RedotPay, a stablecoin payment platform, has successfully raised $107 million in Series B Capital amid strong growth in users, revenue, and volume.

ReddotPay raises $107 million in Series B Capital to expand its stablecoin payment platform.

ReddotPay raises $107 million in Series B Capital to expand its stablecoin payment platform.

ReddotPay raises $107 million in Series B Capital .

- On December 17th, RedotPay, a Hong Kong-based stablecoin-based payment platform, completed its Series B Capital round worth $107 million, amidst strong growth in user numbers, payment volume, and revenue.

RedotPay, a stablecoin payments fintech, has completed a $107 million Series B round led by Goodwater Capital, with participation from Pantera Capital, Blockchain Capital, and Circle Ventures. Existing investor HSG (formerly Sequoia China) also continued its support. The round…

— Wu Blockchain (@WuBlockchain) December 16, 2025

According to the announcement, RedotPay successfully Capital $107 million in its Series B funding round, led by Goodwater Capital, with participation from Pantera Capital, Blockchain Capital, Circle Ventures , and existing investor HSG (formerly Sequoia Capital China).

Notably, this Capital round comes just about three months after RedotPay raised $47 million in its previous strategic investment round in September, at a valuation of over $1 billion. In addition, the company also completed a $40 million Series A round earlier this year. To date, RedotPay has raised approximately $200 million in total Capital .

- Chia to the media, Michael Gao, co-founder and CEO of RedotPay, said the company only began actively raising Capital in late 2024, but demand for the platform has accelerated faster than expected. He Chia :

“We were compelled to raise additional Capital due to the current growth rate. This investment allows RedotPay to expand its infrastructure, legal compliance efforts, and partnerships to keep pace with demand,”

- The entire $107 million Capital will be allocated to three main areas: product development, expanding legal compliance and licensing, and strategic mergers and acquisitions.

According to CEO Michael Gao, the company remains focused on its product, with the majority of its resources dedicated to improving the user experience. Simultaneously, RedotPay is seeking M&A targets to expand its licensing network and strengthen its payment infrastructure.

- RedotPay is a platform focused on building global payment products based on stablecoins, serving both crypto and general consumers. The company's core products include:

- Stablecoin payment cards allow users to spend digital assets globally.

- Cross-border money transfer infrastructure , supporting fast and predictable international money transfers.

- Multi-currency wallet accounts allow users to access and store stablecoins through licensed third-party financial institutions.

- A P2P marketplace , built on RedotPay's own internal infrastructure.

- The platform's goal is to help users store value using reliable assets while still being able to conveniently spend in local currency, especially in areas with unstable banking systems.

According to RedotPay's data, the platform now has over 6 million registered users in more than 100 different markets, processing over $10 billion in annual payments, nearly tripling compared to the same period last year. In 2025, as of the end of November, RedotPay had already attracted over 3 million new users.

- In addition, the company also stated that it is generating over $150 million in annual revenue and has now reached profitability.

Stablecoin market grows after GENIUS Act

- RedotPay's Capital round took place amidst a boom in investment in stablecoin companies in 2025. Many startups and investment funds focusing on stablecoins have successfully raised large amounts of Capital recently, such as M0 with $40 million in its Series B round, Rain Capital $58 million, and Agora raising $50 million.

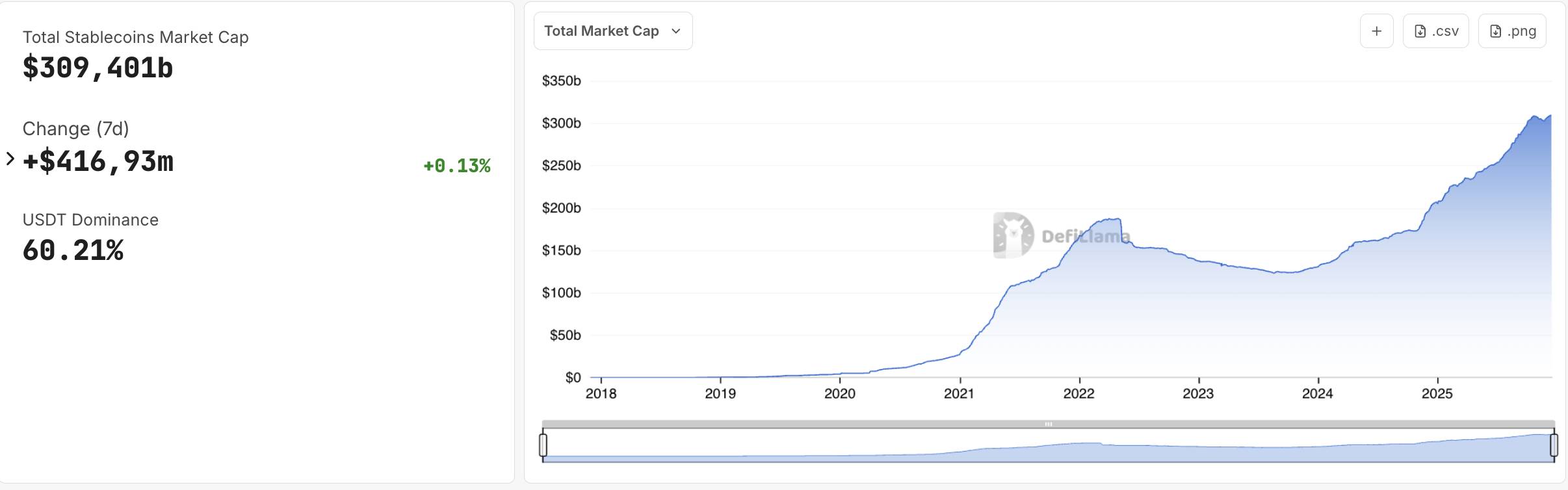

Notably, since the GENIUS Act was passed by the US Congress on July 18th, the total market Capital of stablecoins has increased by more than $50 billion, reaching approximately $309.4 billion. Of that, Tether 's USDT currently accounts for over 60% of the market share.

Stablecoin market statistics. Source: defillama (December 17, 2025)

Stablecoin market statistics. Source: defillama (December 17, 2025)

Coin68 compilation