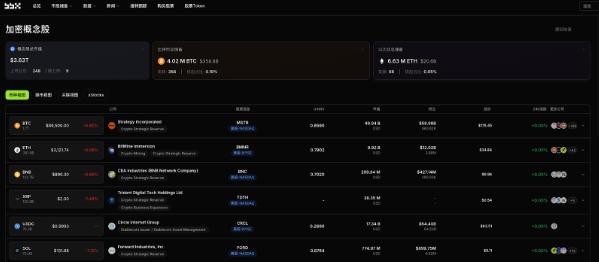

According to ME News, on December 15th (UTC+8), BBX Crypto Concept Stock Information reported that several listed companies from North America, Europe, and Asia disclosed increases in their cryptocurrency holdings and adjustments to their financial portfolios last week. Bitcoin remains a core asset, while Ethereum and Filecoin, crypto assets with specific uses, are also being included in corporate asset portfolios, indicating that listed companies' cryptocurrency strategies are evolving towards a multi-layered and multi-objective approach.

Bitcoin holdings and treasury expansion

Lion Group Holding Limited (NASDAQ: LGHL) announced an $8 million investment to purchase 88.49 Bitcoins (BTC). The company also disclosed that its cryptocurrency portfolio includes 194,727 HYPEs and 10,820 SOLs, demonstrating a multi-asset allocation strategy.

Vanadi Coffee (BME: VANA), a Spanish listed company, increased its holdings by 10 BTC, bringing its total holdings to 129 BTC, ranking 100th among global listed companies in terms of Bitcoin holdings.

ProCap Financial (NASDAQ: BRR) disclosed that its Bitcoin holdings have increased to 5,000 coins. The company stated that this adjustment aims to strengthen its financial stability while also considering capital structure and tax efficiency.

Genius Group Limited (NYSE: GNS) announced the completion of a small-scale BTC acquisition (dozens of coins), realizing approximately $1 million in paper profits from related transactions. The company stated that it will continue to incorporate BTC into its treasury management and corporate asset allocation system.

- Twenty One Capital (NYSE: XXI) disclosed on its first day of listing that it held more than 43,500 BTC, ranking among the top tier of global listed companies with Bitcoin holdings, and made it clear that it will hold Bitcoin for the long term and expand its business and product lines around it.

Hyperscale Data, Inc. (NYSE: GPUS) disclosed that its subsidiary Sentinum currently holds 451.85 BTC, of which 64.37 came from self-mining and the remainder from the open market; the company has also set aside $34 million in cash and plans to continue to expand its holdings through DCA.

Strategy (NASDAQ: MSTR) announced this week that it has invested $962.7 million to acquire 10,624 BTC at a price of $90,615 per BTC. After the transaction, its total holdings have increased to 660,624 BTC, maintaining its position as the world's largest Bitcoin holder among publicly traded companies.

Ethereum and other crypto asset allocation

Republic Technologies (OTCMKTS: DOCKF), a Canadian publicly traded company, disclosed that it has increased its holdings of Ethereum (ETH) by 742.4 ETH, at an average cost of approximately $2,700. Following this increase, its total ETH holdings reach 1,570.6 ETH, with a market value of approximately $5.27 million. The company stated that it has drawn down $10 million in funding to continue acquiring ETH.

Shuntai Holdings Group Limited (HKEX: 01335) purchased 141,734 Filecoin (FIL) on the open market for a total consideration of approximately US$200,000. The company stated that the FIL will be used to meet collateral requirements for Filecoin mining as part of its asset diversification and business synergies.

Market perspective

Based on disclosures from last week, listed companies' involvement in crypto assets has become clearly stratified: on the one hand, companies like Strategy and Twenty One Capital continue to expand their Bitcoin Core treasury; on the other hand, some companies are beginning to integrate assets such as ETH and FIL with specific business scenarios (financing, mining, on-chain applications). Overall, crypto assets are gradually evolving from a "single investment target" into an important component of listed companies' balance sheets and business strategies. (Source: BBX)