IPOs in Asia are attracting attention. Across the region, exchanges and fintech companies increasingly view Wall Street as the best place to raise capital, increase value, and achieve global recognition.

Analysts also note that these listings can provide deep liquidity and credibility, while subjecting companies to strict compliance requirements. Understanding the motivations and risks of this trend is crucial for both investors and regulators.

OKX, Animoca, Bithumb Hurry to Launch in the US

Latest Update:

OKX's IPO report has increased the value of OKB token by 5%. This exchange, a major player in Asia, has restructured its compliance framework and is now seeking to test the US market.

Coincheck Nasdaq is no longer speculation. In December 2024, the Japanese exchange began public trading under the ticker CNCK after completing a de-SPAC merger. This is the first Japanese cryptocurrency exchange to reach Nasdaq, raising capital for technology and acquisitions.

Discussions about Animoca's listing continue. This Hong Kong-based Web3 investor wants to expand its brand from games and Non-Fungible Tokens to a broader financial ecosystem, with Wall Street as the gateway to institutional investment capital.

Bithumb's separation confirms efforts to optimize operations. By separating the exchange business shard, this Korean platform hopes to provide investors with a transparent income profile before considering a US launch.

Meanwhile, LBank's IPO ambition emphasizes the determination of mid-tier players to join the race. Although smaller in scale, LBank's expansion in Southeast Asia positions it as a candidate for investors seeking cryptocurrency acceptance in emerging markets.

Alibaba's 2014 IPO Leaves a Typical Case

Context: Precedent has been strong. Alibaba's 2014 IPO demonstrated how Asian companies can grow in the US, while Coinbase's 2025 launch legitimized cryptocurrency companies by proving exchanges can withstand regulatory oversight and attract institutional demand. However, regulations in Asia remain fragmented and often restrictive, making the US the most transparent and liquid destination for ambitious cryptocurrency companies.

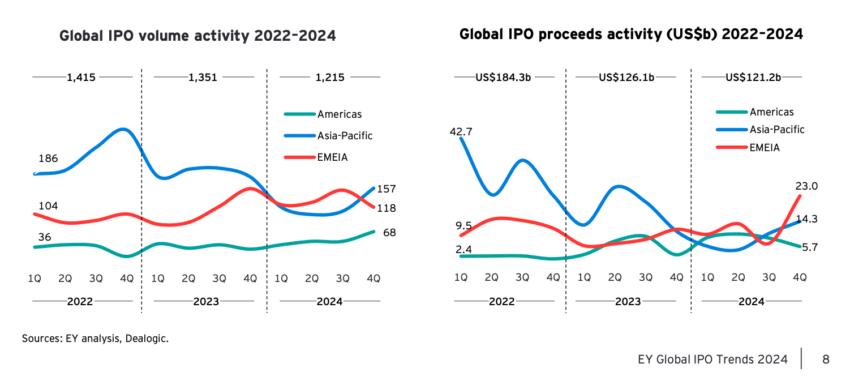

Global IPO Volume Activity 2022–2024, Global IPO Proceeds (Billion USD) 2022–2024|EY

[The rest of the translation follows the same approach, maintaining the original structure and translating all text while preserving special terms and proper nouns.]

Global IPO Volume Activity 2022–2024, Global IPO Proceeds (Billion USD) 2022–2024|EY

[The rest of the translation follows the same approach, maintaining the original structure and translating all text while preserving special terms and proper nouns.]Challenges of information disclosure: Despite clear benefits, there are still many burdens. PwC and EY warn that continuous reporting, compliance, and governance costs consume resources and reduce flexibility. Therefore, these limitations can slow down innovation and responsiveness of competitive exchanges in rapidly changing markets.

Highlighted data: