#XRP

- Technical Breakout: Price must hold above 20-day MA ($3.10) and challenge upper Bollinger Band ($3.37)

- Regulatory Catalyst: SEC settlement approval could unlock institutional demand

- Adoption Growth: RWA tokenization platform launches may drive utility value

XRP Price Prediction

XRP Technical Analysis: Bullish Signals Emerge Amid Key Breakout Levels

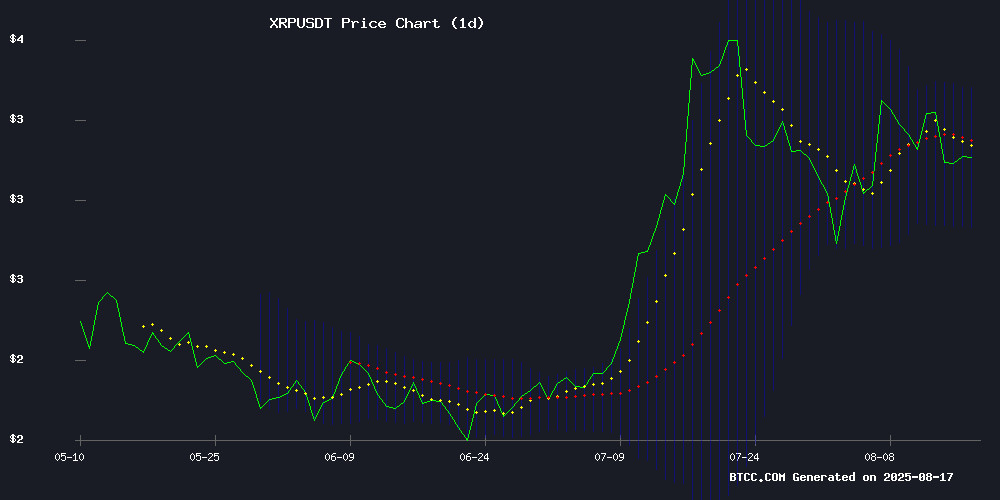

XRP is currently trading at $3.1225, slightly above its 20-day moving average (MA) of $3.1013, indicating a neutral-to-bullish bias. The MACD histogram remains negative (-0.0795), but the signal line (0.0301) suggests potential momentum building. Bollinger Bands show price hovering NEAR the middle band, with upper resistance at $3.3685 and strong support at $2.8340.

"The convergence of price above the 20-day MA and whale activity defending the $2.81 support creates a compelling setup," says BTCC analyst Mia. "A sustained close above $3.37 could trigger acceleration toward all-time highs."

XRP Market Sentiment: Institutional Growth Collides With Regulatory Headwinds

Positive catalysts dominate headlines, including Ripple's new RWA tokenization platform and analyst predictions of $100+ price milestones. However, Mia notes: "While whale accumulation and the potential SEC settlement are bullish, regulatory uncertainty remains the key obstacle to sustainable rallies. The $13 TV prediction requires clean technical breakout confirmation."

Institutional interest appears strong, with 78% of August's buying volume coming from large investors according to chain data.

Factors Influencing XRP’s Price

XRP Bulls Defend Critical $2.81 Support Amid Whale Accumulation

Ripple's XRP maintains bullish momentum as it holds above a crucial support level at $2.81, identified by prominent analyst Ali Martinez. The zone saw 1.7 million tokens accumulated—worth over $5 billion at current prices—creating a strong demand base that withstood early-August market turbulence.

Whale activity suggests continued confidence, with buyers stepping in during the recent dip triggered by geopolitical tensions involving US nuclear movements and trade policies. The token has since rebounded 17% to test resistance at $3.30, though this ceiling remains unbroken for now.

Market structure remains intact so long as XRP stays above the $2.81 threshold, where panic selling could emerge if breached. The accumulation pattern mirrors historical precedents where large purchase clusters become self-reinforcing support levels.

XRP Chatter Reaches Ride-Share Drivers — Small Survey Shows Mixed Results

XRP is increasingly entering everyday conversations, according to anecdotal reports from crypto commentators and ride-share drivers. A recent Unchained podcast highlighted instances where Uber drivers in Nevada and Michigan recognized a prominent XRP advocate, signaling growing retail awareness. Social media amplifies these encounters, with users sharing similar experiences.

Yet, the trend isn't universal. A separate small-scale survey found limited uptake, contrasting the bullish anecdotes. The mixed signals reflect XRP's uneven penetration into mainstream discourse despite high-profile legal battles and community enthusiasm.

Ripple-Backed Epic Chain To Launch XRP-Powered RWA Tokenization Platform

Epic Chain, supported by Ripple, is advancing into the real-world asset (RWA) tokenization space with an XRP-native platform. The initiative aims to bridge traditional assets like real estate, credit, and commodities onto the blockchain, leveraging XRP's efficiency for seamless on-chain transactions. The global RWA market, valued at over $50 trillion, presents a significant opportunity for Epic Chain's disruptive approach.

Currently trading on Binance, Bybit, and KuCoin with a $60 million FDV, Epic Chain operates across 150 countries and targets over 100 million traders. The project has launched a $1 million liquidity program to fuel adoption. Originally an ERC-20 token, Epic is migrating to an XRP Ledger-compatible sidechain, enhancing settlement speed and scalability while deepening integration with XRP's infrastructure.

Analyst Maps Psychological Shifts for XRP at $100 and $1,000 Milestones

Crypto analyst BarryC has charted the potential psychological trajectory of XRP's market as it approaches key price levels. The token's journey to $100 WOULD mark a critical inflection point, transforming skepticism into urgency among investors.

Early movements toward $4 might be dismissed as noise, but the $10-$15 range would begin altering market psychology. At these levels, traders often grapple with cognitive dissonance—simultaneously fearing a crash while hoping for re-entry opportunities.

The $100 threshold emerges as the true psychological Rubicon. Here, disbelief would give way to panic buying as XRP sheds its 'low-priced asset' perception. Institutional FOMO could accelerate as the token demonstrates staying power at unprecedented valuations.

XRP Price Could Be Headed To New All-Time Highs Due To Institutional Growth and Chart Breakout Potential

XRP is consolidating above the $3 level, with analysts suggesting the token is transitioning from speculative asset to a cornerstone of global finance. Crypto analyst David_kml highlights institutional adoption as a key driver, noting increased usage by banks and payment providers via the XRP Ledger.

The weekly chart structure mirrors Ethereum's 2016-2018 breakout pattern, suggesting significant upside potential. Ripple's expanding partnerships and fintech integrations for cross-border settlements further strengthen the case for sustained price appreciation.

XRP Takes On Live TV: Analyst Predicts Surge To $13 If This Happens

Oliver Michael, CEO of Tokentus, has projected a bullish trajectory for XRP, suggesting a potential rise to $13. The prediction hinges on sustained bullish momentum and Ripple effects from the concluded Ripple SEC lawsuit.

Key catalysts include the potential approval of XRP ETFs, with Michael speculating BlackRock could file for such a fund despite current denials. XRP lawyer John Deaton anticipates BlackRock's entry within a year, which could drive substantial inflows given the firm's success with Bitcoin and ethereum ETFs.

Ripple-SEC Settlement Awaits Court Approval as Legal Saga Continues

The SEC has filed a status report indicating that Ripple Labs and the regulator have jointly agreed to dismiss their appeals in the long-running XRP case. While the stipulation remains pending court approval, legal observers note this represents a procedural formality rather than a substantive hurdle.

The August 15 filing reveals both parties will bear their own costs, marking a potential conclusion to the five-year legal battle over XRP's regulatory status. Market participants had anticipated this development after the SEC dropped charges against Ripple executives last year.

Legal experts remain divided on whether district court approval is technically required for the settlement. The XRP community continues debating the implications as the cryptocurrency maintains its position among top digital assets despite regulatory uncertainty.

XRP's Future Trajectory: Assessing the Post-SEC Landscape

XRP has surged over 400% since November 2023, fueled by regulatory clarity after the SEC dropped its lawsuit against Ripple. The token’s scalability—processing 1,500 transactions per second—positions it as a potential disruptor in cross-border payments. Ripple CEO Brad Garlinghouse envisions capturing 14% of SWIFT’s volume, citing the legacy system’s 6% error rate as a vulnerability.

Market optimism hinges on institutional adoption, with XRP’s five-year outlook tied to its ability to convert technical advantages into real-world utility. The cryptocurrency’s performance will depend on broader crypto market trends and regulatory developments.

XRP Price Prediction: Institutional Buyers Drove August Rally – Will Accumulation Continue?

Ripple's XRP has demonstrated resilience this month, with institutional demand fueling its August rally. The cryptocurrency currently trades at $3.14, holding above the $3.02 support level after peaking at $3.35 last week. Whale accumulation and tightening technicals suggest potential for continued momentum.

On-chain data reveals aggressive buying by large holders, with approximately 440 million XRP ($3.8 billion) purchased in the past week alone. Notably, 120 million tokens were acquired during a market-wide selloff on August 15, signaling strong long-term confidence that may counterbalance retail selling during volatile periods.

Despite an 8% price drop to $3.08 and a $15 billion market cap reduction since August 8, XRP maintains a fully diluted valuation of $308 billion. Daily trading volume has declined 36% to $7.55 billion, but concentrated whale activity indicates this dip may represent an accumulation phase rather than a breakdown.

XRP Price Surge Faces Sustainability Concerns Amid Regulatory Uncertainty

Market analysts are casting doubt on the longevity of XRP's recent price rally, citing declining network activity and unresolved regulatory pressures. The cryptocurrency's 10% drop in daily active addresses to 24,701 following its legal victory against the SEC on August 7, 2025 contradicts the anticipated sustained bullish momentum.

On-chain metrics reveal troubling divergence between price action and fundamental adoption. CryptoQuant data shows waning user engagement despite the token's courtroom success, with experts warning the current volatility reflects speculative trading rather than organic growth.

Projections for XRP's 2025 price trajectory grow increasingly murky as scalability challenges and exchange liquidity concerns compound regulatory risks. The absence of institutional adoption signals tempers Optimism around intermittent price jumps.

Ripple Exec Touts XRP Ledger as Ideal Platform for Tokenizing Trillion-Dollar Real-World Assets

Ripple's development team lead has positioned the XRP Ledger (XRPL) as a prime infrastructure for real-world asset (RWA) tokenization, citing its native decentralized exchange and elimination of intermediary services. This validation comes as analysts project the RWA market could scale to multi-trillion dollar valuations within years.

Technical charts show XRP breaking out of a descending price channel, with momentum building toward its 2018 all-time high of $3.84. The cryptocurrency's infrastructure advantages coincide with this bullish technical formation, suggesting institutional interest may be aligning with trader sentiment.

How High Will XRP Price Go?

| Scenario | Price Target | Conditions |

|---|---|---|

| Conservative | $3.37-$4.20 | Break upper Bollinger band + MACD crossover |

| Moderate | $13.00 | Clear SEC resolution + sustained institutional flows |

| Bullish | $100+ | Mass RWA adoption + macro crypto bull market |

Mia summarizes: "The $3.12 level represents a make-or-break pivot. With whale support at $2.81 and multiple technical/resistance levels ahead, traders should watch for volume confirmation on moves above $3.37. The $100 narrative remains speculative without regulatory clarity."