The Perp DEX segment has once again stirred up when Aster, a Derivative project, was just mentioned by CZ just a few hours after the Token launch. This is XEM the key project that helps the BNB Chain system compete with the giant Hyperliquid. So what is special about Aster? Let's find out with Coin68 in the article below.

What is Aster? The leading Derivative DEX on the BNB Chain ecosystem

What is Aster?

Aster is a decentralized Derivative exchange (Perpetual DEX) on BNB Chain , incubated by YZi Labs , the investment fund of Changpeng Zhao (CZ). The project was established in late 2024 through the merger of Astherus and APX Finance to create a new generation perp DEX that can compete with Hyperliquid, which is XEM the leading Derivative platform today.

Aster launched TGE at 5:00 p.m. on September 17, 2025, Vietnam time, with the Token symbol ASTER. Just a few hours later, Binance founder CZ posted a post praising the project on his personal X page. Immediately, Aster became the focus of attention in the crypto community, and the ASTER Token price also increased more than 5 times.

Well done! 👏 Good start. Keep building! pic.twitter.com/oMfOxfsBRS

— CZ 🔶 BNB (@cz_binance) September 17, 2025

This is XEM a rare time that CZ posted a chart of a project other than the two major coins, Bitcoin and BNB . Previously, in June 2025, he also revealed that he wanted to invest in a perp DEX project that could not disclose the Order Book to avoid being tracked when trading. A user suggested the Aster project and CZ expressed his agreement.

Aster products

Aster Pro

As the core product of Aster, it is a decentralized Futures Contract on BNB Chain, Ethereum, Solana and Arbitrum, designed to provide traders with advanced support tools to control the trading mechanism, margin system, risk management,... more effectively.

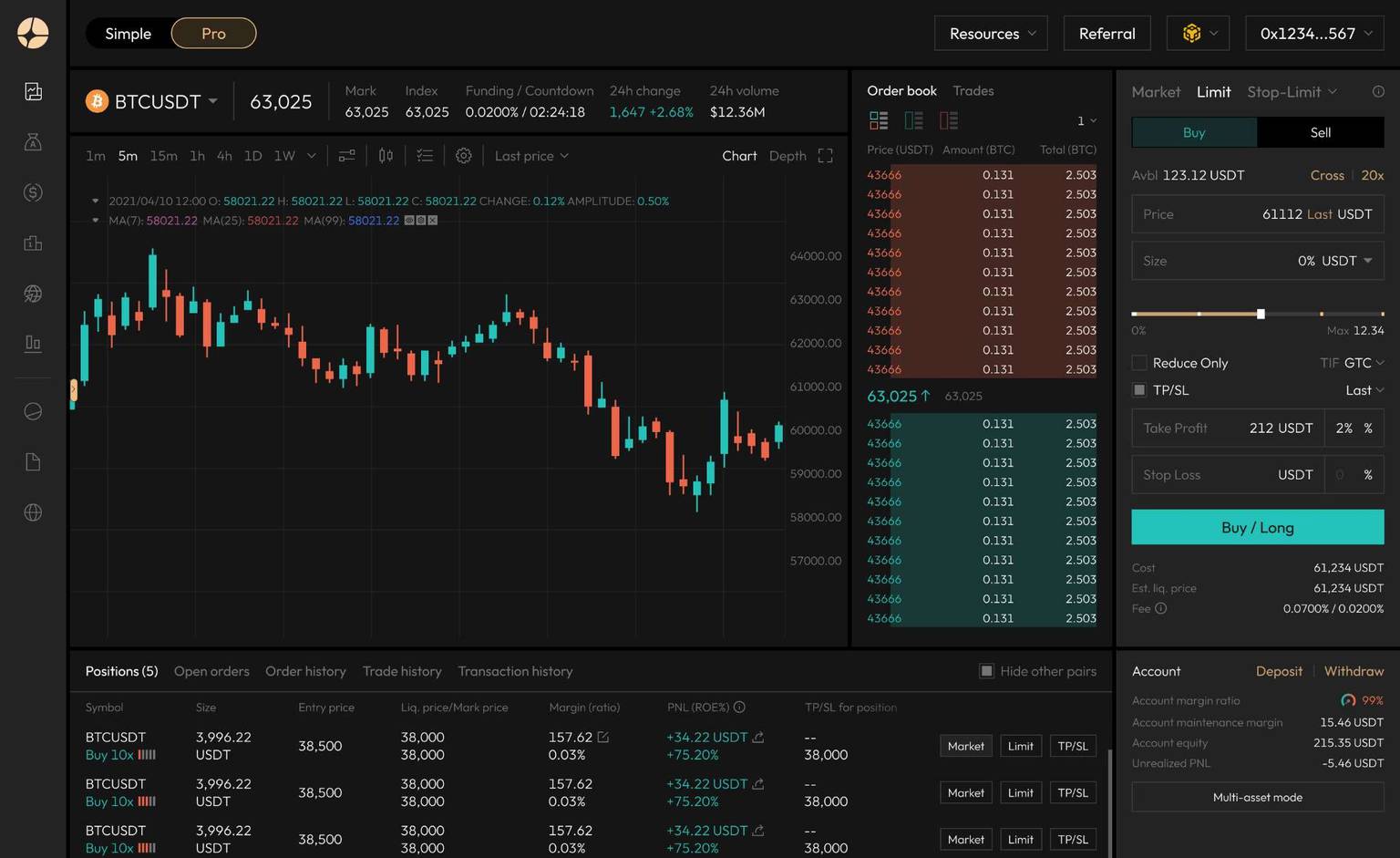

Aster Pro mode interface

Aster Pro mode interface

The main advantages of Aster Pro include:

Multi-asset mode : Trade by depositing multiple assets.

Lower fees than CEX : 0.01% maker fee, 0.035% taker fee.

1001x (Aster Simple)

A simpler version of Aster Pro, it does not require users to deposit funds into the platform like the full version and supports leverage up to 1001x. This feature is now available on BNB Chain and Arbitrum.

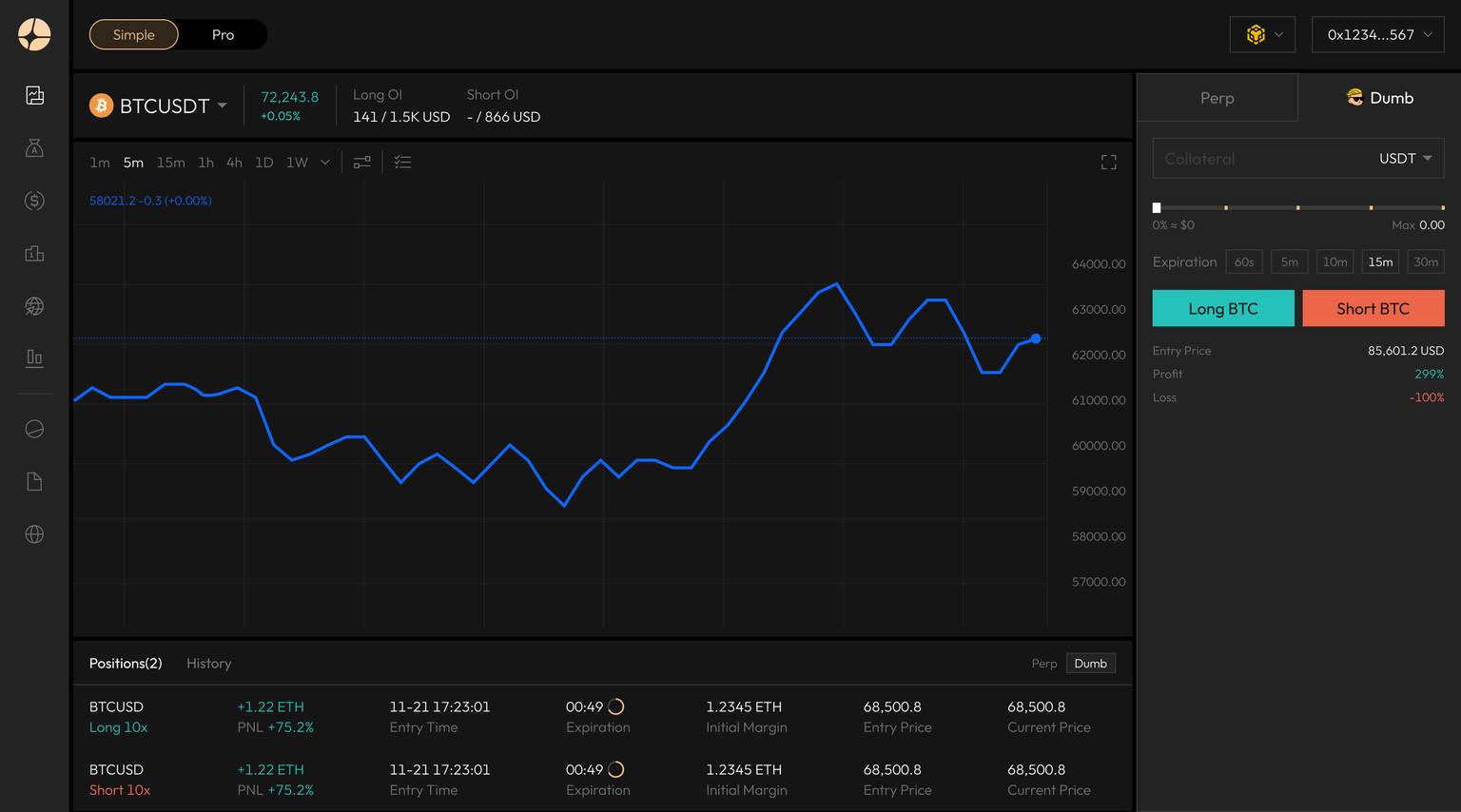

1001x mode interface

1001x mode interface

Some key features of 1001x:

Fully on-chain : Transactions made using 1001x mode will be processed and recorded entirely on the blockchain. Bringing transparency and fairness to transactions.

High Leverage : Aster supports leverage up to 1001x for 2 assets BTCUSD and ETHUSD, helping to amplify investors' trading profits.

Safety Assurance : Aster implements techniques like delta neutrality strategy to effectively manage risk and fraud.

Oracle integration : Aster uses price feeds from Pyth Network, Chainlink , and Binance Oracle, ensuring accurate and tamper-proof pricing.

Additionally, 1001x also boasts a unique feature called Dump Mode, which allows users to predict price movements minute by minute, providing an attractive way to test the market.

Aster Spot

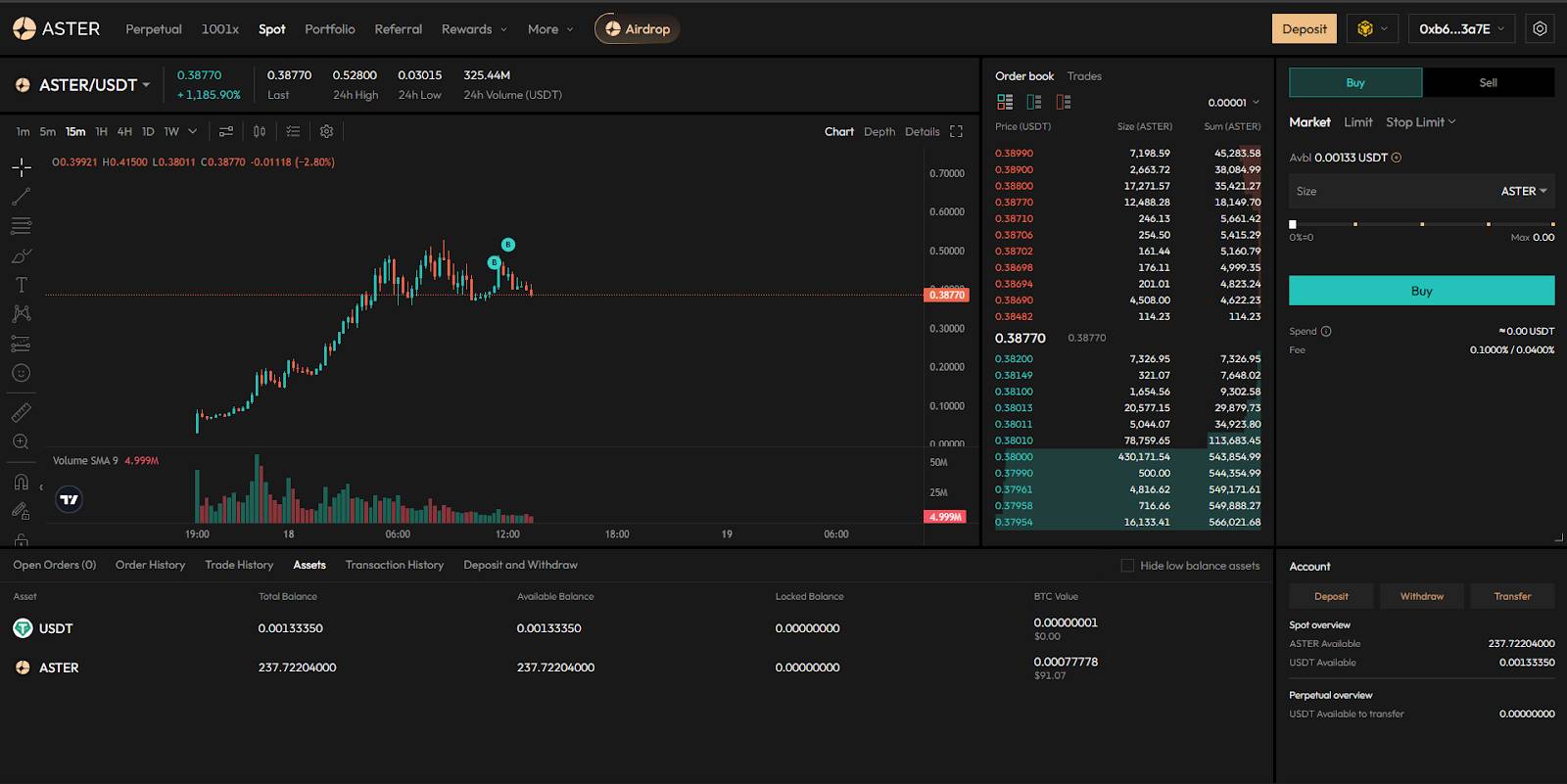

Aster Spot mode interface

Aster Spot mode interface

This feature of Aster allows users to buy Token directly on the platform with USDT similar to centralized exchanges. However, currently Aster Spot only supports a few types of assets such as BTC, ETH, USD1, ASTER,...

Aster Earn

Aster Earn is a profit optimization solution for users through advanced DeFi and CeDeFi strategies, designed with a friendly interface and simple operations.

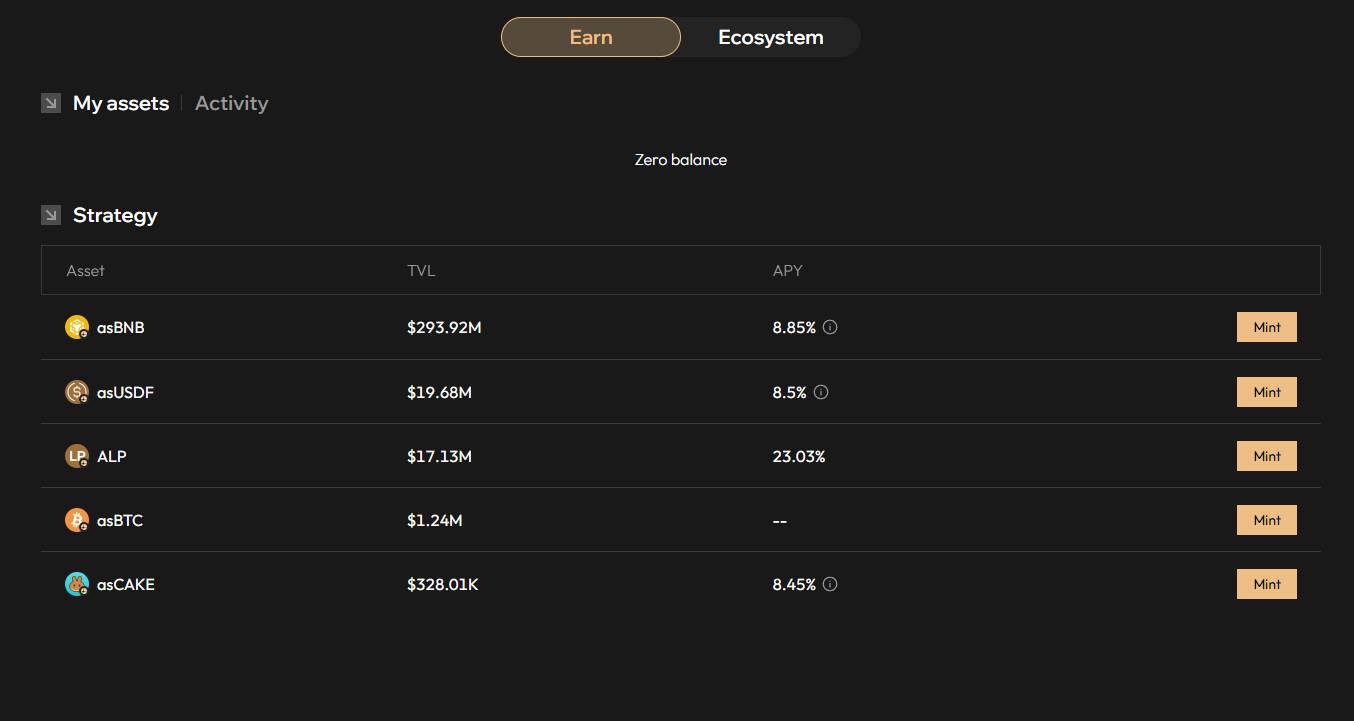

Aster Earn Interface

Aster Earn Interface

Aster Earn supports a variety of assets in the BNB Chain ecosystem such as BNB, CAKE and stablecoin USDF with attractive APY rates, helping to maximize asset value efficiently and safely.

Stablecoin USDF

USDF is a fully Collateralized Stablecoin issued by Aster, with custody services provided by Ceffu. USDF provides profitability to stakers through delta-neutral strategies. Users can use USDT to Mint USDF at a 1:1 ratio.

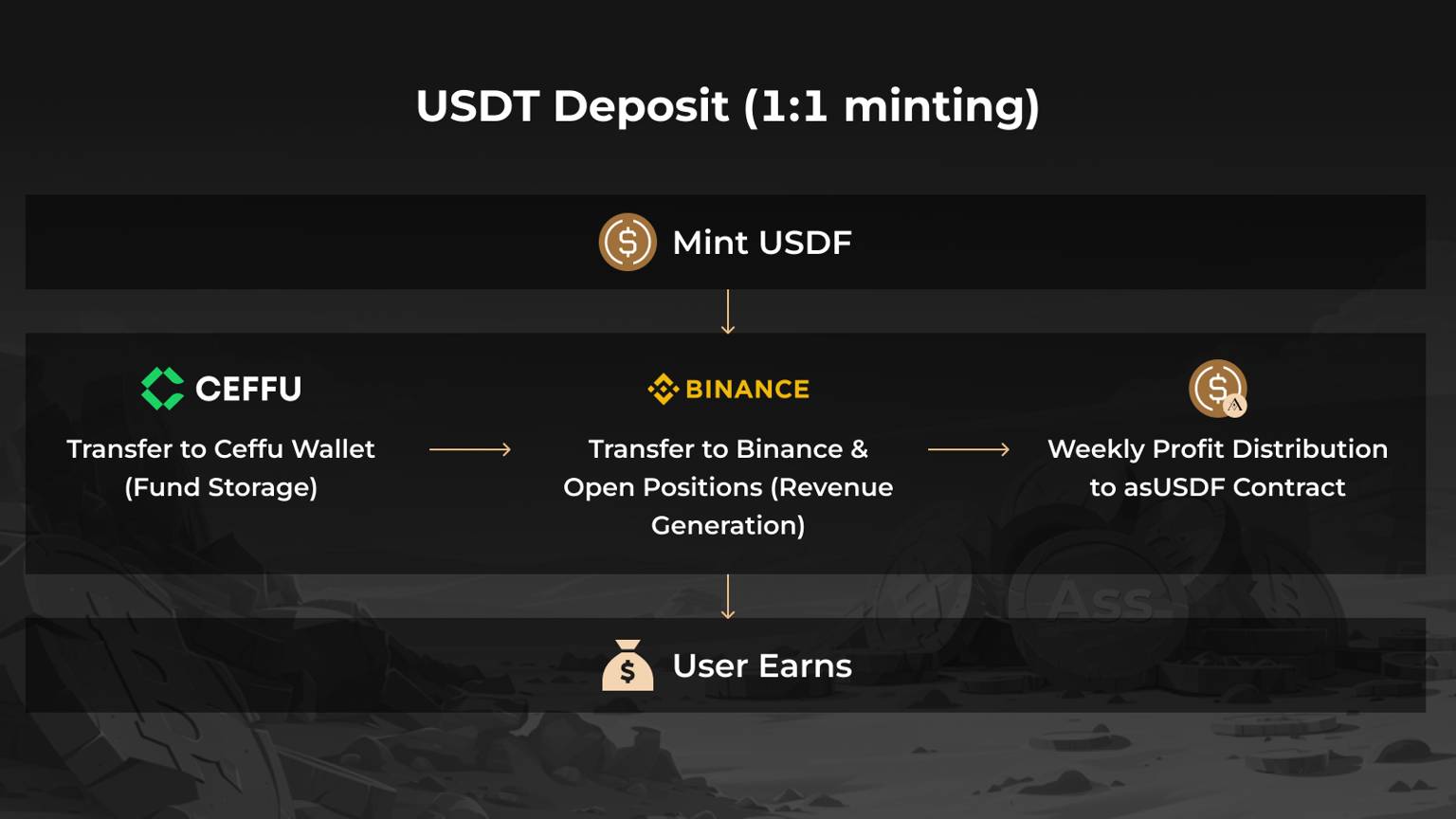

USDF Operation Process

USDF Operation Process

USDF works on a simple process as follows:

Users Mint USDF by depositing USDT at a 1:1 ratio.

That USDT is transferred to the Ceffu wallet, a custodial wallet that holds the USDT safely on behalf of Aster and prepares it for profitable investment.

Funds in the Ceffu wallet are sent to Binance to open trading positions using a low-risk management strategy ( delta neutral ) to generate stable profits. This model has many similarities with Ethena's stablecoin USDE .

Weekly profits from trades on Binance will be calculated and distributed to the asUSDF contract, the Staking version of USDF.

Aster Chain

Aster's own blockchain, focusing on balancing on-chain transparency and user privacy. Currently, Aster Chain is still in beta and only a select few have access to experience this blockchain.

Aster Chain

Aster Chain

The highlight of Aster Chain is the design of separation between transaction intent and transaction execution:

Transactions are recorded publicly on the blockchain to ensure basic transparency.

Transaction details are secured and authenticated using zero-knowledge proofs outside the blockchain.

This approach helps protect sensitive user information while maintaining trust in the payment process. It also limits the situation of users being hunted for orders like the Hyperliquid “whale” incident that shook the market in March 2025.

Aster tokenomics

ASTER Token Specifications

Token name | Aster |

Symbol | ASTER |

Blockchain | BNB Chain |

Total supply | 8,000,000,000 |

Contract | 0x000Ae314E2A2172a039B26378814C252734f556A |

Token allocation ratio

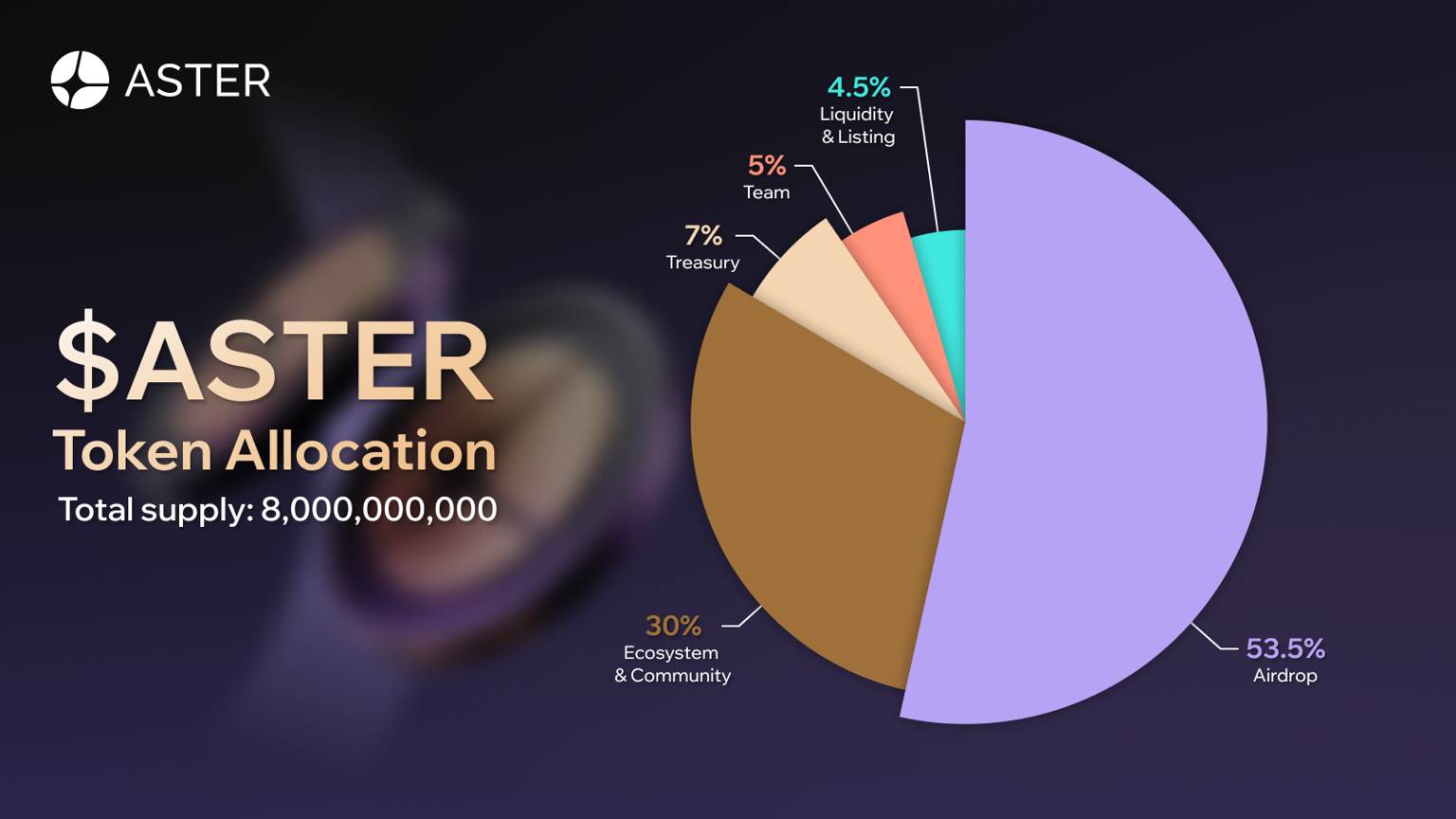

Aster Token Allocation Ratio

Aster Token Allocation Ratio

ASTER Token are distributed as follows:

Airdrop - 53.5% : Unlock 8.8% at TGE, the rest will be released gradually over the next 80 months.

Ecosystem & Community - 30% : Linear distribution over 20 months.

Treasury - 7% : Fully locked until used through governance approved mechanisms.

Development Team - 5% : 1 year lock, then linearly distributed over 40 months.

Liquidity & Listing - 4.5% : Fully unlocked at TGE.

Additionally, Aster will use a portion of the platform's revenue to buy back ASTER from the market.

Token Use Case

ASTER Token are used to:

Reward the community for using the platform.

Staking to receive yield.

Platform administration.

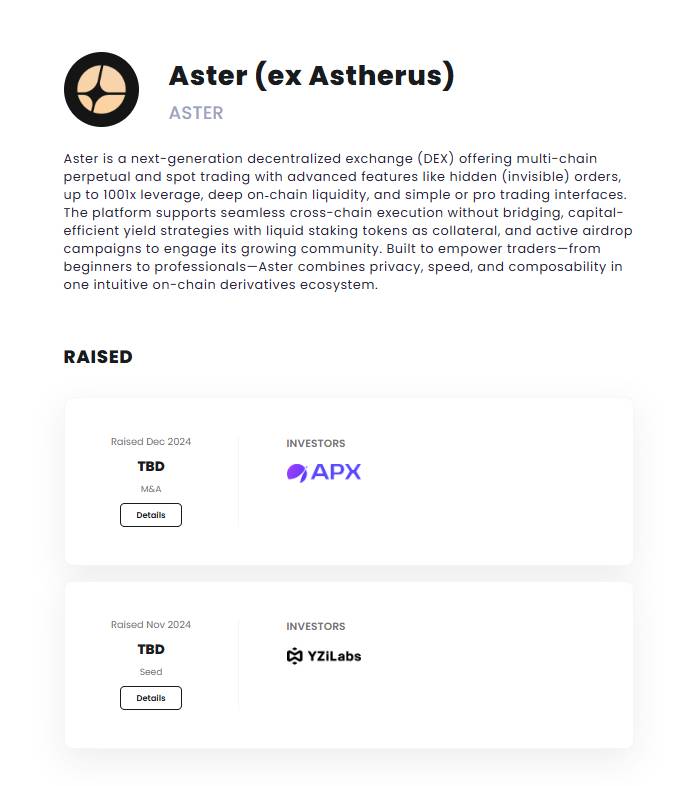

Investors

Aster's investment rounds (Source: Crypto Fundraising)

Aster's investment rounds (Source: Crypto Fundraising)

Aster is invested by YZi Labs and APX Finance. However, the amount raised was not disclosed.

Summary

Above is all the information about the Aster project, Coin68 hopes that readers will grasp the basic information to better understand the project and its highlights. Wish you have more useful knowledge!

Note: The information in the article is not XEM investment advice, Coin68 is not responsible for any of your decisions.