Another week filled with both hope and volatility. Ether (ETH) led a broad crypto market rally, fueled by net inflows into spot ETFs and companies building strategic cryptocurrency reserves—renewing calls for the arrival of an altcoin season.

The cryptocurrency world thrives on powerful narratives, often tied to regulatory policies and global events. The steady progress of bills like the CLARITY Act and the GENIUS Act in the United States, as well as anti-CBDC legislation, is fueling optimism in sectors like stablecoins and RWAs—much like the run-up to the 2017 ICO frenzy.

The price of the cryptocurrency is rising, and the construction is underway. Take CyberCharge, for example: from DePIN's "charge-as-mining" model and ecosystem integration to narrative evolution and new partnerships—we're completing ambitious goals one by one. " Build a better mousetrap, and the world will come knocking ," right?

As we've shared below, our goal is to bring new excitement to the community with each update.

Copycat season is late but here it is?

Speculators and investors are flocking to the crypto market.

Since late June, the price of Ethereum has surged from $2,200 to $4,700 today, a nearly 100% increase, outperforming the market average, while the market capitalization of the Altcoin sector (excluding Bitcoin, Ethereum and stablecoins) has grown from $580 billion to $892 billion.

If we draw lessons from the four phases of the bull market in 2017 and 2021, the market is indeed very FOMO:

- Bitcoin dominance: BTC leads the gains, followed closely by Altcoin, with Bitcoin's market share steadily climbing.

- Ethereum and blue-chip Altcoin are on fire: As BTC's gains slowed, capital shifted to Ethereum and major Altcoin, pushing up their prices.

- Mainstream Altcoin exploded: funds further spread to mature Altcoin and new concepts, forming a general rise.

- Low-cap stocks frenzy: Low-cap coins and memes surge as market excitement reaches peak – before the inevitable crash.

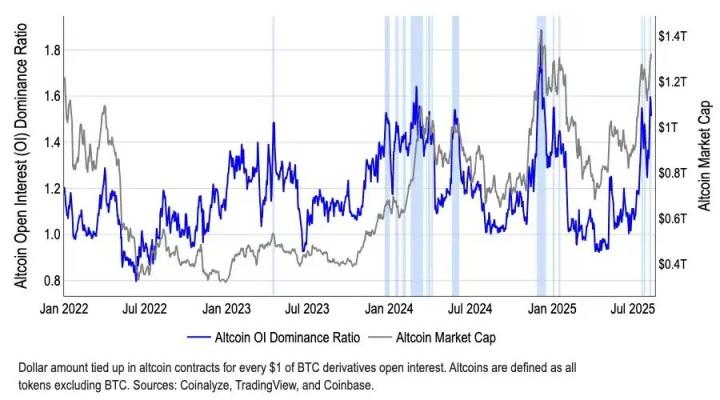

In line with this scenario, the Altcoin sector is now in a thriving phase, with current searches for “altcoin” hitting a five-year high, while Bitcoin’s dominance has dropped from a peak of 65.91% on June 25 to 58.80% today.

In fact, for the past month, Bitcoin has been consolidating at a high level, while Altcoin have been rising one after another, led by Ethereum. On-chain activities have also escaped the doldrums and spawned a large number of "golden dogs" - all signs indicate that we are in the second or third stage of the Altcoin season, even if the Altcoin Season Index has not yet reached the peak of FOMO.

Mini bull market or full bull market?

But this is no simple replay.

First, unlike previous cycles, against the backdrop of high interest rates in the United States, the capital injection in this bull market adopted a "dual-track" financing system: institutions locked up BTC/ETH through spot ETFs to consolidate their independent price trajectory; while retail investors flocked to the chain to chase short-term hype such as Memes or AI tokens, diluting the market share of mainstream Altcoin.

Another shift is the accelerated rotation of hot sectors. While altcoin seasons used to see months of consistent gains, the trend is now fragmented . The AI Agent craze of late last year gave way to the DePIN narrative of early 2018, while the current focus is on Ethereum-based stablecoins, the RWA protocol, and Altcoin specifically designed for corporate treasury reserves.

Of course, not all stablecoin projects garner hype—only those that can consistently create economic value, like Ethena (ENA) or Spark (SPK), attract investor attention.

It's worth noting that Ethereum, the cornerstone of global on-chain finance, is approaching $5,000 and is headed for the moon. As shown below, in the past month, 68 institutions have increased their holdings by over 1.86 million ETH, with a total value of $12.5 billion.

This highlights the growing maturity of cryptocurrency – moving away from fighting yesterday’s battles with outdated strategies and favoring projects with real value capture.

From this perspective, there is growing evidence that a bull market will reward the following themes:

- Policy alignment: Risk assets and stablecoins that comply with US cryptocurrency regulations – such as Ripple (XRP) for real-world payments, Aave (AAVE) as a leader in DeFi lending, or Pendle (PENDLE) for yield farming;

- Technology-driven utility: Pure infrastructure risks becoming a ghost town; new innovations must spur real adoption or economic benefits—think tokenized US stock protocols or AI agent ecosystems.

- Sustainable ecosystems: Projects lacking longevity will decline—think of the last wave of Ponzi schemes chasing total value locked (TVL). The survivors will be true builders who are dedicated to nurturing the ecosystem and rewarding the community, such as Hyperliquid (HYPER), which consistently uses revenue to buy back tokens, decentralized exchange giant Uniswap (UNI), and machine learning network Bittensor (TAO).

In short, a full-scale bull market is waiting for real liquidity overflow brought about by interest rate cuts - and alternative alpha investment opportunities will depend on narrative depth and actual utility, such as persistent sectors such as stablecoins, RWAs, AI and DePIN .

Are you CyberVerse ready?

“ Create the waves, don't just ride them ”—that was the motto of CyberCharge's latest internal meeting.

As the market shifts from a broad-based rally to a fragmented rotation, CyberCharge isn't passively waiting for the Altcoin season to arrive. Instead, we're carefully crafting our own story and preparing for the upcoming Token Generation Event (TGE).

As pioneers of DePIN, we closely monitor policy trends and technological developments—from the institutional appeal of RWAs to the intelligent integration of AI to the practical value capture of DePIN. This isn't simply a trend-following exercise; it's a precise innovation targeting market pain points: actors serve as nodes, and users serve as contributors .

In recent months, we have continuously strengthened the foundation of our ecosystem: hardware upgrades to smarter chargers make "charging to earn money" more convenient and efficient; AI Doggy's virtual pet system combines cuteness economics with emotional stickiness through behavioral verification, avoiding the traditional DePIN cold start; and upcoming products such as CyberPass and CyberMint will realize the value of ecosystem points and internal circulation.

Our innovative narrative is key to our differentiation. CyberCharge emphasizes a " behavior-driven value loop ": from daily charging to GameFi interactions, every step is converted into verifiable digital assets. This is more sustainable than memecoin hype and aligns with the preferences of a mature market: real utility rather than short-term FOMO.

Of course, launching the token in a timely manner is key to rewarding our community — helping everyone seize the structural opportunities of the alt season.

But this isn’t the end. Tokens are a yardstick of value, not a pump to chase . We believe that only sustainable incentive mechanisms and community governance can build a lasting flywheel—behavior verification, value circulation, and consensus formation.

Luck favors builders with goals .

Join CyberCharge and shape the CyberVerse - your actions will determine the next season!

About CyberCharge

CyberCharge is a Singapore-based innovative technology company dedicated to building intelligent hardware infrastructure that integrates Web3 and DePIN. Through its innovative Charge-to-Earn (C2E) and Play-to-Earn (P2E) models, CyberCharge bridges the gap between the real world and the blockchain, accelerating the adoption and practical application of the digital economy.

Join us and start a new era of Web3 charging!

Official website: https://cybercharge.org/

Twitter: https://x.com/CyberChargeWeb3

TG Community: https://t.me/CyberChargeGroup

Medium: https://medium.com/@CyberCharge