Bitcoin has surpassed $117,000 in the past 24 hours, posting gains even as global stock markets were volatile following the Federal Reserve's latest interest rate cut.

While stocks struggled to find direction, BTC held firm, supported by new money flowing into crypto investment products.

Bitcoin ETF inflows increase

The Federal Open Market Committee announced a 25 basis point interest rate cut, which in theory should be positive for digital assets. However, traditional markets interpreted the move as a sign of weakening economic conditions, with indices spiking and then falling in volatile trading sessions.

Bitcoin, however, maintained its upward momentum, largely thanks to institutional support. ETF inflows were strong throughout the week, except for September 17, when the FOMC decision was not yet announced. Investors appeared unfazed by the macro volatility, betting that Bitcoin's direction would remain positive despite concerns in the broader financial markets.

Want more information on Token like this? Sign up for Editor Harsh Notariya's daily Crypto Newsletter here .

Bitcoin ETF Inflows. Source: Farside

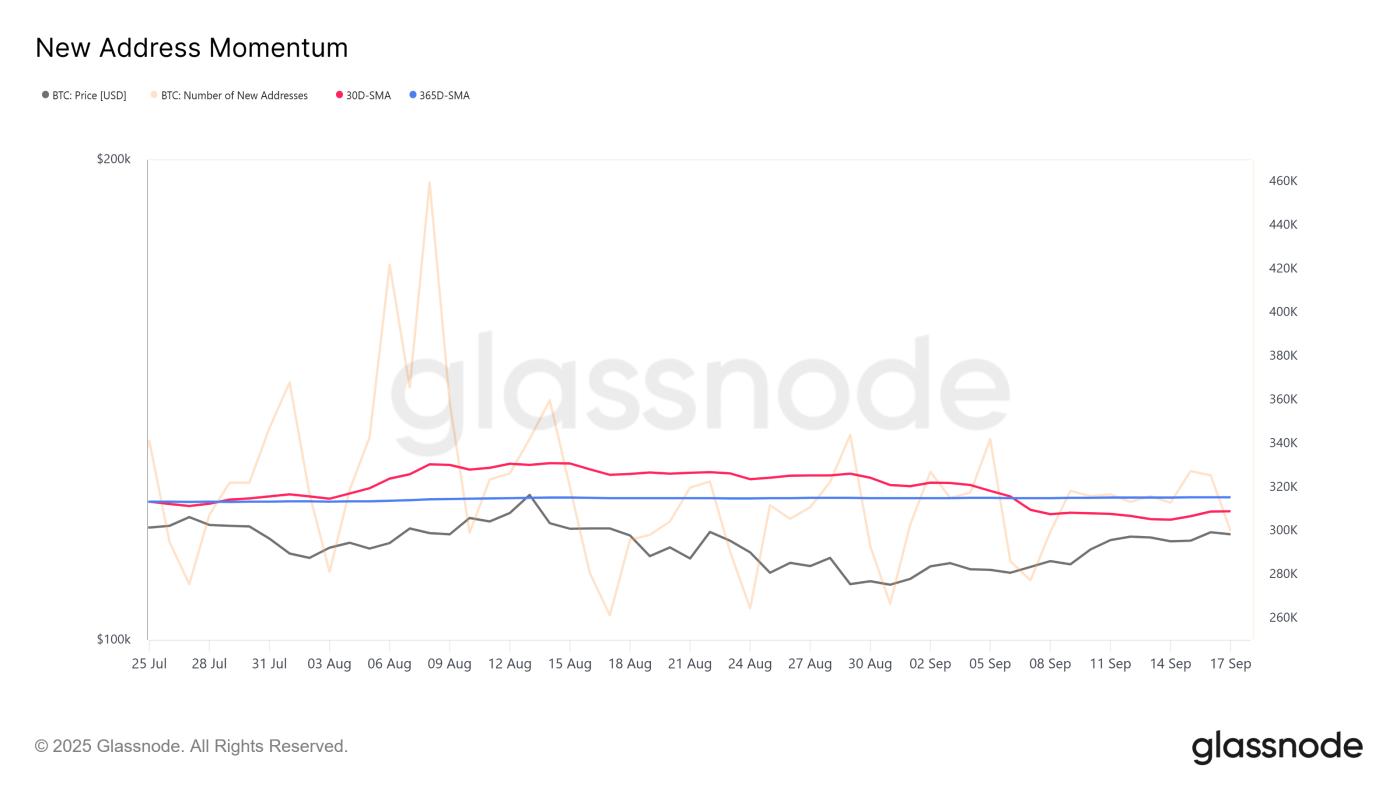

Bitcoin ETF Inflows. Source: FarsideOn chain signals suggest that not all participants are optimistic. New Address Momentum has declined in recent days, reflecting hesitation from retail investors. The lower number of new market entrants suggests concerns about saturation or an upcoming reversal.

However, long-term and institutional investors have remained steady, helping BTC maintain its price strength. While retail investor hesitation may limit growth,Bitcoin's resilience is underscored by its ability to decouple from the stock market when volatility increases.

Bitcoin New Address Dynamics. Source: Glassnode

Bitcoin New Address Dynamics. Source: GlassnodeBTC price may continue to rise

Bitcoin is currently trading at $117,182, continuing its uptrend from the start of the month. The immediate challenge is to turn $117,261 into support, which would provide the necessary foundation for the cryptocurrency to continue growing.

If successful, Bitcoin could target $120,000 as the next milestone. Breaking and consolidating above that level could set the stage for further gains, which is likely to happen, especially if ETF inflows continue to bolster investor confidence.

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingViewHowever, risks remain. If selling pressure increases, Bitcoin may struggle to hold above key levels. A drop below $115,000 could open the door to a correction to $112,500, invalidating the bullish thesis and reducing short-term momentum.