Ethereum Whale Has Accumulated Over 6 Million USD UNI in ETH Uptrend, Attempting to Lower Average Price During Market Volatility.

- Ethereum Whale Exchanged 1,090 ETH for 415,005 UNI During ETH Price Surge on August 13.

- Purchased Additional 115,005 UNI to Reduce Average Price When UNI Price Dropped.

- Total UNI Value Accumulated Reaches 6.26 Million USD, But Still Experiencing Unrealized Loss of Around 535,000 USD.

How Did the Ethereum Whale Conduct UNI Transactions During Price Fluctuation?

During the ETH price surge on August 13, the whale with address 0x4B5…90AFA exchanged 1,090 ETH for 415,005 UNI Token. This was a leveraged action during a positive market, taking advantage of ETH growth to purchase a large amount of UNI.

Using ETH to perform Token Swap for UNI during a price increase demonstrates an asset conversion strategy to diversify investment portfolio, while leveraging the price surge to expand position on another Token.

Why Did This Whale Continue Buying UNI After Significant Price Drop?

When UNI price fell sharply, the whale purchased an additional 115,005 Tokens to lower the average investment price. This is a common strategy for experienced investors, helping minimize losses when price drops below initial purchase price.

Purchasing additional Tokens at lower price levels demonstrates investor's consistency and risk management strategy.

Cryptocurrency Market Analyst, 2024

This action helps maintain long-term accumulation momentum and recovery potential when market turns. However, the whale is still experiencing an unrealized loss of around 535,000 USD, indicating risks in betting on significant Token volatility.

Overall Assessment of ETH Whale's Costs and Current Losses on UNI

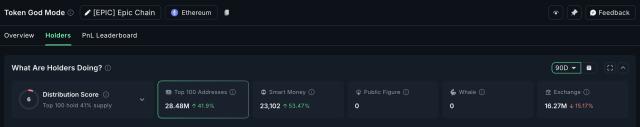

Total UNI value held by the whale is estimated around 6.26 million USD, with current average price of 11.82 USD/Token. Despite accumulating a large Token amount, the unrealized loss has reached 535,000 USD due to recent price fluctuations.

This demonstrates uncertainty and challenges in predicting cryptocurrency prices, even for large investors. This situation also clearly illustrates the strong influence of ETH market on related Tokens.

What Lessons Can Be Drawn from Ethereum Whale's UNI Transactions?

Accumulating large amounts of different Tokens during high market volatility is a strategy with parallel risks and opportunities. Investors must always be prepared with effective risk management plans.

The important lesson is not to rely solely on short-term upward trends while neglecting average price reduction methods, as the cryptocurrency market always has large and unpredictable fluctuation ranges.

Frequently Asked Questions

What is an Ethereum Whale and Why Do They Have Significant Market Impact?

Ethereum Whales are investors holding large amounts of ETH, capable of strongly influencing price movements and liquidation in the cryptocurrency market.

Why Do Whales Use ETH to Exchange for UNI During Market Price Increase?

Exchanging ETH for UNI helps diversify investment portfolio and leverage ETH price surge to expand position on another Token.

What is the Strategy of Buying More Tokens When Price Drops Called and Why is it Applied?

It is called lowering average price, helping reduce average investment cost and limit losses when price drops.

What Does Unrealized Loss Mean in Cryptocurrency Transactions?

Unrealized loss is the current unexecuted loss that can change if Token price recovers or drops further.

What Risks Should Be Considered When Trading Large Token Amounts?

Risks of significant price volatility, poor liquidation, and market psychology are always latent, requiring thorough risk management strategy preparation.