#ETH

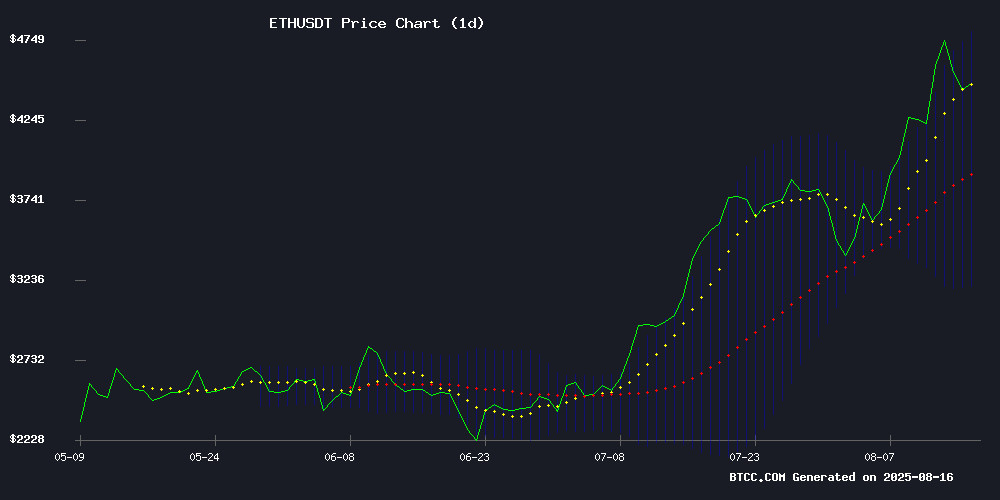

- Technical Breakout: Price holding above 20-day MA with Bollinger Band expansion signals continuation pattern

- Institutional Demand: Multiple firms accumulating ETH treasuries and ETF approvals pending

- Ecosystem Growth: Layer 2 adoption and staking yields creating fundamental support

ETH Price Prediction

Ethereum Technical Analysis: Bullish Signals Emerge Amid Volatility

ETH is currently trading at $4,445.50, significantly above its 20-day moving average of $3,996.11, indicating strong bullish momentum. The MACD histogram remains negative at -153.3090 but shows narrowing bearish divergence. Bollinger Bands suggest heightened volatility with price hugging the upper band at $4,797.40.

"The breach above the 20-day MA with such conviction suggests institutional accumulation," said BTCC analyst Robert. "While MACD remains in bear territory, the tightening bands and ETF speculation could fuel a breakout toward $5,000."

Market Sentiment: Ethereum Ecosystem Buzz Builds Amid ETF Speculation

Positive catalysts dominate headlines with BitMine's strategic accumulation, Fluent's testnet launch, and SharpLink's treasury expansion. Multiple outlets project $9,000-$15K price targets citing ETF approvals and institutional adoption.

"The confluence of technical strength and fundamental developments creates perfect conditions for a parabolic move," noted Robert. "However, traders should watch for potential pullbacks to the $4,200 support level given overbought RSI conditions."

Factors Influencing ETH's Price

BitMine Boldly Buys Ethereum During Market Dip

BitMine, led by Tom Lee, capitalized on Ethereum's recent price drop with a $130 million purchase of 28,650 ETH. The acquisition boosts the firm's holdings to 1.174 million ETH, now valued at $5.26 billion.

Corporate buying strategies are adapting to crypto market volatility. BitMine's aggressive accumulation reflects institutional confidence in ETH's long-term value, even as prices fluctuate. Other major holders now control over $10 billion in ETH, with ETF wallets potentially pushing total institutional exposure beyond $70 billion in coming months.

Fluent Launches Public Testnet with Potential Airdrop Incentives

Fluent, an L2 network specializing in modular blockchain solutions for EVM, SVM, and Wasm environments, has initiated its public testnet phase. The project, backed by $10.2 million in funding from Polychain Capital and other notable investors, encourages user interaction with ecosystem applications to qualify for a potential airdrop.

Participants must connect a Metamask wallet, request test ETH via the project's faucet, and engage with deployed contracts. Activity tracking includes Discord role farming and transactional interactions. While reward specifics remain undisclosed, the testnet's zero-cost, low-time-commitment model presents a strategic opportunity for early adopters.

Ethereum Price Analysis: Mixed Signals as ETH Approaches All-Time High

Ether's price retreated 3% to $4.4 after recent volatility, despite institutional accumulation reaching unprecedented levels. SharpLink Gaming's $3.3 billion treasury allocation and BitMine's $130 million purchase underscore growing corporate adoption.

Futures markets tell a conflicting story. Open Interest surged from $18 billion to $62 billion since April, yet negative funding rates reveal growing bearish sentiment among derivatives traders. The divergence suggests profit-taking near record highs rather than waning fundamental demand.

Validator exits compound short-term pressure, though the ecosystem's structural advantages - particularly with spot ETH ETFs imminent - maintain the long-term bull case. Market mechanics now overshadow narrative drivers as the key price determinant.

Ethereum Price Prediction: ETH ETF Buzz May Push Price To $9,000 By Mid-2026

Institutional demand for Ethereum is surging following the approval of multiple ETH ETFs, with analysts projecting a potential rally to $9,000 by mid-2026. ETF inflows have already exceeded $4 billion, fueling a 50% price increase in just two weeks. On-chain metrics reveal 28% of ETH supply is staked—over 34 million coins—reducing sell pressure while exchange balances hit their lowest since 2016.

Corporate adoption is accelerating, with BlackRock and JPMorgan expanding Ethereum-based infrastructure. Meanwhile, DeFi projects on the network are gaining momentum as first-time holders increase positions by 16% since early July. The convergence of institutional interest and constrained supply creates a bullish setup for ETH's next leg up.

SharpLink Expands ETH Treasury Amid Strategic Overhaul

SharpLink Gaming is making a bold bet on Ethereum, amassing one of the largest corporate ETH reserves globally. The Minneapolis-based firm revealed its Q2 2025 earnings alongside a strategic pivot to Ethereum as its primary treasury asset, aiming to give investors direct exposure to ETH's transformative role in global finance.

The company began aggressively accumulating Ethereum in early June and now ranks among the top corporate holders of the cryptocurrency. SharpLink's strategy explicitly ties shareholder value to Ethereum's growth while generating yield through active staking.

Co-CEO Joseph Chalom highlighted the successful launch of the ETH treasury strategy, noting significant capital raises and accretive scaling of ETH holdings. The company has appointed Ethereum co-founder Joseph Lubin as Chairman and partnered with Consensys for technical expertise.

SharpLink's treasury now holds 728,804 ETH, with nearly the entire position staked to earn network rewards. To date, the staking program has generated 1,326 ETH in rewards. The firm has raised $2.6 billion across various financing rounds to fund its Ethereum acquisitions.

ConsenSys-Backed SharpLink Poised to Dominate Ethereum Treasury Market

SharpLink, backed by ConsenSys, is emerging as a frontrunner in the Ethereum treasury management space. CEO Joseph Lubin predicts the firm will outpace competitors due to its integration with ConsenSys' ecosystem, professional asset management, and advanced staking operations. "We see a positive feedback loop driving results across the board," Lubin stated in a recent Nasdaq interview.

The firm recently secured $200 million in funding to expand its Ethereum holdings, which currently stand at 598,800 ETH—nearly 0.5% of Ethereum's total supply. Co-CEO Joseph Chalom highlighted the potential of tokenized assets, projecting a $100 trillion market powered by Ethereum's infrastructure.

SharpLink's strategic advantages include direct access to ConsenSys' product suite and backing from major financial institutions. This positions the firm to capitalize on growing institutional interest in Ethereum-based treasury solutions.

5 Factors Driving Ethereum Price Toward a Possible $15K Milestone

Institutional investors have poured over $10 billion into Ethereum in less than three years, signaling strong confidence in the asset's long-term potential. Notably, former President Donald Trump's portfolio now holds more than $500 million worth of ETH, underscoring its appeal to high-profile investors.

The approval and growth of spot Ethereum ETFs, which now manage approximately $19 billion in assets, has further legitimized the asset class. Regulatory tailwinds, including the pro-crypto GENIUS Act, continue to fuel institutional interest.

Market momentum is building as Ethereum breaches the $4,000 threshold, with analysts projecting a potential surge to $15,000. Companies like Bitmine and SharpLink are increasingly allocating to ETH over Bitcoin, reflecting a shift in treasury management strategies.

Spot Ethereum ETF issuers have filed proposals to enable staking, potentially unlocking additional yield opportunities. This development could further accelerate institutional adoption as investors seek both capital appreciation and income generation.

ConsenSys CEO Backs SharpLink as Leader in Ethereum Treasury Race

Ethereum co-founder Joseph Lubin predicts SharpLink will outpace competitors in the Ether treasury sector. The ConsenSys CEO, who chairs SharpLink, highlighted the firm's integration with Ethereum's core ecosystem as a key advantage. "Positive feedback loops between ConsenSys products, advanced staking services, and professional asset management create a formidable combination," Lubin stated during a Nasdaq interview.

SharpLink Co-CEO Joseph Chalom outlined a $100 trillion vision for tokenized assets on Ethereum. "Stablecoins, traditional funds, and real-world assets demand a programmable, neutral infrastructure—Ethereum's position here could be transformative," Chalom remarked. The commentary underscores growing institutional confidence in Ethereum's role as the backbone for decentralized finance.

Ethereum Nears $600B Market Cap as Nexchain AI's Sub-$1 Presale Gains Traction

Ethereum's resurgence has propelled its market capitalization toward the $600 billion threshold, cementing its dominance among top-tier cryptocurrencies. Yet the network remains below its 2021 all-time high, creating opportunities for challengers.

Nexchain AI emerges as a formidable contender with its sub-dollar token presale, targeting Ethereum's scalability limitations. The AI-native blockchain combines hybrid Proof-of-Stake consensus with machine learning optimization, achieving throughput gains through sharding and DAG architecture. Its self-optimizing smart contracts represent a paradigm shift in blockchain automation.

Investors have committed $8.6 million during the presale's 25th funding stage, nearing its $9.3 million target. Security assurances come via a CERTIK audit partnership, though questions remain about execution risks in this ambitious technical roadmap.

SharpLink Gaming's Strategic Ethereum Pivot Overshadowed by Non-Cash Losses

SharpLink Gaming, Inc. (Nasdaq: SBET) saw its shares dip 0.35% in pre-market trading following its Q2 2025 earnings report. The company's aggressive shift toward Ethereum as its primary treasury asset—amassing 728,804 ETH and becoming one of the largest corporate holders—was marred by $87 million in non-cash impairment charges tied to LsETH holdings.

The firm staked nearly all its ETH, generating 1,326 ETH in rewards within weeks, but accounting losses totaling $103 million for the quarter dampened investor enthusiasm. Key Ethereum ecosystem figures, including Consensys founder Joseph Lubin and strategist Jacob Chalom, have joined SharpLink's team to bolster its $2.6 billion ETH-centric treasury strategy.

Ethereum's Rally Fuels Cloud Mining Interest as SIX MINING Promises High Returns

Ethereum's price surge to $4,740.77—a 56% monthly gain—has reignited interest in cloud mining, with SIX MINING claiming users can earn up to $7,000 daily. The UK-based platform, operational since 2018, leverages clean energy to reduce costs while offering a $12 sign-up bonus.

Trading volume for ETH rose 13% this month, reflecting renewed market optimism. SIX MINING's decentralized model eliminates hardware maintenance, targeting both individual and institutional miners seeking passive crypto income streams.

How High Will ETH Price Go?

Based on current technicals and market catalysts, ETH appears poised for significant upside:

| Timeframe | Bull Case | Base Case | Key Levels |

|---|---|---|---|

| Short-term (1-3 months) | $5,200 | $4,800 | Support: $4,200 |

| Mid-term (2026) | $15,000 | $9,000 | Resistance: $4,800 |

"The $4,800 level represents the all-time high breakout zone," explained Robert. "A weekly close above this could accelerate momentum toward our $9K ETF-driven target."