In the booming DeFi market, Paradex has emerged as a new generation Derivative DEX built on Starknet and incubated by Paradigm. This platform aims to bridge the gap between CeFi and DeFi, providing a comprehensive trading experience with zero fees, superior liquidation , institutional-grade privacy, and high-performance Layer 2 infrastructure. So what is Paradex? Let's learn about the Hyperliquid-like Derivative DEX on Starknet with Coin68 through the article below!

What is Paradex? Learn about the Derivative DEX exchange on Starknet

What is Paradex?

Paradex is a next-generation decentralized finance (DeFi) platform incubated by Paradigm, a liquidation provider in the crypto industry (not to be confused with the unrelated Paradigm fund of the same name) , with the goal of bridging the gap between CeFi and DeFi to fuel the next wave of on-chain adoption.

Paradex Home Page

The platform stands out by offering a superior trading experience with zero fees, more competitive liquidation than many centralized exchanges, lightning-fast execution speeds, and institutional-grade privacy mechanisms. In addition to a diverse trading platform with Futures Contract, perpetual, spot, and pre-market options, Paradex has developed a Vaults system to help users maximize profits, along with a high-performance Layer 2 blockchain based on Starknet technology .

With the vision of building an open, transparent and completely decentralized financial ecosystem, Paradex is gradually asserting its position as a new generation "SuperDEX" in the crypto market.

Features of Paradex

SuperDEX

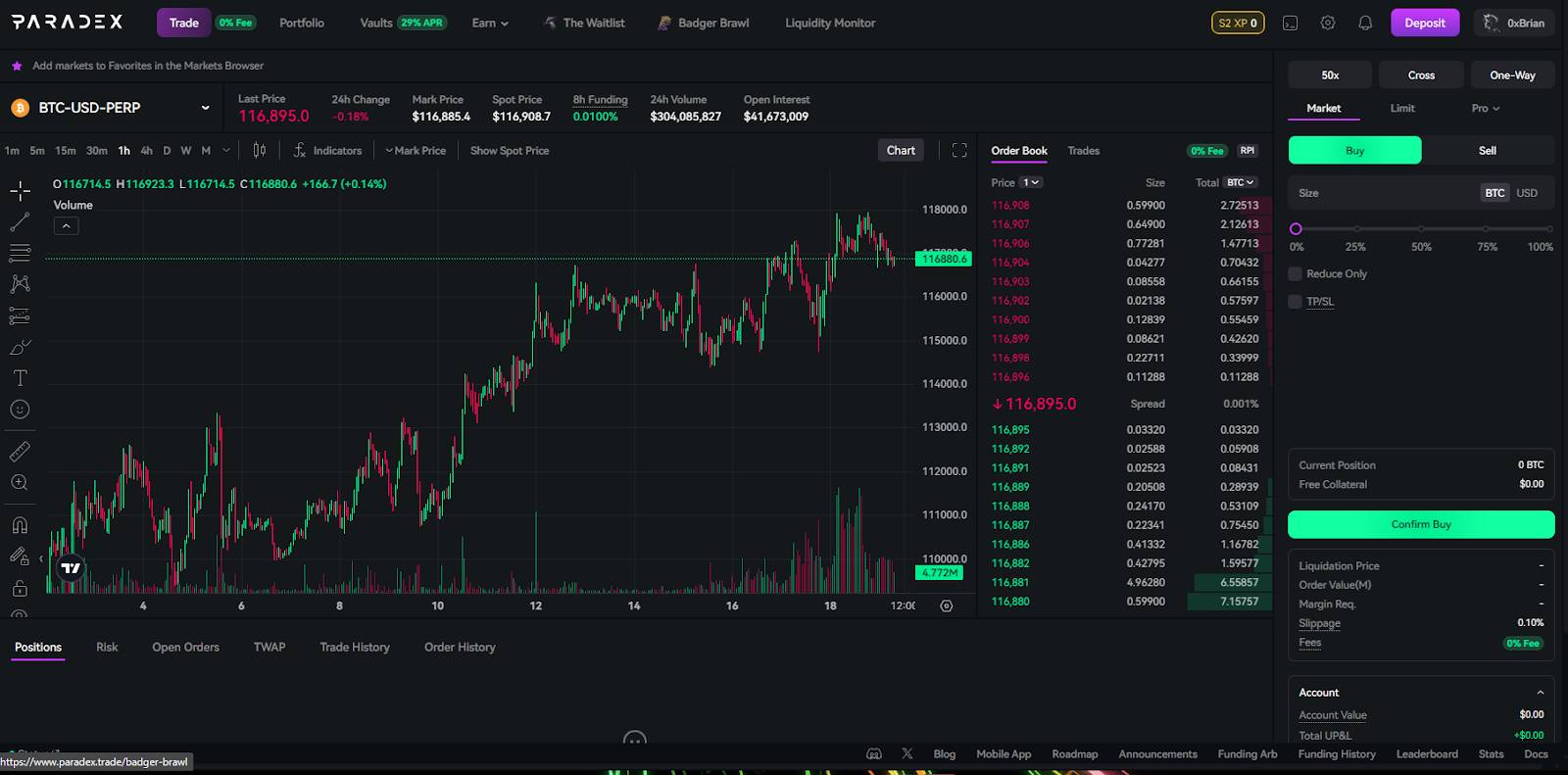

Paradex's SuperDEX is a comprehensive decentralized exchange, supporting over 250 markets including perpetual Futures Contract (perps), perpetual options, spot and pre-market. Highlights include zero fees for retail traders on over 100 Perps markets, combined with a Retail Price Improvement (RPI) mechanism that helps orders match at better prices than CEXs.

SuperDEX

Paradex also focuses on privacy with zk-encrypted accounts and off-chain orderbooks, moving towards complete security. The platform also integrates Unified Margin and multiple margin modes (Isolated, Cross, Portfolio Margin) to optimize capital and manage risk. In addition, perpetual options Capital provide high leverage without liquidation worries, and a fast Token listing mechanism helps users trade new assets early.

Paradex Vaults

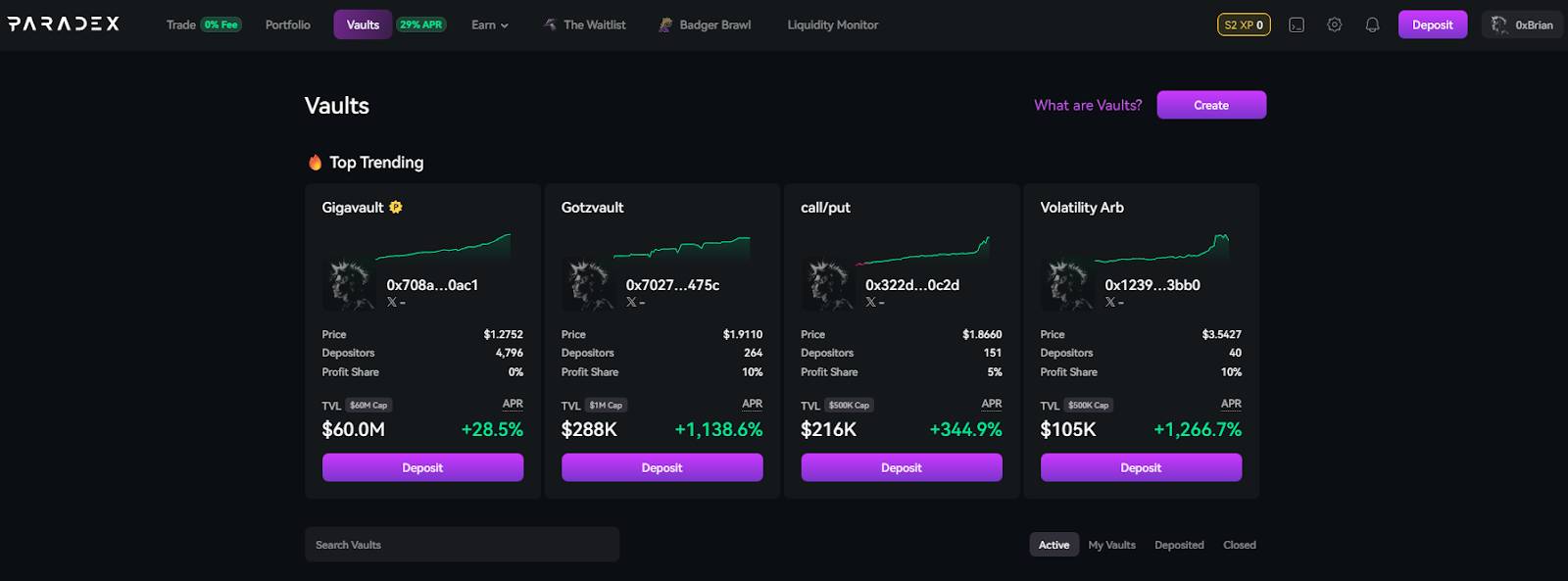

Paradex Vaults are on-chain asset pools that allow users to deposit collateral (currently primarily USDC) to receive Vault Tokens and profit from strategies managed by Vault Operators.

Paradex Vaults

Initially, the vaults focus on perpetual Futures Contract , but in the future will expand to Spot, Options and support more assets such as BTC, ETH. LP Tokens from the vault can be used as collateral for trading or reinvesting, helping to maximize profits.

The vault system is designed to be safe and fair: an off-chain Order Book prevents front-running, and a withdrawal mechanism gradually closes positions to reduce slippage and limit the impact on others. Vault owners can customize the profit Chia ratio (0–20%), lock-up period, and TVL limit. Participants are also rewarded with weekly XP, creating incentives for long-term engagement with the ecosystem.

SuperChain

SuperChain is a layer-2 blockchain developed by Paradex, built on Starknet Stack and secured by Ethereum . Thanks to the application of ZK-STARKs technology and Cairo language, the network achieves impressive performance of about 1,000 TPS, transaction completion time of only 2-3 seconds, while significantly reducing Gas Price.

Paradex also implements Account Abstraction , turning every wallet into a smart contract with multi- Token payments, Multisignature support, and Gas Price transactions, providing a seamless user experience. The ecosystem is directly compatible with Starknet, allowing existing applications to deploy easily by simply changing the RPC endpoints.

To ensure security, RPC Node Proxy is developed to authenticate every access with cryptographic signatures. The entire system is powered by the gas Token $DIME, which is the main source of energy for open finance on Paradex Chain.

XUSD

XUSD is Paradex's native stablecoin, designed to be delta-neutral to generate returns for all depositors. The returns come from the Paradex Futures Contract base, and XUSD can be used as collateral, deposited into vaults or lending pools to continue generating returns. In this way, XUSD completely solves the problem of opportunity cost of collateral in DeFi.

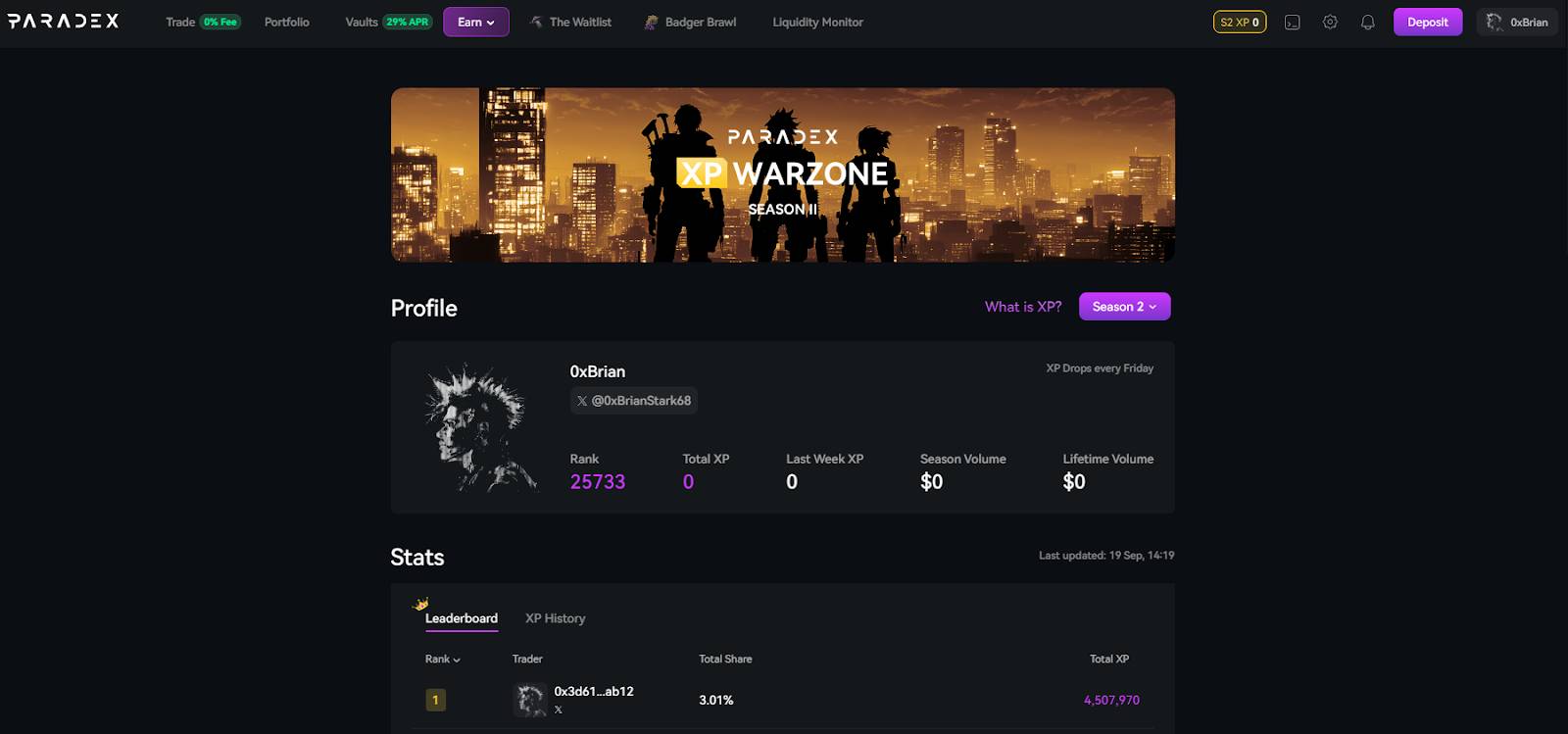

XP Program

Paradex implements an XP system to reward all user activities such as trading, providing liquidation, depositing assets into Vaults or referring friends. The referral program allows the referrer to receive 5% taker fee, and the referred person gets a 5% discount on fees. For KOLs, the Affiliate program offers commissions and XP rewards up to 25%, with a Sub-Affiliate mechanism to expand the network. The entire system is protected by a Sybil detection tool, ensuring transparency and fairness.

Referral Program

Infrastructure and ecosystem

Paradex's infrastructure and ecosystem are comprehensively designed to provide a seamless and secure user experience. The platform integrates multiple bridges and on-ramps, supporting deposits and withdrawals from over 30 blockchains as well as directly from CEX or fiat. Users can use internal wallets, MetaMask , Argent X , Braavos or email/social wallets secured by Privy.

Paradex currently supports USDC as collateral and will expand to more assets. The entire system is tightly secured with audited contracts, Security Lockdown, Guardian Keys, Bug Bounty, and provides full REST API, WebSocket, and RPC Node Proxy to support developers.

Paradex Token Details

Basic information about DIME Token

Token name | DIME |

Ticker | DIME |

Blockchain | Paradex Chain |

Contract | Updating... |

Total supply | Updating... |

Circulating supply | Updating... |

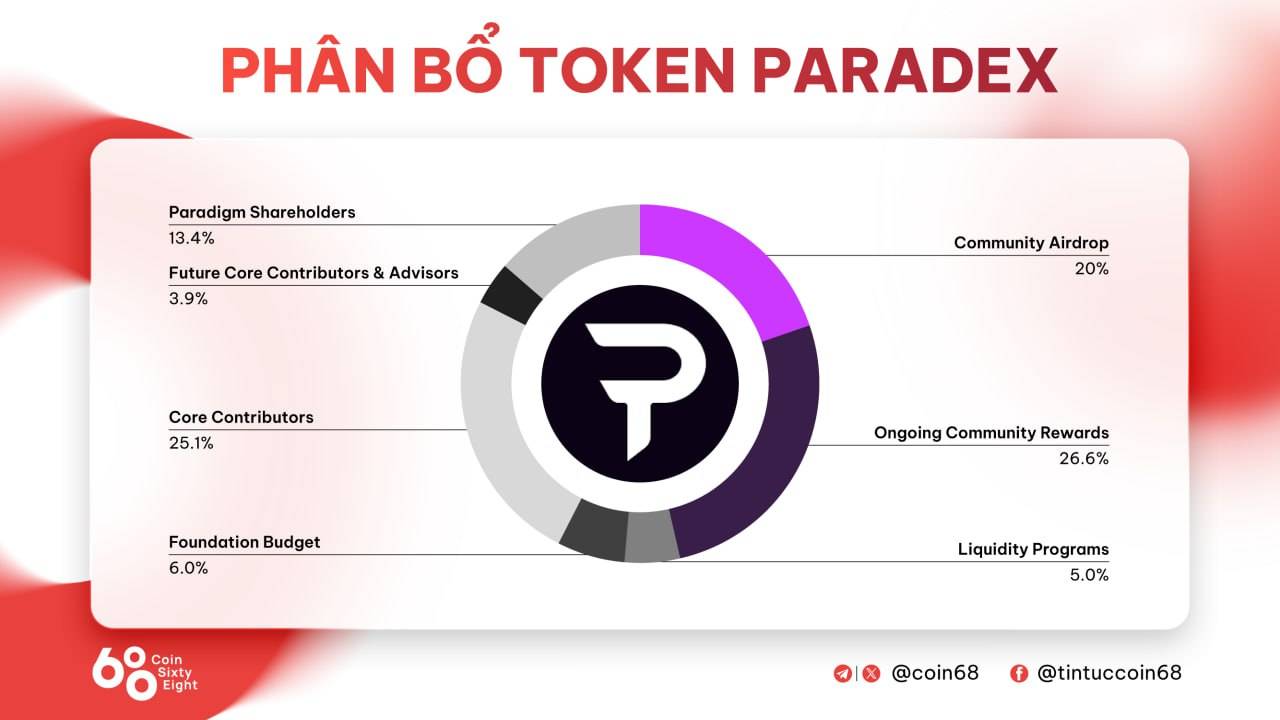

DIME Token Allocation

DIME Token Allocation

Community Airdrop : 20%

Ongoing Community Rewards : 26.6%

Liquidity Programs : 5.0%

Foundation Budget : 6.0%

Core Contributors : 25.1%

Future Core Contributors & Advisors : 3.9%

Paradigm Shareholders : 13.4%

Uses of DIME Token

- Gas Token : DIME is used to pay transaction fees on Paradex Chain.

- Aligning interests : Linking interests between the community, development team and investors.

- Ecosystem utilities : Reduced fees, Staking , liquidity mining, rewards for users.

- Governance: Participate in voting and shape Paradex's development roadmap.

Paradex Development Roadmap

2023

Launch Internal Testnet with ETH Futures Contract .

Launch Closed Beta Mainnet ( ETH, BTC Perps).

Open Public Testnet v1, add deposit/withdrawal, funding, UI/UX features.

2024

Complete infrastructure, expand testnet.

Wallet integration, improved user experience.

Preparing for mainnet beta and product expansion.

2025 (Q1 – Q3)

Q1: 11 new futures markets, beta perpetual options, multi-strategy Vault, social login (Privy).

Q2: +15 futures markets, BTC/ ETH/ SOL/HYPE options, Mobile UI 2.0, RPI mechanism, Solana deposit, RhinoFi bridge, Layerswap, Orbiter.

Q3: Portfolio Margin, PAXG options, Hyperlane bridge (cross-chain deposit/withdrawal), Public bug bounty, 16 more futures markets.

2025 (Q4 and thereafter)

Launched Spot Market, Spot VTFs, XUSD, Mobile 3.0, Pre-market Perps, Dated Options.

Deploy lending/borrowing, auto-borrow & lend market.SuperChain Mainnet, Fiat On-Ramp, CEX integration.

Smart contract level privacy & Encrypted DA.

Upgrade from Stage 0 to Stage 1 to Stage 2 Rollup for full decentralization.

Open source the entire system (web app, chain, risk engine, API).

Open Paradex Chain for external developers to build dApps and expand the ecosystem.

Paradex Development Team

The Paradex team is incubated by Paradigm , the world’s leading crypto liquidation network, and is backed by many of the industry’s leading investors and traders. Instead of traditional venture Capital , Paradex is directly provided with resources, technical expertise, and Capital to focus on building a superior product.

Investors in Paradex

Paradex’s key investors and backers have played a key Vai in the ecosystem’s formation and growth, with Paradigm being the most prominent, which has been a key incubator for the project.

As the world’s largest crypto options liquidation network (over $1 billion traded daily, 30% global market share), Paradigm brings technical expertise, resources, and Capital to Paradex, while also avoiding the need for traditional VC Capital . Paradigm and its shareholders own 13.4% of the total DIME supply, with a gradual unlocking mechanism to avoid market pressure. Paradex also has support from several other leading investors and traders in the industry, although the specific identities have not been disclosed.

Summary

Through this article, you have probably grasped some basic information about the Paradex project to make your own judgment.

Note : The information in the article is not XEM investment advice, Coin68 is not responsible for any of your decisions.