Bitcoin's price recently dropped from its All-Time-High (ATH), signaling a potential shift in market conditions. Although this decline seems normal, it may indicate underlying concerns about future volatility.

Historical indicators suggest a potential volatility explosion is approaching, causing key investors to become neutral.

Bitcoin Faces Calm Before the Storm

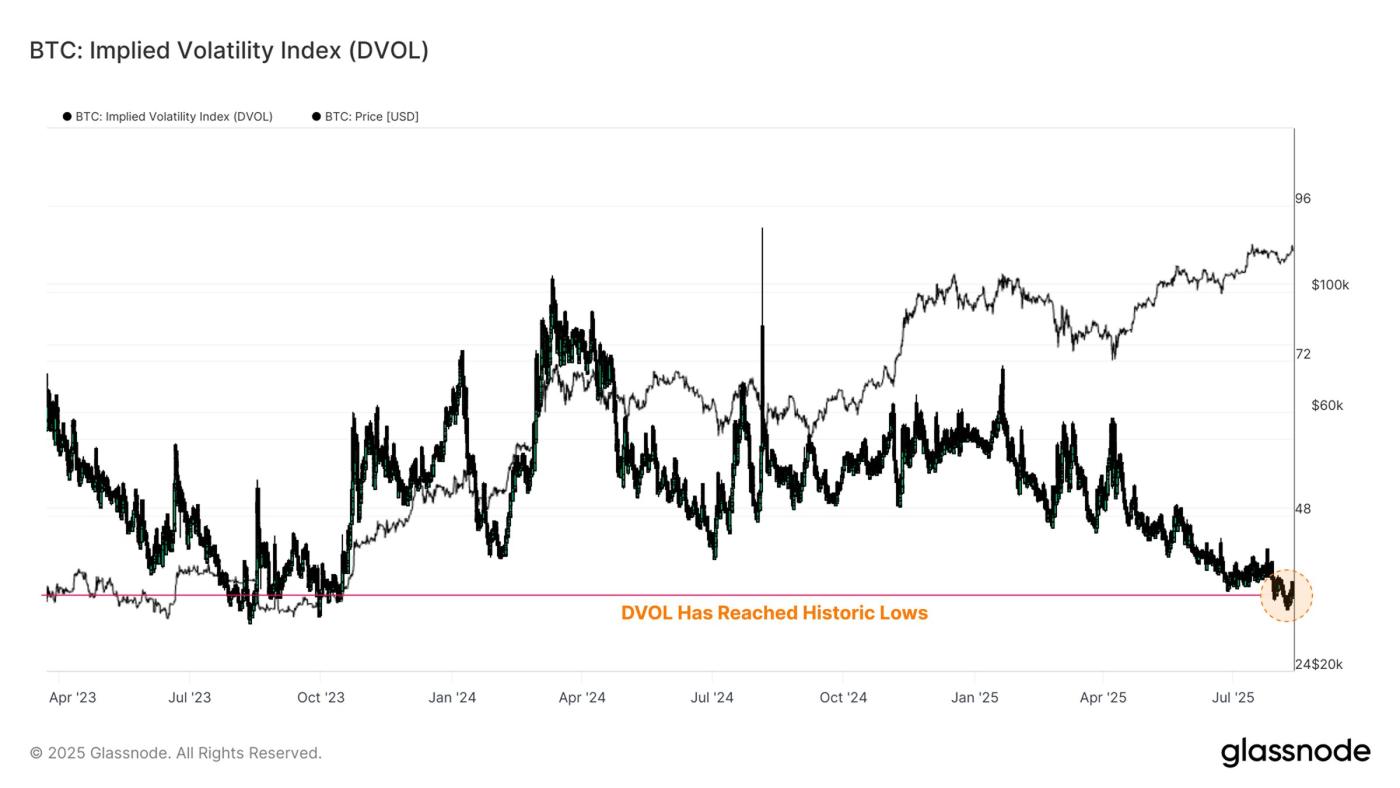

Bitcoin's DVOL index, tracking asset volatility, is at a historic low. Only 2.6% of days have lower values, indicating extreme market complacency. This suggests investors are not hedging against potential price drops, which could lead to significant price fluctuations if unforeseen events trigger volatility.

DVOL measures expected price volatility for the next month, and the current low level indicates a relaxed view from traders. However, this peace may be temporary, as volatility shocks often follow complacent periods. If a market event occurs unexpectedly, Bitcoin could experience rapid price movements that might catch investors off guard.

For token TA and market updates: Want more detailed information about tokens like this? Subscribe to Harsh Notariya's Daily Crypto Newsletter here.

Bitcoin's DVOL Index. Source: glassnode

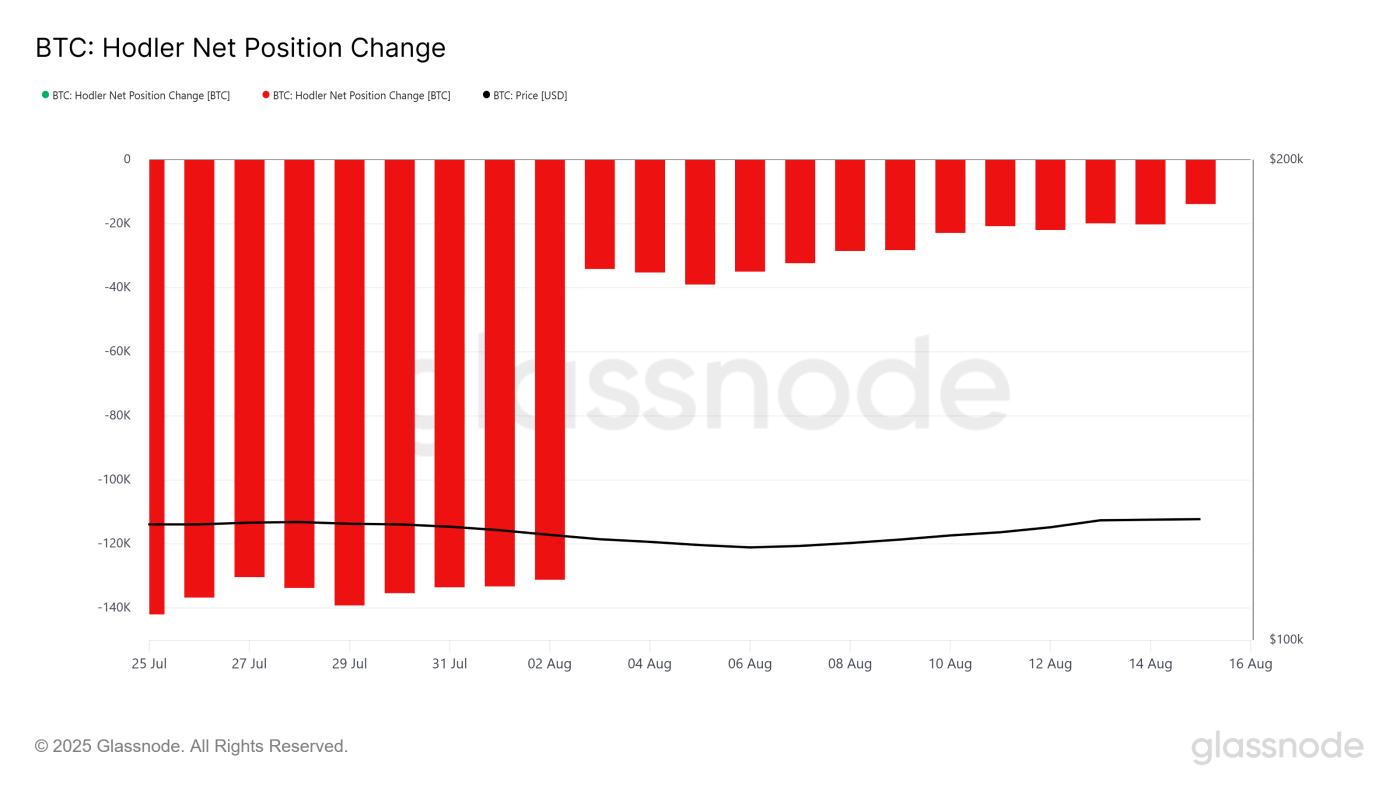

Bitcoin's DVOL Index. Source: glassnodeBitcoin's overall macro momentum shows a distinct shift in investor behavior. HODLer's net position change has slowed, signaling reduced activity from long-term investors (LTHs). Although LTHs began accumulating at the beginning of the month, this buying trend has paused, possibly due to current market uncertainty.

Despite the lack of new buying activity, the absence of selling suggests a level of optimism from these holders. They seem to be waiting for a clearer market direction before making their next move. This indicates that LTHs are cautious but expect any potential volatility might lead to price increases, maintaining their current positions.

Bitcoin HODLer's Net Position Change. Source: glassnode

Bitcoin HODLer's Net Position Change. Source: glassnodeBTC Price May Maintain Support Level

Bitcoin's price showed an upward trend throughout the month, but this momentum stalled in the past 24 hours, with BTC dropping to $117,305. This decline occurred as the price slipped below the established upward trend line, signaling a shift in market sentiment.

If investors maintain their positions during the expected volatility, Bitcoin could stabilize around $117,000. This would open opportunities for a potential push towards $120,000, establishing it as support and allowing further growth.

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingViewHowever, if investor sentiment turns negative and selling increases in response to volatility, Bitcoin could face a significant decline. In this scenario, the price might drop below the $115,000 support level, potentially falling to as low as $112,526. This would erase the gains seen in August, negating the price increase prospects.