Deng Tong, Jinse Finance

On December 12, 2025, Tether announced its plan to acquire a full stake in Italian football club Juventus FC. Tether submitted an all-cash binding offer to its controlling shareholder, Exor, for 65.4% of the club's shares and prepared to launch a public tender offer for the remaining shares after the transaction, aiming to increase its stake to 100%. However, the Exor Group rejected Tether's offer to acquire Juventus shares, reiterating its intention not to sell its stake in Juventus.

Why did Tether acquire Juventus? Because they have too much money!

A few days ago, Nate Geraci, president of The ETF Store, posted on the X platform: "While U.S. politicians are debating whether stablecoins should be allowed to pay interest... let me remind you: Tether will rake in $15 billion in profits this year, with a profit margin of 99%."

What recent acquisitions and investments has this giant made? With a profit margin of 99%, how has Tether built its vast business empire spanning crypto and traditional fintech?

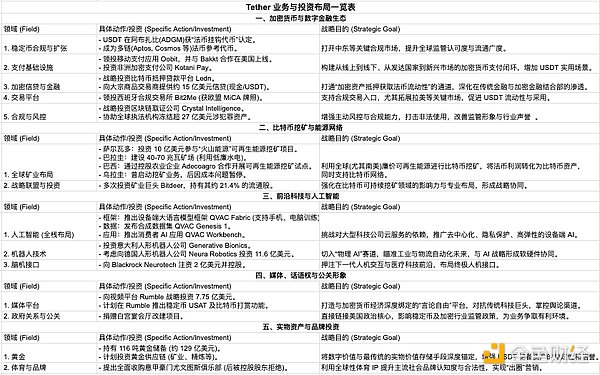

I. Improve the business landscape of cryptocurrency

1. Create fiat currency-pegged tokens

On December 9th, Tether's stablecoin USDT was officially recognized as a "fiat-pegged token" at the Abu Dhabi Global Market (ADGM), authorizing institutions to provide regulated custody and trading services. This marks a significant step forward in the UAE's stablecoin regulation. USDT has been officially recognized as a fiat-backed reference token for multiple blockchains, including Aptos, Cosmos, and Near. This move helps Tether penetrate the compliant digital asset market in the Middle East, leveraging Abu Dhabi's regional financial center status to further expand the influence and circulation of its stablecoin in the global compliant market.

2. Mobile payment

On December 9th, Oobit, a Tether-backed mobile payment app, announced its partnership with Bakkt and officially launched in the United States. This "touch-to-pay" solution integrates non-custodial wallets such as Base, Binance, MetaMusk, Phantom, and Trust Wallet, allowing users to make purchases directly using cryptocurrency on iOS and Android devices. Merchants receive fiat currency settlements in real time through their existing Visa payment network. The collaboration between Tether and Oobit began last year. In 2024, Oobit completed a $25 million Series A funding round, led by Tether, with participation from investors including the co-founder of Solana. This funding has become a crucial support for Oobit's subsequent technological iterations and global market expansion.

In October 2025, Tether announced an investment in Kotani Pay, an African-based crypto payment company. The investment aims to help African users more easily access digital assets, lower the barriers to financial participation, and promote financial inclusion and blockchain finance development in Africa by providing infrastructure that connects Web3 applications with local payment channels in Africa.

3. Digital asset lending

On November 18, Tether announced a strategic investment in digital asset lending platform Ledn. This move aims to expand access to credit, enabling individuals and businesses to obtain loans without selling their digital assets. Ledn focuses on Bitcoin-secured loans and has disbursed over $2.8 billion in loans since its inception, with over $1 billion disbursed by 2025, marking the company's strongest annual performance. Its annual recurring revenue (ARR) has exceeded $100 million.

On November 15, Tether CEO Paolo Ardoino stated in an interview that Tether has provided approximately $1.5 billion in credit support to commodity traders, with financing in the form of cash and its USDT stablecoin, which is pegged 1:1 to the US dollar. Tether is currently focusing on traditional commodity trading areas such as agricultural products and oil, and plans to further expand its business exposure in these sectors.

4. Stock Exchange

On August 7, Tether, through its subsidiary Tether Ventures, led a €30 million funding round for Spanish crypto exchage Bit2Me, acquiring a minority stake. Bit2Me has already received authorization from the Spanish securities regulator, becoming the first Spanish-language fintech company to obtain an EU MiCA license, and plans to use this round of funding to expand its presence in the Latin American market, with a focus on expanding its business in Argentina.

5. Blockchain Evidence Collection

In July, Tether announced a strategic investment in blockchain forensics company Crystal Intelligence to combat cryptocurrency crime; the specific investment amount was not disclosed. This investment enables Tether to directly use Crystal's suite of real-time risk monitoring, fraud detection, and regulatory intelligence tools, thereby enhancing the company's ability to help law enforcement agencies worldwide track suspicious activity. With the rise of cryptocurrency-related scams and fraud, Tether is committed to curbing the illicit use of its USDT stablecoin. This move will also help Tether further advance cryptocurrency compliance; previously, Tether has assisted 255 law enforcement agencies in 55 jurisdictions in freezing over $2.7 billion in criminally involved stablecoins.

II. Mining

1. Uruguay

Tether initially announced the launch of a "sustainable Bitcoin mining operation" in Uruguay in May 2023, aiming to utilize the country's renewable energy sources for mining. On November 28, a Tether spokesperson confirmed that due to rising energy costs, Tether had suspended its Bitcoin mining operations in Uruguay, but remained committed to its long-term projects in Latin America. Tether formally notified the Uruguayan Ministry of Labor of the suspension of mining activities and the layoff of 30 employees. Tether had originally planned to invest $500 million in its mining operations in Uruguay.

2. Paraguay

In November 2023, Tether announced its plans to build a Bitcoin mining farm in Paraguay, with a planned capacity of 40-70 megawatts. The core advantage of choosing Paraguay was its low electricity costs, which account for approximately 80% of total mining costs; low electricity prices significantly reduce operating costs. The mining farm was subsequently successfully launched and became one of Tether's key mining nodes in South America.

3. El Salvador

In June 2023, Tether officially announced its participation in the "Volcano Energy" large-scale renewable energy project in El Salvador, investing $1 billion. The project is located in the small village of Elchist in Metapan, Santa Ana Province, and plans to build a 241-megawatt renewable energy power generation park, encompassing 169 megawatts of photovoltaic solar power and 72 megawatts of wind power. In addition to its investment, Tether also provides technical support in the energy, hardware, and communications fields. Once operational, the initial hashrate will exceed 1.3 ehashes per second, placing the mining pool among the top 20 global Bitcoin mining pools in terms of cumulative hashrate.

4. Brazil

In September 2024, Tether partnered with Adecoagro, a South American agricultural company. Tether invested $100 million to acquire a 9.8% stake in Adecoagro. On April 30, 2025, Tether further acquired a 70% stake in Adecoagro, after which Adecoagro's board of directors underwent significant changes. On July 3, 2025, the two parties officially signed a memorandum of understanding, finalizing a pilot project for renewable energy-driven Bitcoin mining.

5. Bitdeer

In May 2024, Tether made its first investment in Bitdeer, acquiring approximately 18.6 million shares through Tether International for $100 million, with an option to purchase 5 million more shares at $10 per share. From February 26 to March 13, 2025, Tether acquired another $18.2 million worth of Bitdeer Class A stock. Following this acquisition, Tether, through two affiliated companies, held nearly 32 million Bitdeer shares, representing 21.4% of its outstanding shares. This included 26.7 million shares purchased for over $138.7 million and nearly 5.2 million warrants. This investment was a significant step for Tether in strengthening its influence in the sustainable Bitcoin mining business.

III. AI and Cutting-Edge Technologies

1. Robot

On December 8th, it was reported that Tether is supporting the development of a new type of industrial humanoid robot that will perform dangerous and physically demanding tasks in factories and logistics centers. Tether, along with AMD Ventures, the Italian state-backed artificial intelligence fund, and other investors, raised €70 million for Generative Bionics (a new spin-off company from the Italian Polytechnic Institute).

"Physical AI" humanoid robots will operate in human-created environments, handling lifting, carrying, and repetitive tasks that are difficult for traditional robotic arms to perform. For Tether, this investment is part of a strategy described by its CEO, Paolo Ardoino, to "shift towards supporting digital and physical infrastructure." These projects aim to expand the company's reach beyond stablecoins and reduce what he calls "the growing reliance on centralized systems regulated by large tech companies."

On November 16, the company behind Tether considered investing $1.16 billion in Neura Robotics, a rapidly growing German robotics company that develops humanoid robots. Neura's valuation is between $9.29 billion and $11.6 billion.

2. Large Language Model

On December 2, Tether Data announced the launch of QVAC Fabric, a large language model framework that enables users to execute, train, and personalize large language models directly on everyday hardware, including consumer-grade GPUs, laptops, and even smartphones. Tasks that previously required high-end cloud servers or dedicated NVIDIA systems can now be accomplished on users' existing devices. The model reportedly supports training on a variety of GPUs, including AMD, Intel, NVIDIA, Apple Silicon, and mobile chips.

A major breakthrough of this release is the ability to fine-tune models on mobile GPUs such as Qualcomm Adreno and ARM Mali. This is the first production-ready framework that supports modern LLM training on smartphone-grade hardware. This opens the door to personalized AI, which can learn directly from user devices, protecting user privacy, functioning even without an internet connection, and providing robust support for a new generation of highly resilient and robust on-device AI applications.

On October 24th, Tether Data's AI research arm, QVAC, released the synthetic dataset QVAC Genesis I for training STEM-focused AI models. Tether Data also launched its first consumer application, QVAC Workbench, a comprehensive workspace showcasing the potential of AI on local devices. QVAC Workbench is currently targeted at AI enthusiasts, advanced users, and researchers. It already supports a wide range of LLM and other AI models, including Llama, Medgemma, Qwen, SmolVLM, Whisper, and more. The application is available for smartphones (currently Android, with iOS support coming in a few days) and desktop platforms (Windows, macOS, and Linux), offering the most comprehensive device support compared to existing products.

3. Brain-computer interface

In April 2024, Tether invested $200 million in Blackrock Neurotech, making it a majority shareholder in the brain-computer interface company. The funds were primarily used to commercialize Blackrock Neurotech's innovative medical solutions, which had already been implemented in over 40 patients, and to strengthen its R&D capabilities to solidify its leading position in the brain-computer interface field. In June 2025, Tether CEO Paolo Ardoino stated that the brain-computer interface company in which Tether had invested had surpassed the technological level of Elon Musk's Neuralink.

IV. Media Tools and Public Relations Image

1. Media tools

In December 2024, Rumble announced a definitive agreement with Tether for a $775 million strategic investment. Tether purchased 103,333,333 Rumble Class A common stock at $7.50 per share, and agreed that $250 million would be used for Rumble to attract creators, make strategic acquisitions, and upgrade Rumble Cloud's technology infrastructure.

In October 2025, two key developments in the collaboration were revealed. First, Tether planned to launch a new stablecoin, USAT, on the Rumble platform for the US market, with an expected official launch in December. Second, it was officially announced that a Bitcoin tipping feature would be available for Rumble creators, initially planned for early to mid-December. On November 24th, the Rumble CEO announced the official launch of Rumble Wallet, and the platform began testing BTC, XAUT, and USDT tipping features.

2. Public Relations Image

On October 23, the White House released a list of donors for the White House banquet hall, and Tether was on the list. For Tether, this donation was not merely a charitable act, but a key move to strengthen its ties with the US political establishment. Previously, the US had passed the GENIUS Act, a regulatory bill targeting stablecoins, and the SEC had withdrawn several lawsuits against the crypto industry. Tether hopes to use such compliance actions to further solidify its regulatory influence in the US market, while simultaneously pushing for more policy support for its stablecoin business.

V. In-kind investment

1. Stockpiling gold

In September of this year, Tether held talks regarding investments in gold mining. Tether plans to invest in all aspects of the gold supply chain, including mining, refining, trading, and franchising companies. Currently, Tether's gold reserves stand at 116 tons, equivalent to approximately $12.9 billion. This is comparable to the central bank gold reserves of countries like South Korea and Hungary, placing it in the mid-range of global sovereign reserves.

2. Acquisition of Italian football club Juventus

On December 12, Tether announced its plan to acquire Italian football club Juventus FC in its entirety. Tether submitted an all-cash binding offer to controlling shareholder Exor for 65.4% of the club's shares and plans to launch a public tender offer for the remaining shares after the transaction is completed, aiming to increase its stake to 100%. Tether stated that if the deal is successful, it will inject $1 billion into the club. CEO Paolo Ardoino emphasized that as a lifelong Juventus fan, he hopes to provide the team with long-term, stable capital support through Tether's strong financial resources. "Tether is financially sound and plans to support Juventus with stable funding and a long-term vision." Tether currently holds more than 10% of Juventus' shares.

Following the announcement, Juventus' fan token JUV briefly surged by 30%.

However, EXOR Group subsequently rejected Tether's offer to acquire Juventus shares, reiterating that it had no intention of selling Juventus shares.

Note: EXOR is a holding group controlled by the Agnelli family, whose connection to Juventus dates back to 1923, giving them control of the club for nearly a century. Currently, EXOR holds 65.4% of Juventus' shares, making it the absolute controlling shareholder. Furthermore, in recent years, EXOR has spearheaded several capital increases for Juventus.

VI. Conclusion

Tether has transformed from a simple stablecoin issuer into a vast investment empire spanning digital finance, cutting-edge technology, energy and mining, media and communications, and physical assets. Its exceptionally high profit margin of 99% stems from both USDT's underlying advantage as a global cryptocurrency liquidity hub and its ever-expanding ambitions. Starting with stablecoin issuance, Tether is injecting capital into traditional technology sectors, attempting to reshape the development landscape of both the crypto and traditional industries.