The SEC has closed its investigation AAVE after four years. Photo: The Daily Hodl

The SEC has closed its investigation AAVE after four years. Photo: The Daily Hodl

AAVE acquitted of legal charges by the SEC.

The U.S. Securities and Exchange Commission ( SEC ) has officially concluded its investigation into the AAVE protocol, a victory seen as a win for DeFi lending XEM and the digital asset industry in the U.S. in general.

After four years, we are finally ready to share that the SEC has concluded its investigation into the AAVE Protocol.

— Stani. ETH (@StaniKulechov) December 16, 2025

This process demanded significant effort and resources from our team, and from me personally as the founder, to protect AAVE, its ecosystem, and DeFi more… pic.twitter.com/aZeLrZz5ZQ

Confirming on social media platform X, AAVE CEO Stani Kulechov stated that the SEC has stopped pursuing its oversight activities after four years.

“DeFi has faced unfair regulatory pressure in recent years. We are thrilled to be able to leave this chapter behind and enter a new era where developers can truly build the future of finance.”

In a photograph of a letter dated August 15th attached to Kulechov's post, the SEC stated that it has no plans to recommend any enforcement action against the AAVE protocol. The letter also refers to the Wells Notice – a form of notification indicating that the SEC team may have considered enforcement action, but ultimately did not proceed further.

On the SEC's side, a spokesperson emphasized that the agency typically does not comment on whether or not investigations exist. However, AAVE 's acquittal after all these years is seen by observers as one of the clearest signals that the SEC's approach to DeFi is softening.

SEC cools down on crypto.

As Coin68 reported , the SEC is gradually moving away from the litigation-based enforcement strategy that dominated previous administrations. Earlier this month, Ondo Finance also confirmed that the SEC had closed an investigation that began during the Biden administration.

In the past, the SEC has sued numerous big names in the crypto industry for failing to register their operations, forcing many American companies to either downsize or relocate overseas.

However, this stance is clearly undergoing a shift. The SEC has withdrawn numerous registration-related lawsuits , established a crypto task force , and launched “Project Crypto” to update the regulatory framework, focusing more on on-chain activity rather than imposing a traditional financial model.

The Securities and Exchange Commission also approved an accelerated licensing process for ETFs; XEM new regulations to streamline product launch times for crypto companies; and even collaborated with the CFTC to revive crypto Derivative trading in the US …

AAVE perseveres through legal challenges.

Remarkably, AAVE not only survived four years of scrutiny but also experienced strong growth. The total value of assets locked (TVL) on the protocol now stands at approximately $33 billion, more than double its value at the start of the investigation. This figure solidifies AAVE 's position as a pillar of the global DeFi market, despite the uncertain regulatory environment.

AAVE 's TVL volatility over time. Source: DeFi LIama (December 17, 2025)

AAVE 's TVL volatility over time. Source: DeFi LIama (December 17, 2025)

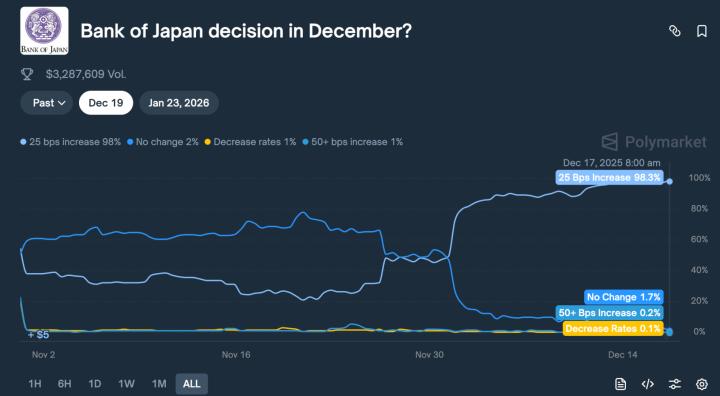

However, the market's reaction was quite cautious. The price of the AAVE Token did not experience a sharp increase after the SEC closed its investigation, and even saw a downward correction at times. This reflects the fact that the legal risks had been somewhat pre-priced by the market, and investors remain wary of DeFi in the context of global liquidation and monetary policy that has not yet been truly loosened.

Immediately after overcoming legal hurdles, AAVE leadership team revealed its long-term development vision, viewing the current period as "day zero" for the next growth cycle, focusing on expanding DeFi in a more sustainable and compliant manner.

Meanwhile, the AAVE DAO community is also discussing a crucial governance proposal – transferring full ownership of the brand, domain name, media channels, and development platform from AAVE Labs to the DAO.

Coin68 compilation