Meta Volatility Comparison

(One-year rolling annualized volatility; data source: Bitwise Asset Management, based on Bloomberg data; time range: December 31, 2019 to June 30, 2025)

In conversations with institutional investors, this volatility decline is prompting them to reconsider cryptocurrency allocation in their portfolios, with a significant increase compared to the past. Before the spot Bitcoin ETF launch, initial discussions typically started at a 1% allocation, but now I frequently hear discussions starting at 5% or even higher.

This is also a key reason for the accelerated inflow of Bitcoin ETF funds. Since July 1, net inflows have reached $5.6 billion, which, if extrapolated, would approach $50 billion for the year. It's worth noting that summer is traditionally a slow season for ETF fund inflows, which makes me believe this trend may further accelerate in the autumn.

ICO 2.0: The Rebirth of Cryptocurrency Financing

Initial Coin Offerings (ICOs) have become notorious. In 2018, fraudulent ICOs were rampant, with such scam projects raising billions from investors before disappearing, never delivering the promised products, which was a significant reason for the abrupt end of the 2017 cryptocurrency bull market. The US SEC subsequently cracked down, and investors became thoroughly disgusted with such fraudulent practices.

I believe most investors and observers have viewed ICOs as "defective goods", but SEC Chairman Paul Atkins recently outlined a blueprint for ICO rebirth in his "Cryptocurrency Plan" speech:

"I have asked the team to develop disclosure rules, exemption clauses, and safe harbor systems tailored to so-called 'Initial Token Offerings', 'Airdrops', and 'Network Rewards'... In my view, if we can adhere to this path, the innovation field may be on the verge of a 'Cambrian explosion'."

If this concept is implemented, it could become an important catalyst for market upward movement. Looking back, cryptocurrency investors' enthusiasm for crypto projects has never waned, whether during the ICO boom or bust. Once the new ICO 2.0 market launches, it could attract a large amount of new funds to the cryptocurrency market.

Conclusion

The market will not rise due to known positive news, but only because of positive news not yet reflected in prices.

I believe that overall, the market underestimates the scale of the current cryptocurrency bull market and overlooks some specific driving factors that will gradually reveal their influence in the coming months or even years.

Be cautious of subsequent sharp price surges.