#XRP

- Technical Outlook: XRP shows short-term bearish signals but maintains key support at $3.00 with whale accumulation providing downside protection

- Market Sentiment: Divided between bullish institutional milestones and bearish macroeconomic crypto liquidations

- Long-Term Value Proposition: Ripple's growing RWA ecosystem and CBDC partnerships may drive multi-decade appreciation

XRP Price Prediction

XRP Technical Analysis: Key Indicators and Future Trends

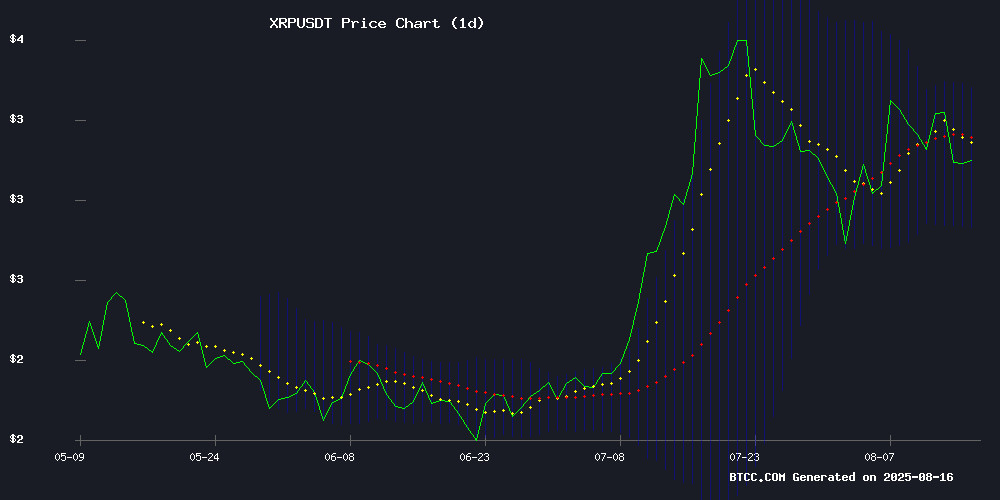

According to BTCC financial analyst Olivia, XRP is currently trading at $3.0925, slightly below its 20-day moving average (MA) of $3.1007. The MACD indicator shows a bearish crossover with a value of -0.0290, while the Bollinger Bands suggest a potential range-bound movement between $2.8334 (lower band) and $3.3680 (upper band). Olivia notes that a break above the 20-day MA could signal a bullish reversal, but caution is advised given the current MACD divergence.

XRP Market Sentiment: Whale Activity and Price Resilience

BTCC financial analyst Olivia highlights mixed market sentiment for XRP. On one hand, whale accumulation of 120 million tokens and Ripple's $1B RWA milestone are bullish signals, with some analysts eyeing $4.50-$5 targets. However, bearish divergence and a 7% price drop amid broader crypto liquidations indicate short-term volatility. Olivia emphasizes that XRP's ability to hold above $3.00 demonstrates resilience, but the $3.20 resistance remains critical for bullish momentum.

Factors Influencing XRP’s Price

Ripple’s XRP Whale Accumulates 120 Million Tokens Amid Price Dip

XRP whales have seized the opportunity presented by a recent price decline, accumulating 120 million tokens in a show of long-term confidence. The cryptocurrency, currently trading at $3.07, has drawn attention from analysts who foresee a bullish breakout with potential targets at $3.33, $4.36, $5.85, and even $10.47.

Support levels at $3.00, $2.85, and $2.64 are attracting buying interest, reinforcing the asset's resilience. Daily trading volume stands at $10.65 billion, with a market capitalization of $181.25 billion.

Crypto analyst Ali Martinez highlighted the whale activity, noting the aggressive accumulation during the dip. Technical analyst Dark Defender pointed to an emerging ABC correction pattern, often a precursor to upward momentum.

XRP Price Eyes $4.50 as New Challenger Emerges in Remittance Space

XRP's price shows renewed momentum, with analysts eyeing a $4.50 target as the asset trades at $3.27, up 3.22% in recent sessions. The cryptocurrency's $194.39 billion market cap and $8.79 billion daily trading volume reflect sustained institutional and retail interest, driven by cross-border payment adoption and network utility.

Meanwhile, Remittix (RTX), a $0.0944 altcoin, is gaining traction as a potential XRP rival in the remittance sector. With an active presale and upcoming product launches, RTX positions itself as a utility-focused alternative to speculative assets. Market participants increasingly favor projects with real-world applications, a trend benefiting both XRP and its emerging competitors.

Moon or Doom: XRP Price at Critical Juncture

XRP faces a decisive moment as traders weigh its next move. The cryptocurrency hovers near the $3 mark, a pivotal level that could determine whether it rallies to $4 or retreats to $2. Market sentiment remains cautiously optimistic, with prediction platform Myriad assigning a 63.7% probability to the upside scenario.

Recent inflation data triggered a 6.4% pullback, testing key support. Despite this, XRP maintains its position as the third-largest cryptocurrency by market capitalization at $181 billion. The asset recently touched an all-time high of $3.65, adding fuel to both bullish and bearish arguments.

Technical analysis reveals conflicting signals, explaining the divided trader sentiment. The XRP community remains watchful as the battle between bulls and bears plays out at this critical price threshold.

XRP Price Resilience Amid Market Turbulence as Ripple's RWA Milestone Hits $1B

XRP weathered a 6% drop yesterday followed by another 1% decline today, testing the $3 support level as crypto markets paused after last week's rally. The token's ability to hold this psychological threshold could signal bullish momentum, though $255 million in sector-wide liquidations over 12 hours—per CoinGlass data—hints at lingering volatility risks.

Ripple's network achieved a significant milestone with real-world asset (RWA) tokenization surpassing $1 billion in TVL, capturing 7.6% market share. Brazilian platform VERT Capital drove nearly 90% of this growth since its July launch on XRP Ledger, positioning Ripple as the third-largest RWA network behind Ethereum and ZKsync.

The RWA sector's expansion underscores blockchain's disruptive potential in traditional finance, with estimates suggesting $30 trillion in assets—from Treasuries to commodities—could eventually migrate to tokenized formats. This growth narrative contrasts with XRP's short-term price pressures, highlighting the divergence between network utility and speculative trading activity.

XRP Price Eyes $5 as Whales Accumulate Amid Market Volatility

XRP rebounded sharply from weekly lows of $3.05 after a $1 billion liquidation storm swept through crypto markets. Blockchain data reveals whales aggressively accumulated at support levels, fueling speculation of an impending breakout.

A bullish flag pattern on daily charts suggests potential upside toward $5, contingent on reclaiming the $3.13 resistance level. Ripple CTO's recent emphasis on XRP Ledger utility adds fundamental support despite macroeconomic headwinds.

The token's resilience during August's volatility highlights growing institutional interest. Late-session buying pressure indicates sophisticated investors are positioning for the next leg up as retail traders capitulate.

XRP Faces Bearish Divergence as Price Slips to $3.05

XRP's price has dipped 1% to $3.05, erasing recent gains as analysts flag a concerning bearish divergence. The Relative Strength Index (RSI) shows weakening momentum—a pattern last seen in late 2020, preceding a 62-74% collapse.

Key support levels now loom at $2.90-$3.00, with breaches potentially accelerating declines toward $2.75 or even $2.55. The token's broader structure appears fragile after this year's rally turned to consolidation and breakdowns.

XRP Maintains Bullish Structure Amid Correction, Eyes $4.19 Target

Ripple's XRP continues to exhibit bullish technical signals despite its recent pullback from all-time highs. The cryptocurrency finds strong support at $2.80, a level reinforced by historical resistance-turned-support and Fibonacci confluences.

Market structure remains decisively positive, with higher highs and higher lows confirming sustained upward momentum. A retest of the 0.618 Fibonacci level could catalyze the next leg upward toward the $4.19 extension target.

Traders are watching the $3.60 value area high as critical resistance. The current consolidation appears to be building energy for a potential breakout, with on-chain metrics and derivatives data supporting the technical outlook.

Ripple CTO Highlights XRP Ledger's Resilience Amid Price Manipulation Claims

Ripple CTO David Schwartz has reaffirmed the robustness of the XRP Ledger (XRPL), framing it as a foundational pillar for digital finance. This comes alongside renewed allegations of XRP price manipulation, casting a spotlight on the cryptocurrency's market dynamics.

The XRPL, with its 13-year legacy, stands apart from newer blockchains by offering low transaction costs and eliminating the need for a separate gas token. These features streamline cross-border payments, making it a preferred choice for financial institutions.

Schwartz also teased plans for a high-performance XRPL server, a personal initiative aimed at bolstering network services. The move underscores his long-term commitment to the ecosystem, even as scrutiny around XRP's market behavior intensifies.

XRP Price Rebounds After Heavy Selloff Amid Broad Crypto Liquidation Event

XRP staged a sharp recovery after plunging to $3.04 during a market-wide cryptocurrency selloff that triggered over $1 billion in liquidations. The token rebounded to $3.08 at press time, marking a 4.39% decline from recent highs.

Trading volumes surged to $11.1 billion during the morning session before cooling to $7.56 billion. A notable hourly spike recorded 436.98 million XRP changing hands—the largest single-hour volume this quarter. The flurry of activity coincided with the price bottom, followed by renewed buying pressure from large traders.

Analyst Crypto King suggests XRP has transitioned from accumulation to an expansion phase, citing technical indicators that could propel prices toward $7. "The chart and fundamentals are lining up for something massive," the analyst noted. On-chain data from Ali Martinez corroborates the bullish thesis, highlighting substantial whale activity during the dip.

XRP Faces Critical Resistance at $3.20 Amid Market Volatility

XRP's price action is at a pivotal juncture, dropping 4.33% to $3.13 with trading volume surging 8.44% to $10.68 billion. Market participants are closely watching the $3.20 resistance level—a breakout could propel the token toward $3.43 and $3.67, while rejection may trigger a retreat to $2.95.

The RSI nears oversold territory as bearish momentum persists, with weekly losses now at 5.52%. Analysts note the increased volatility reflects shifting investor sentiment, though the elevated trading volume suggests continued market interest despite the downturn.

XRP Tumbles 7% Amid $1B Crypto Market Liquidation Storm

XRP plunged to weekly lows as a cascade of liquidations rattled digital asset markets, with over $1 billion in positions unwound across major cryptocurrencies. The token shed 7.19% between August 14-15, bottoming near $3.05 before institutional bids emerged to stem the bleeding.

A midday capitulation event saw 436.98 million XRP change hands in a single hour - among the largest volume spikes this quarter. The selloff mirrored profit-taking in U.S. equities, though Ripple's CTO attempted to shore up sentiment by reaffirming the XRP Ledger's readiness for institutional adoption.

Late-session recovery from $3.09 suggested accumulation by large holders, with the token demonstrating relative stability after testing critical support. The episode highlighted crypto's continued volatility as traditional market risk-off flows spill into digital assets.

XRP Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and market sentiment, BTCC analyst Olivia provides these projections (all prices in USDT):

| Year | Conservative | Base Case | Bullish | Key Drivers |

|---|---|---|---|---|

| 2025 | $2.80 | $3.50 | $5.00 | RWA adoption, SEC resolution |

| 2030 | $6.00 | $12.00 | $25.00 | Cross-border payment dominance |

| 2035 | $15.00 | $30.00 | $60.00 | Institutional CBDC bridges |

| 2040 | $40.00 | $75.00 | $150+ | Full decentralized finance integration |

Note: These estimates assume no black swan events and gradual regulatory clarity.